Printable 1099 Misc Forms

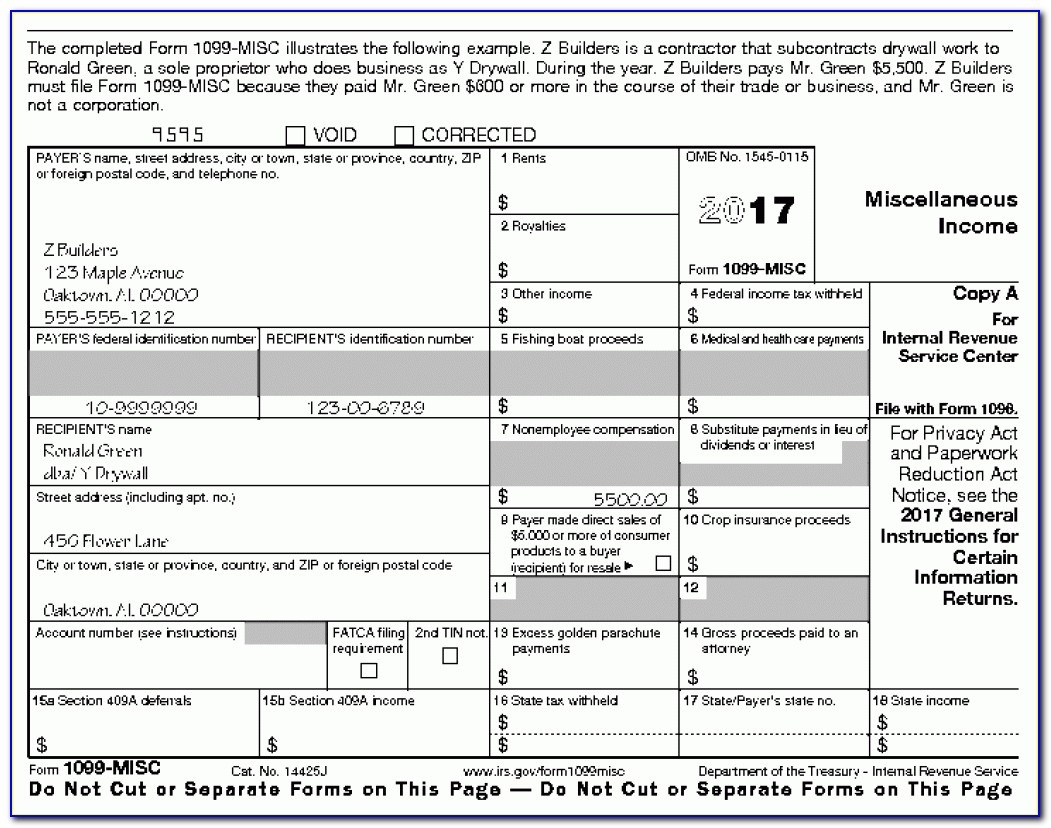

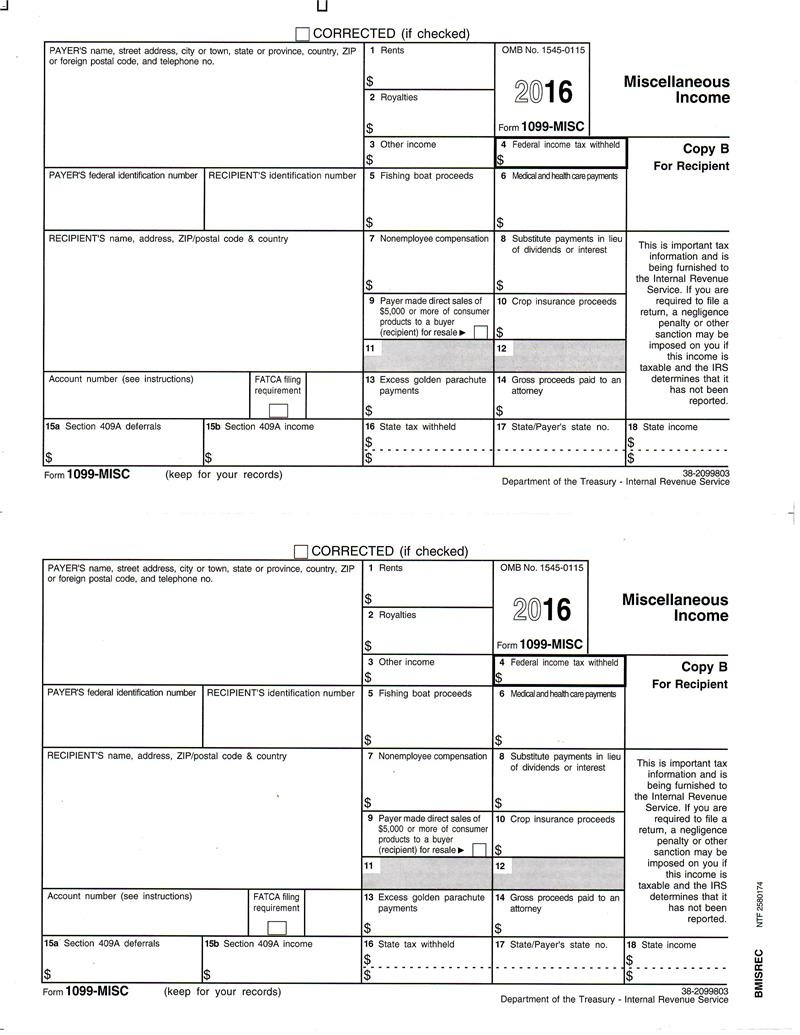

Printable 1099 Misc Forms - Penalties may apply if the form is postmarked after that date. Web instructions for recipient recipient’s taxpayer identification number (tin). Both the forms and instructions will be updated as needed. Cash paid from a notional principal contract made to an individual, partnership, or. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). An amount shown in box 2a may be taxable earnings on an excess contribution. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. Web the first is that the recipient must receive the statement by january 31;

