Oklahoma Tax Withholding Form

Oklahoma Tax Withholding Form - You must submit form wth10006 by regular mail. Employers engaged in a trade or business who pay compensation form 9465; Tax formula withholding formula (effective pay period 03, 2022) Web change the entries on the form. Complete this section if you want to withhold based on the oklahoma tax withholding tables: You can download blank forms from the business forms section of the otc website. Opers has extracted specific pages, however, full publications with tables can be found at: Non resident royalty withholding tax; Employee's withholding certificate form 941; To register your account with oktap you will need the following information:

A quarterly return is due on or before the 20th day of the month following each quarter. Estimated withholding tax payments you were required to make estimated withholding tax payments if the amount required to be withheld from all nonresident members (line 2 of annual report) Irrespective of the state a business owner sets up his business, he is liable to pay the payroll taxes to the government. Web change the entries on the form. Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an electronic signature. You had no federal income tax liability in 2021 and No action on the part of the employee or the personnel office is necessary. Request a state of ohio income tax form be mailed to you. Employers engaged in a trade or business who pay compensation form 9465; Interest is calculated by 1.25% for each month on the unpaid tax liability and.

Both methods use a series of tables for single and married taxpayers for Your first name and middle initial employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home address (number and street or rural route) city or town state zip code filing status single married married, but withhold at higher single rate last. Web opers has two forms to provide tax withholding preferences for federal and state taxes. No action on the part of the employee or the personnel office is necessary. Pay period 03, 2022 summary the single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. 505, tax withholding and estimated tax. Tax formula withholding formula (effective pay period 03, 2022) Married, but withhold at higher single rate. You must submit form wth10006 by regular mail. A quarterly return is due on or before the 20th day of the month following each quarter.

