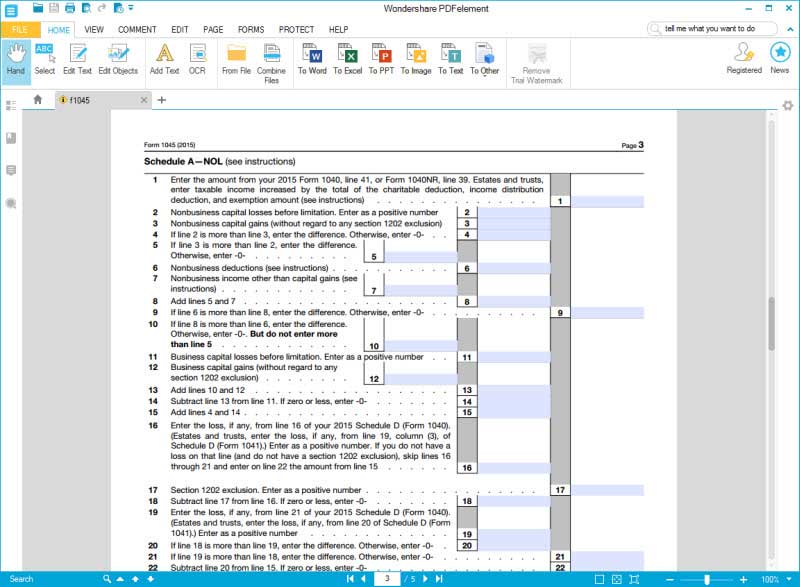

Schedule A Of Form 1045

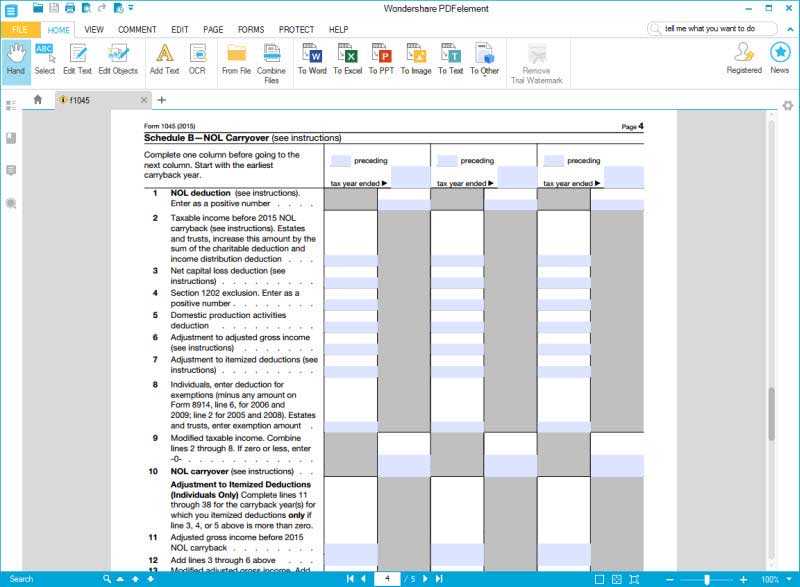

Schedule A Of Form 1045 - Those with a negative balance on form. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as. Filing form 1045 with a carryback to a section 965 inclusion year. Web go to www.irs.gov/form1045 for the latest information. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form 1045 both to make the election and apply for a. Compute the net operating loss (nol) 2. The schedule will appear on the right side of your screen. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web form 1045 (2010) page 2 schedule a—nol (see instructions) enter the amount from your 2010 form 1040, line 41, or form 1040nr, line 39. Complete, edit or print tax forms instantly.

Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Estates and trusts, enter taxable. Because of the changes in the nol rules under the cares act, you may. Web to review the current year nol information on form 1045 schedule a online navigation instructions sign in to your taxact online return click tools click forms assistant. Get ready for tax season deadlines by completing any required tax forms today. Click ok to confirm you wish to delete the form, schedule, document, or. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. Filing form 1045 with a carryback to a section 965 inclusion year. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as.

Complete, edit or print tax forms instantly. Compute the net operating loss (nol) 2. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as. Get ready for tax season deadlines by completing any required tax forms today. Web schedule a from form 1045. Because of the changes in the nol rules under the cares act, you may. Ad access irs tax forms. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form 1045 both to make the election and apply for a. Web to review the current year nol information on form 1045 schedule a online navigation instructions sign in to your taxact online return click tools click forms assistant.

