Schedule B Form 941 For 2021

Schedule B Form 941 For 2021 - The filing of schedule b. In some situations, schedule b may be filed. Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Qualified small business payroll tax credit for increasing research activities. Web everything you need to know about form 941 schedule b. Web irs form 941 schedule b for 2021 941 schedule b tax. Web we’ll examine his tax liabilities for quarters 3 and 4 in 2021, as well as quarters 1 and 2 in 2022:

For employers who withhold taxes from employee's paychecks or who must pay the employer's. Web jazlyn williams reporter/editor a revised form 941 and instructions reflecting changes made by the arpa were issued for use in the 2nd through 4th. Web we’ll examine his tax liabilities for quarters 3 and 4 in 2021, as well as quarters 1 and 2 in 2022: See deposit penalties in section 11 of pub. The filing of schedule b. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. For 2021.step by step instructions for the irs form 941 schedule b.e. 15 or section 8 of pub. Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors. Web schedule b is filed with form 941.

Employers engaged in a trade or business who pay compensation form 9465. The irs demands that the form 941 and the schedule b match to the penny…every single time…without. 15 or section 8 of pub. It takes only a few minutes to complete form 941 schedule b online. Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors. Apply a check mark to point the choice where expected. In some situations, schedule b may be filed. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. For employers who withhold taxes from employee's paychecks or who must pay the employer's. Web we’ll examine his tax liabilities for quarters 3 and 4 in 2021, as well as quarters 1 and 2 in 2022:

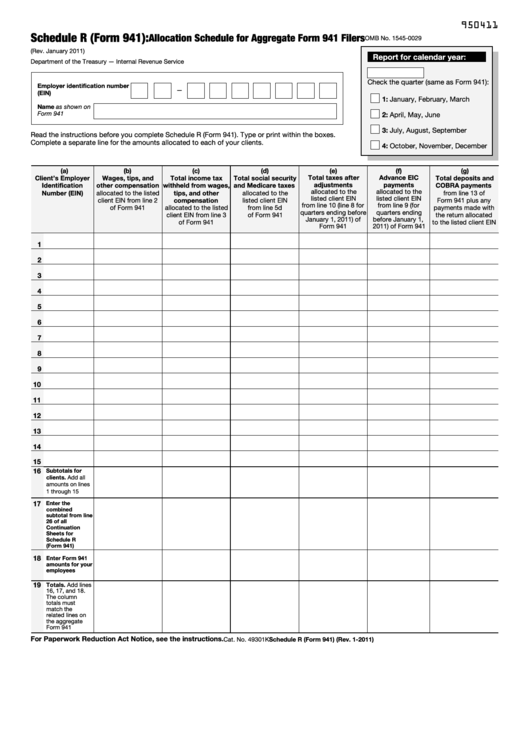

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

See deposit penalties in section 11 of pub. This information is collected on schedule b. Web everything you need to know about form 941 schedule b. Web irs form 941 schedule b for 2021 941 schedule b tax. Step by step instructions for the irs form 941 schedule b.

