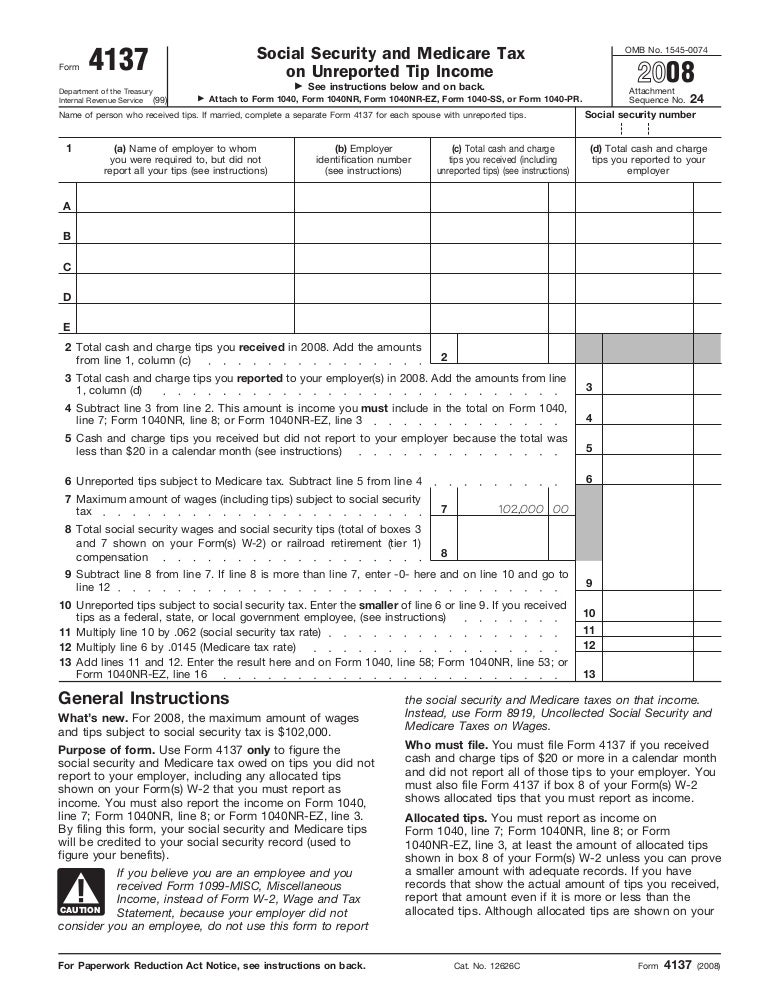

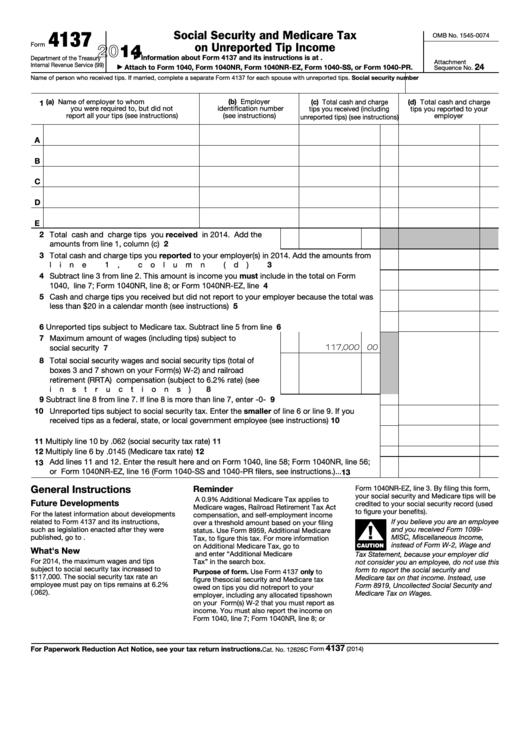

Tax Form 4137

Tax Form 4137 - Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn tips are required to report all tip income each month and pay the. Web income tax forms form 4137 federal — social security and medicare tax on unreported tip income download this form print this form it appears you don't have a pdf plugin. Private delivery services should not deliver returns to irs offices other than. Department of the treasury |. Web form 4137, social security and medicare tax on unreported tip income use irs form 4137 to determine the social security and medicare tax owed on tips you did not report. Web form 4137 2014 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Web report error it appears you don't have a pdf plugin for this browser. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. You must also file form 4137. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest.

