Schedule M Tax Form

Schedule M Tax Form - In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. For example, the form 1040 page is at. Web general instructions applicable schedule and instructions. Web purpose of schedule. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Web what is the purpose of schedule m? Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. If your agi exceeds $75,000, then you multiply the difference by 2 percent.

Nonprofit organizations that file form 990 may be required to include schedule m to. Web general instructions applicable schedule and instructions. For optimal functionality, save the form to your computer before completing or printing. Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. Web what is tax form 1040 schedule m? Web almost every form and publication has a page on irs.gov with a friendly shortcut. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. For example, the form 1040 page is at. Reconciliation of income (loss) per books with analysis of net income (loss) per return.

Web in form 1065, u.s. Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. Web enclose with form 740 enter name(s) as shown on tax return. Web general instructions applicable schedule and instructions. Web what is the purpose of schedule m? Web what is tax form 1040 schedule m? Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Classifying federal income (loss) for pa personal income tax purposes classify,.

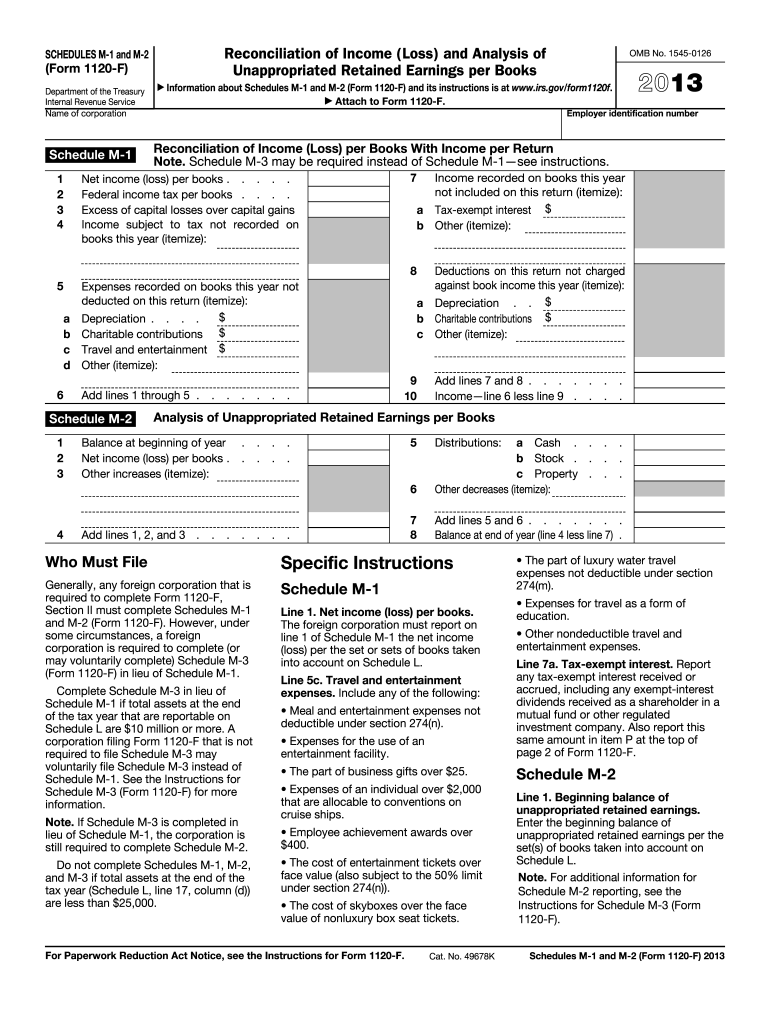

IRS 1120F Schedule M1 & M2 2013 Fill out Tax Template Online

Web in form 1065, u.s. Reconciliation of income (loss) per books with analysis of net income (loss) per return. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Nonprofit organizations that file form 990 may be required to include schedule m to. Web general instructions applicable schedule and instructions.

2019 Form IRS 990 Schedule M Fill Online, Printable, Fillable, Blank

Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Web in form 1065, u.s. For example, the form 1040 page is at. Web what is the purpose of schedule m?

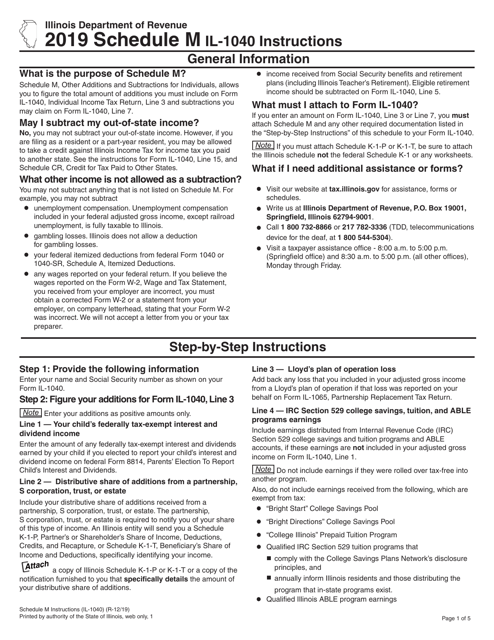

Download Instructions for Form IL1040 Schedule M Other Additions and

Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. In 2010, if your gross wages are more than $6,451, or.

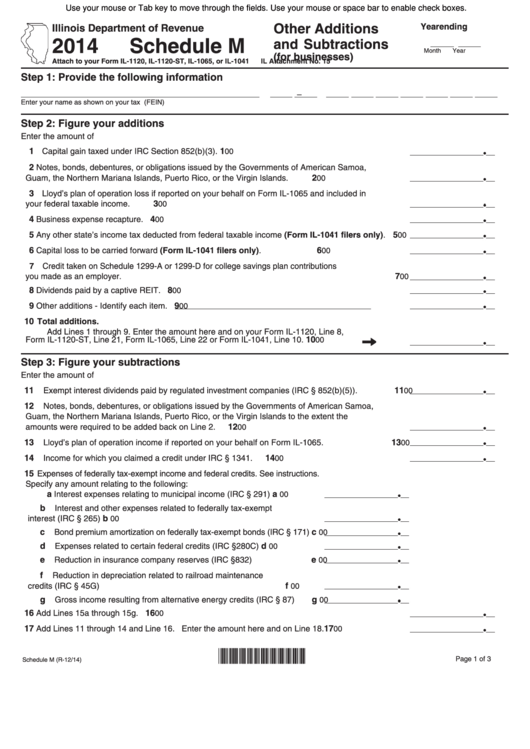

Fillable Schedule M Illinois Other Additions And Subtractions (For

Nonprofit organizations that file form 990 may be required to include schedule m to. Reconciliation of income (loss) per books with analysis of net income (loss) per return. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. Classifying federal income (loss) for pa personal.

Form 8858 (Schedule M) Transactions between Foreign Disregarded

Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. The making work pay credit is scheduled to end this year, but.

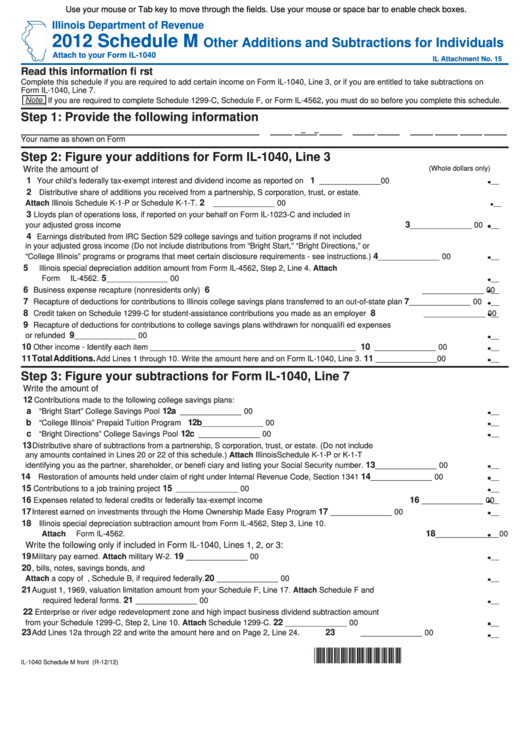

Fillable Schedule M Other Additions And Subtractions For Individuals

The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. Nonprofit organizations that file form 990 may be required to include.

