Short Form 990

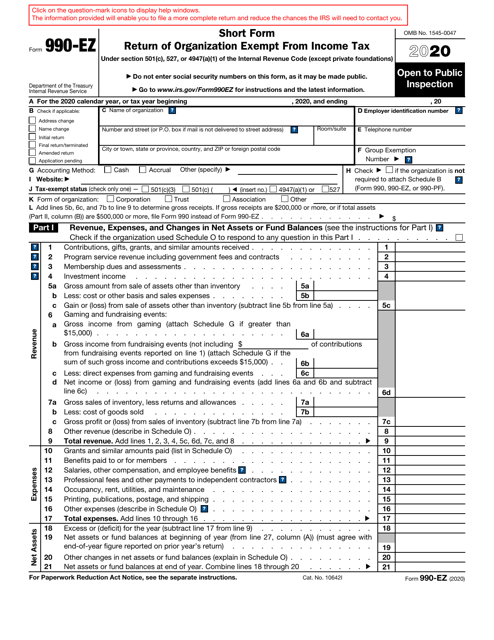

Short Form 990 - Ad access irs tax forms. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. For prior year forms, use the prior. Optional for others.) balance sheets (see the instructions for. Short form return of organization exempt from income tax. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. How can i learn about using them?

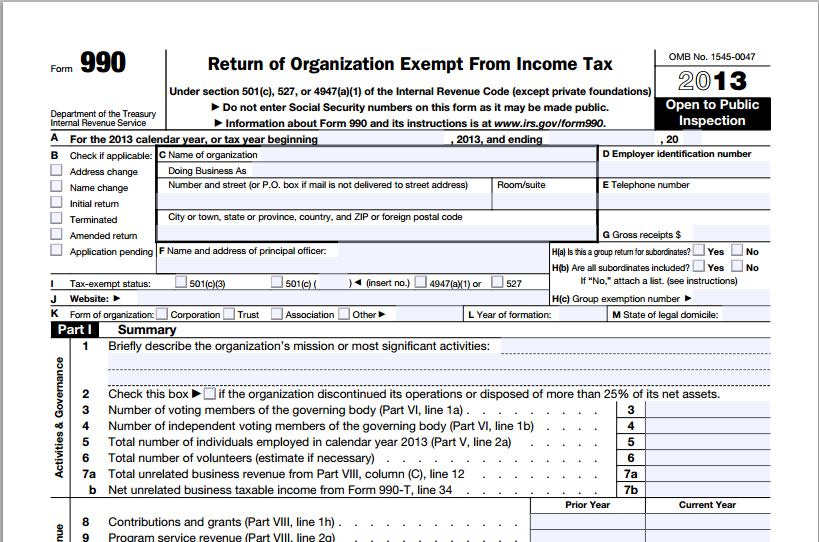

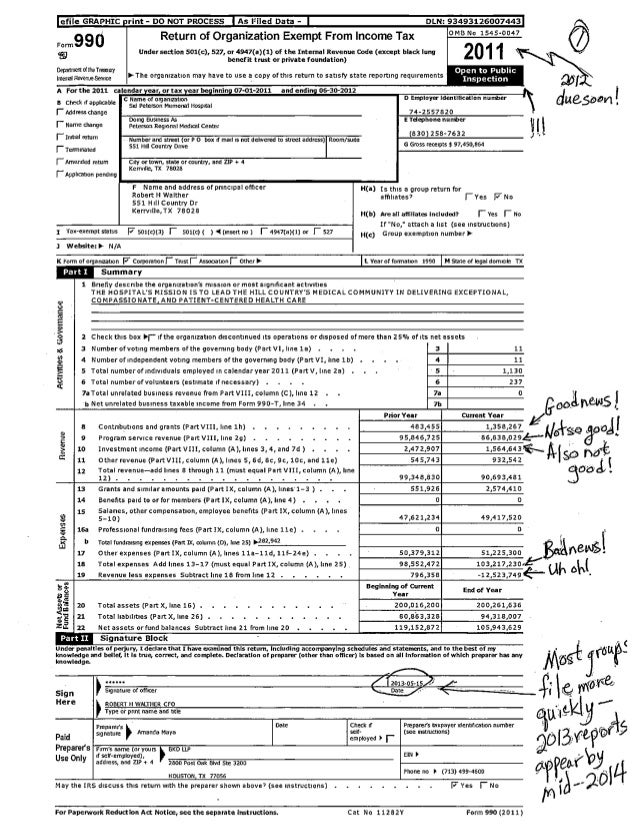

Generating/preparing a short year return;. Short form return of organization exempt from income tax. Web what is a 990 form? In a nutshell, the form gives the irs an overview of the organization's. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Ad access irs tax forms. Web the four main variations of form 990 include: In short, a form 990 is an informational document highlighting your nonprofit’s mission, programs, finances, and accomplishments. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

Ad get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. This form is incredibly short with only eight questions and it must be filed electronically. Optional for others.) balance sheets (see the instructions for. For prior year forms, use the prior. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Web the four main variations of form 990 include: Short form return of organization exempt from income tax. The instructions include a reminder that form. How can i learn about using them?

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. In short, a form 990 is an informational document highlighting your nonprofit’s mission, programs, finances, and accomplishments. For prior year forms, use the prior. Web the four main variations of form 990 include: Web form 990 department.

Form 990EZ Short Form Return of Organization Exempt from Tax