For some of the western states, the following addresses were previously used: Web form 4137 2014 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Department of the treasury |. Web about form 4137, social security and medicare tax on unreported tip income. Web report error it appears you don't have a pdf plugin for this browser. Use form 4137 only to figure the social security and medicare tax owed on. Find irs forms and answers to tax questions. Web form 4137, social security and medicare tax on unreported tip income use irs form 4137 to determine the social security and medicare tax owed on tips you did not report. These where to file addresses. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest.

Web form 4137 2014 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Web income tax forms form 4137 federal — social security and medicare tax on unreported tip income download this form print this form it appears you don't have a pdf plugin. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn tips are required to report all tip income each month and pay the. For some of the western states, the following addresses were previously used: Web form 4137 2021 social security and medicare tax on unreported tip income department of the treasury internal revenue service (99) go to. Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. Web find irs addresses for private delivery of tax returns, extensions and payments. We help you understand and meet your federal tax responsibilities. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest.

Da Form 4137 Fill Out and Sign Printable PDF Template signNow

Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. We help you understand and meet your federal tax responsibilities. Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn.

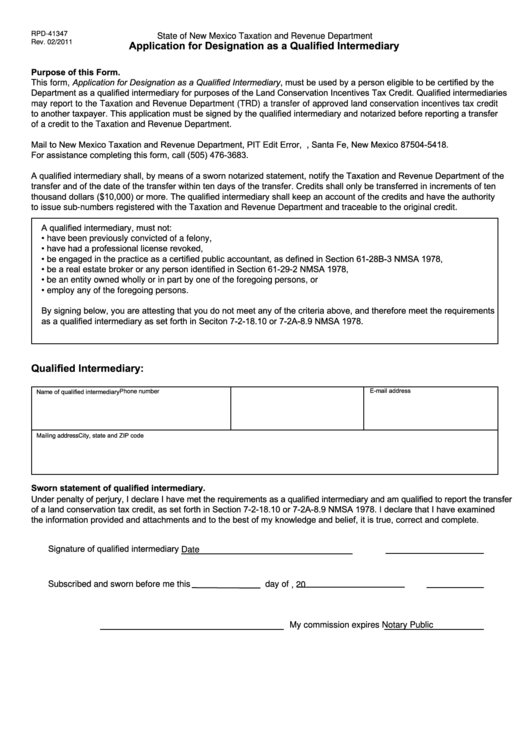

Form Rpd41347 Application For Designation As A Qualified

Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. Web find irs addresses for private delivery of tax returns, extensions and payments. Web form 4137 2021 social security and medicare tax on unreported tip income department of.

4137 Social Security and Medicare Tax on Unreported Tip Inco YouTube

Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. Department of the treasury |. For some of the western states, the following addresses were previously used: Web form 4137 helps to determine social security and medicare tax.

Irs 1040 Form Line 14 New For 2019 Taxes Revised 1040 Only 3

Find irs forms and answers to tax questions. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Web about form 4137, social security and medicare tax on unreported tip income. Web form 4137, social security and medicare tax on unreported tip income use.

Form 4137 Social Security and Medicare Tax On Unreported Tip

Web social security and medicare tax on unreported tip income see instructions below and on back. Web about form 4137, social security and medicare tax on unreported tip income. Web find irs addresses for private delivery of tax returns, extensions and payments. Web form 4137 2014 department of the treasury internal revenue service (99) social security and medicare tax on.

