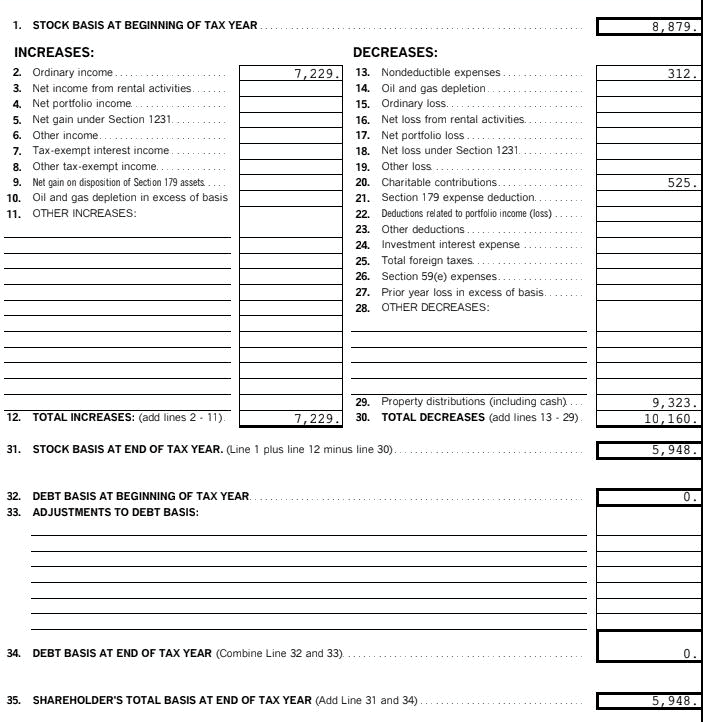

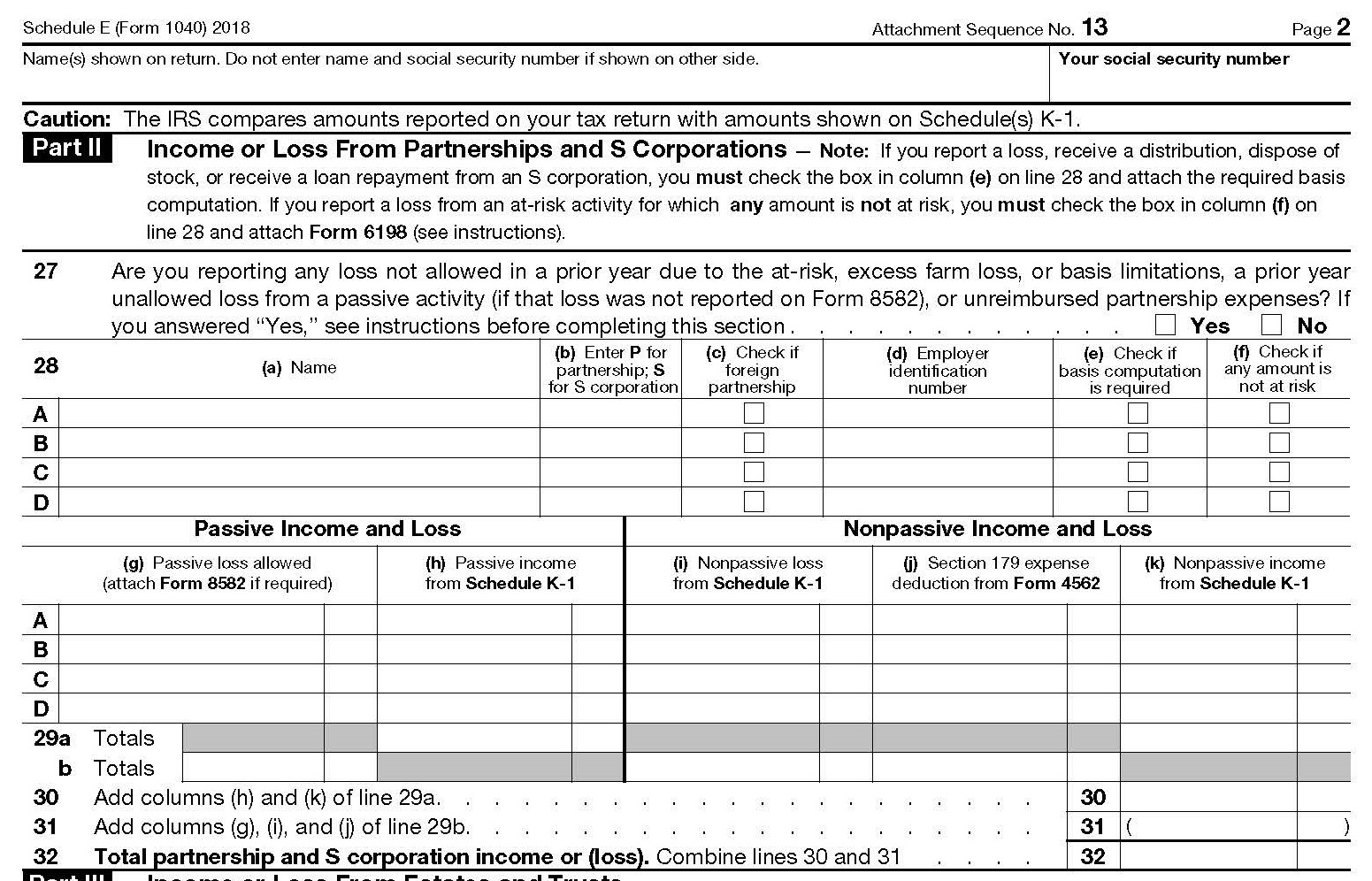

S Corp Basis Form

S Corp Basis Form - Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Get started on yours today. According to the irs, basis is defined as the amount of investment that an. Election by a small business corporation with the irs. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Start your corporation with us. Web irs issues new tax basis form for s corporation shareholders (parker tax publishing april 2022) the irs issued a new form to be filed by certain s corporation. Web documenting s corporation shareholder basis as protection against an irs audit american institute of certified public accountants washington, dc www.aicpa.org/tax. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns.

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. We're ready when you are. Election by a small business corporation with the irs. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. Web documenting s corporation shareholder basis as protection against an irs audit american institute of certified public accountants washington, dc www.aicpa.org/tax. Shareholders who have ownership in an s corporation must make a point to have a. Get started on yours today. Web this number called “basis” increases and decreases with the activity of the company. Start your corporation with us. Web irs issues guidance for s corporation shareholders.

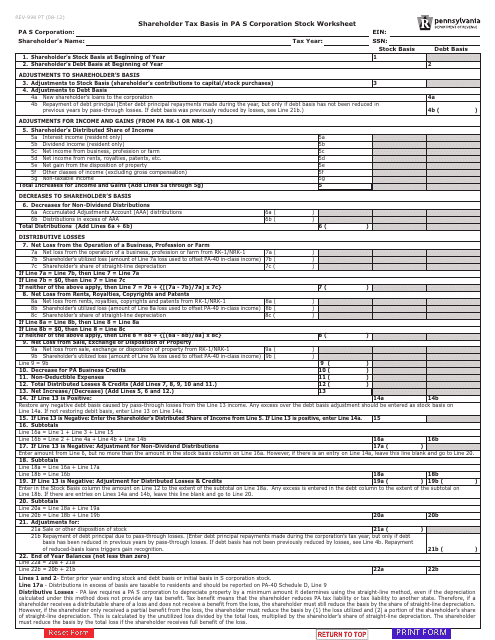

Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. The final form is expected to be. Start your corporation with us. Ad 3m+ customers have trusted us with their business formations. We're ready when you are. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. According to the irs, basis is defined as the amount of investment that an. Web campaign description s corporation shareholders must track adjustments to their basis in s corporation stock and debt to avoid improperly claiming losses and deductions in. Shareholders who have ownership in an s corporation must make a point. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt.