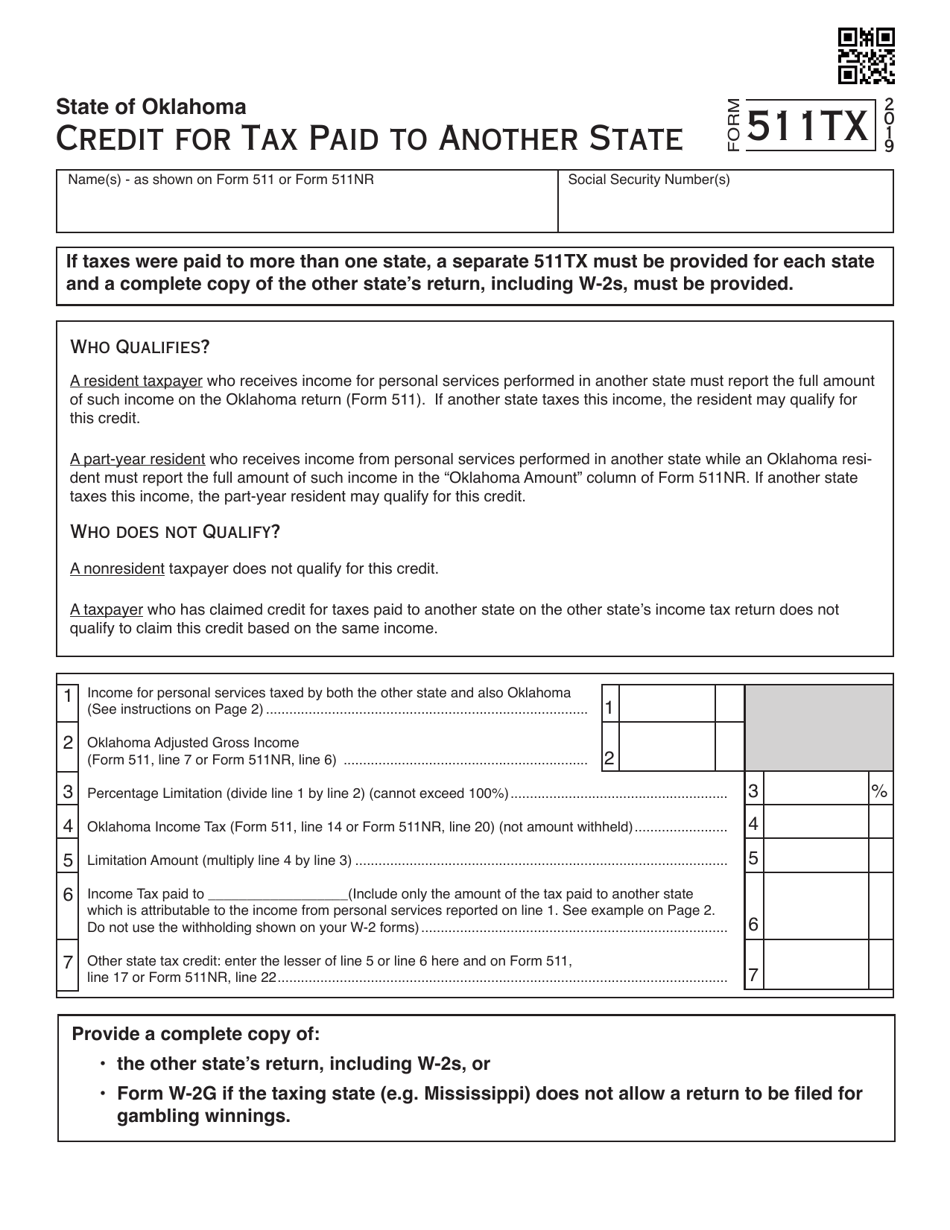

Form 511TX Download Fillable PDF or Fill Online Oklahoma Credit for Tax

Employers engaged in a trade or business who pay compensation form 9465; View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. Opers has extracted specific pages, however, full publications with tables can be found at: Deductions and exemptions reduce the amount of your taxable income. Do not send a payment with quarterly return.

