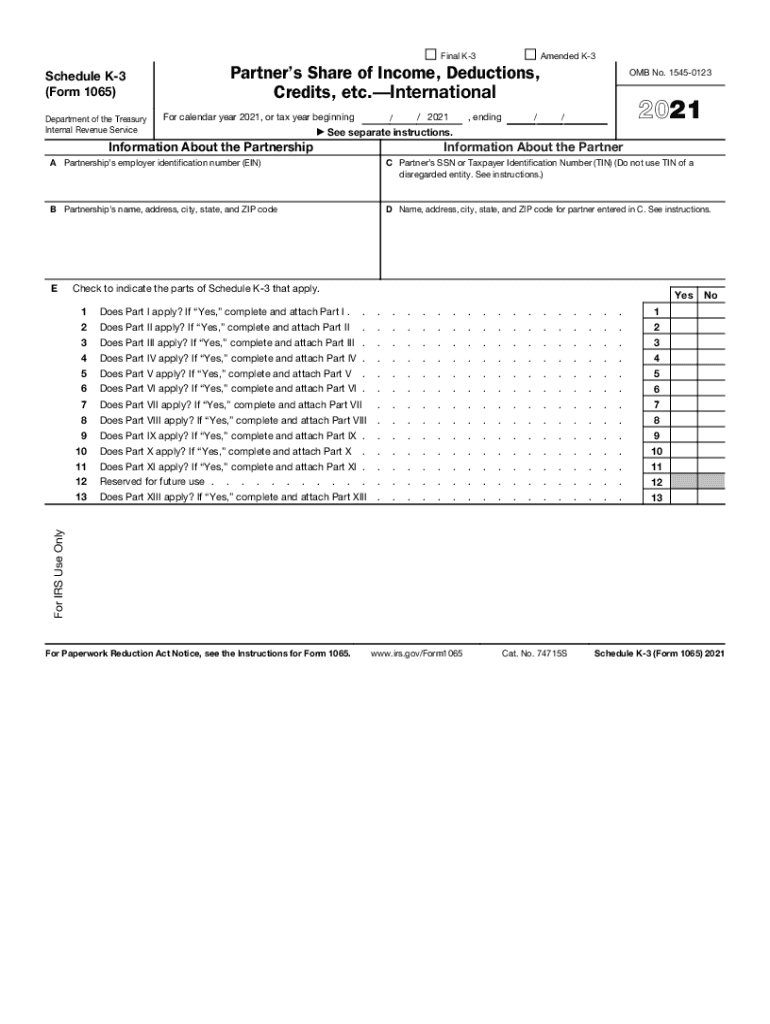

Schedule K-3 Form 1065

Schedule K-3 Form 1065 - Web the irs announced on tuesday february 15, 2022 that most k2/k3 reporting for 2021 can be delayed until the 2022 tax return filing. Web partnerships filing form 1065, u.s. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Using the tax planner worksheet in proseries. The 2019 irs data book has. Partnership tax return (form 1065); Return of partnership income, were first required to be filed for the 2021 tax year. 1) must file a u.s. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. And 2) it has 2 irs 2017 partnership return data.

Web the irs announced on tuesday february 15, 2022 that most k2/k3 reporting for 2021 can be delayed until the 2022 tax return filing. Partnership tax return (form 1065); And 2) it has 2 irs 2017 partnership return data. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Income tax return for an s corporation ;and u.s. Web itemized deductions (form 1040 filers enter on schedule a form 1040). Web k2 and k3 filing requirements & exceptions. Using the tax planner worksheet in proseries. Below is a list of items that are not. As mike9241 posted you have until 4/15/26 to amend your 2022.

Using the tax planner worksheet in proseries. Web itemized deductions (form 1040 filers enter on schedule a form 1040). It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web partnerships filing form 1065, u.s. Partnership tax return (form 1065); Web k2 and k3 filing requirements & exceptions. Web the irs announced on tuesday february 15, 2022 that most k2/k3 reporting for 2021 can be delayed until the 2022 tax return filing. Return of partnership income, were first required to be filed for the 2021 tax year. 1) must file a u.s.