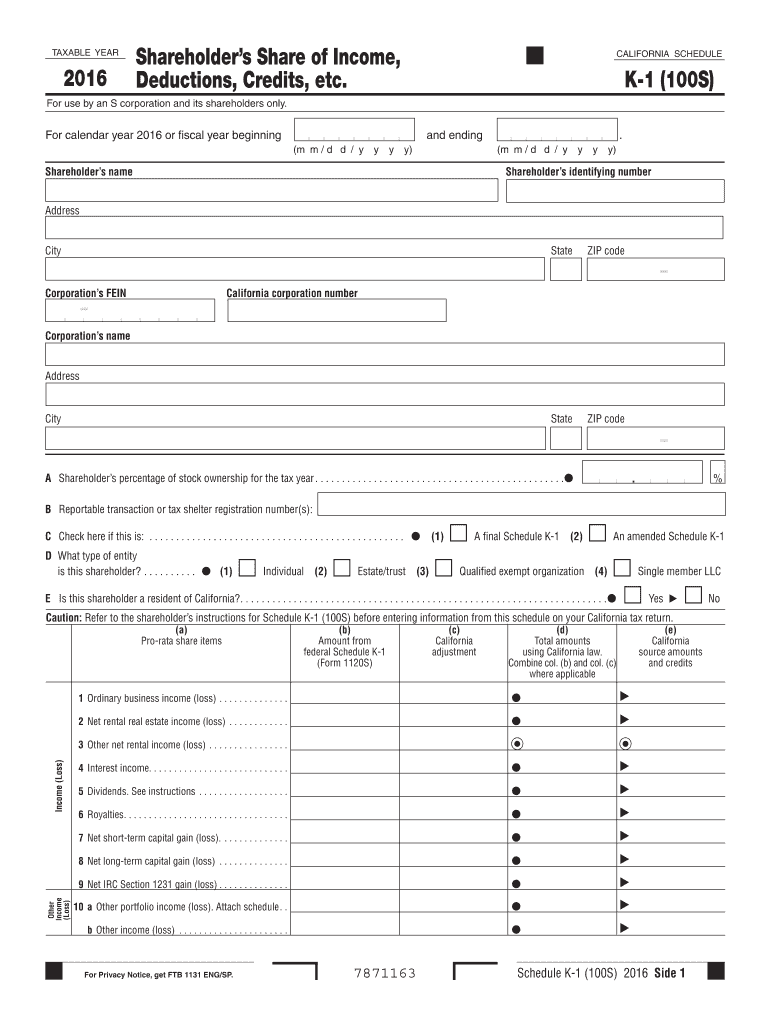

Online Ftb State Of Ca Schedule K 1 For S Corp Form Fill Out and Sign

Start your corporation with us. Web this number called “basis” increases and decreases with the activity of the company. Unless this is your initial year owning stock in the s. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. Web 43 rows.

