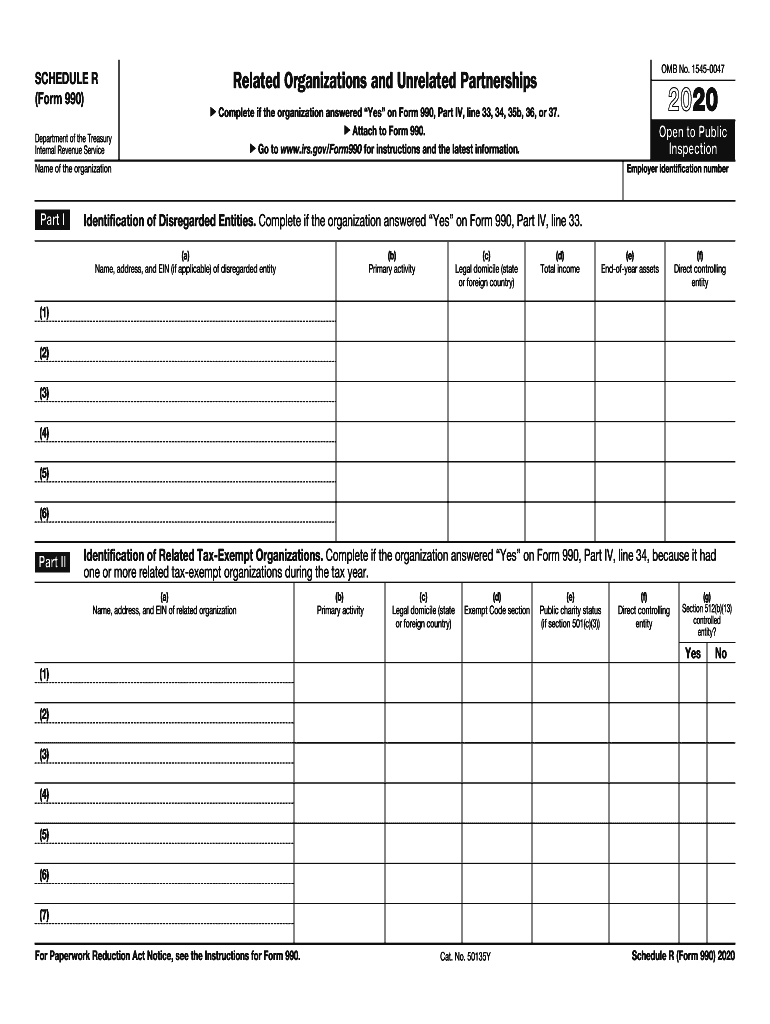

Schedule R Form 990

Schedule R Form 990 - Web schedule r (form 990) 2020 page 2 part iii identification of related organizations taxable as a partnership. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. April 2006) 2 tls, have you transmitted all r text files for this cycle update? Get ready for tax season deadlines by completing any required tax forms today. Web solved•by intuit•updated november 10, 2022. Complete if the organization answered 'yes' on form 990, part iv, line. Web the form 990 roadmap continued: Web schedule r is filed by the organization with form 990 to report information on related organizations and transactions made with those organizations. Purpose of schedule schedule r (form 990) is used by an organization that files. On related organizations, on certain transactions with related organizations, and;

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web solved•by intuit•updated november 10, 2022. Fill in all required fields in your file using our powerful pdf. Complete, edit or print tax forms instantly. Purpose of schedule schedule r (form 990) is used by an organization that files. Get ready for tax season deadlines by completing any required tax forms today. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Web schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations,. Tax returns filed by nonprofit organizations are public records.

Web schedule r is filed by the organization with form 990 to report information on related organizations and transactions made with those organizations. Tax returns filed by nonprofit organizations are public records. The internal revenue service releases them. Web schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations,. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Web full text of form 990, schedule r for fiscal year ending dec. The internal revenue service releases them. Tax returns filed by nonprofit organizations are public records. Web continuation sheet for schedule r (form 990) form 712 (rev. Web supplemental information to form 990:

Form 990 (Schedule R) Related Organizations and Unrelated

Web solved•by intuit•updated november 10, 2022. April 2006) 2 tls, have you transmitted all r text files for this cycle update? Complete, edit or print tax forms instantly. Below are solutions to frequently asked questions about entering information about the statements and. Click the button get form to open it and begin editing.

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

Complete if the organization answered 'yes' on form 990, part iv, line. (column (b) must equal form 990, part x, col. Complete, edit or print tax forms instantly. Web solved•by intuit•updated november 10, 2022. The schedule is also used to.

Form 990 Schedule D Edit, Fill, Sign Online Handypdf

Fill in all required fields in your file using our powerful pdf. Ad access irs tax forms. Web more about the federal 990 (schedule r) estate tax ty 2022. Web schedule r (form 990) 2020 page 2 part iii identification of related organizations taxable as a partnership. Tax returns filed by nonprofit organizations are public records.

