Tax Abatement Form Nevada

Tax Abatement Form Nevada - Web nevada department of business and industry division of industrial relations occupational safety and health administration. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of. Web the state/goed offers standard tax abatements that include sales and use tax abatements on capital equipment purchases, abatements on personal property and. Web nevada from 2014 through 2019. Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement of property. 2022 projects 2021 projects 2020 projects previous projects statutes. Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. Web state of nevada tax abatements are regulatory abatements, regulated by statute that sets criteria each company must meet in order to qualify for abatements (wage, job and. Contact the department holiday schedule public records request department of taxation. Web to save time and money, submit a property tax cap claim form for your property in churchill county.

Abatement of 50 percent of the 1.378%. Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold. Personal property tax abatement of. Web by the nevada department of taxation for the year in which the tax cap applies, the owner may file this claim form to receive the “low tax cap”, which cannot exceed 3%. Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement of property. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of. 2022 projects 2021 projects 2020 projects previous projects statutes. Web (fox5) by alexis fernandez published: Web the state/goed offers standard tax abatements that include sales and use tax abatements on capital equipment purchases, abatements on personal property and. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw).

Of the 56 power plants in nevada, 23 are exporting a total of 2,271. Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement of property. Rate on quarterly wages exceeding $50,000. Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of. Web nevada from 2014 through 2019. Personal property tax abatement of. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax abatement company. 2022 projects 2021 projects 2020 projects previous projects statutes. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county.