Ad access irs tax forms. Department of the treasury internal revenue service. Web the four main variations of form 990 include: This form is incredibly short with only eight questions and it must be filed electronically. Optional for others.) balance sheets (see the instructions for.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Department of the treasury internal revenue service. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Short form return of organization exempt from income tax. Web the 2020.

IRS Form 990EZ Download Fillable PDF or Fill Online Short Form Return

In short, a form 990 is an informational document highlighting your nonprofit’s mission, programs, finances, and accomplishments. This form is incredibly short with only eight questions and it must be filed electronically. Get ready for tax season deadlines by completing any required tax forms today. Web the four main variations of form 990 include: Complete, edit or print tax forms.

Fillable IRS Form 990EZ Free Printable PDF Sample FormSwift

Web what is a 990 form? Web the four main variations of form 990 include: In a nutshell, the form gives the irs an overview of the organization's. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Generating/preparing a short year return;.

Form 990EZ Short Form Return of Organization Exempt from Tax

For prior year forms, use the prior. Short form return of organization exempt from income tax. Ad access irs tax forms. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Failure To File Form 990N free download programs ealetitbit

Generating/preparing a short year return;. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. For prior year forms, use the prior.

Pdf 2020 990 N Fill Out Fillable and Editable PDF Template

Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how.

Form 990EZ Short Form Return of Organization Exempt from Tax

Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Complete, edit or print tax forms instantly. How can i learn about using them? Optional for others.) balance sheets (see the instructions for. The instructions include a reminder that form.

