Schedule 1 Form 2290 Instructions

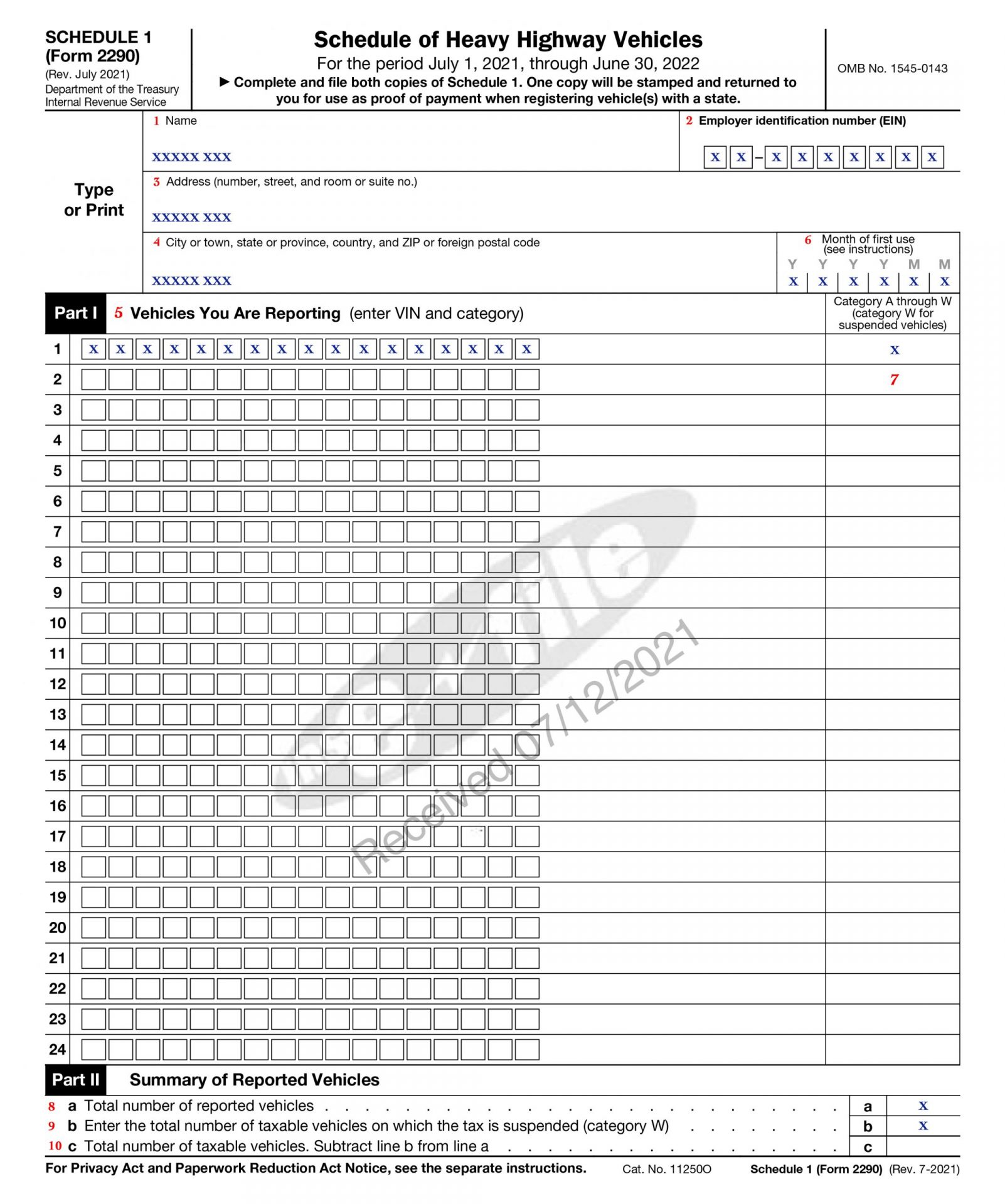

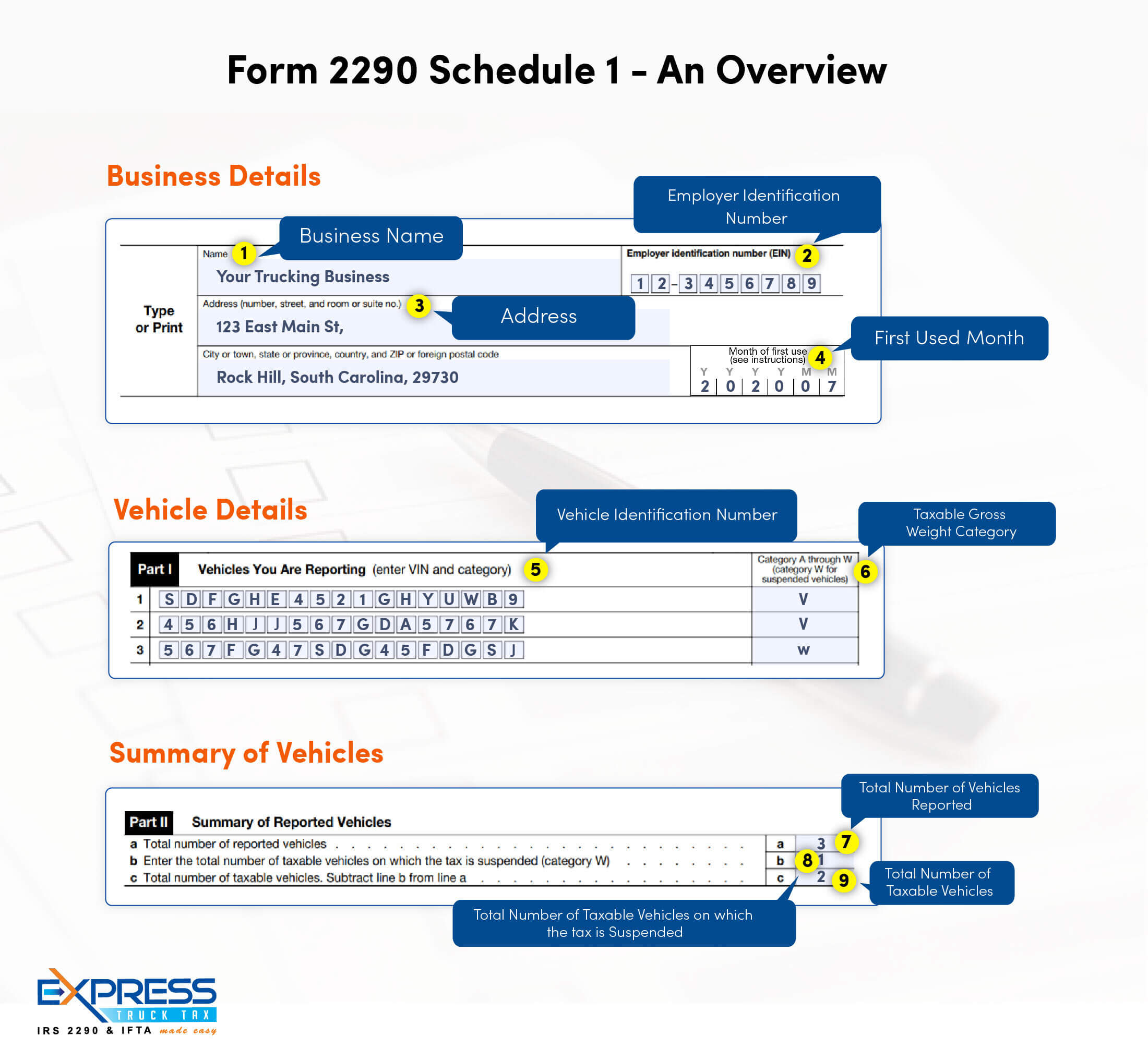

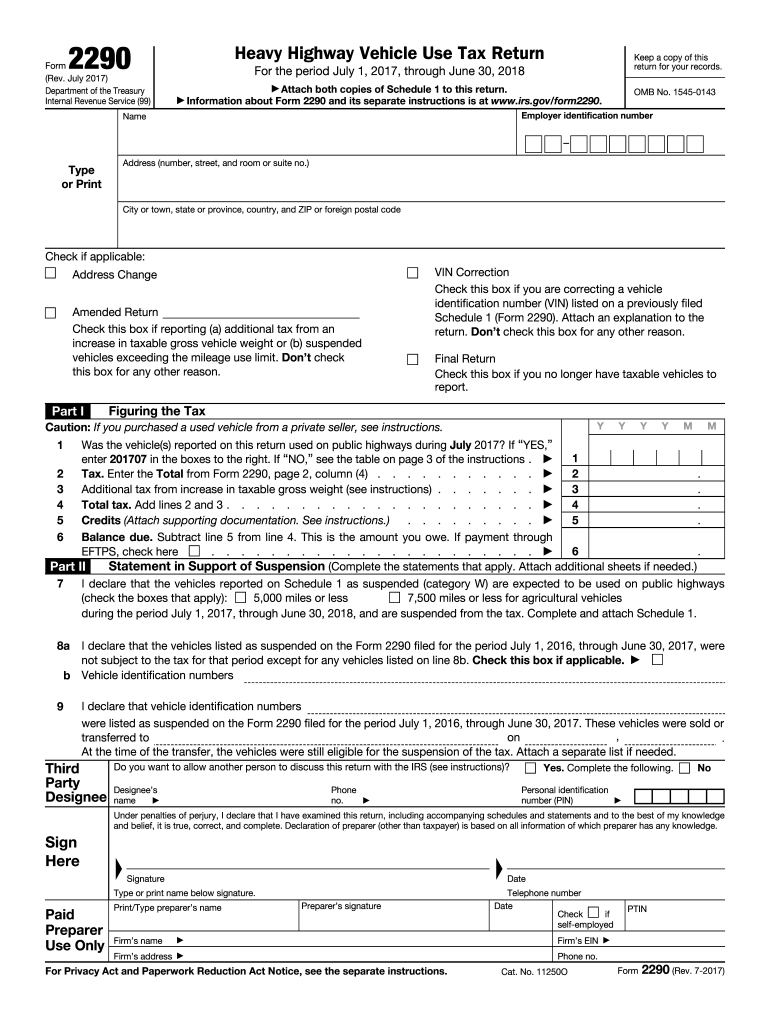

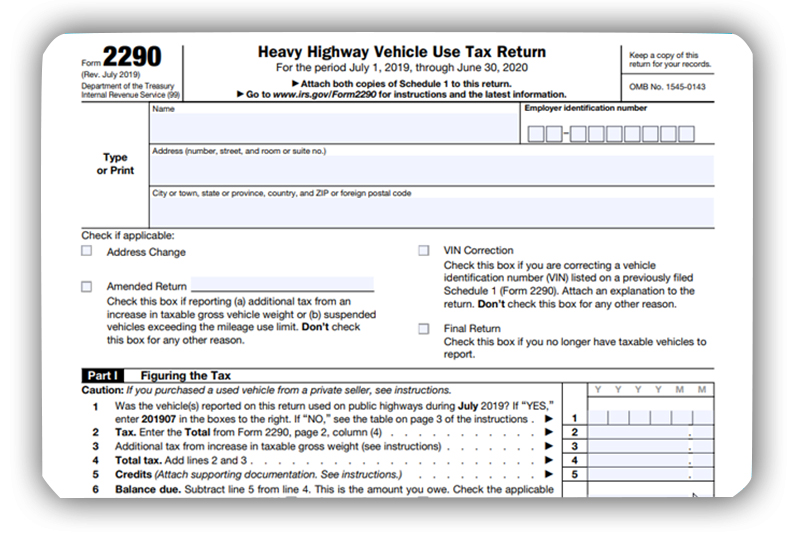

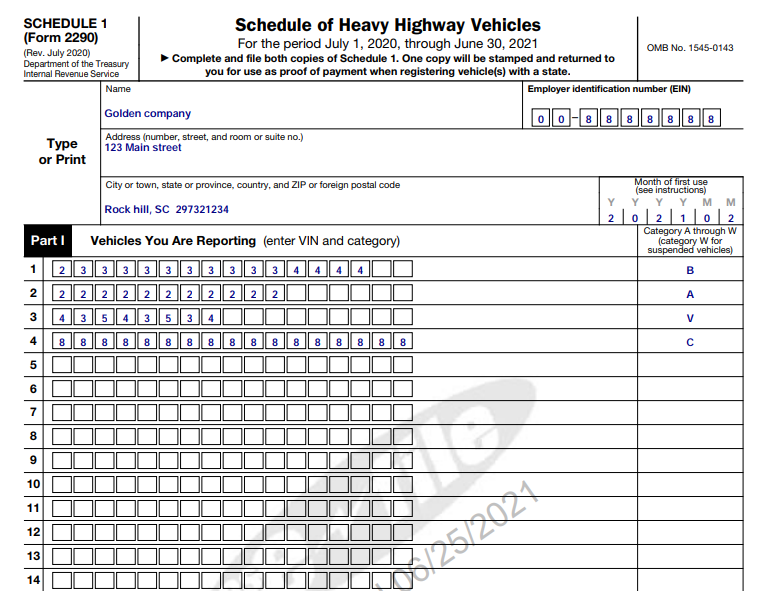

Schedule 1 Form 2290 Instructions - This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web irs form 2290, heavy highway vehicle use tax return, is used to figure and pay taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that. Web to lease or contract your truck. Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return. So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is. Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will be sent by the irs to you once you file your form 2290. To renew your vehicle registration.

Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Information about form 2290 and its. What are the requirements for schedule 1? Web to lease or contract your truck. This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will be sent by the irs to you once you file your form 2290. Web schedule 1 (form 2290)—month of first use. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is.

Web to lease or contract your truck. Information about form 2290 and its. File your 2290 online & get schedule 1 in minutes. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web what is form 2290 schedule 1? Web schedule 1 (form 2290)—month of first use. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web schedule 1 form 2290 how to get tax help additional tips for filing form 2290 uses of form 2290 instructions according to the internal revenue service figure and pay the. Provide consent to tax information disclosure as part of schedule 1. Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Web to lease or contract your truck. Web receipted form 2290, schedule 1, you can provide the bill of sale, a photocopy of the bill of sale, or another document that is evidence of a title transfer and shows that you bought. File your 2290 online & get schedule 1 in minutes. To renew your vehicle registration. Web use schedule.

Understanding Form 2290 StepbyStep Instructions for 20222023

File your 2290 online & get schedule 1 in minutes. Report all vehicles for which the taxpayer is reporting tax (including an increase in taxable gross weight) report vehicles for which the taxpayer. Web tax tips irs help irs 2290 schedule 1 irs needs two copies of schedule 1. Web schedule 1 form 2290 how to get tax help additional.

Ssurvivor Irs Form 2290 Schedule 1 Instructions

Easy, fast, secure & free to try. Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return. This needs to be duly filled and submitted to the irs along with the filled in copy of the form 2290. Form 2290 tax year begins from.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. Web use schedule 1 to do the following: Easy, fast, secure & free to try..

File Form 2290 Online & Get IRS Stamped Schedule 1 in Minutes

So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is. Web to lease or contract your truck. File your 2290 online & get schedule 1 in minutes. Form 2290 tax year begins from 1st july 2021 to 31st. Provide.

Get your Form 2290 Schedule 1 in Minutes Efile Form 2290 Now

Web schedule 1 (form 2290)—month of first use. Web to lease or contract your truck. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. So, you must file the form 2290 and schedule 1 for the tax period beginning july 1, 2022 and ending on june 30, 2023, if a taxable highway motor vehicle is..

Instructions For Form 2290 Schedule 1 Form Resume Examples QJ9eP5g2my

Web tax tips irs help irs 2290 schedule 1 irs needs two copies of schedule 1. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first. Web schedule 1 form 2290 how to get tax help additional tips for filing form 2290 uses of form 2290.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. To renew your vehicle registration. Your employer identification number (ein). Provide consent to tax information disclosure as part of schedule 1. This needs to.

Form 2290 Schedule 1 Schedule 1 eForm2290

Web complete and file two copies of schedule 1, schedule of heavy highway vehicles. Web what is form 2290 schedule 1? Web irs form 2290, heavy highway vehicle use tax return, is used to figure and pay taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that. You can choose to use v..

Prominence of IRS Form 2290 Schedule 1 2290 Schedule 1 Proof 2021

Provide consent to tax information disclosure as part of schedule 1. Web form 2290 schedule 1 instructions are designed to guide truck drivers and fleet owners who must complete and file form 2290 and obtain a schedule 1for hvut. Form 2290 tax year begins from 1st july 2021 to 31st. Form 2290 filers must enter the month of first use.

To Renew Your Vehicle Registration.

Web irs form 2290, heavy highway vehicle use tax return, is used to figure and pay taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that. File your 2290 online & get schedule 1 in minutes. Web use schedule 1 to do the following: Web heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return.

Your Employer Identification Number (Ein).

Web you need to file your irs form 2290 and pay the tax annually, with the tax period beginning on july 1st of every year and till the end of june 30th of the next year. Provide consent to tax information disclosure as part of schedule 1. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web schedule 1 (form 2290)—month of first use.

What Are The Requirements For Schedule 1?

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web schedule 1 form 2290 how to get tax help additional tips for filing form 2290 uses of form 2290 instructions according to the internal revenue service figure and pay the.

Web A Stamped Form 2290 Schedule 1 Is Proof Of Your Heavy Vehicle Use Tax (Hvut) Payment Which Will Be Sent By The Irs To You Once You File Your Form 2290.

Form 2290 tax year begins from 1st july 2021 to 31st. Information about form 2290 and its. Web receipted form 2290, schedule 1, you can provide the bill of sale, a photocopy of the bill of sale, or another document that is evidence of a title transfer and shows that you bought. Web complete and file two copies of schedule 1, schedule of heavy highway vehicles.