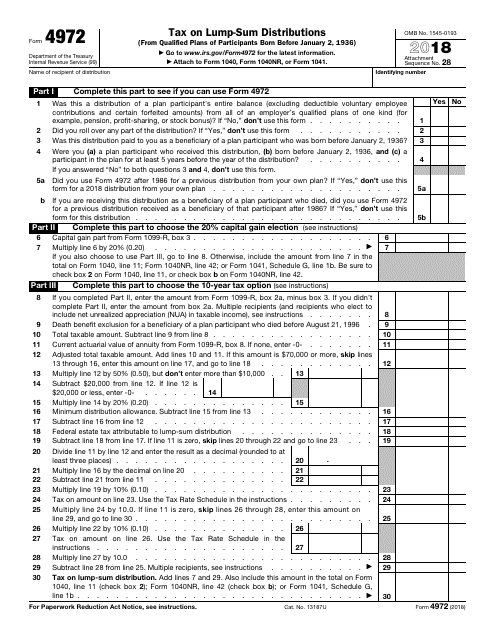

Tax Form 4972

Tax Form 4972 - If you do, your child will not have to file a return. Web purpose of form use this form if you elect to report your child’s income on your return. Web tax form 4972 is used for reducing taxes. Other items you may find useful all form 4972 revisions See capital gain election, later. 2020 tax computation schedule for line 19 and line 22 line 4: The biggest requirement is that you have to be born before january 2, 1936. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. You can make this election if your child meets all of the following conditions. Your client gets a payment of the plan participant's entire balance.

Web tax form 4972 is used for reducing taxes. The form’s primary function is to calculate and record the tax associated with these benefits. This form is usually required when: It allows beneficiaries to receive their entire benefit in a single payment. Web purpose of form use this form if you elect to report your child’s income on your return. Other items you may find useful all form 4972 revisions 2020 tax computation schedule for line 19 and line 22 line 4: See capital gain election, later. Irs form 4972 eligibility 1. Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies.

Other items you may find useful all form 4972 revisions Irs form 4972 eligibility 1. Current revision form 4972 pdf recent developments none at this time. It allows beneficiaries to receive their entire benefit in a single payment. Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies. Multiply line 17 by 10%.21. The form’s primary function is to calculate and record the tax associated with these benefits. Web tax form 4972 is used for reducing taxes. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. This form is usually required when:

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

The form’s primary function is to calculate and record the tax associated with these benefits. This happens with two kinds of plans, either an inherited account or an employer account. Web purpose of form use this form if you elect to report your child’s income on your return. Irs form 4972 eligibility 1. The biggest requirement is that you have.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Current revision form 4972 pdf recent developments none at this time. This happens with two kinds of plans, either an inherited account or an employer account. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. Multiply line 17 by 10%.21. Other items you may find useful all form 4972.

Form 1040NR U.S. Nonresident Alien Tax Return Form (2014

The biggest requirement is that you have to be born before january 2, 1936. You can make this election if your child meets all of the following conditions. See capital gain election, later. Other items you may find useful all form 4972 revisions Multiply line 17 by 10%.21.

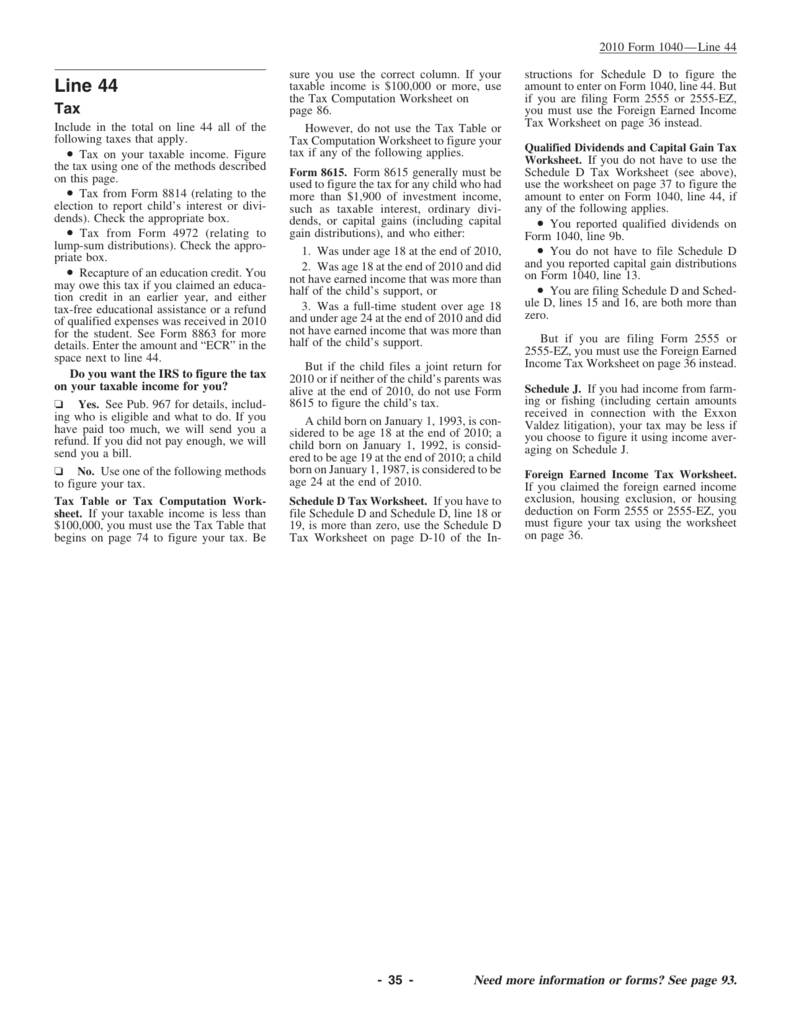

instructions for line 44

Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. Other items you may find useful all form 4972 revisions If you do, your child will.