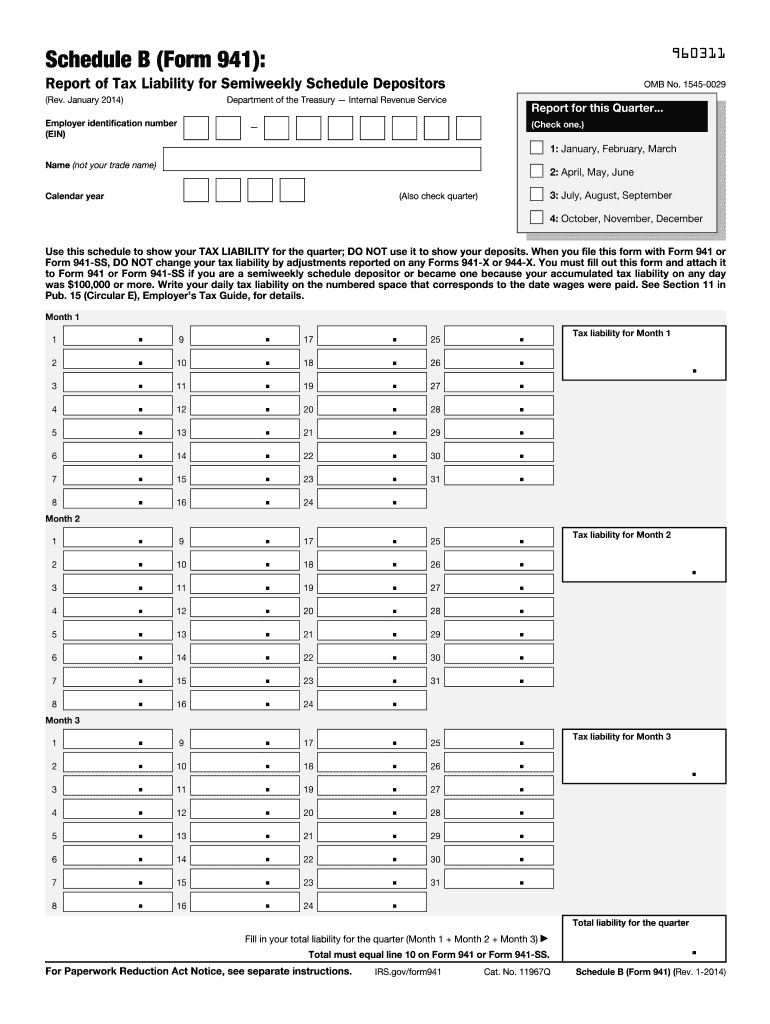

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

Ad download or email irs 941 & more fillable forms, register and subscribe now! It discusses what is new for the latest version form in. You are a semiweekly depositor if you: Web changes & updates to form 941 schedule b for 2021 what is schedule b (form 941)? Web schedule b with form 941, the irs may propose an.

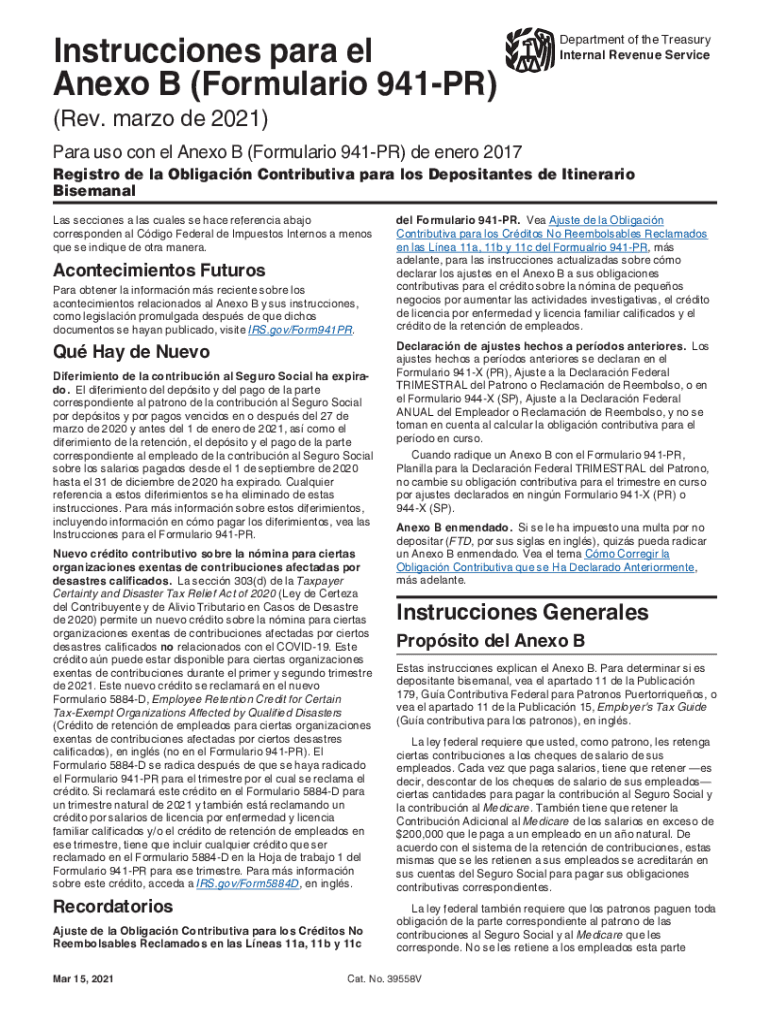

IRS Instructions 941PR Schedule B 20212022 Fill and Sign

Taxbandits also supports prior year filings of form 941 for 2022,. I'll provide information on how it will be included when filing your 941 forms. Web report error it appears you don't have a pdf plugin for this browser. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web form.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors. Web everything you need to know about form 941 schedule b. Web schedule b is filed with form 941. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web complete schedule b (form 941), report of tax.