Form 990 (Schedule R1) Related Organizations and Unrelated

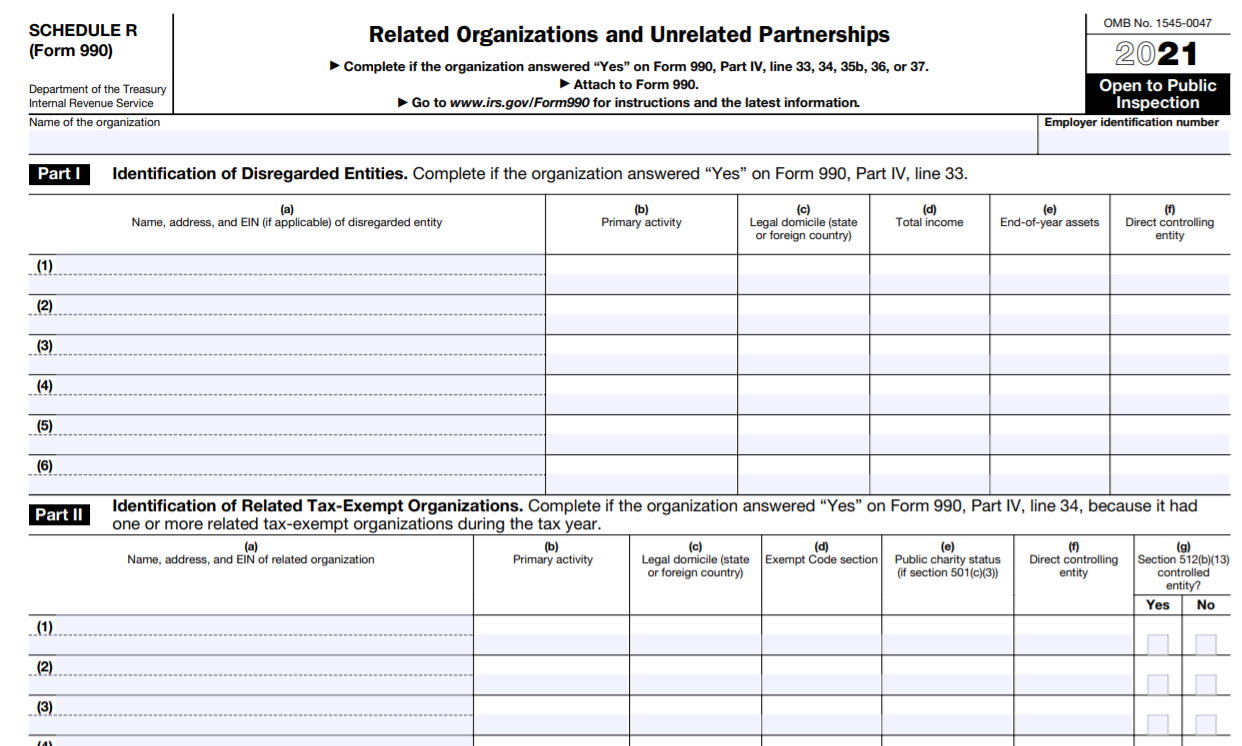

We last updated the related organizations and unrelated partnerships in december 2022, so this is the latest version. Web schedule r (form 990) department of the treasury internal revenue service related organizations and unrelated partnerships complete if the organization answered. Web full text of form 990, schedule r for fiscal year ending dec. Web schedule r, part v, form 990,.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Web the form 990 roadmap continued: April 2006) 2 tls, have you transmitted all r text files for this cycle update? Complete, edit or print tax forms instantly. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web schedule r is filed by an organization along with form 990 to report information on related organizations and.

Form 990 (Schedule R) Related Organizations and Unrelated

Web schedule r, part v, form 990, requires reporting of transactions between the filing organization and its related organizations. Web schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations,. Fill in all required fields in your file using our powerful pdf. Web supplemental information.

Form 990 (Schedule R1) Related Organizations and Unrelated

Web form 990 schedule r, part v by @nicholasware| aug 6, 2018| uncategorized| 0 comments once you’ve identified any related organizationsyou have,. The internal revenue service releases them. In the spring, we did a deep dive into the core form 990 and provided. Web more about the federal 990 (schedule r) estate tax ty 2022. Fill in all required fields.

Form 990 (Schedule R1) Related Organizations and Unrelated

Web form 990 schedule r, part v by @nicholasware| aug 6, 2018| uncategorized| 0 comments once you’ve identified any related organizationsyou have,. We last updated the related organizations and unrelated partnerships in december 2022, so this is the latest version. Ad access irs tax forms. Fill in all required fields in your file using our powerful pdf. Web schedule r.

Form 990 (Schedule I) Grants and Other Assistance to Organizations

In the spring, we did a deep dive into the core form 990 and provided. Tax returns filed by nonprofit organizations are public records. Web schedule r, part v, form 990, requires reporting of transactions between the filing organization and its related organizations. Purpose of schedule schedule r (form 990) is used by an organization that files. April 2006) 2.

IRS Form 990 Schedule R Instructions Related Organizations and

Web schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with , and on certain. Web schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions with related organizations,. Web the faqs expand on information.

Web More About The Federal 990 (Schedule R) Estate Tax Ty 2022.

April 2006) 2 tls, have you transmitted all r text files for this cycle update? Complete, edit or print tax forms instantly. Web schedule r (form 990) department of the treasury internal revenue service related organizations and unrelated partnerships complete if the organization answered. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization.

Below Are Solutions To Frequently Asked Questions About Entering Information About The Statements And.

Web solved•by intuit•updated november 10, 2022. Web the form 990 roadmap continued: Tax returns filed by nonprofit organizations are public records. Tax returns filed by nonprofit organizations are public records.

Web Schedule R Is Filed By The Organization With Form 990 To Report Information On Related Organizations And Transactions Made With Those Organizations.

Get ready for tax season deadlines by completing any required tax forms today. Web glossary of the instructions for form 990, return of organization exempt from income tax. Ad access irs tax forms. Web schedule r, part v, form 990, requires reporting of transactions between the filing organization and its related organizations.

Web Go To Www.irs.gov/Form990 For Instructions And The Latest Information.

Web supplemental information to form 990: The internal revenue service releases them. (column (b) must equal form 990, part x, col. Fill in all required fields in your file using our powerful pdf.