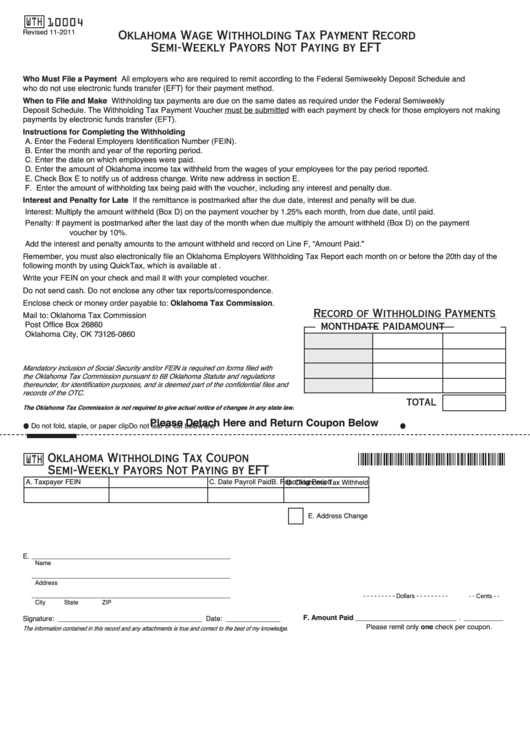

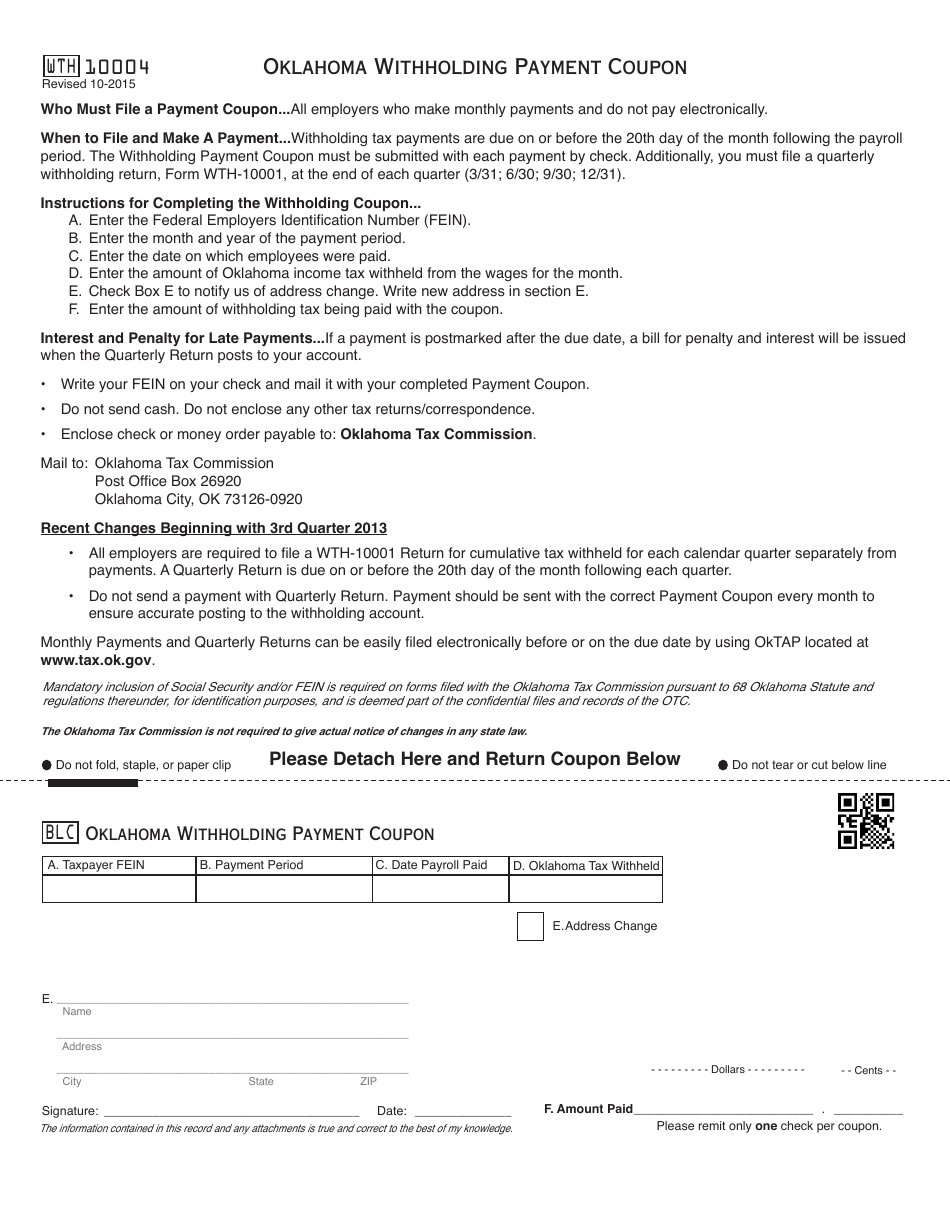

Fillable Form Wth10004 Oklahoma Wage Withholding Tax Payment Record

Web to apply on paper, use form wth10006, oklahoma wage withholding tax application. Pay period 03, 2022 summary the single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Request a state of ohio income tax form be mailed to you. Web oklahoma taxable income and tax withheld. Tax formula.

