Rental Deposit Return Form

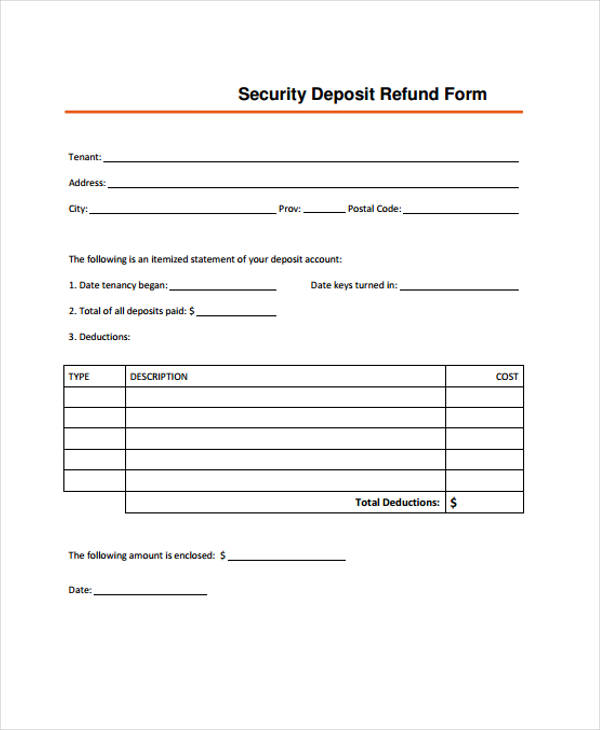

Rental Deposit Return Form - Interest on the security deposit during the lease was $ _____. In general, you can deduct expenses of. This amount is placed in the landlord’s bank account for the security of the lease. Web security deposit refund to: Most landlords will make deductions for damages made to. Web updated april 14, 2023 a security deposit receipt is provided by a landlord to a tenant after receiving payment for the security deposit. I will not be returning your security deposit for the premises located at [address of the property]. A security deposit return letter usually includes a check in the amount of the remaining security deposit from the tenancy. 414 rental income and expenses. Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income.

