Shared Policy Allocation Form 8962

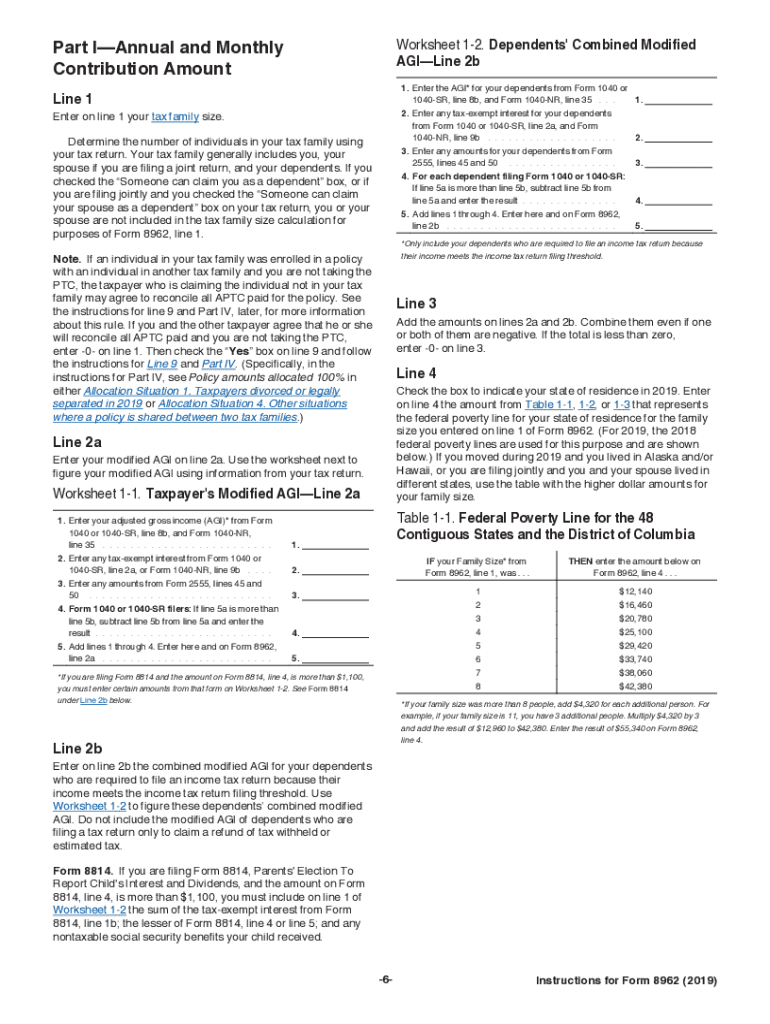

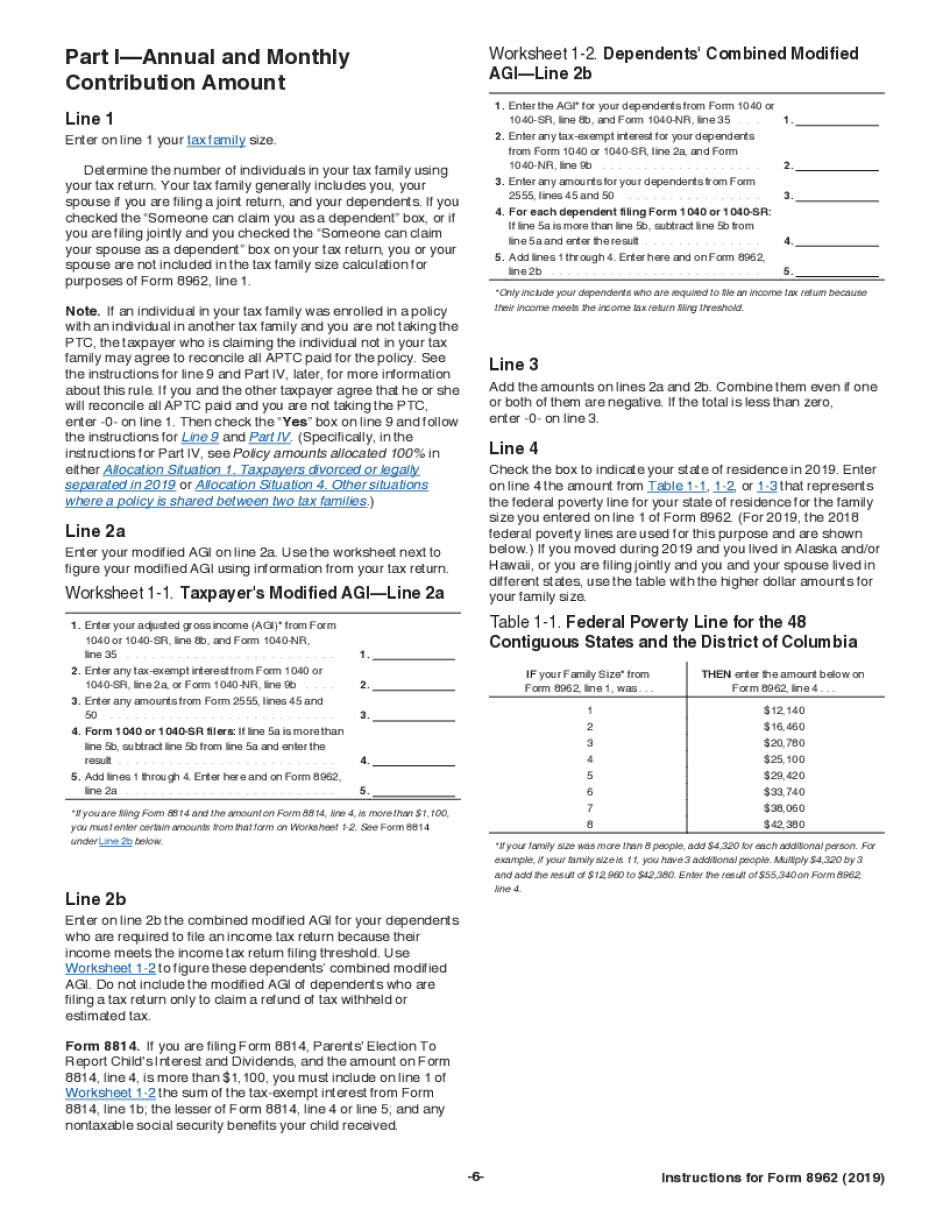

Shared Policy Allocation Form 8962 - Also, form 8962 part iv will be filled out with the spouse's ssn. Amount in view differs from data entry. Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Department of the treasury internal revenue service. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. Web select the months that the shared policy allocation started and ended. Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select. This article doesn't cover scenarios. To enter a shared policy allocation into taxslayer pro, from the main menu of the tax return (form 1040) select: Policy issuer’s name (part i) policy start or end date (part i, part ii) premium cost (part iii, column a) aptc received (part iii, column c) do not seek a correction for:.

This article doesn't cover scenarios. Department of the treasury internal revenue service. Also, form 8962 part iv will be filled out with the spouse's ssn. Web see here for examples of shared policy allocations. Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select. Web are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage (see instructions)? Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. Web this article shows how to enter the shared policy allocation in form 8962 part iv in taxslayer pro for some common scenarios. Policy issuer’s name (part i) policy start or end date (part i, part ii) premium cost (part iii, column a) aptc received (part iii, column c) do not seek a correction for:.

Policy issuer’s name (part i) policy start or end date (part i, part ii) premium cost (part iii, column a) aptc received (part iii, column c) do not seek a correction for:. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. This article doesn't cover scenarios. Web the health coverage tax credit (hctc, form 8885) and the premium tax credit (ptc, form 8962) cannot be claimed for the same coverage for the same month. Web this article shows how to enter the shared policy allocation in form 8962 part iv in taxslayer pro for some common scenarios. Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. To enter a shared policy allocation into taxslayer pro, from the main menu of the tax return (form 1040) select: Also, form 8962 part iv will be filled out with the spouse's ssn. Web are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage (see instructions)? Web see here for examples of shared policy allocations.