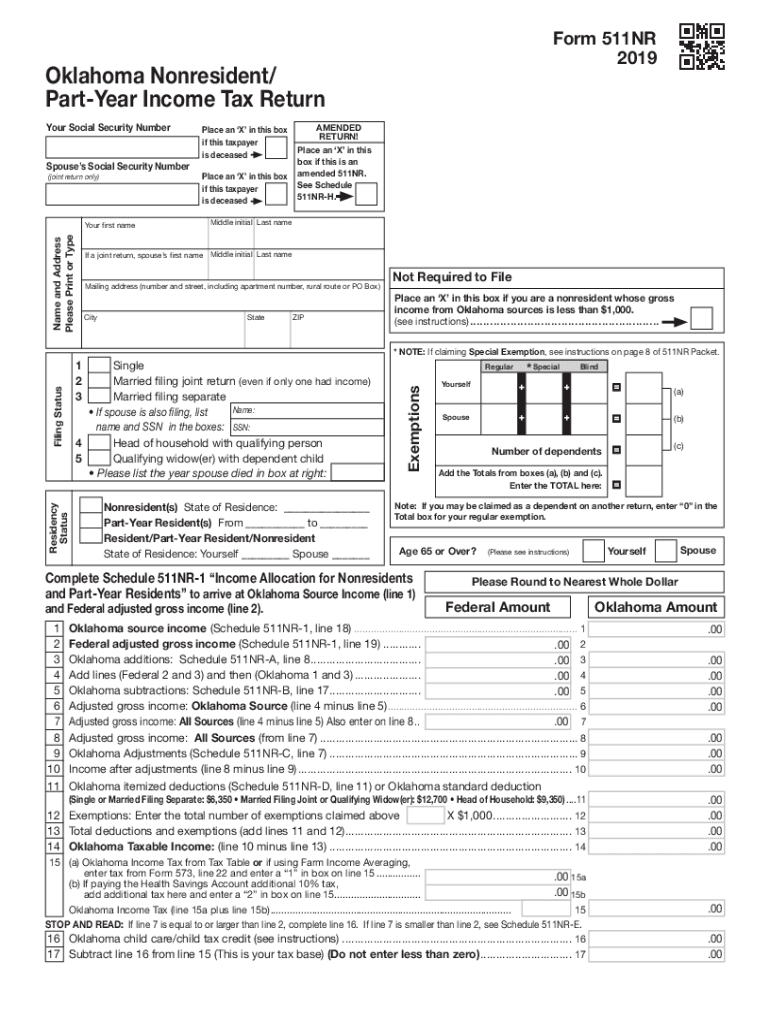

Oklahoma Tax Commission Forms Fill Out and Sign Printable PDF

Web opers has two forms to provide tax withholding preferences for federal and state taxes. You may claim exemption from withholding for 2022 if you meet both of the following conditions: Do not send a payment with quarterly return. Tax formula withholding formula (effective pay period 03, 2022) Tax withholding tables the federal and state tax withholding tables calculate income.

Oklahoma Employee Tax Withholding Form 2023

Non resident royalty withholding tax; Do not send a payment with quarterly return. Complete this section if you want to withhold based on the oklahoma tax withholding tables: If you register on paper, it can take up to six weeks to receive a state tax id number. Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms.

