Oklahoma Tax Return Form

Oklahoma Tax Return Form - You can complete the forms with the help of. As of july 19, the. Web generally, to claim a refund, your amended return must be filed within three years from the date tax, penalty and interest was paid. Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. • instructions for completing the form 511: Form 511 can be efiled, or a paper copy can be filed via mail. Web request for copy of income tax return: Complete, edit or print tax forms instantly. Web the 2022 oklahoma state income tax return forms for tax year 2022 (jan. • generally, your return must be postmarked by april 15, 2021.

Web popular forms & instructions; Web generally, to claim a refund, your amended return must be filed within three years from the date tax, penalty and interest was paid. Web form 511 is the general income tax return for oklahoma residents. You can complete the forms with the help of. As of july 19, the. Web printable income tax forms. Complete, edit or print tax forms instantly. Web 2022 oklahoma corporation income and franchise tax forms and instructions. Web when fed rates go up, so do credit card rates. Web 2021 oklahoma resident individual income tax forms and instructions.

As of july 19, the. Individual tax return form 1040 instructions; Web extension of time to file the oklahoma return. Web 2021 oklahoma resident individual income tax forms and instructions. For most taxpayers, the three year period begins. Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. Web federal taxpayers will fill out a form 1040 either online or mail a paper form, though tax returns sent by mail may take six months or more to process. Web 2022 oklahoma corporation income and franchise tax forms and instructions. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web when fed rates go up, so do credit card rates.