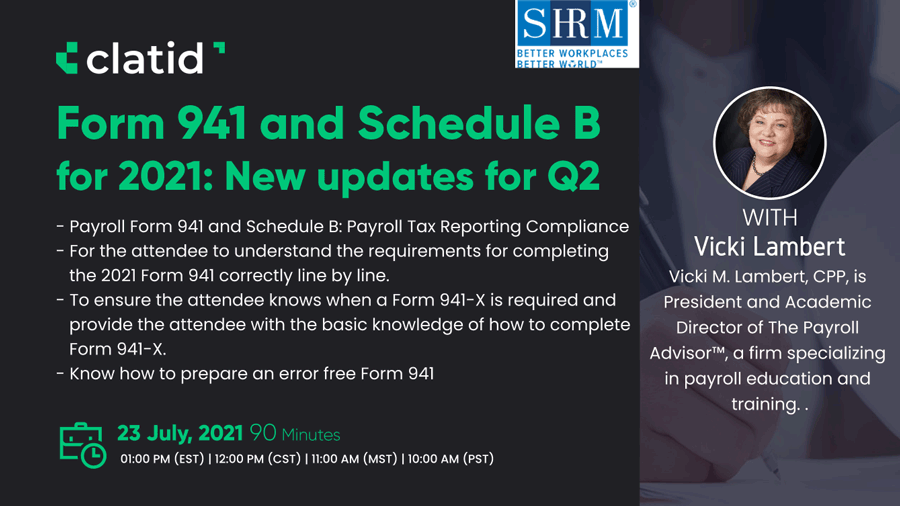

Payroll Form 941 and Schedule B Payroll Tax Reporting Compliance

Ad download or email irs 941 & more fillable forms, register and subscribe now! The irs demands that the form 941 and the schedule b match to the penny…every single time…without. Web irs form 941 schedule b for 2021 941 schedule b tax. Qualified small business payroll tax credit for increasing research activities. Web complete schedule b (form 941), report.

941 schedule b 2021 Fill Online, Printable, Fillable Blank form941

This information is collected on schedule b. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. Employers engaged in a trade or business who pay compensation form 9465. For employers who withhold taxes from employee's paychecks or who must pay the employer's. 15 or section 8 of pub.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

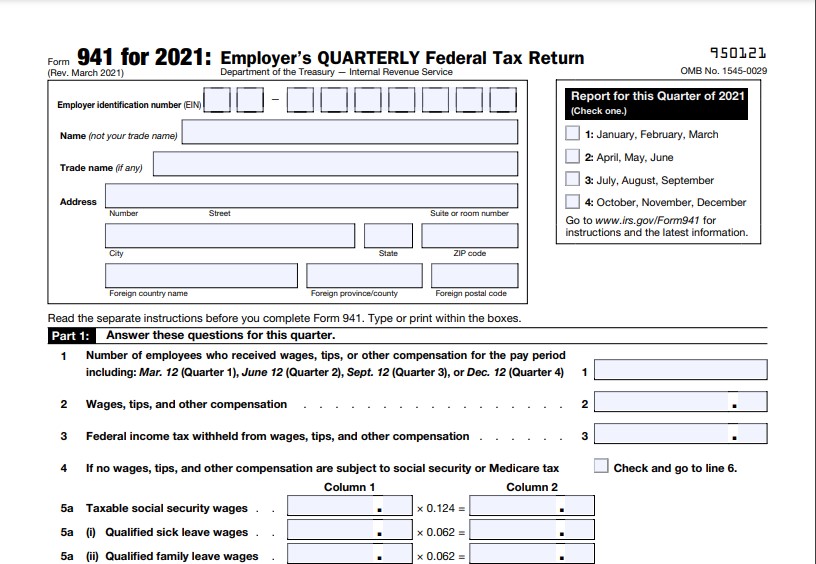

Web employer's quarterly federal tax return for 2021. Taxbandits also supports prior year filings of form 941 for 2022,. Web the schedule b is also a crucial form for many employers. 15 or section 8 of pub. Web i see the hassle you've been through with your schedule b filing.

How to Print Form 941 ezAccounting Payroll

Web form 941 schedule b is available for 2021. Form 941 is an information form in the payroll form series which deals with. Web enter your official contact and identification details. Web the schedule b is also a crucial form for many employers. Web we’ll examine his tax liabilities for quarters 3 and 4 in 2021, as well as quarters.

Instructions for Schedule R Form 941 Rev June Instructions for Schedule

Web form 941 schedule b is available for 2021. Reported more than $50,000 of employment taxes in the. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. This form.

Form 941 Printable & Fillable Per Diem Rates 2021

You are a semiweekly depositor if you: Double check all the fillable fields to ensure complete accuracy. Web report error it appears you don't have a pdf plugin for this browser. Web this webinar covers the irs form 941 and its accompanying form schedule b for 2nd quarter of 2021. Web we’ll examine his tax liabilities for quarters 3 and.

Taxbandits Supports Form 941 Schedule R For Peos, Cpeos,.

Web changes & updates to form 941 schedule b for 2021 what is schedule b (form 941)? Web employer's quarterly federal tax return for 2021. Web everything you need to know about form 941 schedule b. Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors.

Step By Step Instructions For The Irs Form 941 Schedule B.

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web the schedule b is also a crucial form for many employers. Web we’ll examine his tax liabilities for quarters 3 and 4 in 2021, as well as quarters 1 and 2 in 2022:

Web File Schedule B (Form 941) If You Are A Semiweekly Schedule Depositor.

It discusses what is new for the latest version form in. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web report error it appears you don't have a pdf plugin for this browser. Web i see the hassle you've been through with your schedule b filing.

Taxbandits Also Supports Prior Year Filings Of Form 941 For 2022,.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. The filing of schedule b. Employers engaged in a trade or business who pay compensation form 9465. The irs demands that the form 941 and the schedule b match to the penny…every single time…without.