Preferred Dividends On Balance Sheet

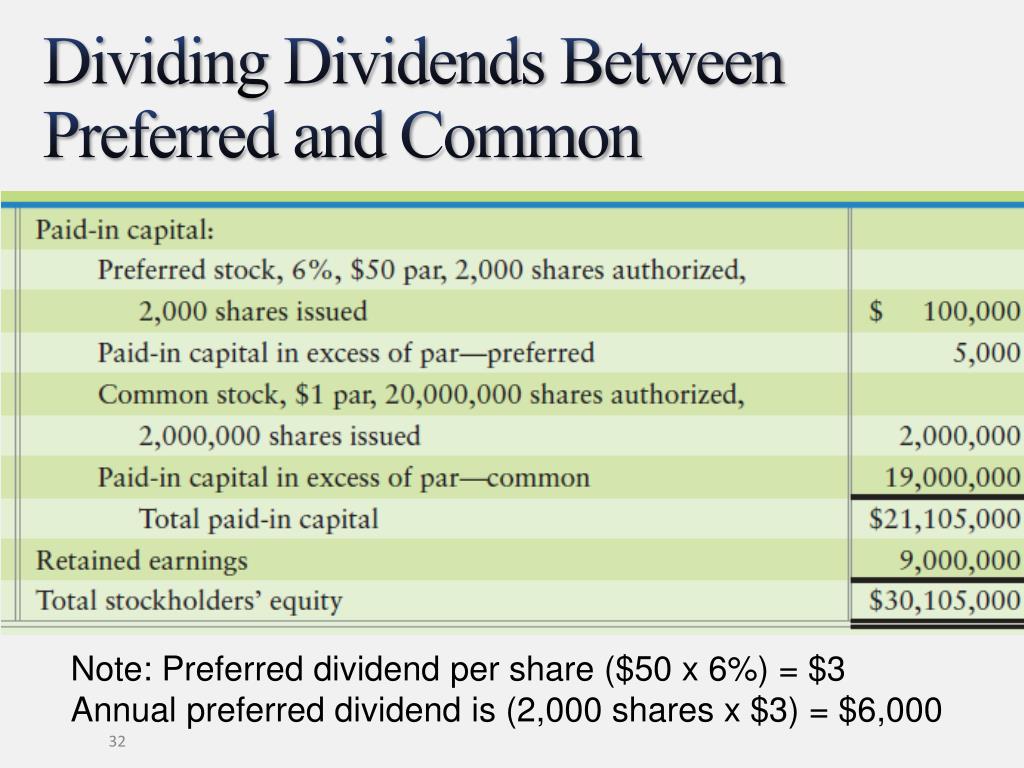

Preferred Dividends On Balance Sheet - Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. For example, a 4 percent dividend on preferred stock with. Read more by the company to raise capital in the primary and secondary markets. The cash flow statement would show $9 million in dividends distributed. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web the income statement would show $10 million, and the balance sheet would show $1 million. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. If a company is unable to pay all dividends, claims to preferred dividends take. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. The preferred stock pays a fixed percentage of.

Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web the income statement would show $10 million, and the balance sheet would show $1 million. Web they are recorded as owner's equity on the company's balance sheet. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. For example, a 4 percent dividend on preferred stock with. The cash flow statement would show $9 million in dividends distributed. If a company is unable to pay all dividends, claims to preferred dividends take. Read more by the company to raise capital in the primary and secondary markets. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share.

The cash flow statement would show $9 million in dividends distributed. For example, a 4 percent dividend on preferred stock with. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. The preferred stock pays a fixed percentage of. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. Web the income statement would show $10 million, and the balance sheet would show $1 million. If a company is unable to pay all dividends, claims to preferred dividends take. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Read more by the company to raise capital in the primary and secondary markets.

Cost of Preferred Stock (kp) Formula + Calculator

Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web they are recorded as owner's equity on the company's balance sheet. The preferred stock pays a fixed percentage of. Web the income statement would show $10 million, and the balance sheet would show $1 million. If a company is unable to.

2 Tandy Company was issued a charter by the state of Indiana on January

Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. The cash flow statement would show $9 million in dividends distributed. Web they are recorded as owner's equity on the company's balance sheet. The preferred stock pays a fixed percentage of. Web.

Dividend Recap LBO Tutorial With Excel Examples

Web the income statement would show $10 million, and the balance sheet would show $1 million. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Read more by the company to raise capital in the.