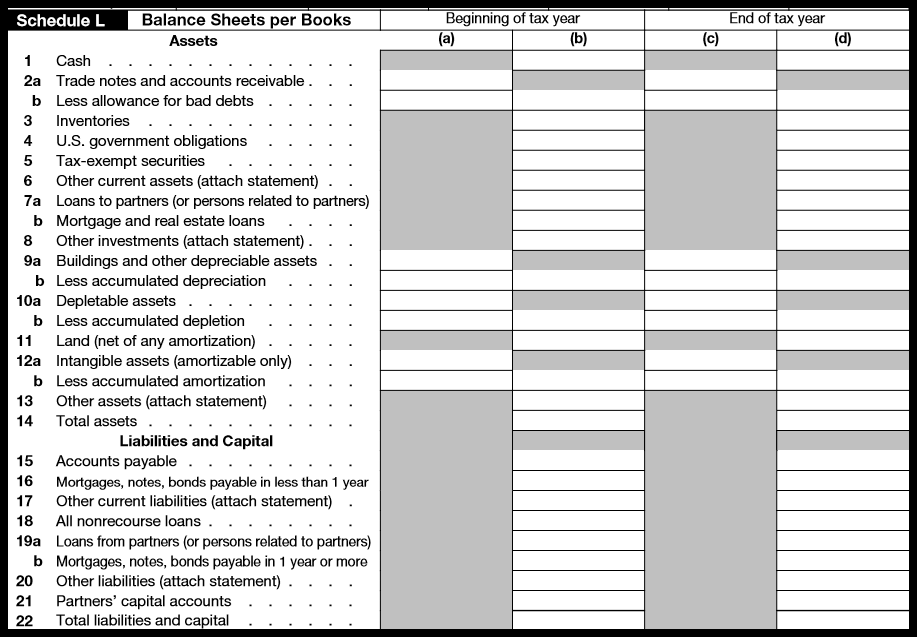

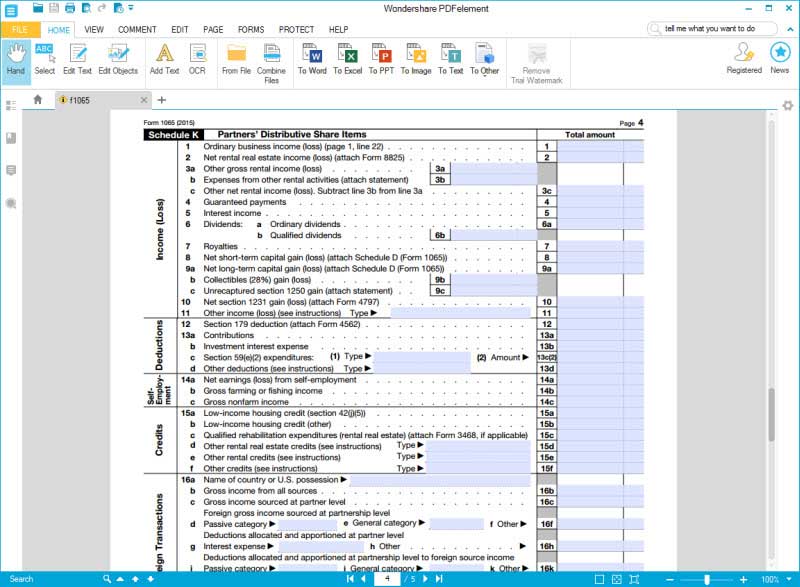

541Form 1065 Example

Web partnerships filing form 1065, u.s. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Below is a list of items that are not. As mike9241 posted you have until 4/15/26 to amend your 2022.