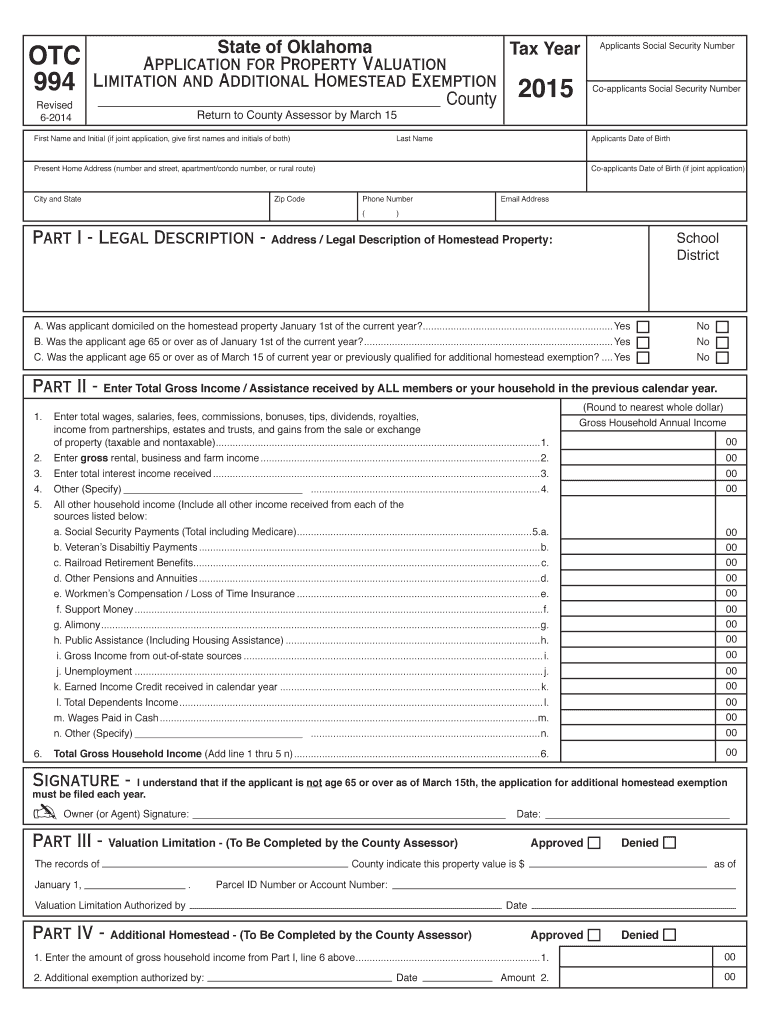

Oklahoma Tax Homestead Exemption Form Fill Out and Sign Printable PDF

Business forms withholding alcohol & tobacco motor fuel miscellaneous taxes payment options forms & publications. Pay period 03, 2022 summary the single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an.

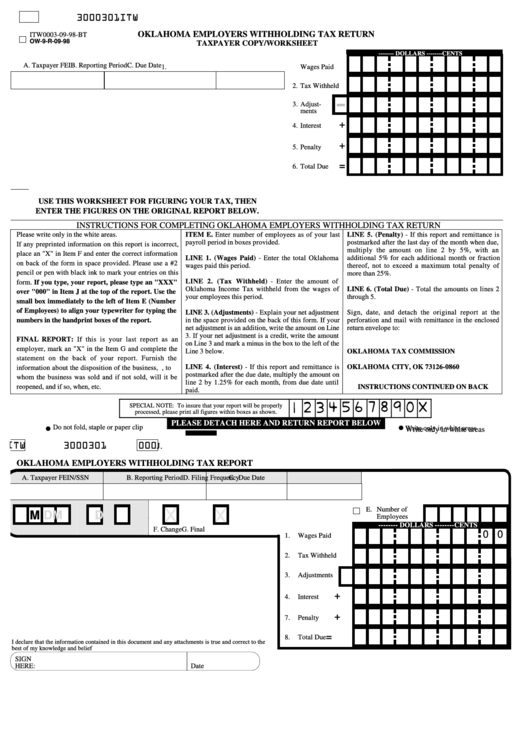

Oklahoma Employers Withholding Tax Return Oklahoma Tax Commission

Married, but withhold at higher single rate. You had no federal income tax liability in 2021 and Pay period 03, 2022 summary the single and married income tax withholdings for the state of oklahoma have changes to the formula for tax year 2022. Web change the entries on the form. What are the requirements for oklahoma payroll tax withholding?

