Rollover Contribution Form 5498

Rollover Contribution Form 5498 - However, i have not received a. Form 5498 is not entered into your tax return. Web contributions to your traditional ira or sep ira and you did not roll over the total distribution, use form 8606 to figure the taxable amount. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web in addition, form 5498, ira contribution information, must be filed to report any regular, rollover, roth ira conversion, sep ira, or simple ira contribution to an ira that. Form 5498, ira contributions information, reports your ira. It is for your information only. Web • rira = rollover ira • roth = roth ira • sep= sep ira • simple = simple ira • contribution amounts and contribution characterizations. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Why did i receive a.

Web • rira = rollover ira • roth = roth ira • sep= sep ira • simple = simple ira • contribution amounts and contribution characterizations. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Why did i receive a. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web although a rollover or conversion of assets from one retirement plan into an ira isn’t deductible, they are considered contributions and will be reported in boxes. However, i have not received a. Web rollover ira contribution from form 5498 form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer. Web contributions to your traditional ira or sep ira and you did not roll over the total distribution, use form 8606 to figure the taxable amount. Web general information what is the purpose of a 5498?

If property was rolled over, see. Web • rira = rollover ira • roth = roth ira • sep= sep ira • simple = simple ira • contribution amounts and contribution characterizations. Why did i receive a. Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web rollover ira contribution from form 5498 form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Web in addition, form 5498, ira contribution information, must be filed to report any regular, rollover, roth ira conversion, sep ira, or simple ira contribution to an ira that. Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer. Web although a rollover or conversion of assets from one retirement plan into an ira isn’t deductible, they are considered contributions and will be reported in boxes. Web do i enter the rollover contributions on form 5498 box 2 as contribution? Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,.

401k Rollover Form 5498 Universal Network

Form 5498 is not entered into your tax return. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing deadline. If property was rolled over, see. Form 5498, ira contributions information, reports your ira. Web general information what.

The Purpose of IRS Form 5498

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. It is for your information only. Web contributions to your traditional ira or sep ira and you did not roll over the.

Ira Rollover Tax Form 5498 Universal Network

Web general information what is the purpose of a 5498? Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Form 5498, ira contributions information, reports your ira. However, i have not received a. Web how do i enter rollover fair market value.

IRS Form 5498 IRA Contribution Information

Form 5498 is not entered into your tax return. However, i have not received a. Web • rira = rollover ira • roth = roth ira • sep= sep ira • simple = simple ira • contribution amounts and contribution characterizations. Web although a rollover or conversion of assets from one retirement plan into an ira isn’t deductible, they are.

401k Rollover Form 5498 Universal Network

Web in addition, form 5498, ira contribution information, must be filed to report any regular, rollover, roth ira conversion, sep ira, or simple ira contribution to an ira that. Web general information what is the purpose of a 5498? If property was rolled over, see. Web how do i enter rollover fair market value contributions from form 5498 in a.