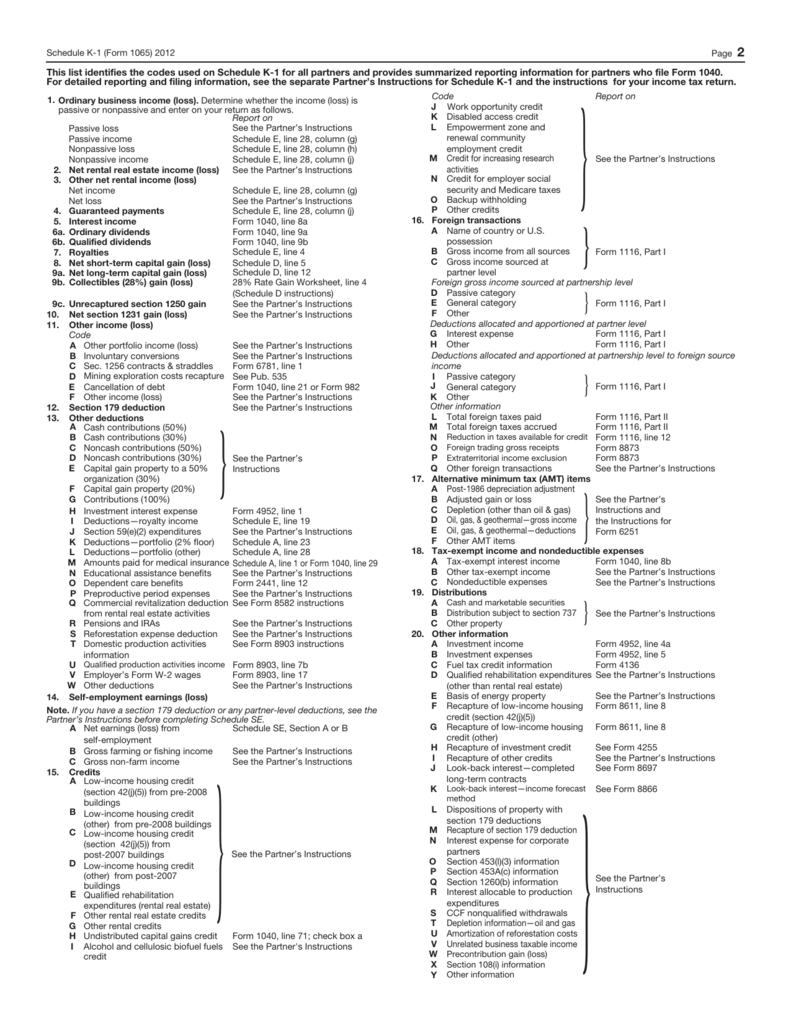

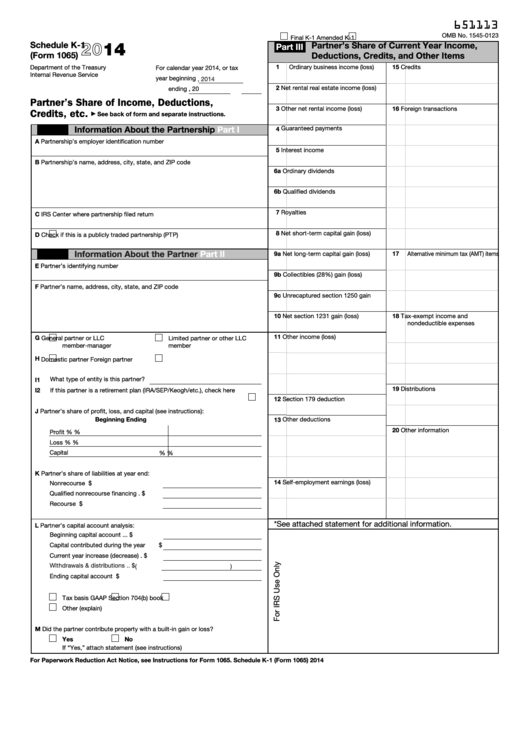

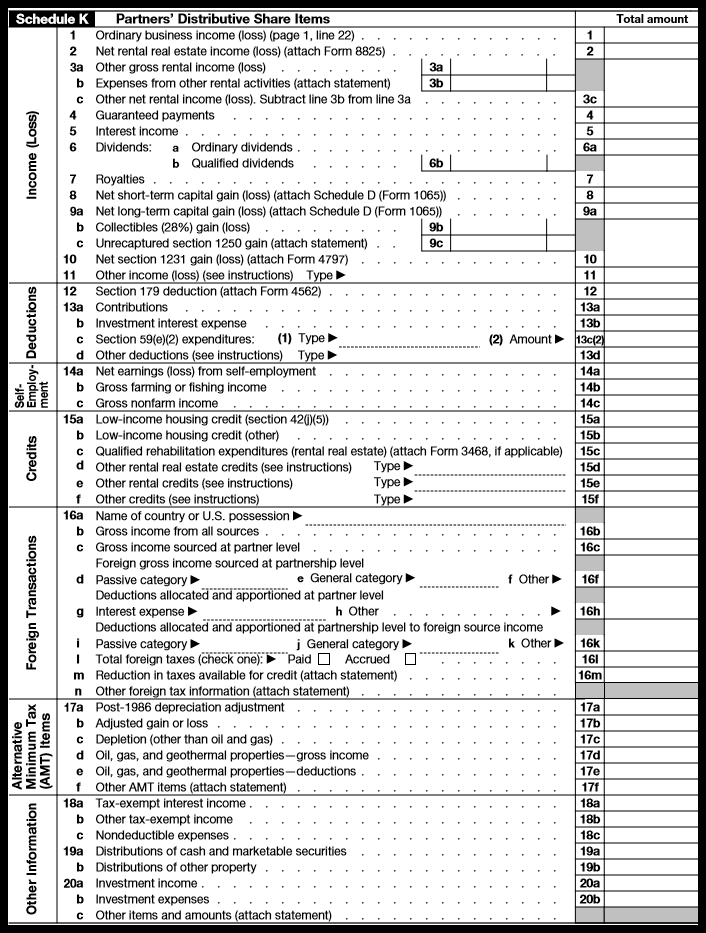

2012 Form 1065 (Schedule K1)

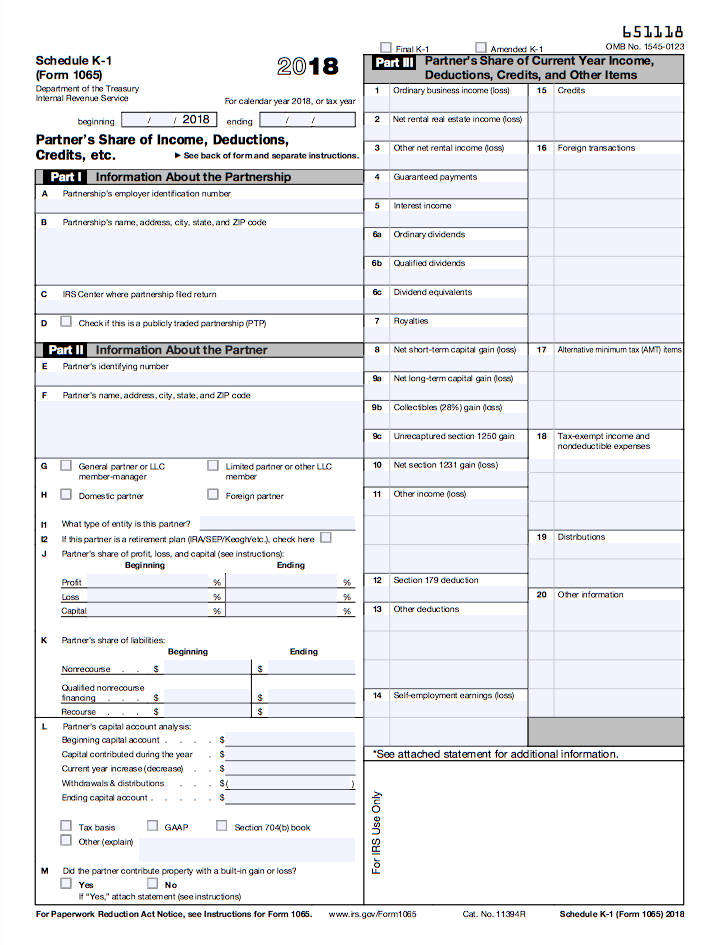

Partnership tax return (form 1065); Web partnerships filing form 1065, u.s. Income tax return for an s corporation ;and u.s. Web the irs announced on tuesday february 15, 2022 that most k2/k3 reporting for 2021 can be delayed until the 2022 tax return filing. It’s generally used to report a partner’s or shareholder’s portion of the items reported on.