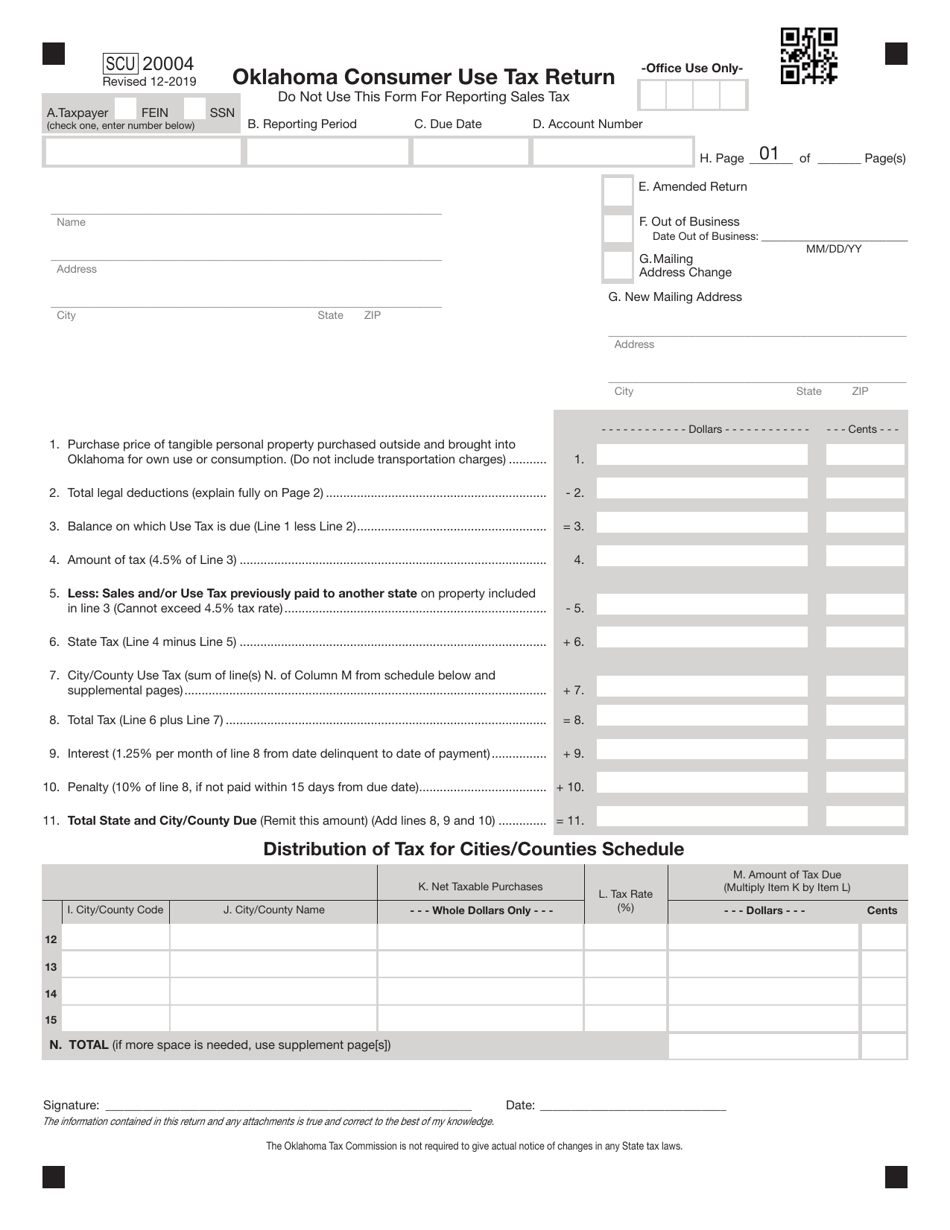

Form SCU20004 Download Fillable PDF or Fill Online Oklahoma Consumer

For most taxpayers, the three year period begins. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. When you file your oklahoma return, simply enclose a copy of the federal extension. Web form 511 oklahoma — individual resident income tax return download this form.

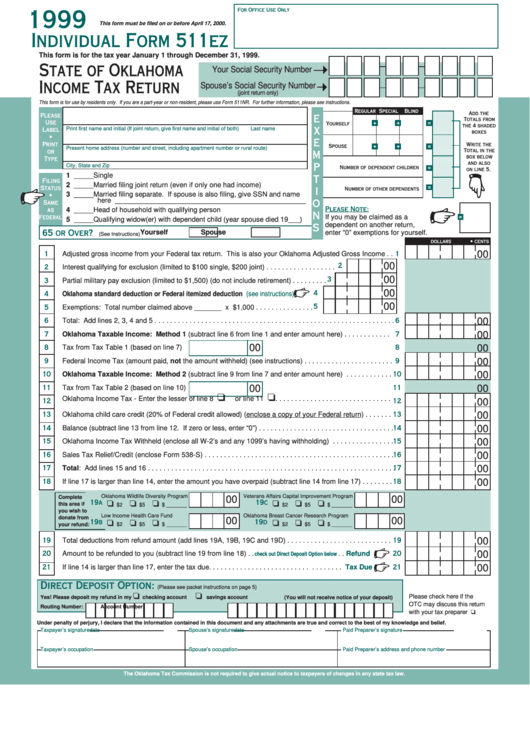

Individual Form 511ez State Of Oklahoma Tax Return 1999

Web federal taxpayers will fill out a form 1040 either online or mail a paper form, though tax returns sent by mail may take six months or more to process. Web 2021 oklahoma resident individual income tax forms and instructions. You can complete the forms with the help of. Web form 511 is the general income tax return for oklahoma.