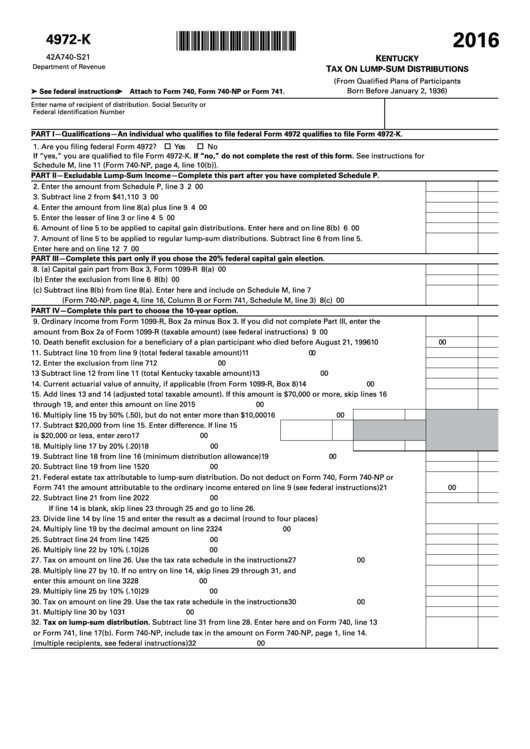

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2016

The biggest requirement is that you have to be born before january 2, 1936. Your client gets a payment of the plan participant's entire balance. Multiply line 17 by 10%.21. Current revision form 4972 pdf recent developments none at this time. This happens with two kinds of plans, either an inherited account or an employer account.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. The biggest requirement is that you have to be born before january 2, 1936. If you do, your child will not have.

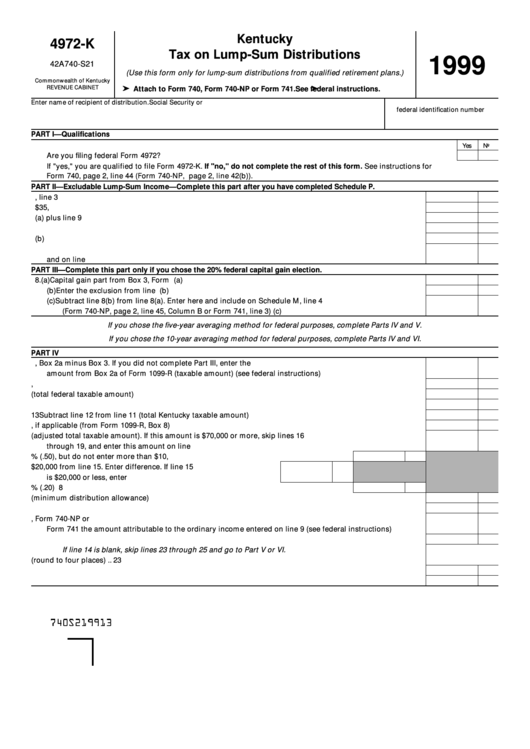

Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. Irs form 4972 eligibility 1. 2020 tax computation schedule for line 19 and line 22 line 4: See capital gain election, later. Your client gets a payment of the plan participant's entire balance.

revenue.ne.gov tax current f_1040n

If you do, your child will not have to file a return. Multiply line 17 by 10%.21. It allows beneficiaries to receive their entire benefit in a single payment. Web tax form 4972 is used for reducing taxes. You can make this election if your child meets all of the following conditions.

4972K Kentucky Tax on Lump Sum Distribution Form 42A740S21

See capital gain election, later. Other items you may find useful all form 4972 revisions 2020 tax computation schedule for line 19 and line 22 line 4: The biggest requirement is that you have to be born before january 2, 1936. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. It allows beneficiaries to receive their entire benefit in a single payment. Other items you may find useful all form 4972 revisions Current revision form 4972 pdf recent developments none at this time. 2020 tax computation schedule for line 19 and line.

Current Revision Form 4972 Pdf Recent Developments None At This Time.

Web purpose of form use this form if you elect to report your child’s income on your return. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. It allows beneficiaries to receive their entire benefit in a single payment. The biggest requirement is that you have to be born before january 2, 1936.

If You Do, Your Child Will Not Have To File A Return.

Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. You can make this election if your child meets all of the following conditions. See capital gain election, later. This form is usually required when:

Web Tax Revenue Is Based On Values Determined By The Assessor In Conjunction With The Levies (Including Excess Levies) Set By The Authorized Levying Bodies.

This happens with two kinds of plans, either an inherited account or an employer account. Irs form 4972 eligibility 1. The form’s primary function is to calculate and record the tax associated with these benefits. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements.

Multiply Line 17 By 10%.21.

Other items you may find useful all form 4972 revisions Your client gets a payment of the plan participant's entire balance. Web tax form 4972 is used for reducing taxes. 2020 tax computation schedule for line 19 and line 22 line 4: