Schedule L Form 990

Schedule L Form 990 - The next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with interested persons. Web the irs has received a number of questions about how to report transactions with interested persons on schedule l (form 990), transactions with interested persons pdf. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web state major nonprofit categories org. What types of transactions are reportable on schedule l? Web certain transactions between your organization and interested persons — including excess benefit transactions, loans, grants, and business transactions — are required to be reported on the form 990, schedule l. Schedule l provides information on certain financial transactions between the organization and interested persons. Web october 27, 2022 filed under: Page 2 provide additional information for responses to questions on schedule l (see instructions). Instructions for these schedules are combined with the schedules.

Web state major nonprofit categories org. Page 2 provide additional information for responses to questions on schedule l (see instructions). Instructions for these schedules are combined with the schedules. What types of transactions are reportable on schedule l? Web purpose of schedule. These transactions include excess benefits transactions, loans, grants or other assistance, and business transactions. Web october 27, 2022 filed under: Web the irs has received a number of questions about how to report transactions with interested persons on schedule l (form 990), transactions with interested persons pdf. Complete if the organization answered “yes” on form 990, part iv, line 28a, 28b, or 28c. Ideally, an organization would have a conflict of interest policy that provides guidance to interested persons on reportable.

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web schedule l (form 990) 2022 part ivbusiness transactions involving interested persons. The next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with interested persons. Page 2 provide additional information for responses to questions on schedule l (see instructions). These transactions include excess benefits transactions, loans, grants or other assistance, and business transactions. Instructions for these schedules are combined with the schedules. Web the irs has received a number of questions about how to report transactions with interested persons on schedule l (form 990), transactions with interested persons pdf. Web the questions below relate to schedule l, transactions with interested persons pdf, to form 990, return of organization exempt from income tax pdf. Web october 27, 2022 filed under: Web certain transactions between your organization and interested persons — including excess benefit transactions, loans, grants, and business transactions — are required to be reported on the form 990, schedule l.

Fill Free fillable F990sl Accessible 2019 Schedule L (Form 990 or 990

Page 2 provide additional information for responses to questions on schedule l (see instructions). Web certain transactions between your organization and interested persons — including excess benefit transactions, loans, grants, and business transactions — are required to be reported on the form 990, schedule l. Web october 27, 2022 filed under: What types of transactions are reportable on schedule l?.

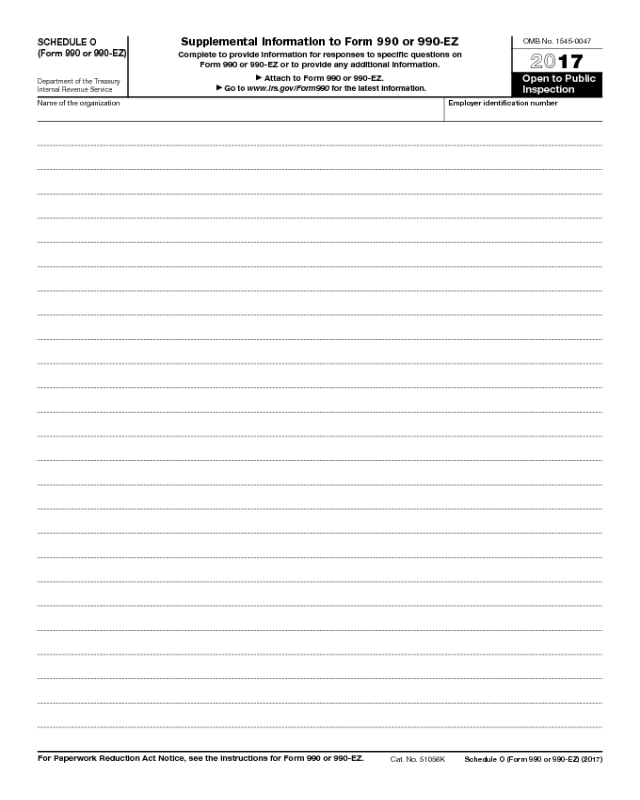

Form 990 Schedule O Edit, Fill, Sign Online Handypdf

Web the questions below relate to schedule l, transactions with interested persons pdf, to form 990, return of organization exempt from income tax pdf. Ideally, an organization would have a conflict of interest policy that provides guidance to interested persons on reportable. Instructions for these schedules are combined with the schedules. Schedule l provides information on certain financial transactions between.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Page 2 provide additional information for responses to questions on schedule l (see instructions). Web state major nonprofit categories org. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Complete if the organization answered “yes” on form 990, part iv, line 28a, 28b, or 28c. Ideally, an organization would have.

Form990 (20192020) by OutreachWorks Issuu

What types of transactions are reportable on schedule l? Web certain transactions between your organization and interested persons — including excess benefit transactions, loans, grants, and business transactions — are required to be reported on the form 990, schedule l. The next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with.

Form 990 (Schedule R1) Related Organizations and Unrelated

Instructions for these schedules are combined with the schedules. Web state major nonprofit categories org. What types of transactions are reportable on schedule l, form 990? Web purpose of schedule. What types of transactions are reportable on schedule l?

Form 990 Schedule L Instructions

Web october 27, 2022 filed under: Web schedule l (form 990) 2022 part ivbusiness transactions involving interested persons. Ideally, an organization would have a conflict of interest policy that provides guidance to interested persons on reportable. Instructions for these schedules are combined with the schedules. Complete if the organization answered “yes” on form 990, part iv, line 28a, 28b, or.