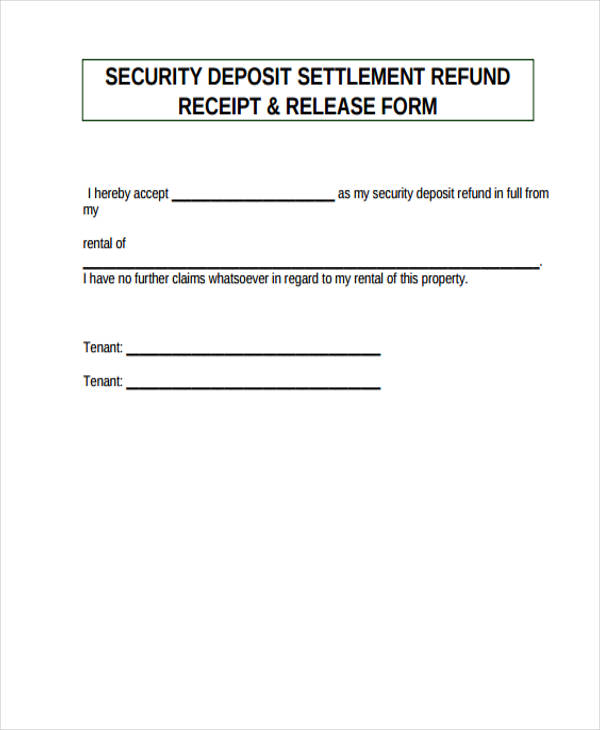

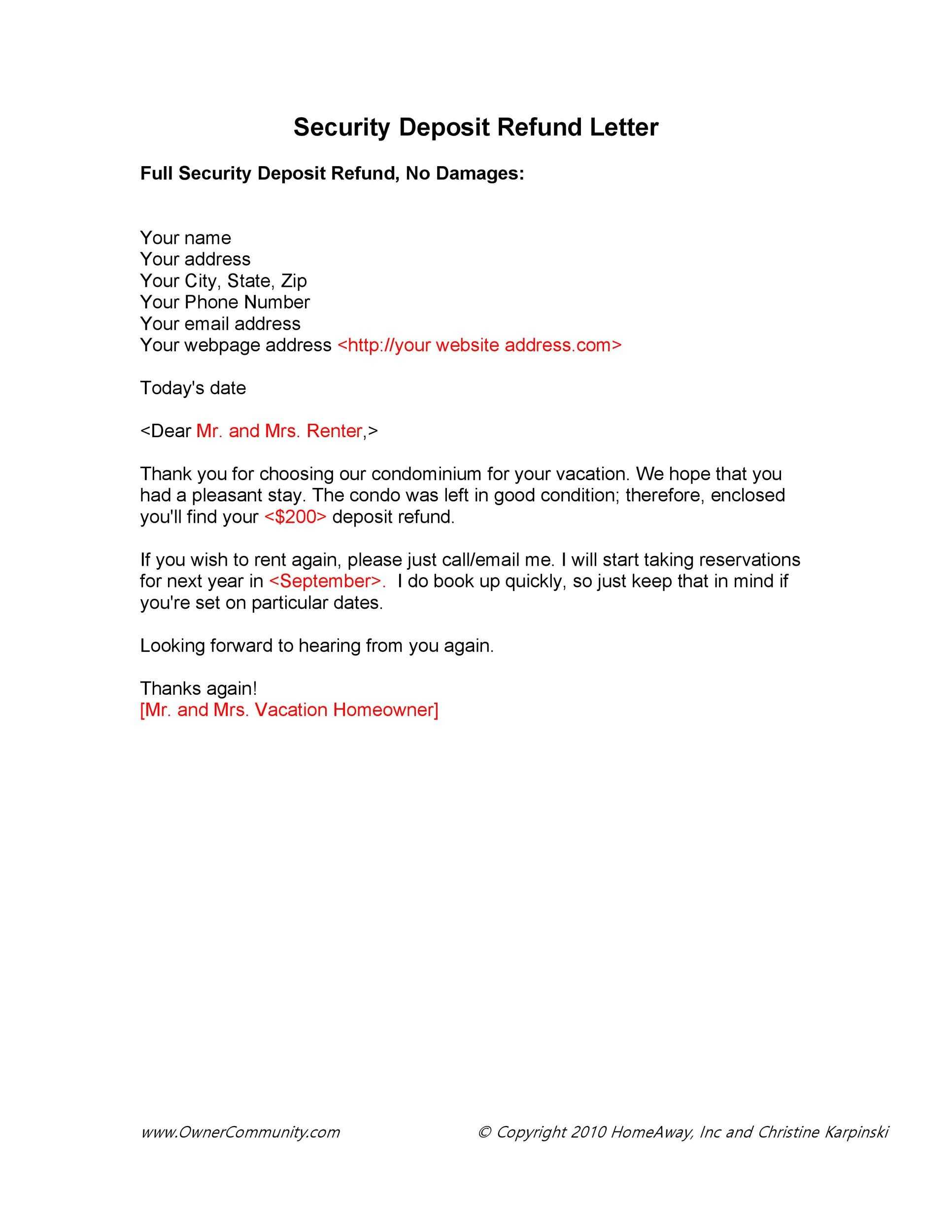

Web a security deposit return letter is a letter sent by a landlord to a tenant indicating how much of the original security deposit is being returned at the end of the tenancy, as well as itemized information for any deductions made. Web free security deposit return letter. This amount is placed in the landlord’s bank account for the security of the lease. Web updated april 14, 2023 a security deposit receipt is provided by a landlord to a tenant after receiving payment for the security deposit. 414 rental income and expenses. ____________________________________ for premises located at: Web security deposit refund to: Web when a tenant moves out, you’ll send your tenant a security deposit return letter that itemizes the cost of any damages or repairs the tenant is responsible for (if applicable), the remaining balance of the security deposit after those costs are deducted, and the amount being refunded. Your tenant should have left a forwarding address with you before moving out, but if not, you can either reach out to them via phone or email within your designated time frame for where to send the letter. Some states require a landlord to provide this letter before withholding any of the tenant’s security.