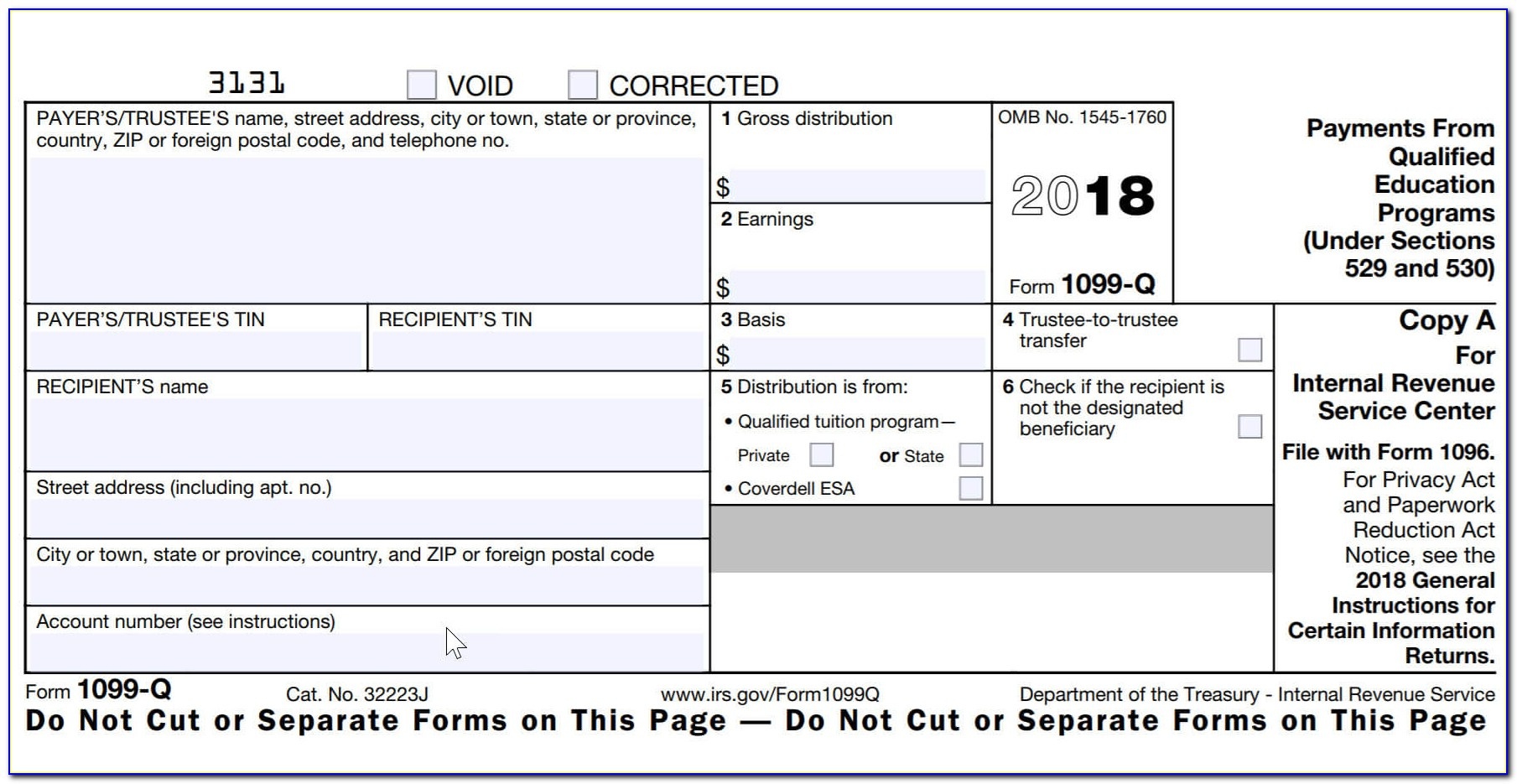

You must compute any taxable amount on form 8606. The second deadline is for filing 1099s with the irs. Both the forms and instructions will be updated as needed. Cash paid from a notional principal contract made to an individual, partnership, or. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web instructions for recipient recipient’s taxpayer identification number (tin). Penalties may apply if the form is postmarked after that date. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. An amount shown in box 2a may be taxable earnings on an excess contribution.

For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. Cash paid from a notional principal contract made to an individual, partnership, or. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. You must compute any taxable amount on form 8606. The second deadline is for filing 1099s with the irs. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). An amount shown in box 2a may be taxable earnings on an excess contribution. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Medical and health care payments. Both the forms and instructions will be updated as needed.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Cash paid from a notional principal contract made to an individual, partnership, or. For distributions from a roth ira, generally the payer isn’t required to compute the.

Where To Get Official 1099 Misc Forms Universal Network

Web instructions for recipient recipient’s taxpayer identification number (tin). For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the.

Form 1099MISC for independent consultants (6 step guide)

Web the first is that the recipient must receive the statement by january 31; The second deadline is for filing 1099s with the irs. Penalties may apply if the form is postmarked after that date. Medical and health care payments. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount.

EFile 1099 File Form 1099 Online Form 1099 for 2020

Web instructions for recipient recipient’s taxpayer identification number (tin). Penalties may apply if the form is postmarked after that date. Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. The second deadline is for filing 1099s with the irs. Both the forms and.

1099MISC Form Printable and Fillable PDF Template

Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). An amount shown in box 2a may be taxable earnings on an excess contribution. You must compute.