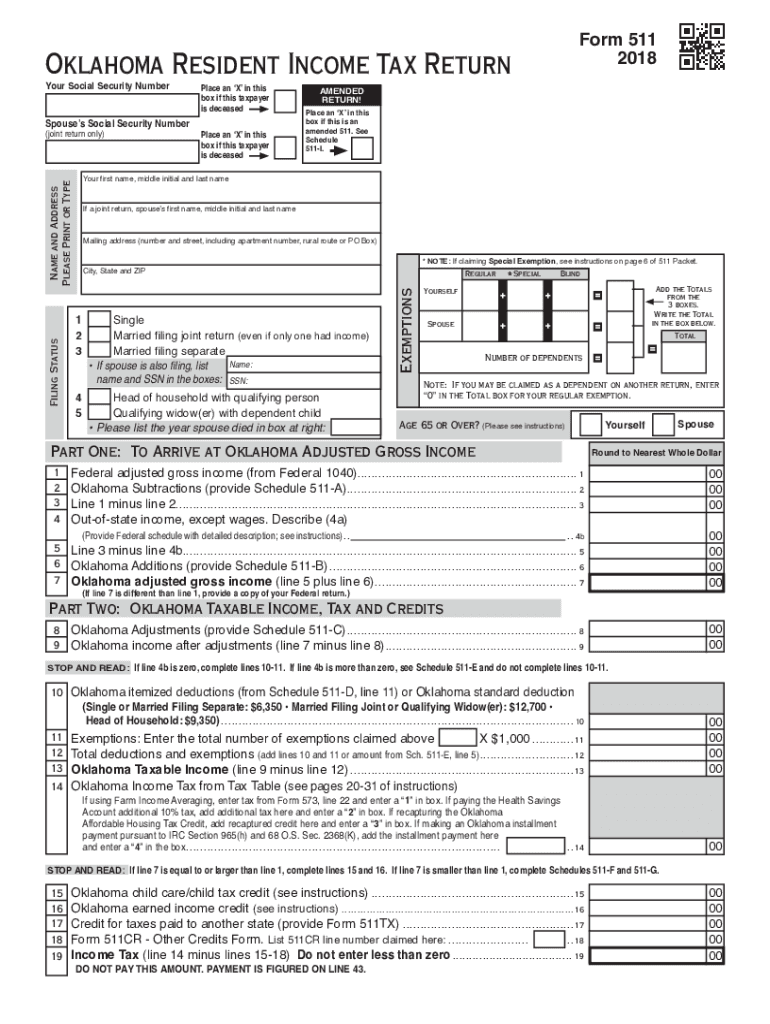

2018 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Tax withholding tables the federal and state tax withholding tables calculate income tax on employee wages. Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an electronic signature. Employee's withholding certificate form 941; Web opers has two forms to provide tax withholding preferences for federal and state taxes. You may claim.

OTC Form WTH10004 Download Fillable PDF or Fill Online Oklahoma

You had no federal income tax liability in 2021 and You must submit form wth10006 by regular mail. You can download blank forms from the business forms section of the otc website. If you register on paper, it can take up to six weeks to receive a state tax id number. Non resident royalty withholding tax;

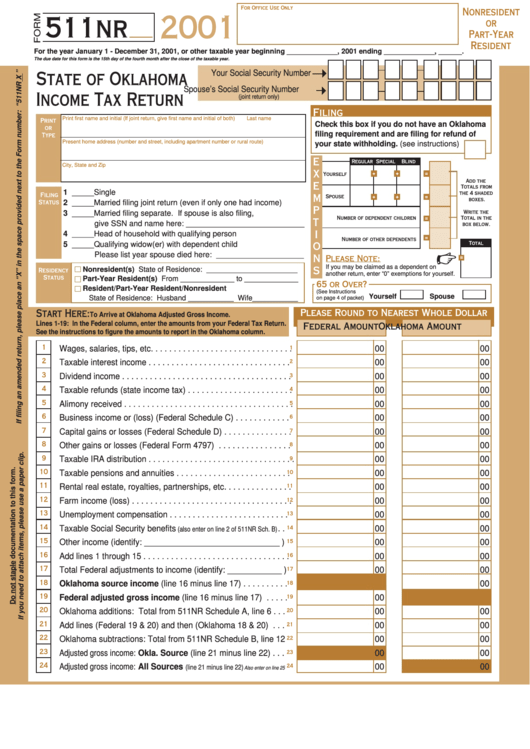

Form 511nr Oklahoma Tax Return 2001 printable pdf download

To register your account with oktap you will need the following information: Your first name and middle initial employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home address (number and street or rural route) city or town state zip code filing status single married married, but withhold at higher single rate last. If you register on paper,.