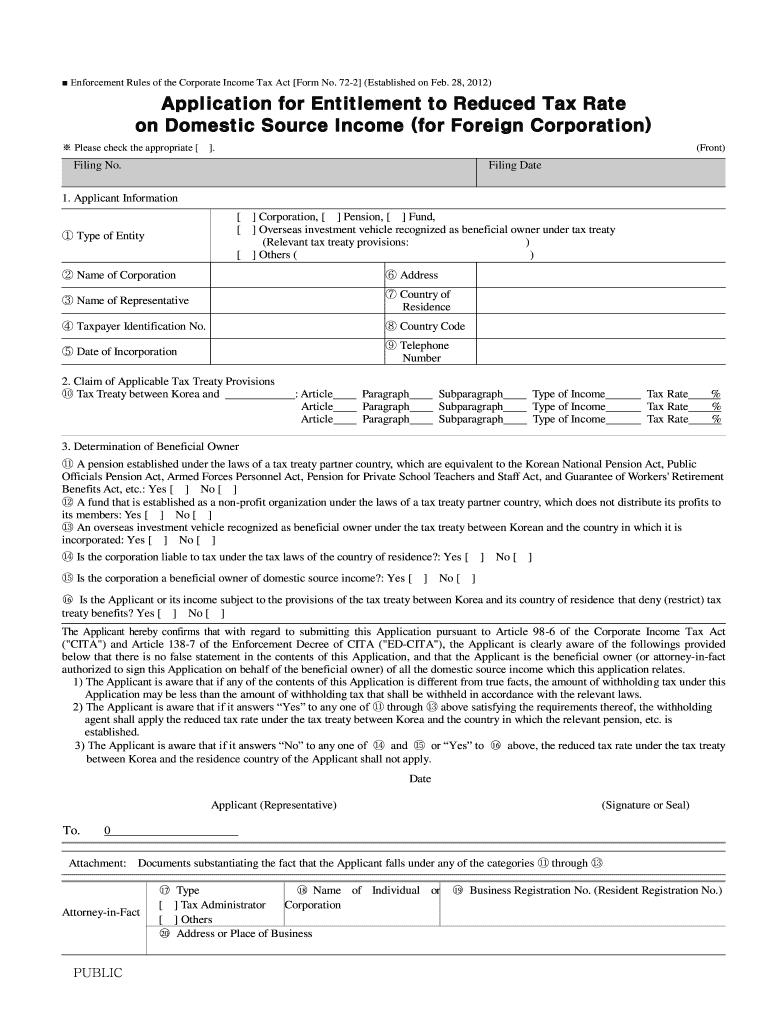

Application for Entitlement to Reduced Tax Rate on Domestic Source

These where to file addresses. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips.

Form 4137Social Security and Medicare Tax on Unreported Tip

Web form 4137 2021 social security and medicare tax on unreported tip income department of the treasury internal revenue service (99) go to. Use form 4137 only to figure the social security and medicare tax owed on. Private delivery services should not deliver returns to irs offices other than. Web income tax forms form 4137 federal — social security and.

Fillable Form 4137 Social Security And Medicare Tax On Unreported Tip

Web income tax forms form 4137 federal — social security and medicare tax on unreported tip income download this form print this form it appears you don't have a pdf plugin. Find irs forms and answers to tax questions. Web find irs addresses for private delivery of tax returns, extensions and payments. Web form 4137, social security and medicare tax.

Small Business Form —

Use form 4137 only to figure the social security and medicare tax owed on. Web you must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and did not report all of those tips to your employer. Department of the treasury |. You must also file form 4137. Web about form.

Fc 029 Form Pdf / Fc Form 4137 Fill Online, Printable, Fillable

Department of the treasury |. Web form 4137 2021 social security and medicare tax on unreported tip income department of the treasury internal revenue service (99) go to. Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn tips are required to report all tip income each month and pay the. Web.

We Help You Understand And Meet Your Federal Tax Responsibilities.

Use form 4137 only to figure the social security and medicare tax owed on. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Web about form 4137, social security and medicare tax on unreported tip income. These where to file addresses.

You Must Also File Form 4137.

Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. Find irs forms and answers to tax questions. Web find irs addresses for private delivery of tax returns, extensions and payments. Web social security and medicare tax on unreported tip income see instructions below and on back.

Web Form 4137 2021 Social Security And Medicare Tax On Unreported Tip Income Department Of The Treasury Internal Revenue Service (99) Go To.

Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest. Web income tax forms form 4137 federal — social security and medicare tax on unreported tip income download this form print this form it appears you don't have a pdf plugin. Web form 4137 2014 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income information about form 4137 and its. For some of the western states, the following addresses were previously used:

Department Of The Treasury |.

Web report error it appears you don't have a pdf plugin for this browser. Web form 4137, social security and medicare tax on unreported tip income use irs form 4137 to determine the social security and medicare tax owed on tips you did not report. Web form 4137 helps to determine social security and medicare tax on unreported tip income taxpayers who earn tips are required to report all tip income each month and pay the. Web form 4137 department of the treasury internal revenue service (99) social security and medicare tax on unreported tip income go to www.irs.gov/form4137 for the latest.