2019 Form 8962 Instructions Fill Out and Sign Printable PDF Template

Amount in view differs from data entry. Also, form 8962 part iv will be filled out with the spouse's ssn. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. Web the health coverage tax credit (hctc, form 8885) and the premium tax credit.

how to fill out form 8962 step by step Fill Online, Printable

Web see here for examples of shared policy allocations. Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select. Amount in view differs from data entry. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a.

Tax Filing and Reconciliation Shared Policy Allocation for

Review the premium tax credit shared policy allocation worksheet in. How is the premium tax credit calculated? Web are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage (see instructions)? To enter a shared policy allocation into taxslayer pro, from the main menu of the tax return (form 1040).

How to Fill Out Form 8962 Correctly in 2022 EaseUS

Web form 8962 line 9 will be marked yes. Web this article shows how to enter the shared policy allocation in form 8962 part iv in taxslayer pro for some common scenarios. Web see here for examples of shared policy allocations. Go to view and select form 8962 pg 2 (8962.pg2 in drake15. Also, form 8962 part iv will be.

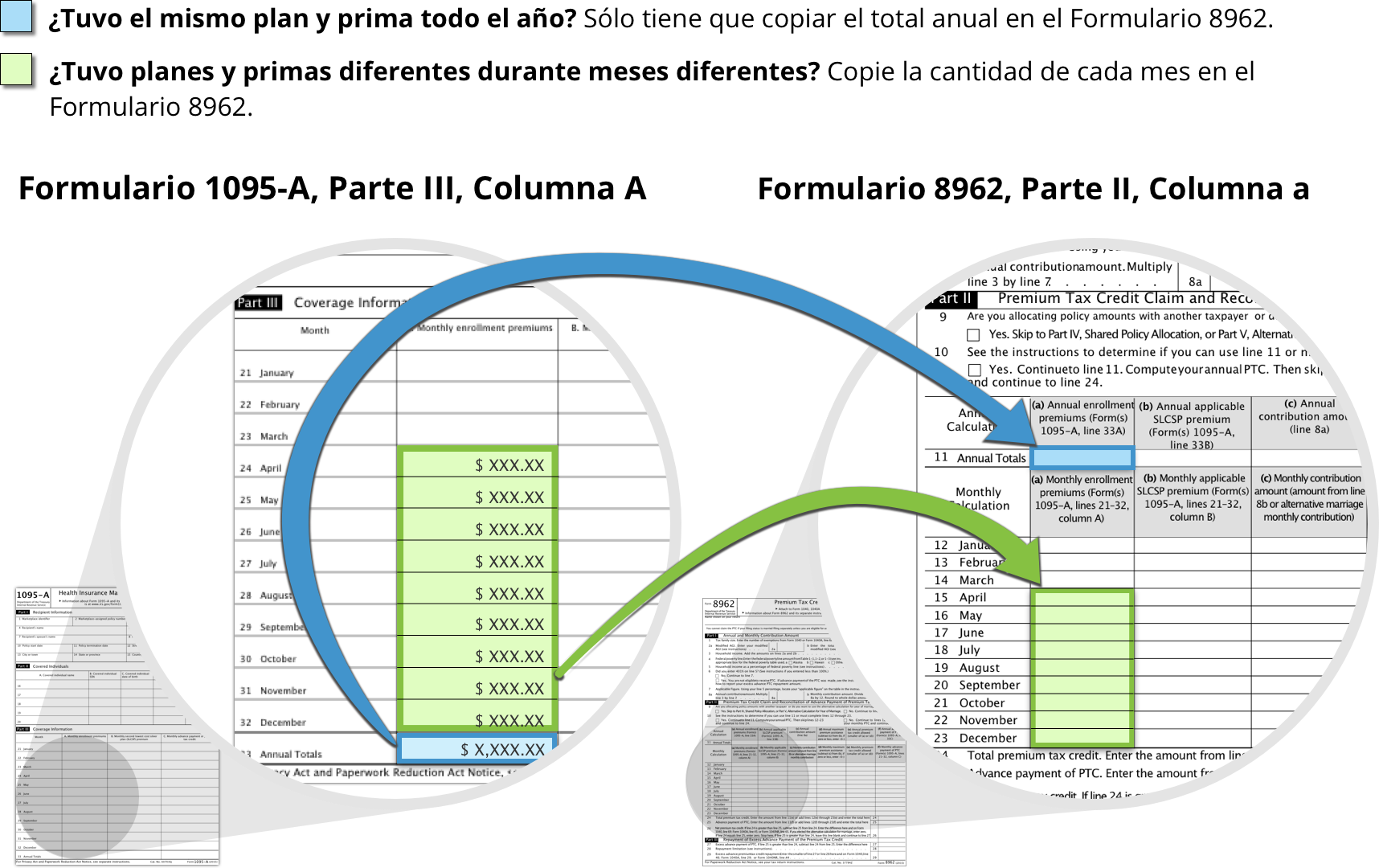

Cómo ajustar su crédito fiscal para las primas HealthCare.gov

Review the premium tax credit shared policy allocation worksheet in. This article doesn't cover scenarios. To enter a shared policy allocation into taxslayer pro, from the main menu of the tax return (form 1040) select: Amount in view differs from data entry. Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts.

Form 8962 Premium Tax Credit Definition

Department of the treasury internal revenue service. Also, form 8962 part iv will be filled out with the spouse's ssn. How is the premium tax credit calculated? Web see here for examples of shared policy allocations. To enter a shared policy allocation into taxslayer pro, from the main menu of the tax return (form 1040) select:

Form 8965, Health Coverage Exemptions and Instructions

Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select. Web the health coverage tax credit (hctc, form 8885) and the premium tax credit (ptc, form 8962) cannot be claimed for the same coverage for the same month. Web form 8962 line 9 will be marked yes..

Fill Free fillable Form 8962 Premium Tax Credit (PTC) (IRS) PDF form