State Of Nevada Sales Tax Rates By County Literacy Ontario Central South

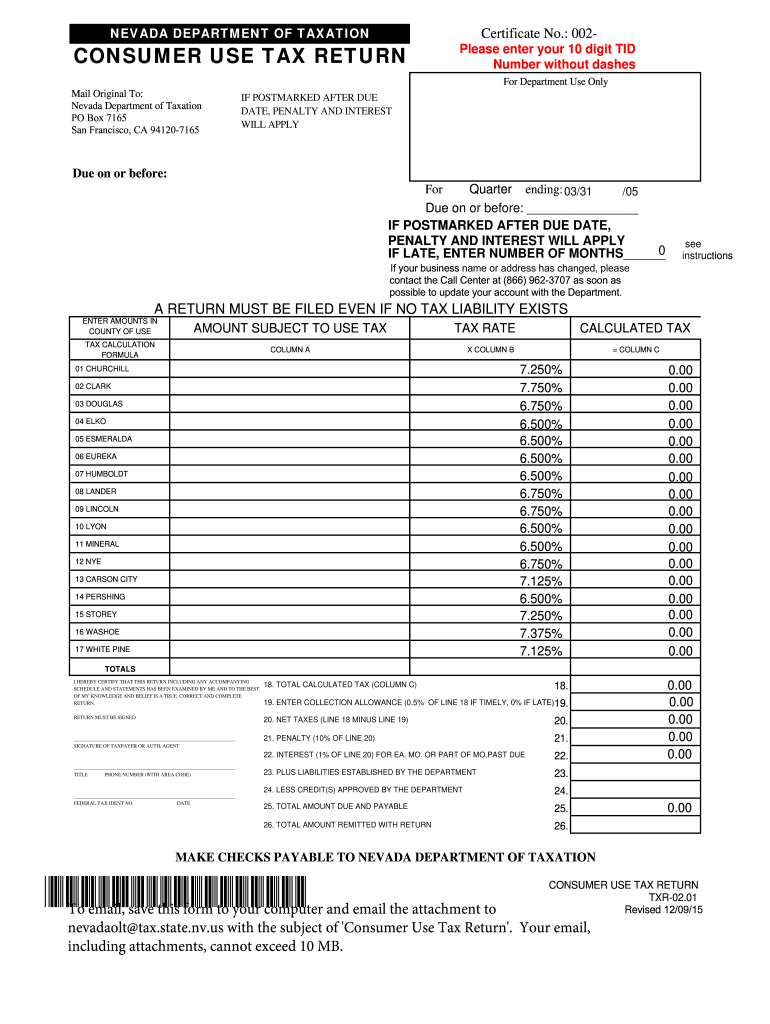

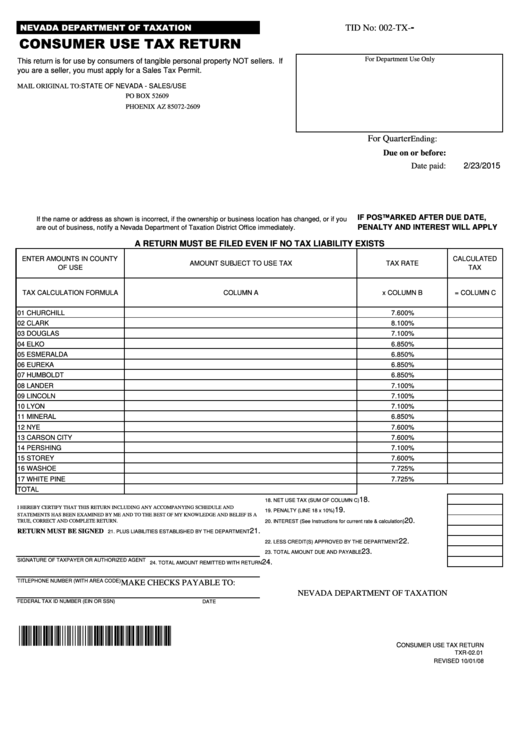

Web to save time and money, submit a property tax cap claim form for your property in churchill county. Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise tax formscommerce tax formsgold. Web (fox5) by alexis fernandez published: Web of the facilities granted a partial sales and use tax and/or property tax.

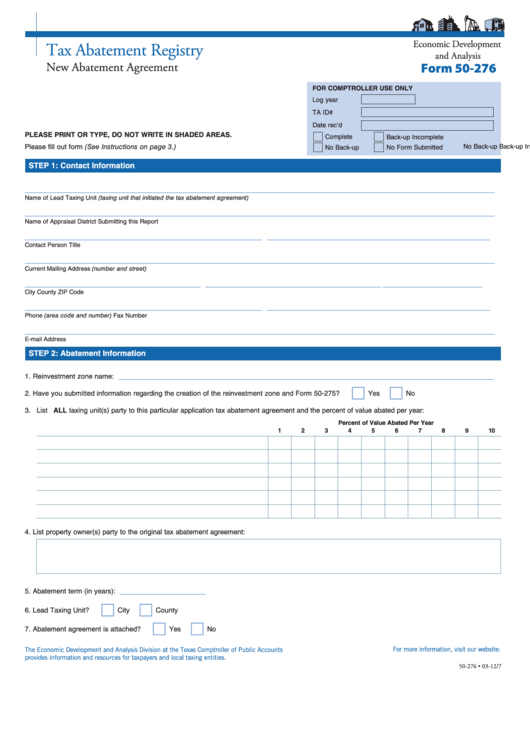

Fillable Form 50276 Tax Abatement Registry Texas Comptroller Of

What is the partial tax abatement or the. Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax abatement company. Web to save time and money, submit a property tax cap claim form for your property in churchill county. 2022 projects 2021 projects 2020 projects previous projects.

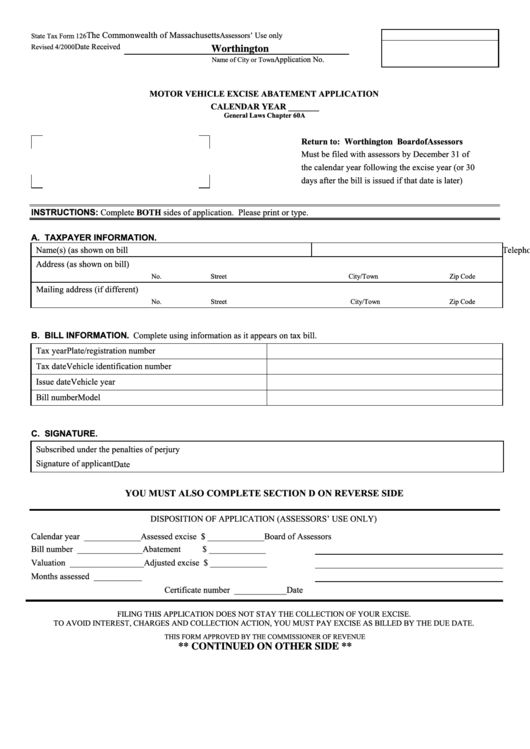

State Tax Form 126 Motor Vehicle Excise Abatement Application

Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). What is the partial tax abatement or the. Web nevada department of business and industry division of industrial relations occupational safety and health administration. Personal.