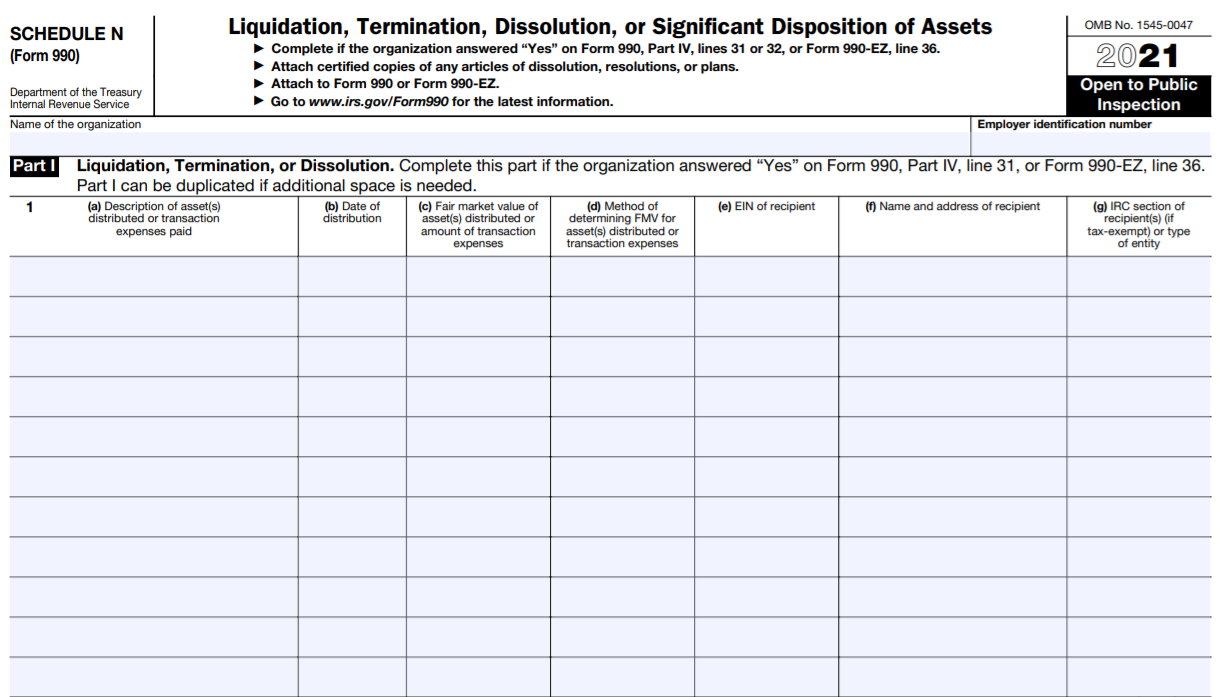

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Complete if the organization answered “yes” on form 990, part iv, line 28a, 28b, or 28c. These transactions include excess benefits transactions, loans, grants or other assistance, and business transactions. Web october 27, 2022 filed under: Ideally, an organization would have a conflict of interest policy that provides guidance to interested persons on reportable. Instructions for these schedules are combined.

IRS Form 990 Schedule L Instructions ExpressTaxExempt Fill Online

Page 2 provide additional information for responses to questions on schedule l (see instructions). Complete if the organization answered “yes” on form 990, part iv, line 28a, 28b, or 28c. Web state major nonprofit categories org. What types of transactions are reportable on schedule l, form 990? Web schedule l (form 990) 2022 part ivbusiness transactions involving interested persons.

2018 Form IRS 990 Schedule D Fill Online, Printable, Fillable, Blank

Web the irs has received a number of questions about how to report transactions with interested persons on schedule l (form 990), transactions with interested persons pdf. Web purpose of schedule. Ideally, an organization would have a conflict of interest policy that provides guidance to interested persons on reportable. What types of transactions are reportable on schedule l, form 990?.

2017 form 990 schedule d Fill Online, Printable, Fillable Blank

The next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with interested persons. Page 2 provide additional information for responses to questions on schedule l (see instructions). Web the irs has received a number of questions about how to report transactions with interested persons on schedule l (form 990), transactions with.

Web Certain Transactions Between Your Organization And Interested Persons — Including Excess Benefit Transactions, Loans, Grants, And Business Transactions — Are Required To Be Reported On The Form 990, Schedule L.

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Complete if the organization answered “yes” on form 990, part iv, line 28a, 28b, or 28c. Web october 27, 2022 filed under: Web state major nonprofit categories org.

Page 2 Provide Additional Information For Responses To Questions On Schedule L (See Instructions).

Web the irs has received a number of questions about how to report transactions with interested persons on schedule l (form 990), transactions with interested persons pdf. Schedule l (form 990) 2022 Web the questions below relate to schedule l, transactions with interested persons pdf, to form 990, return of organization exempt from income tax pdf. Web nonprofit tax tidbits:

These Transactions Include Excess Benefits Transactions, Loans, Grants Or Other Assistance, And Business Transactions.

Ideally, an organization would have a conflict of interest policy that provides guidance to interested persons on reportable. What types of transactions are reportable on schedule l? Web purpose of schedule. Web schedule l (form 990) 2022 part ivbusiness transactions involving interested persons.

Instructions For These Schedules Are Combined With The Schedules.

What types of transactions are reportable on schedule l, form 990? Schedule l provides information on certain financial transactions between the organization and interested persons. The next installment in our series on the schedules of the irs form 990 focuses on schedule l, transactions with interested persons.