Printable 1099 Nec Form 2022

Printable 1099 Nec Form 2022 - For internal revenue service center. Locate a blank template online or in print. Gather the necessary information, including your name, address, and social security number. Follow the instructions included in the document to enter the data. Web here are the steps you need to take to complete the template: Log in to your pdfliner account. Report payment information to the irs and the person or business that received the payment. Web electronic filing of returns. To get the form, either hit the fill this form button or do the steps below: For the first time since 1982, this form has been utilized and reinstated in 2022.

Web here are the steps you need to take to complete the template: To get the form, either hit the fill this form button or do the steps below: Open the document by pushing the fill online button. Locate a blank template online or in print. Download the template, print it out, or fill it in online. If those regulations are finalized, they will be effective for tax years 2022 and beyond, with first filing requirements in 2023. You'll be able to obtain the blank form from the pdfliner catalog. For internal revenue service center. Report payment information to the irs and the person or business that received the payment. Log in to your pdfliner account.

Gather the necessary information, including your name, address, and social security number. Current general instructions for certain information returns. Locate a blank template online or in print. Download the template, print it out, or fill it in online. To get the form, either hit the fill this form button or do the steps below: Web electronic filing of returns. Both the forms and instructions will be updated as needed. In addition to filing with the irs, you are required to send a copy to your recipient. If those regulations are finalized, they will be effective for tax years 2022 and beyond, with first filing requirements in 2023. Log in to your pdfliner account.

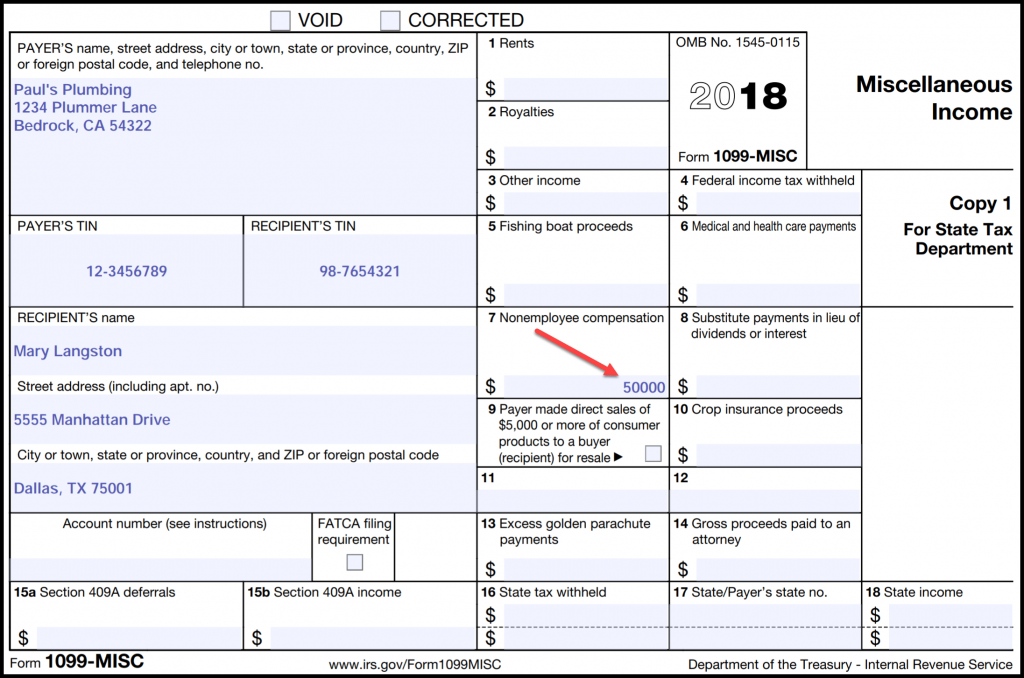

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Report payment information to the irs and the person or business that received the payment. Follow the instructions included in the document to enter the data. Web electronic filing of returns. Download the template, print it out, or fill it in online. Current general instructions for certain information returns.