Web the health coverage tax credit (hctc, form 8885) and the premium tax credit (ptc, form 8962) cannot be claimed for the same coverage for the same month. Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select. Review the premium tax credit shared policy allocation worksheet.

What Individuals Need to Know About the Affordable Care Act for 2016

Web the health coverage tax credit (hctc, form 8885) and the premium tax credit (ptc, form 8962) cannot be claimed for the same coverage for the same month. Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select. Web taxpayers who divorce or legally separate during the.

IAAI February Special Edition Newsletter

Department of the treasury internal revenue service. Review the premium tax credit shared policy allocation worksheet in. Web the health coverage tax credit (hctc, form 8885) and the premium tax credit (ptc, form 8962) cannot be claimed for the same coverage for the same month. Web form 8962 line 9 will be marked yes. Web taxpayers who divorce or legally.

How Is The Premium Tax Credit Calculated?

Web the health coverage tax credit (hctc, form 8885) and the premium tax credit (ptc, form 8962) cannot be claimed for the same coverage for the same month. Web taxpayers who divorce or legally separate during the tax year but obtained minimum essential coverage through the marketplace or a state health care exchange must. To enter a shared policy allocation into taxslayer pro, from the main menu of the tax return (form 1040) select: Policy issuer’s name (part i) policy start or end date (part i, part ii) premium cost (part iii, column a) aptc received (part iii, column c) do not seek a correction for:.

Department Of The Treasury Internal Revenue Service.

Also, form 8962 part iv will be filled out with the spouse's ssn. Web the information for policy allocation is found in the 8962 instructions part iv allocation of policy amounts. Web this article shows how to enter the shared policy allocation in form 8962 part iv in taxslayer pro for some common scenarios. Amount in view differs from data entry.

Web Select The Months That The Shared Policy Allocation Started And Ended.

Web form 8962 line 9 will be marked yes. Go to view and select form 8962 pg 2 (8962.pg2 in drake15. This article doesn't cover scenarios. Web select ‘payments, estimates & eic’ select ‘premium tax credit (ptc)’ select ‘shared policy with another taxpayer.’ next select ‘shared policy allocation.’ select.

Web See Here For Examples Of Shared Policy Allocations.

Review the premium tax credit shared policy allocation worksheet in. Web are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage (see instructions)?

/affordable_care_act-9765a407b10444bb98b60706b31b0426.jpg)