11 Common Misconceptions About Irs Form 11 Form Information Free

Penalties may apply if the form is postmarked after that date. You must compute any taxable amount on form 8606. The second deadline is for filing 1099s with the irs. Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer.

Free Printable 1099 Misc Forms Free Printable

An amount shown in box 2a may be taxable earnings on an excess contribution. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Cash paid from a notional principal contract made to an individual, partnership, or. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. Both the forms and instructions will be.

1099MISC 3Part Continuous 1" Wide Formstax

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Medical and health care payments. The second deadline is for filing 1099s with the irs. If you are required to file a return, a negligence penalty or.

11 Common Misconceptions About Irs Form 11 Form Information Free

The second deadline is for filing 1099s with the irs. Medical and health care payments. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web instructions for recipient recipient’s taxpayer identification number (tin). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the.

Free Printable 1099 Misc Forms Free Printable

An amount shown in box 2a may be taxable earnings on an excess contribution. For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. Medical and health care payments. You must compute any taxable amount on form 8606. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

The Second Deadline Is For Filing 1099S With The Irs.

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. You must compute any taxable amount on form 8606. Penalties may apply if the form is postmarked after that date.

Web The First Is That The Recipient Must Receive The Statement By January 31;

Web copy 1 for state tax department www.irs.gov/form1099misc (if checked) copy b for recipient this is important tax information and is being furnished to the irs. Cash paid from a notional principal contract made to an individual, partnership, or. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. An amount shown in box 2a may be taxable earnings on an excess contribution.

Web Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

For distributions from a roth ira, generally the payer isn’t required to compute the taxable amount. Medical and health care payments. Both the forms and instructions will be updated as needed.