1099 MISC Form 2022 1099 Forms TaxUni

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Locate a blank template online or in print. Both the forms and instructions will be updated as needed. To get the form, either hit the fill this form button or do the steps below: Current general instructions for certain information returns.

1099 MISC Form 2022 1099 Forms TaxUni

Download the template, print it out, or fill it in online. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Log in to your pdfliner account. For the first time since 1982, this form has been utilized and reinstated in 2022. Current general instructions for certain information returns.

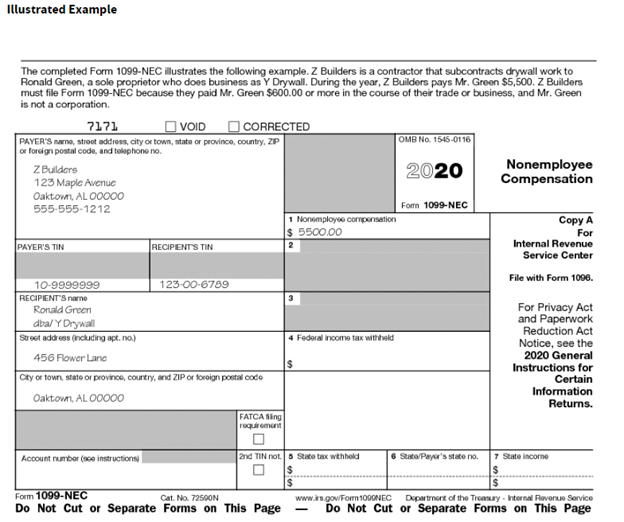

1099 NEC Form 2022

Locate a blank template online or in print. Report payment information to the irs and the person or business that received the payment. Web electronic filing of returns. Open the document by pushing the fill online button. For the first time since 1982, this form has been utilized and reinstated in 2022.

Irs Printable 1099 Form Printable Form 2022

You'll be able to obtain the blank form from the pdfliner catalog. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. If those regulations are finalized, they will be effective for tax years 2022 and beyond, with first filing requirements in 2023. For internal revenue service center. Log in to your pdfliner account.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

For the first time since 1982, this form has been utilized and reinstated in 2022. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Current general instructions for certain information returns. Locate a blank template online or in print. Web here are the steps you need to take to complete the template:

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Follow the instructions included in the document to enter the data. Both the forms and instructions will be updated as needed. Report payment information to the irs and the person or business that received the payment. Web here are the steps you need to take to complete the template: In addition to filing with the irs, you are required to.

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

To get the form, either hit the fill this form button or do the steps below: Both the forms and instructions will be updated as needed. Open the document by pushing the fill online button. Web electronic filing of returns. Gather the necessary information, including your name, address, and social security number.

How to File Your Taxes if You Received a Form 1099NEC

To get the form, either hit the fill this form button or do the steps below: Locate a blank template online or in print. Report payment information to the irs and the person or business that received the payment. Gather the necessary information, including your name, address, and social security number. Open the document by pushing the fill online button.

What the 1099NEC Coming Back Means for your Business Chortek

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For the first time since 1982, this form has been utilized and reinstated in 2022. Current general instructions for certain information returns. To get the form, either hit the fill this form button or do the steps below: Log in to your pdfliner account.

For Internal Revenue Service Center.

Web electronic filing of returns. You'll be able to obtain the blank form from the pdfliner catalog. Report payment information to the irs and the person or business that received the payment. If those regulations are finalized, they will be effective for tax years 2022 and beyond, with first filing requirements in 2023.

Open The Document By Pushing The Fill Online Button.

Gather the necessary information, including your name, address, and social security number. Locate a blank template online or in print. For the first time since 1982, this form has been utilized and reinstated in 2022. Both the forms and instructions will be updated as needed.

Follow The Instructions Included In The Document To Enter The Data.

Download the template, print it out, or fill it in online. Web here are the steps you need to take to complete the template: To get the form, either hit the fill this form button or do the steps below: In addition to filing with the irs, you are required to send a copy to your recipient.

For The Most Recent Version, Go To Irs.gov/Form1099Misc Or Irs.gov/Form1099Nec.

Current general instructions for certain information returns. Log in to your pdfliner account.