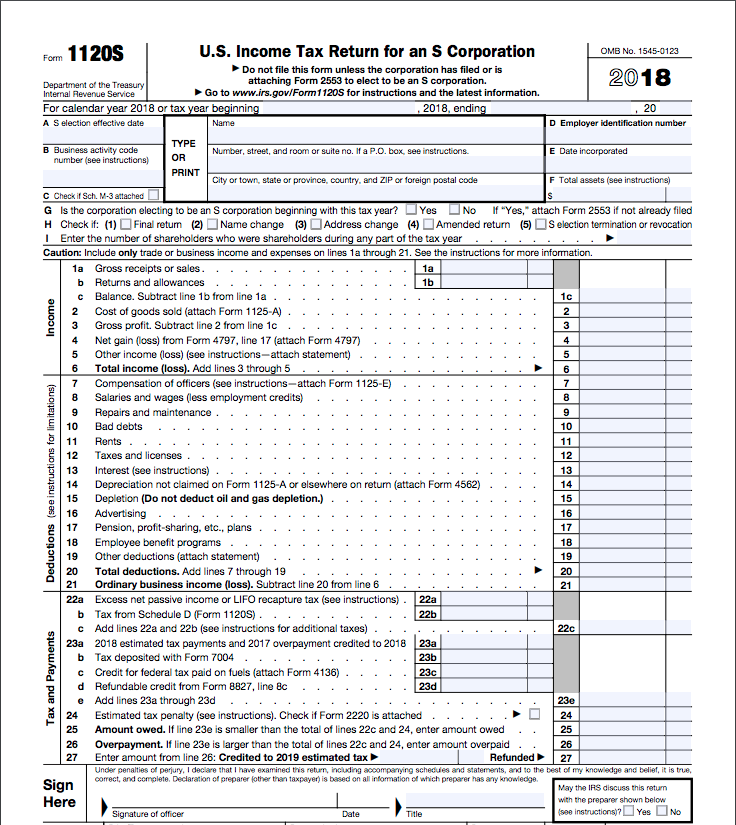

S Corporation Tax Filing Benefits, Deadlines, and Howto Bench

Web irs issues new tax basis form for s corporation shareholders (parker tax publishing april 2022) the irs issued a new form to be filed by certain s corporation. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. We're ready when you.

S Corp Basis Worksheet Studying Worksheets

Ad 3m+ customers have trusted us with their business formations. The irs defines it as the amount of one’s investment in the business for tax purposes. Web irs issues guidance for s corporation shareholders. Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation. Web 43 rows forms for corporations.

Shareholder Basis Worksheet Excel Worksheet List

Get started on yours today. Web campaign description s corporation shareholders must track adjustments to their basis in s corporation stock and debt to avoid improperly claiming losses and deductions in. Web irs issues new tax basis form for s corporation shareholders (parker tax publishing april 2022) the irs issued a new form to be filed by certain s corporation..

S Corp Tax Basis Worksheet Worksheet Resume Examples

Shareholders who have ownership in an s corporation must make a point to have a. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) The irs defines.

1120s Other Deductions Worksheet Ivuyteq

Web 43 rows forms for corporations. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Unless this is your initial year owning stock in the s. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder.

S Corp Basis 7203 NEW IRS Form 7203 [S Corporation] Shareholder Stock

The formation requirements for an s corporation are. Election by a small business corporation with the irs. Web 43 rows forms for corporations. Web up to 10% cash back an s corporation is a corporation that has elected a special tax status with the internal revenue service (irs). We're ready when you are.

SCorp Preparation, Basis Calculations & Distributions Form 1120S

Web this number called “basis” increases and decreases with the activity of the company. Use this form to —. Ad 3m+ customers have trusted us with their business formations. First, you will close the sole proprietorship permanently and forever on dec 31, 2019. Shareholders who have ownership in an s corporation must make a point to have a.

S Corp Basis Worksheet Studying Worksheets

Web irs issues guidance for s corporation shareholders. Web this number called “basis” increases and decreases with the activity of the company. Unless this is your initial year owning stock in the s. Ad 3m+ customers have trusted us with their business formations. The irs defines it as the amount of one’s investment in the business for tax purposes.

Cover Your Basis Understanding SCorp Basis Rules

The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation. Web up to 10% cash back an s corporation is a corporation that has elected a special tax status with the internal revenue service (irs). Shareholders who have.

Get Started On Yours Today.

Election by a small business corporation with the irs. Unless this is your initial year owning stock in the s. We're ready when you are. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis.

Shareholders Who Have Ownership In An S Corporation Must Make A Point To Have A.

Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web irs issues guidance for s corporation shareholders. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web documenting s corporation shareholder basis as protection against an irs audit american institute of certified public accountants washington, dc www.aicpa.org/tax.

Web Irs Issues New Tax Basis Form For S Corporation Shareholders (Parker Tax Publishing April 2022) The Irs Issued A New Form To Be Filed By Certain S Corporation.

First, you will close the sole proprietorship permanently and forever on dec 31, 2019. According to the irs, basis is defined as the amount of investment that an. The irs recently issued a new draft form 7203, s corporation shareholder stock and debt. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders.

Web 43 Rows Forms For Corporations.

Shareholders who have ownership in an s corporation must make a point. Ad 3m+ customers have trusted us with their business formations. Web campaign description s corporation shareholders must track adjustments to their basis in s corporation stock and debt to avoid improperly claiming losses and deductions in. Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation.

![S Corp Basis 7203 NEW IRS Form 7203 [S Corporation] Shareholder Stock](https://i.ytimg.com/vi/EaPvB98yCZQ/maxresdefault.jpg)