Don't make checks out to 'IRS' for federal taxes, or your payment could

For example, the form 1040 page is at. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. Web enclose with form 740 enter name(s) as shown on tax return. Web 2007010057 fein official use only pa sales tax license number pa schedule m, part.

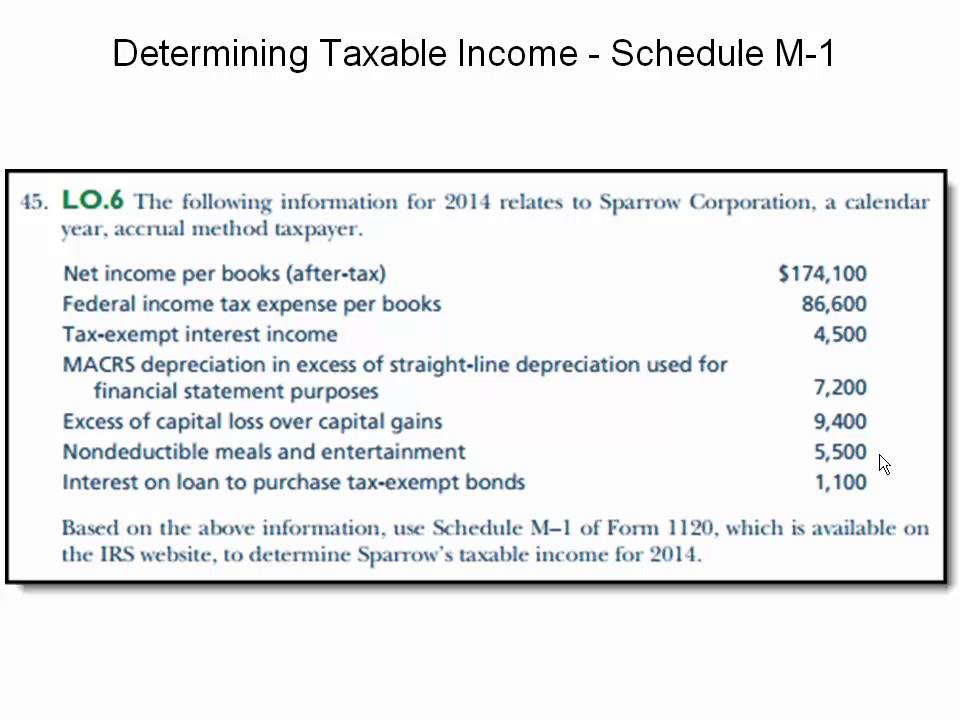

Taxable Schedule M1 Form 1120 YouTube

Web almost every form and publication has a page on irs.gov with a friendly shortcut. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then.

3.11.15 Return of Partnership Internal Revenue Service

Web what is the purpose of schedule m? Classifying federal income (loss) for pa personal income tax purposes classify,. Web what is tax form 1040 schedule m? Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. For example, the form 1040 page is at.

schedule m 2 fashion online magazine

In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. Web what is tax form 1040 schedule m? Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. Web general instructions applicable schedule and instructions. Web schedule m, lines 3 and.

Web 2007010057 Fein Official Use Only Pa Sales Tax License Number Pa Schedule M, Part I.

For optimal functionality, save the form to your computer before completing or printing. Web in form 1065, u.s. Nonprofit organizations that file form 990 may be required to include schedule m to. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi.

Web Almost Every Form And Publication Has A Page On Irs.gov With A Friendly Shortcut.

For example, the form 1040 page is at. Web what is tax form 1040 schedule m? Web purpose of schedule. Web general instructions applicable schedule and instructions.

Web Schedule M, Lines 3 And 12 Only If You Have Elected For Federal Income Tax Purposes To Take The 30 Percent Or The 50 Percent Special Depreciation Allowance Or The Increased Section.

Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Web what is the purpose of schedule m? If your agi exceeds $75,000, then you multiply the difference by 2 percent.

The Making Work Pay Credit Is Scheduled To End This Year, But If You Know What Tax Form 1040 Schedule M Is, Then You.

Web enclose with form 740 enter name(s) as shown on tax return. Classifying federal income (loss) for pa personal income tax purposes classify,. Your social security number m 2020 commonwealth of kentucky schedule department of revenue a.