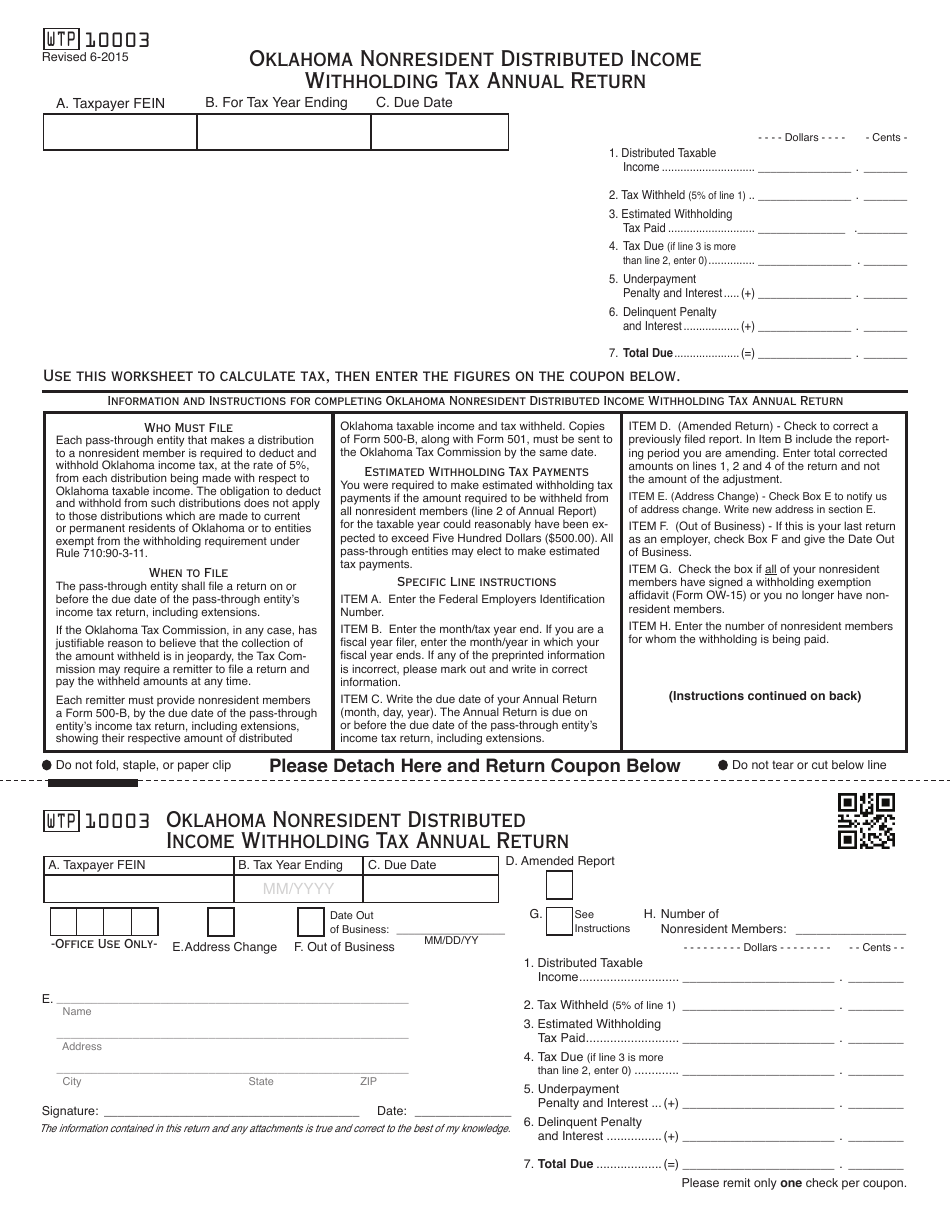

OTC Form WTP10003 Download Fillable PDF or Fill Online Oklahoma

Employers engaged in a trade or business who pay compensation form 9465; You had no federal income tax liability in 2021 and Web both federal and oklahoma state tax withholding forms are available to complete through a digital form with an electronic signature. To register your account with oktap you will need the following information: Web oklahoma taxable income and.

To Register Your Account With Oktap You Will Need The Following Information:

Your first name and middle initial employee’s signature (form is not valid unless you sign it)date (mm/dd/yyyy) home address (number and street or rural route) city or town state zip code filing status single married married, but withhold at higher single rate last. Web oklahoma taxable income and tax withheld. You may claim exemption from withholding for 2022 if you meet both of the following conditions: If you register on paper, it can take up to six weeks to receive a state tax id number.

505, Tax Withholding And Estimated Tax.

You can download blank forms from the business forms section of the otc website. Tax withholding tables the federal and state tax withholding tables calculate income tax on employee wages. Web any oklahoma income tax withheld from your pension. Non resident royalty withholding tax;

Employee's Withholding Certificate Form 941;

No action on the part of the employee or the personnel office is necessary. Estimated withholding tax payments you were required to make estimated withholding tax payments if the amount required to be withheld from all nonresident members (line 2 of annual report) Employers engaged in a trade or business who pay compensation form 9465; Interest is calculated by 1.25% for each month on the unpaid tax liability and.

You Had No Federal Income Tax Liability In 2021 And

Do not send a payment with quarterly return. Web to apply on paper, use form wth10006, oklahoma wage withholding tax application. View bulk orders tax professional bulk orders download tbor 1 declaration of tax representative. Web opers has two forms to provide tax withholding preferences for federal and state taxes.