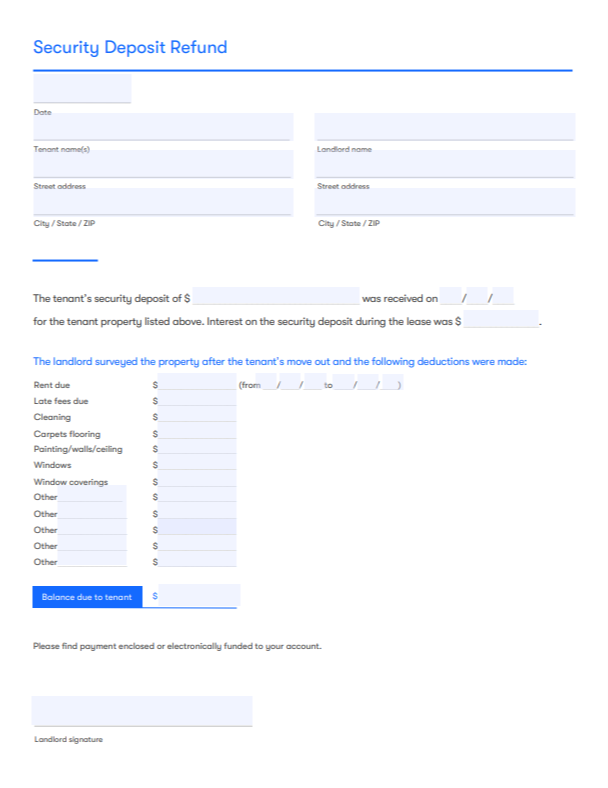

Web updated april 14, 2023 a security deposit receipt is provided by a landlord to a tenant after receiving payment for the security deposit. Web the best way to return the deposit is to send it, and your return deposit letter, via mail. ____________________________________ for premises located at: The landlord surveyed the property after the tenant’s move out and the following deductions were made: Web dear [tenant’s name], this letter concerns your security deposit in the amount of [amount of the total deposit] for the premises located at [address of the property] during your lease period of [start and end dates]. Per state laws, this amount will be returned to the tenant at the end of the tenancy. This amount is placed in the landlord’s bank account for the security of the lease. Web free security deposit return letter. Check out this preview of our template and then download the full security deposit return letter as a pdf. Use our security deposit return letter as a receipt for the refunded portion of a tenant’s security deposit.

Landlord Letter To Tenant Regarding Security Deposit Return

This amount is placed in the landlord’s bank account for the security of the lease. A security deposit return letter usually includes a check in the amount of the remaining security deposit from the tenancy. ____________________________________ for premises located at: Most landlords will make deductions for damages made to. Check out this preview of our template and then download the.

12 Rental Deposit Forms to Download for Free Sample Templates

Your tenant should have left a forwarding address with you before moving out, but if not, you can either reach out to them via phone or email within your designated time frame for where to send the letter. Use our security deposit return letter as a receipt for the refunded portion of a tenant’s security deposit. Web security deposit refund.

50 Effective Security Deposit Return Letters [MS Word] ᐅ TemplateLab

Web security deposit refund the tenant’s security deposit of $ _____ was received on ____/____/____ for the tenant property listed above. In general, you can deduct expenses of. This amount is placed in the landlord’s bank account for the security of the lease. Web dear [tenant’s name], this letter concerns your security deposit in the amount of [amount of the.

Tenant Deposit Refund Letter Collection Letter Template Collection

Interest on the security deposit during the lease was $ _____. Web when a tenant moves out, you’ll send your tenant a security deposit return letter that itemizes the cost of any damages or repairs the tenant is responsible for (if applicable), the remaining balance of the security deposit after those costs are deducted, and the amount being refunded. Your.