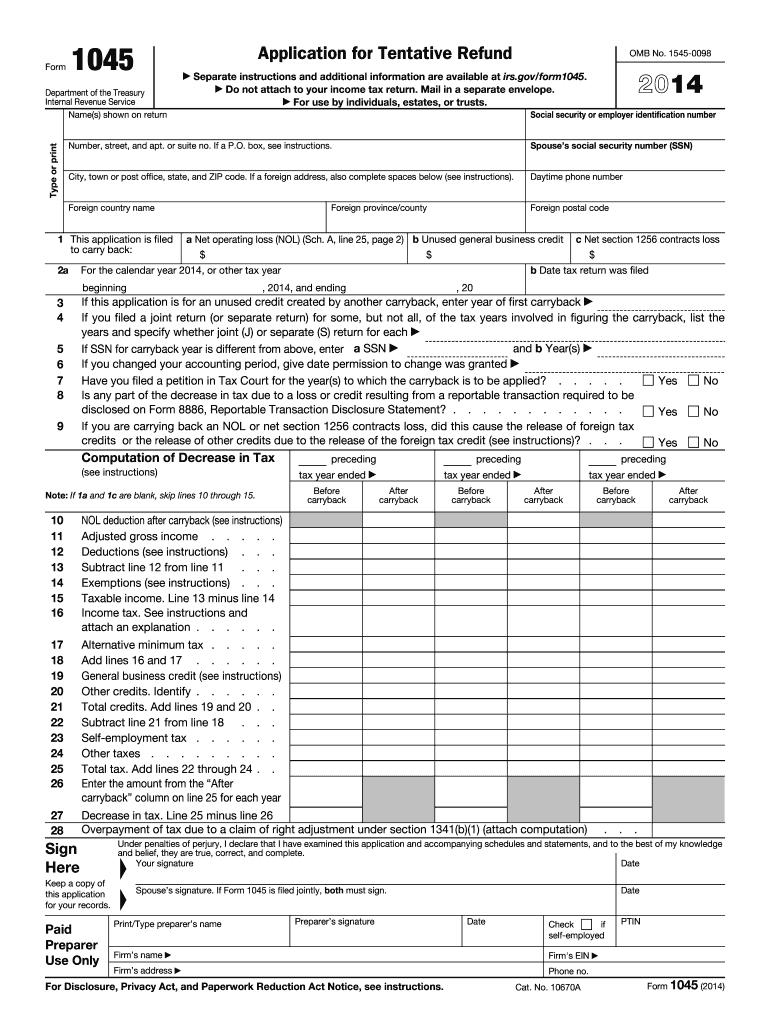

Form 1045, page 1

Complete, edit or print tax forms instantly. Compute the net operating loss (nol) 2. The schedule will appear on the right side of your screen. Get ready for tax season deadlines by completing any required tax forms today. Those with a negative balance on form.

Form 1045 Application for Tentative Refund (2014) Free Download

Web form 1045 (2010) page 2 schedule a—nol (see instructions) enter the amount from your 2010 form 1040, line 41, or form 1040nr, line 39. Web to review the current year nol information on form 1045 schedule a online navigation instructions sign in to your taxact online return click tools click forms assistant. Those with a negative balance on form..

403 Forbidden

Estates and trusts, enter taxable. Filing form 1045 with a carryback to a section 965 inclusion year. Get ready for tax season deadlines by completing any required tax forms today. Web to review the current year nol information on form 1045 schedule a online navigation instructions sign in to your taxact online return click tools click forms assistant. Web schedule.

Publication 536, Net Operating Losses (NOLs) for Individuals, Estates

Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Web schedule a from form 1045. You can download or print current. Ad access irs tax forms. Those with a negative balance on form.

2014 Form IRS 1045 Fill Online, Printable, Fillable, Blank pdfFiller

Click ok to confirm you wish to delete the form, schedule, document, or. Web to review the current year nol information on form 1045 schedule a online navigation instructions sign in to your taxact online return click tools click forms assistant. You can download or print current. Web form 1045 schedule a is used to compute a net operating loss.

IRS Form 1045 Fill it as You Want

Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. Estates and trusts, enter taxable. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. Web to review the current year nol information on form 1045 schedule a.

Form 1045 Application for Tentative Refund (2014) Free Download

Ad access irs tax forms. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as. The schedule will appear on the right side of your screen. Web we last updated the application for tentative refund in december 2022, so this is.

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Compute the net operating loss (nol) 2. Get ready for tax season deadlines by completing any required tax forms today. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as. Web information on how to make the election. Web form 1045.

IRS Form 1045 Fill it as You Want

Ad access irs tax forms. Web go to www.irs.gov/form1045 for the latest information. Estates and trusts, enter taxable. Get ready for tax season deadlines by completing any required tax forms today. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.

Form 1045 Application for Tentative Refund (2014) Free Download

Filing form 1045 with a carryback to a section 965 inclusion year. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates, or trusts. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as..

Filing Form 1045 With A Carryback To A Section 965 Inclusion Year.

Click ok to confirm you wish to delete the form, schedule, document, or. The schedule will appear on the right side of your screen. Get ready for tax season deadlines by completing any required tax forms today. Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.

Web Go To Www.irs.gov/Form1045 For The Latest Information.

You can download or print current. Web form 1045 (2010) page 2 schedule a—nol (see instructions) enter the amount from your 2010 form 1040, line 41, or form 1040nr, line 39. Web we last updated the application for tentative refund in december 2022, so this is the latest version of form 1045, fully updated for tax year 2022. Because of the changes in the nol rules under the cares act, you may.

Web Form 1045 Department Of The Treasury Internal Revenue Service Application For Tentative Refund For Individuals, Estates, Or Trusts.

Web schedule a from form 1045. Web the key to determining when you have a net operating loss is that the loss must be from “operating,” i.e., from “active” sources of income or deductions as. Ad access irs tax forms. Those with a negative balance on form.

Web Information On How To Make The Election.

The use of indiana modifications may result in an indiana net operating loss even if there is no federal nol. Web to review the current year nol information on form 1045 schedule a online navigation instructions sign in to your taxact online return click tools click forms assistant. Complete, edit or print tax forms instantly. Estates and trusts, enter taxable.