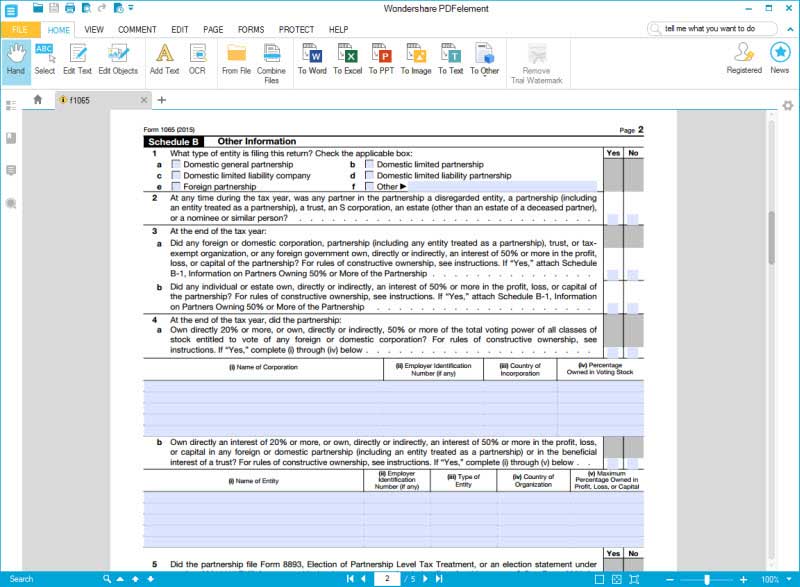

How To Complete Form 1065 With Instructions

The 2019 irs data book has. Web itemized deductions (form 1040 filers enter on schedule a form 1040). Using the tax planner worksheet in proseries. Income tax return for an s corporation ;and u.s. And 2) it has 2 irs 2017 partnership return data.

22 tax deductions, no itemizing required, on Schedule 1 Don't Mess

As mike9241 posted you have until 4/15/26 to amend your 2022. Web partnerships filing form 1065, u.s. And 2) it has 2 irs 2017 partnership return data. Web k2 and k3 filing requirements & exceptions. Web itemized deductions (form 1040 filers enter on schedule a form 1040).

IRS Form 1065 How to fill it With the Best Form Filler

The 2019 irs data book has. Return of partnership income, were first required to be filed for the 2021 tax year. (article 136555) how do i populate schedule. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Income tax return for an s corporation ;and u.s.

IRS Form 1065 How to fill it With the Best Form Filler

It’s generally used to report a partner’s or shareholder’s portion of the items reported on. As mike9241 posted you have until 4/15/26 to amend your 2022. Partnership tax return (form 1065); Income tax return for an s corporation ;and u.s. Return of partnership income, were first required to be filed for the 2021 tax year.

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Below is a list of items that are not. Partnership tax return (form 1065); Using the tax planner worksheet in proseries. And 2) it has 2 irs 2017 partnership return data.

IRS 1065 Schedule K3 20212022 Fill and Sign Printable Template

Web the irs announced on tuesday february 15, 2022 that most k2/k3 reporting for 2021 can be delayed until the 2022 tax return filing. Web itemized deductions (form 1040 filers enter on schedule a form 1040). It’s generally used to report a partner’s or shareholder’s portion of the items reported on. And 2) it has 2 irs 2017 partnership return.

Get a copy of 1065 tax transcript opmrestaurant

And 2) it has 2 irs 2017 partnership return data. Below is a list of items that are not. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web partnerships filing form 1065, u.s. (article 136555) how do i populate schedule.

How To Complete Form 1065 With Instructions

Web k2 and k3 filing requirements & exceptions. Web itemized deductions (form 1040 filers enter on schedule a form 1040). As mike9241 posted you have until 4/15/26 to amend your 2022. Return of partnership income, were first required to be filed for the 2021 tax year. Using the tax planner worksheet in proseries.

Using The Tax Planner Worksheet In Proseries.

Below is a list of items that are not. (article 136555) how do i populate schedule. It’s generally used to report a partner’s or shareholder’s portion of the items reported on. Partnership tax return (form 1065);

Income Tax Return For An S Corporation ;And U.s.

Return of partnership income, were first required to be filed for the 2021 tax year. 1) must file a u.s. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. As mike9241 posted you have until 4/15/26 to amend your 2022.

Web Itemized Deductions (Form 1040 Filers Enter On Schedule A Form 1040).

And 2) it has 2 irs 2017 partnership return data. The 2019 irs data book has. Web the irs announced on tuesday february 15, 2022 that most k2/k3 reporting for 2021 can be delayed until the 2022 tax return filing. Web k2 and k3 filing requirements & exceptions.