FREE 11+ Sample Rental Deposit Forms in PDF MS Word

Per state laws, this amount will be returned to the tenant at the end of the tenancy. Use our security deposit return letter as a receipt for the refunded portion of a tenant’s security deposit. Web a security deposit return letter is a letter sent by a landlord to a tenant indicating how much of the original security deposit is.

Security Deposit Return form Template Elegant Property Management forms

Web the best way to return the deposit is to send it, and your return deposit letter, via mail. The landlord surveyed the property after the tenant’s move out and the following deductions were made: Web updated april 14, 2023 a security deposit receipt is provided by a landlord to a tenant after receiving payment for the security deposit. Cash.

FREE 10+ Security Deposit Return Forms in PDF MS Word

Your tenant should have left a forwarding address with you before moving out, but if not, you can either reach out to them via phone or email within your designated time frame for where to send the letter. Check out this preview of our template and then download the full security deposit return letter as a pdf. Interest on the.

Not Returning Security Deposit Letter

Web security deposit refund to: In general, you can deduct expenses of. Your tenant should have left a forwarding address with you before moving out, but if not, you can either reach out to them via phone or email within your designated time frame for where to send the letter. Check out this preview of our template and then download.

FREE 39+ Receipt Forms in PDF MS Word

Web when a tenant moves out, you’ll send your tenant a security deposit return letter that itemizes the cost of any damages or repairs the tenant is responsible for (if applicable), the remaining balance of the security deposit after those costs are deducted, and the amount being refunded. A security deposit return letter usually includes a check in the amount.

FREE 10+ Security Deposit Return Forms in PDF MS Word

This amount is placed in the landlord’s bank account for the security of the lease. Web a security deposit return letter is a letter sent by a landlord to a tenant indicating how much of the original security deposit is being returned at the end of the tenancy, as well as itemized information for any deductions made. Check out this.

Per State Laws, This Amount Will Be Returned To The Tenant At The End Of The Tenancy.

Web security deposit refund the tenant’s security deposit of $ _____ was received on ____/____/____ for the tenant property listed above. Web free security deposit return letter. I will not be returning your security deposit for the premises located at [address of the property]. A security deposit return letter usually includes a check in the amount of the remaining security deposit from the tenancy.

The Landlord Surveyed The Property After The Tenant’s Move Out And The Following Deductions Were Made:

In general, you can deduct expenses of. Check out this preview of our template and then download the full security deposit return letter as a pdf. Web a security deposit return letter is a letter sent by a landlord to a tenant indicating how much of the original security deposit is being returned at the end of the tenancy, as well as itemized information for any deductions made. ____________________________________ for premises located at:

Web Dear [Tenant’s Name], This Letter Concerns Your Security Deposit In The Amount Of [Amount Of The Total Deposit] For The Premises Located At [Address Of The Property] During Your Lease Period Of [Start And End Dates].

Web when a tenant moves out, you’ll send your tenant a security deposit return letter that itemizes the cost of any damages or repairs the tenant is responsible for (if applicable), the remaining balance of the security deposit after those costs are deducted, and the amount being refunded. Web the best way to return the deposit is to send it, and your return deposit letter, via mail. Web updated april 14, 2023 a security deposit receipt is provided by a landlord to a tenant after receiving payment for the security deposit. 414 rental income and expenses.

This Amount Is Placed In The Landlord’s Bank Account For The Security Of The Lease.

Use our security deposit return letter as a receipt for the refunded portion of a tenant’s security deposit. Your tenant should have left a forwarding address with you before moving out, but if not, you can either reach out to them via phone or email within your designated time frame for where to send the letter. Most landlords will make deductions for damages made to. Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income.

![50 Effective Security Deposit Return Letters [MS Word] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2019/03/security-deposit-return-letter-13.jpg?w=395)