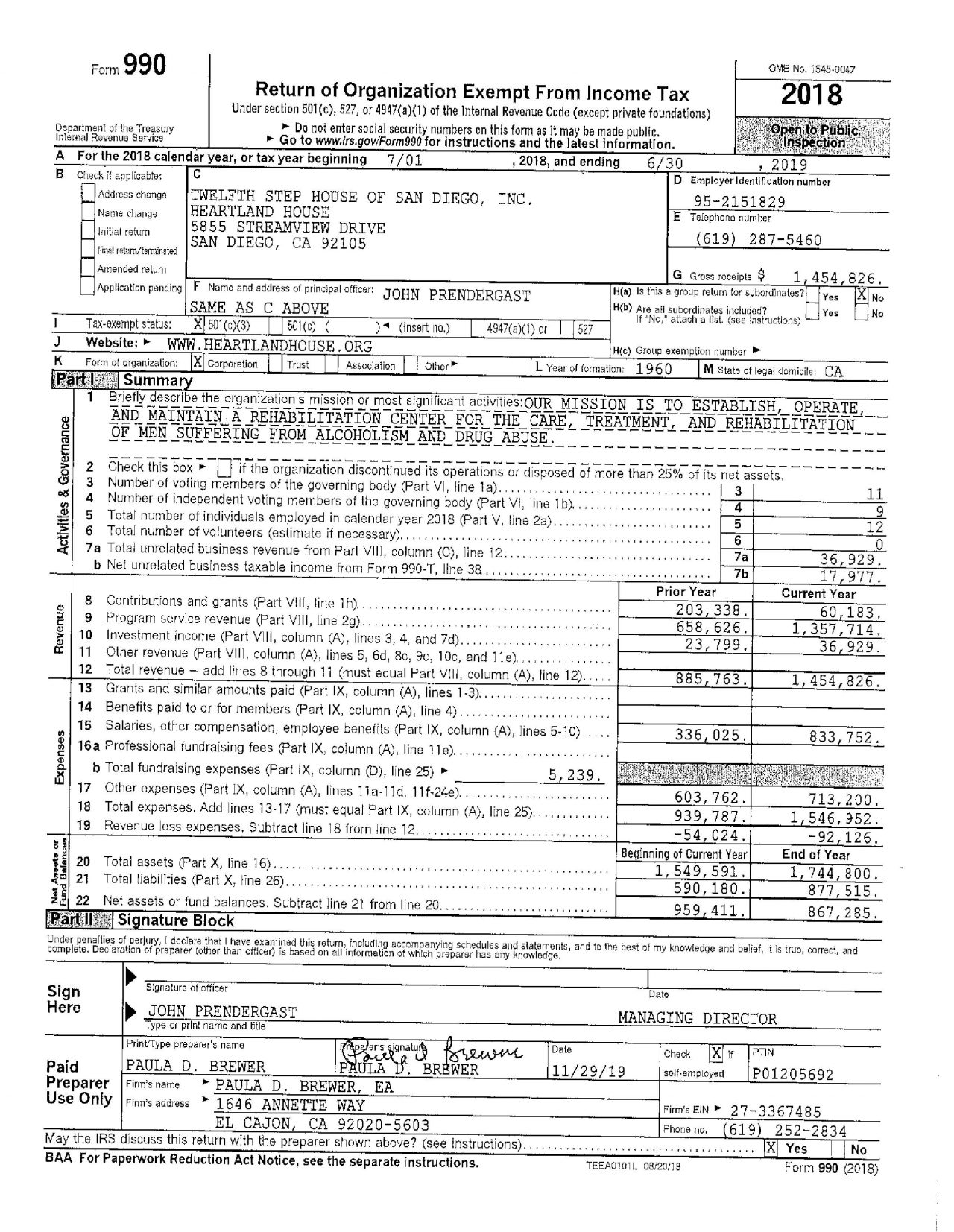

IRS Form 990 Heartland House

Web the four main variations of form 990 include: Optional for others.) balance sheets (see the instructions for. In a nutshell, the form gives the irs an overview of the organization's. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. How can i learn about using them?

In Short, A Form 990 Is An Informational Document Highlighting Your Nonprofit’s Mission, Programs, Finances, And Accomplishments.

Short form return of organization exempt from income tax. Web the four main variations of form 990 include: Optional for others.) balance sheets (see the instructions for. Complete, edit or print tax forms instantly.

This Form Is Incredibly Short With Only Eight Questions And It Must Be Filed Electronically.

Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: In a nutshell, the form gives the irs an overview of the organization's. Get ready for tax season deadlines by completing any required tax forms today.

Exempt Organizations Must File A Tax Return Called A Form 990 With The Irs Each Year To Comply.

Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Web what is a 990 form? For prior year forms, use the prior.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

How can i learn about using them? Ad access irs tax forms. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. The instructions include a reminder that form.