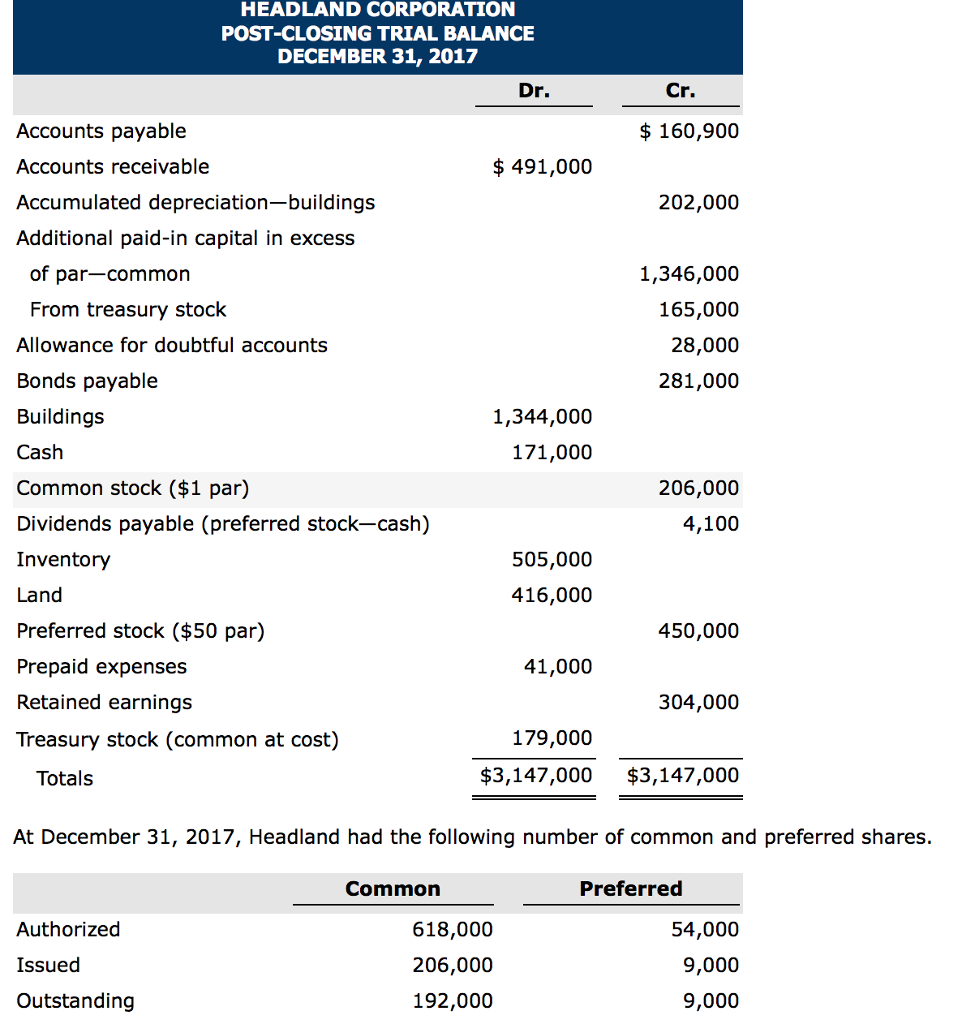

Solved HEADLAND CORPORATION POSTCLOSING TRIAL BALANCE

The cash flow statement would show $9 million in dividends distributed. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. If a company is unable to pay all dividends, claims to preferred dividends take. For example, a 4 percent dividend on preferred stock with. Read more by the company to raise.