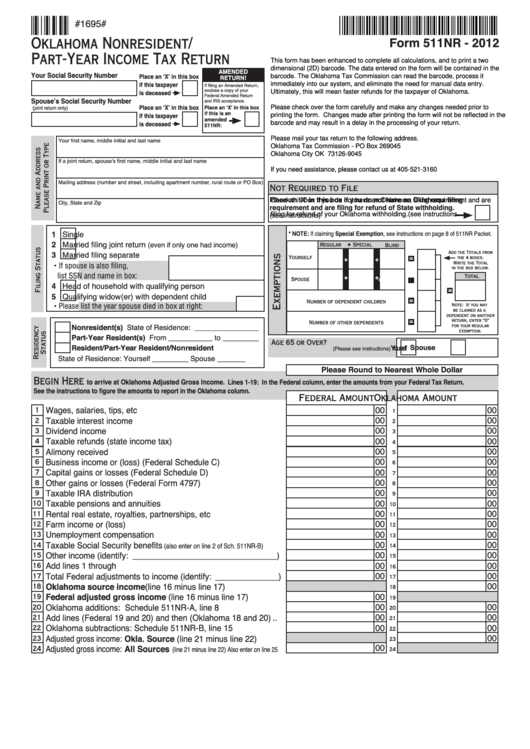

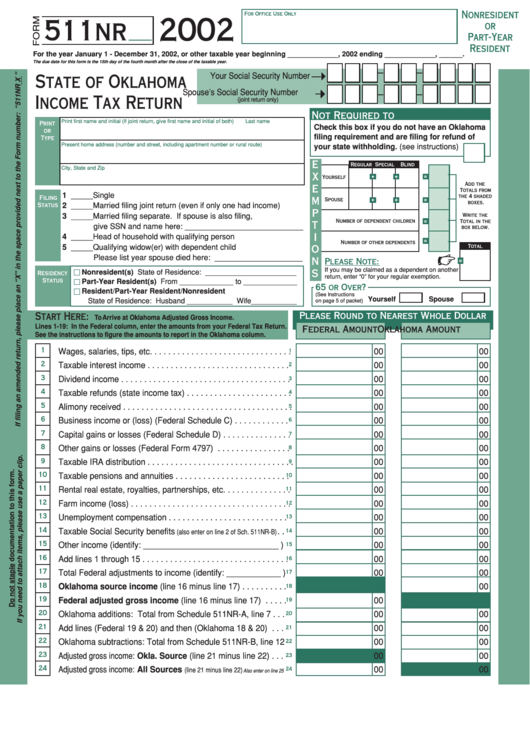

Fillable Form 511nr Oklahoma NonResident/partYear Tax Return

Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web extension of time to file the oklahoma return. Web request for copy of income tax return: Web 2022 oklahoma corporation income and franchise tax forms and instructions. Form 511 can be efiled, or a.

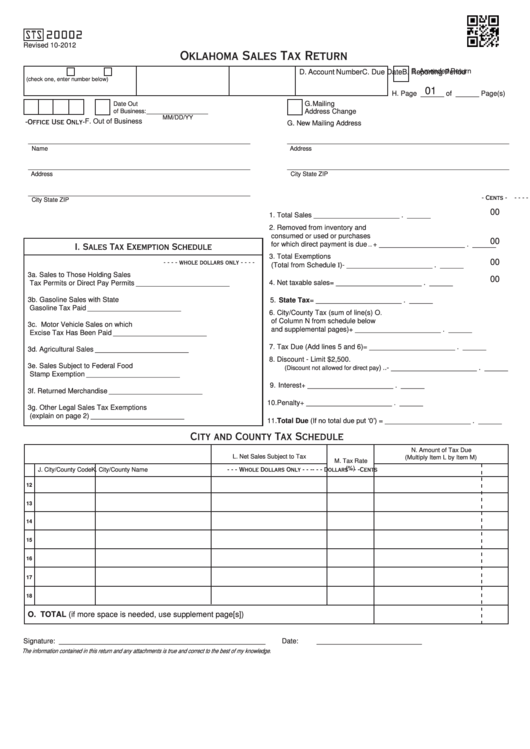

Fillable Form Sts20002 Oklahoma Sales Tax Return printable pdf download

Web when fed rates go up, so do credit card rates. • this form is also used to file an. Download or email ok form 511 & more fillable forms, register and subscribe now! Web form 511 is the general income tax return for oklahoma residents. Complete, edit or print tax forms instantly.

Oklahoma Form 511 (Individual Resident Tax Return) 2021

You can complete the forms with the help of. Web printable income tax forms. Oklahoma resident income tax return. For additional information, see the “due date” section on page 4. As of july 19, the.