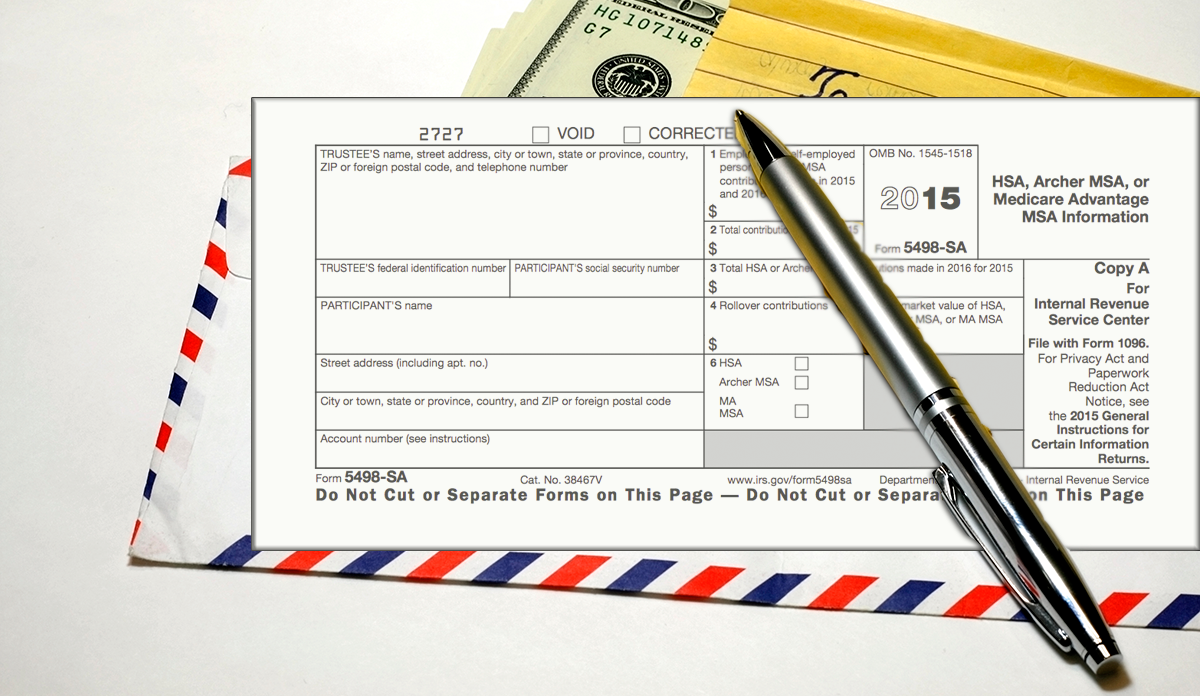

What is IRS Form 5498SA? BRI Benefit Resource

Web rollover ira contribution from form 5498 form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Web do i enter the rollover contributions on form 5498 box 2 as contribution? Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to.

5498 Software to Create, Print & EFile IRS Form 5498

It is for your information only. Web although a rollover or conversion of assets from one retirement plan into an ira isn’t deductible, they are considered contributions and will be reported in boxes. Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer..

A16 Rollover Contribution Form MMBB Storefront

Web • rira = rollover ira • roth = roth ira • sep= sep ira • simple = simple ira • contribution amounts and contribution characterizations. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Web rollover ira contribution from form 5498 form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Web the.

Ira Rollover Form 5498 Universal Network

Form 5498, ira contributions information, reports your ira. Web how do i enter rollover fair market value contributions from form 5498 in a 1040 return in taxwise®? Form 5498 is not entered into your tax return. It is for your information only. Web general information what is the purpose of a 5498?

IRS Form 5498 Instructions for 2021 Line by Line 5498 Instruction

Web do i enter the rollover contributions on form 5498 box 2 as contribution? Web rollover ira contribution from form 5498 form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee,.

Form 5498, Ira Contributions Information, Reports Your Ira.

Web do i enter the rollover contributions on form 5498 box 2 as contribution? Web instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web • rira = rollover ira • roth = roth ira • sep= sep ira • simple = simple ira • contribution amounts and contribution characterizations. Web contributions to your traditional ira or sep ira and you did not roll over the total distribution, use form 8606 to figure the taxable amount.

If Property Was Rolled Over, See.

It is for your information only. However, i have not received a. Web general information what is the purpose of a 5498? Why did i receive a.

Web Up To 10% Cash Back Form 5498 Identifies An Individual (I.e., Ira Owner Or Beneficiary) By Name, Address On Record With The Ira Custodian/Trustee, And Taxpayer.

Form 5498 is not entered into your tax return. Web rollover ira contribution from form 5498 form 5498 for my traditional ira shows a value in line 2 (rollover contributions). Web although a rollover or conversion of assets from one retirement plan into an ira isn’t deductible, they are considered contributions and will be reported in boxes. Web how do i enter rollover fair market value contributions from form 5498 in a 1040 return in taxwise®?

Furnished By Edward Jones To Report Contributions, Rollovers, Conversions And Recharacterizations.

Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions,. Web in addition, form 5498, ira contribution information, must be filed to report any regular, rollover, roth ira conversion, sep ira, or simple ira contribution to an ira that. Web form 5498 should be mailed to you by may 31st to show traditional ira contributions made for the prior year between january 31st of the prior year and the tax filing deadline.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)