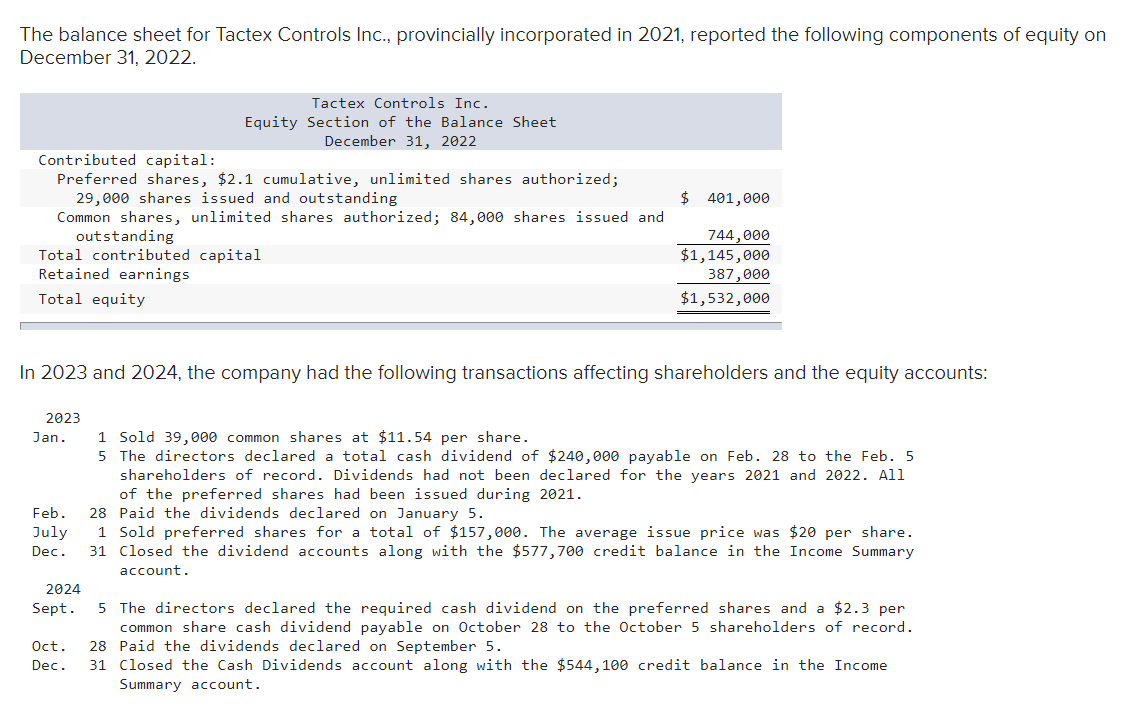

the balance sheet for tactex controls inc provincially incorporated in

Web the income statement would show $10 million, and the balance sheet would show $1 million. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. For example, a 4 percent dividend on preferred stock with. Read more by the company to raise capital in the primary and secondary markets. Web they.

Dividend Recap LBO Tutorial With Excel Examples

Read more by the company to raise capital in the primary and secondary markets. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. If a company is unable to pay all dividends, claims to preferred dividends take. Web they are recorded as owner's equity on the company's balance sheet. Web the total value.

What is share capital BDC.ca

Web the income statement would show $10 million, and the balance sheet would show $1 million. For example, a 4 percent dividend on preferred stock with. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web a preferred dividend is a dividend that is allocated to and paid on a company's.

Eligible Dividends

Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. The cash flow statement would show $9 million in dividends distributed. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. If a company is unable to pay all dividends, claims to preferred dividends take. Web.

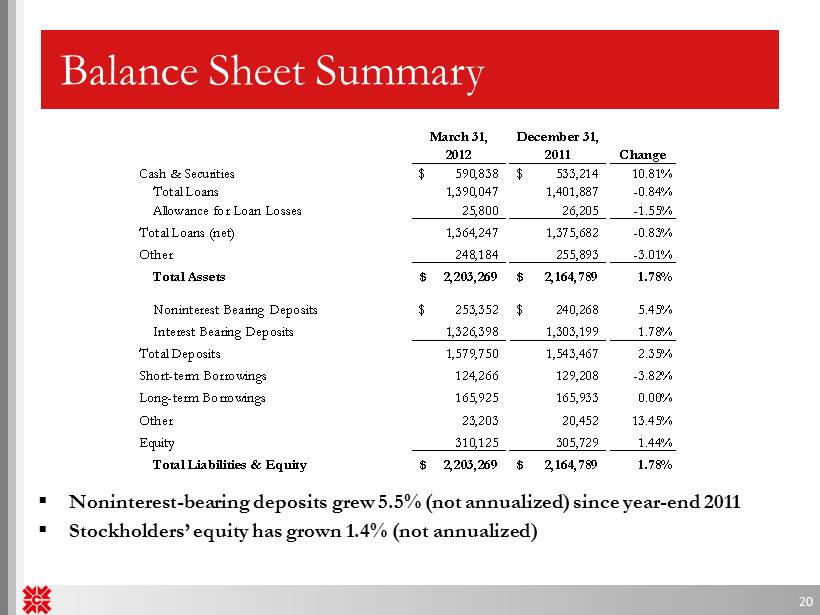

balance sheet example dividends DriverLayer Search Engine

Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web the income statement would show $10 million, and the balance sheet would show $1 million. For example, a 4 percent dividend on preferred stock with. If a company is unable to pay all dividends, claims to preferred dividends take. Web they.