Form 511nr State Of Oklahoma Tax Return 2002 printable pdf

• generally, your return must be postmarked by april 15, 2021. • this form is also used to file an. Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Individual tax return form 1040 instructions; Oklahoma has a state income tax that ranges between.

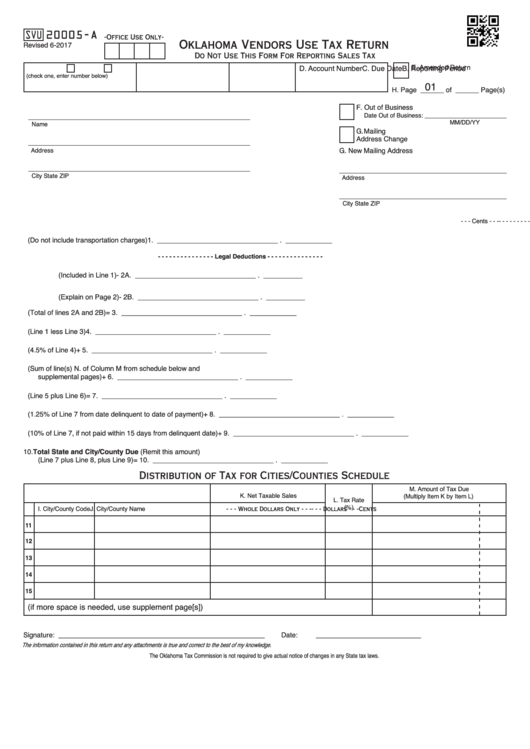

Fillable Form Svu20005A Oklahoma Vendors Use Tax Return 2017

Form for taxpayers to request that the oklahoma. Web form 511 is the general income tax return for oklahoma residents. Web the 2022 oklahoma state income tax return forms for tax year 2022 (jan. As of july 19, the. Form 511 can be efiled, or a paper copy can be filed via mail.

Form 511 Oklahoma Resident Tax Return and Sales Tax Relief

Web generally, to claim a refund, your amended return must be filed within three years from the date tax, penalty and interest was paid. Web federal taxpayers will fill out a form 1040 either online or mail a paper form, though tax returns sent by mail may take six months or more to process. • this form is also used.

2019 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Oklahoma has a state income tax that ranges between 0.5% and 5% , which is administered by the oklahoma tax commission. Web request for copy of income tax return: Form for taxpayers to request that the oklahoma. Web popular forms & instructions; Complete, edit or print tax forms instantly.