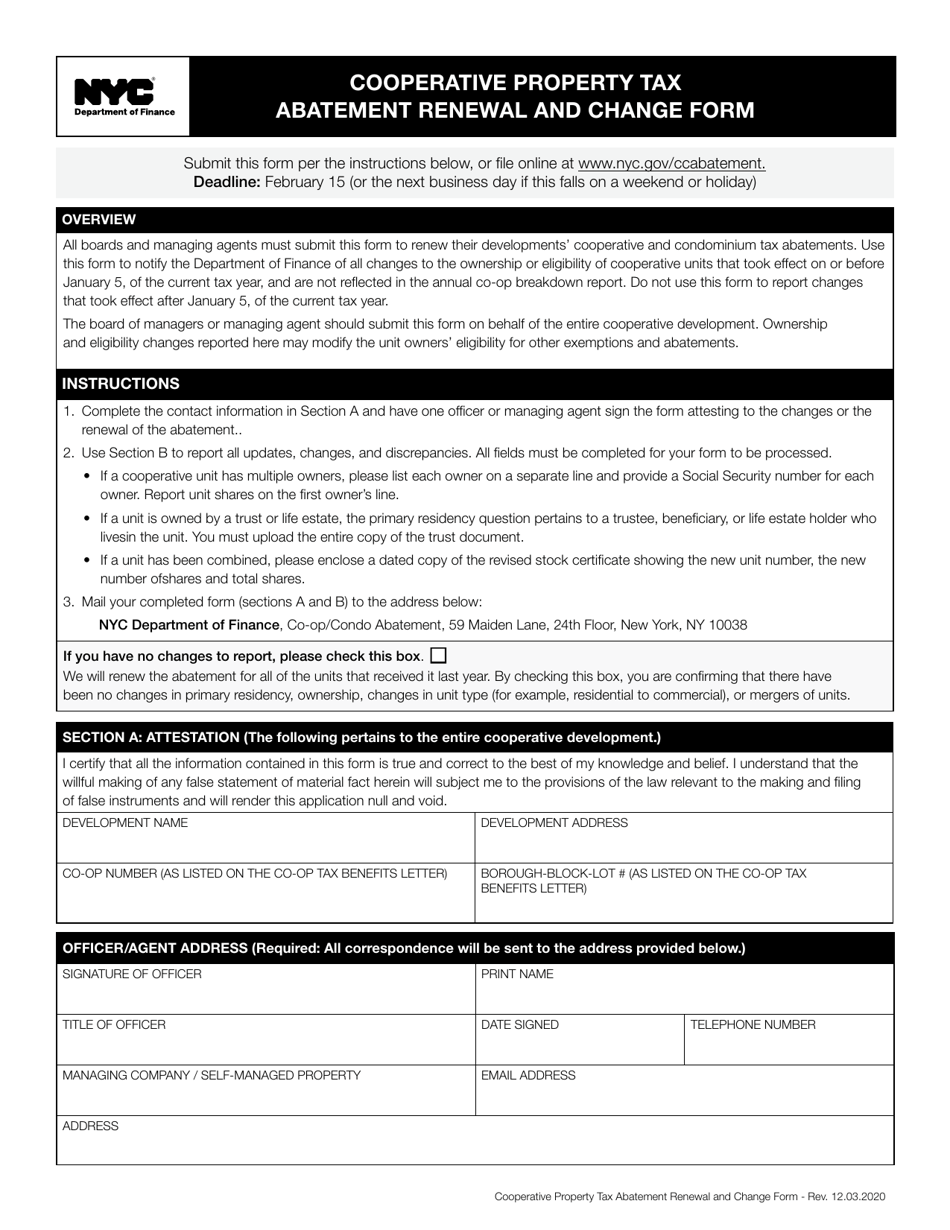

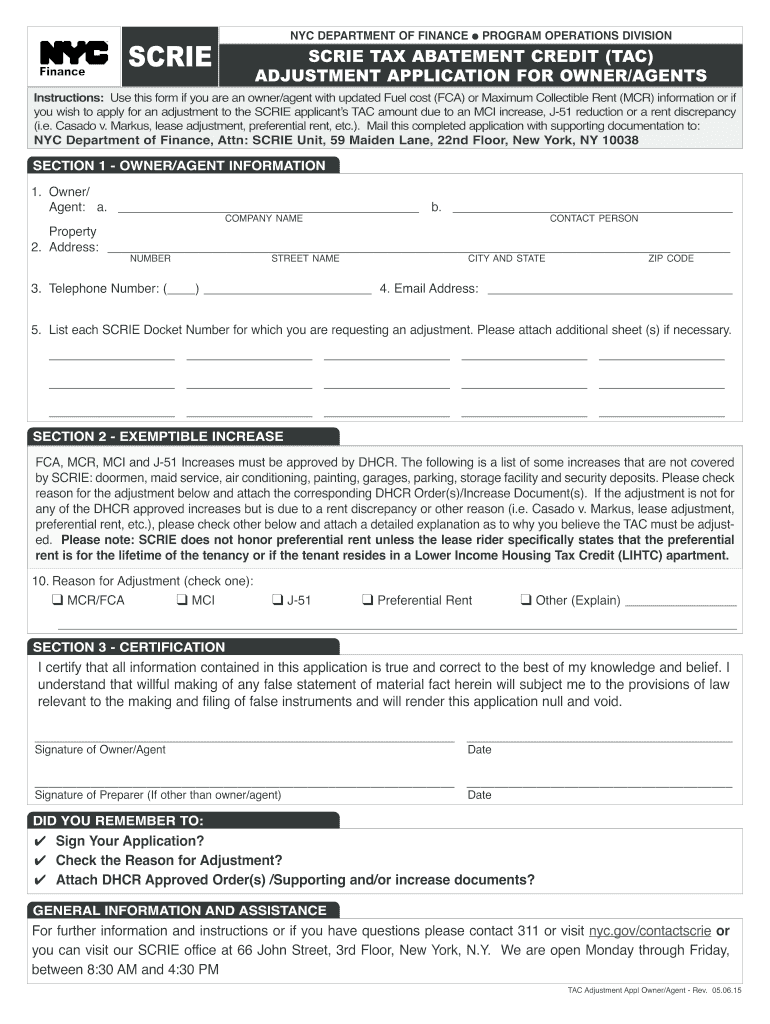

New York Tac Tax Abatement Fill Online, Printable, Fillable, Blank

Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. Web nevada from 2014 through 2019. Of the 56 power plants in nevada, 23 are exporting a total of 2,271. Web by the nevada department of taxation for the year in which the tax cap applies, the owner may file this claim form to.

Form 843 Claim for Refund and Request for Abatement (2011) Free Download

Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. 27, 2023 at 4:53 pm pdt las vegas, nev. Web to save.

Form 843 Claim for Refund and Request for Abatement Definition

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web nrs 360.750 companies meeting requirements that include paying 100% or more of the state or county wide average wage may qualify for: Web abated projects goe has approved 54 tax.

New York City Cooperative Property Tax Abatement Renewal and Change

Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. Personal property tax abatement of. What is the partial tax abatement or the. Web tax forms tax formsgeneral purpose formssales & use tax formsmodified business tax formslive entertainment tax formsexcise.

Nevada Redetermination Fill Out and Sign Printable PDF Template signNow

Abatement of 50 percent of the 1.378%. _____ this section to be completed for residential properties only: Web nevada department of business and industry division of industrial relations occupational safety and health administration. Rate on quarterly wages exceeding $50,000. Web by the nevada department of taxation for the year in which the tax cap applies, the owner may file this.

NYC 421a Tax Abatement What it is and how you can benefit from it?

Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax abatement company. Web nevada department of business and industry division of industrial relations occupational safety and health administration. 2022 projects 2021 projects 2020 projects previous projects statutes. What is the partial tax abatement or the. Abatement of.

20152022 Form NV TXR02.01 Fill Online, Printable, Fillable, Blank

Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. Contact the department holiday schedule public records request department of taxation..

Web By The Nevada Department Of Taxation For The Year In Which The Tax Cap Applies, The Owner May File This Claim Form To Receive The “Low Tax Cap”, Which Cannot Exceed 3%.

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. What is the partial tax abatement or the. Web abated projects goe has approved 54 tax abatement applications since the program began in 2010. 2022 projects 2021 projects 2020 projects previous projects statutes.

Of The 56 Power Plants In Nevada, 23 Are Exporting A Total Of 2,271.

Web type of incentives (please check all that the company is applying for on this application) sales & use tax abatement property tax abatement company. Web of the facilities granted a partial sales and use tax and/or property tax abatement is 5,262 megawatts (mw). Web to save time and money, submit a property tax cap claim form for your property in churchill county. Web renewable energy tax abatement application.

_____ This Section To Be Completed For Residential Properties Only:

Web nrs 360.750 companies meeting requirements that include paying 100% or more of the state or county wide average wage may qualify for: Web abatement appeal nevada revised statutes provides taxpayers with the right to appeal through a written petition form for partial abatement of property. Web nevada department of business and industry division of industrial relations occupational safety and health administration. Web the state/goed offers standard tax abatements that include sales and use tax abatements on capital equipment purchases, abatements on personal property and.

Web Nevada From 2014 Through 2019.

Rate on quarterly wages exceeding $50,000. Web state of nevada tax abatements are regulatory abatements, regulated by statute that sets criteria each company must meet in order to qualify for abatements (wage, job and. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial. 27, 2023 at 4:53 pm pdt las vegas, nev.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)