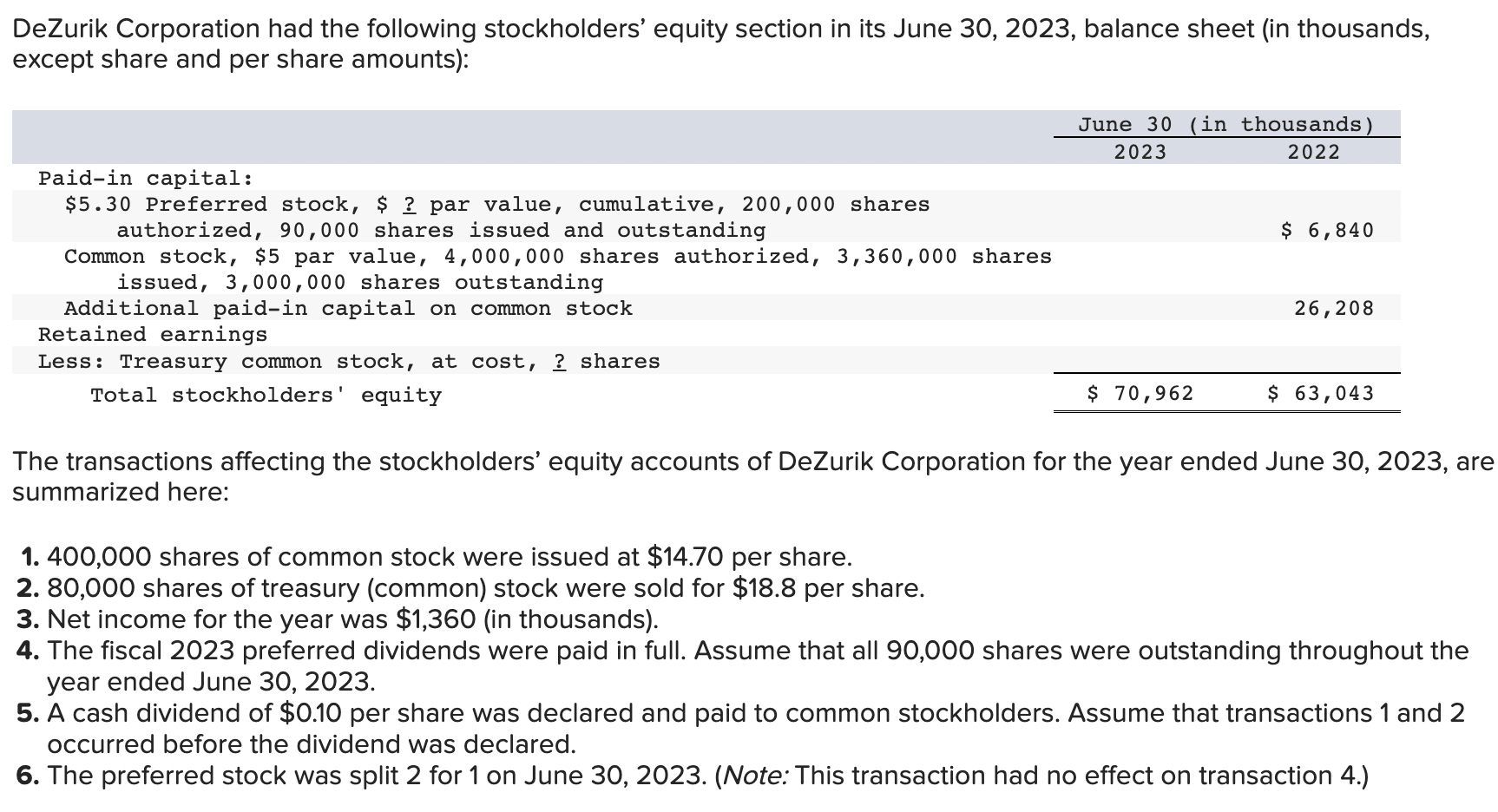

Solved DeZurik Corporation had the following stockholders’

Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. The preferred stock pays a fixed percentage of. Read more by the company to raise capital in the primary and secondary markets. The cash flow statement would show $9 million in dividends.

The Preferred Stock Pays A Fixed Percentage Of.

Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Read more by the company to raise capital in the primary and secondary markets. The cash flow statement would show $9 million in dividends distributed. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in.

For Example, A 4 Percent Dividend On Preferred Stock With.

Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. Web they are recorded as owner's equity on the company's balance sheet. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web the income statement would show $10 million, and the balance sheet would show $1 million.