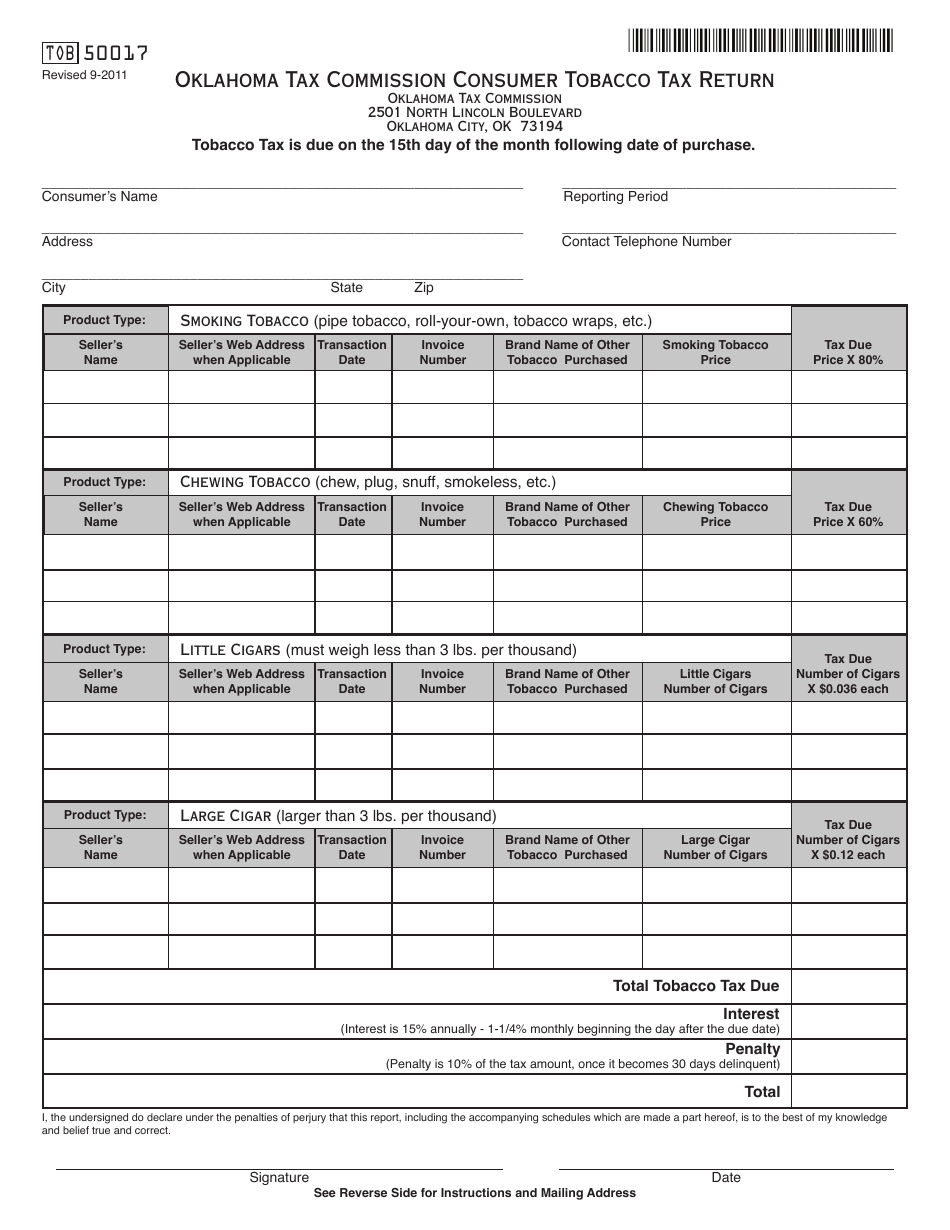

OTC Form TOB50017 Download Fillable PDF or Fill Online Oklahoma Tax

You only need to use this form to apply for. You can complete the forms with the help of. Web form 511 is the general income tax return for oklahoma residents. Web printable income tax forms. Complete, edit or print tax forms instantly.

Oklahoma Has A State Income Tax That Ranges Between 0.5% And 5% , Which Is Administered By The Oklahoma Tax Commission.

Web extension of time to file the oklahoma return. • generally, your return must be postmarked by april 15, 2021. Web 2021 oklahoma resident individual income tax forms and instructions. For additional information, see the “due date” section on page 4.

Web Generally, To Claim A Refund, Your Amended Return Must Be Filed Within Three Years From The Date Tax, Penalty And Interest Was Paid.

Web printable income tax forms. Web popular forms & instructions; Web when fed rates go up, so do credit card rates. Web form 511 is the general income tax return for oklahoma residents.

Oklahoma Resident Income Tax Return.

Web request for copy of income tax return: Individual tax return form 1040 instructions; Form 511 can be efiled, or a paper copy can be filed via mail. You only need to use this form to apply for.

• Instructions For Completing The Form 511:

Web the oklahoma tax forms are listed by tax year below and all ok back taxes for previous years would have to be mailed in. Web the 2022 oklahoma state income tax return forms for tax year 2022 (jan. Web federal taxpayers will fill out a form 1040 either online or mail a paper form, though tax returns sent by mail may take six months or more to process. You can complete the forms with the help of.