Tax Form 5405

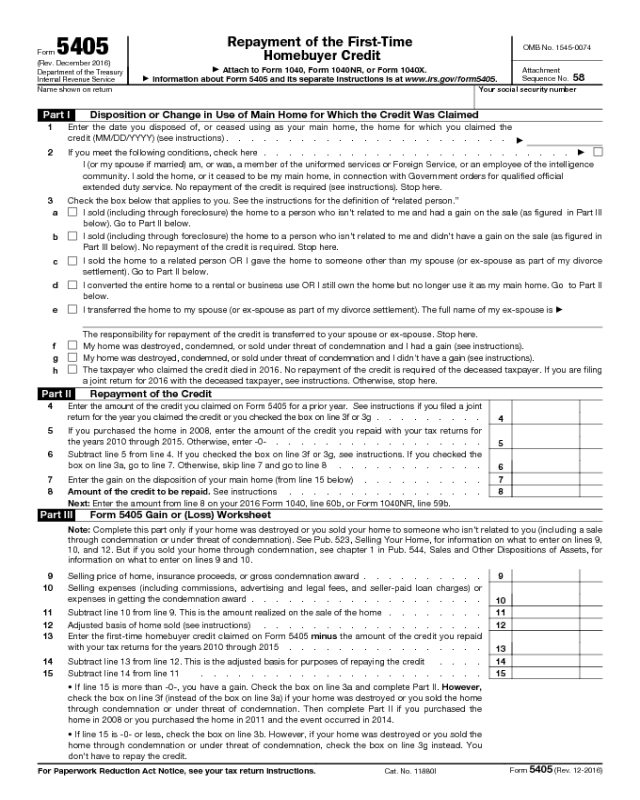

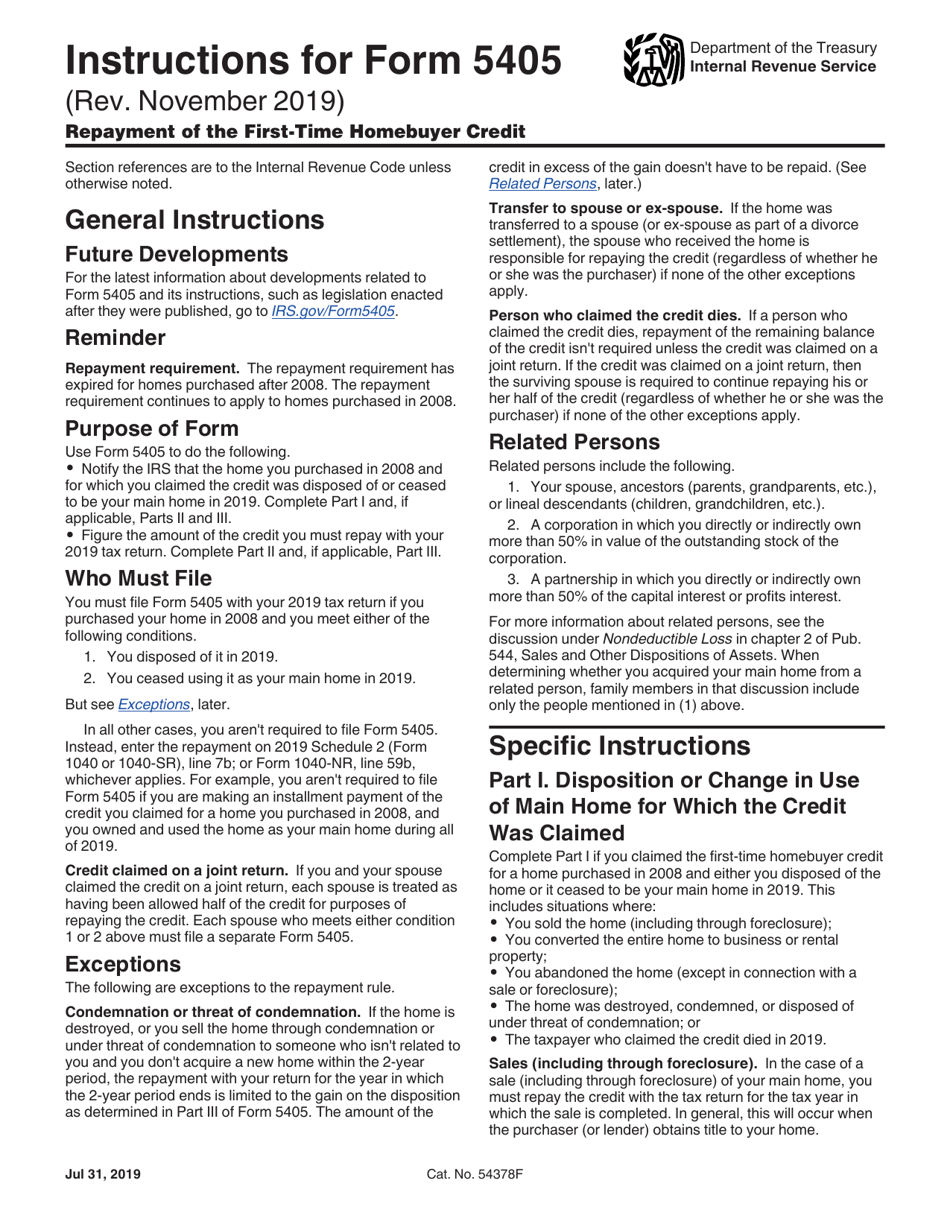

Tax Form 5405 - Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. Web enter the amount of the credit you claimed on form 5405 for a prior year. Web if you are filing joint return for 2014 with the deceased taxpayer, see instructions. You cannot claim the credit. Do not file form 5405. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web go to line f. Complete, edit or print tax forms instantly. November 2019) department of the treasury internal revenue service. Notify the irs that the home for which you claimed the credit was.

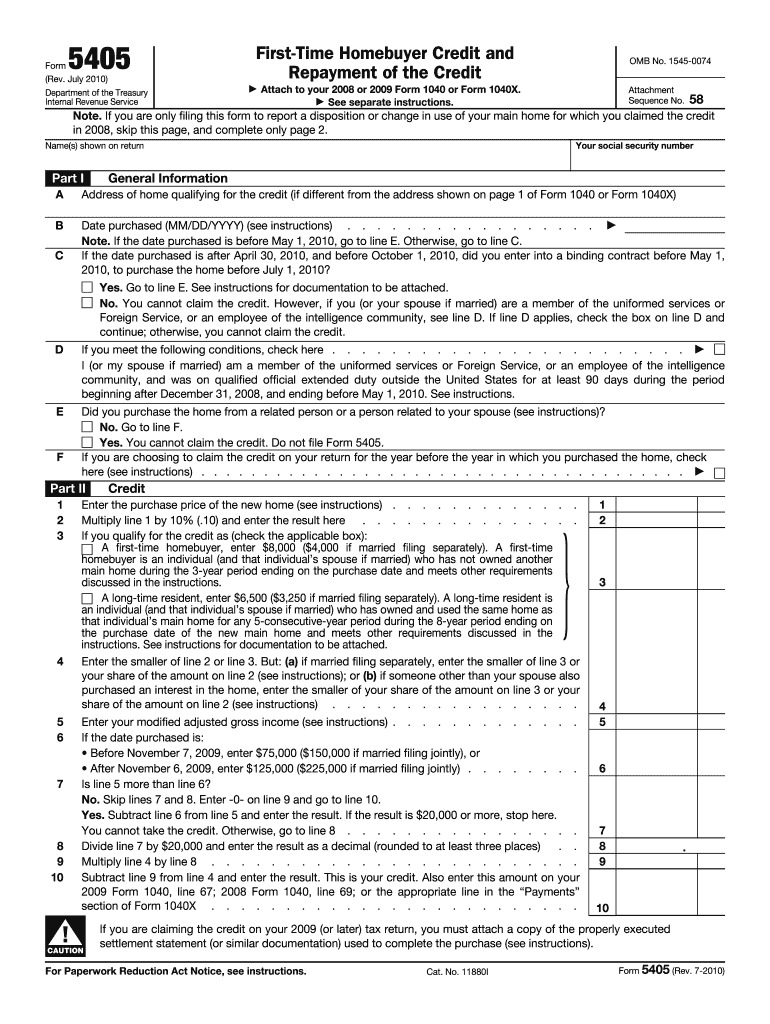

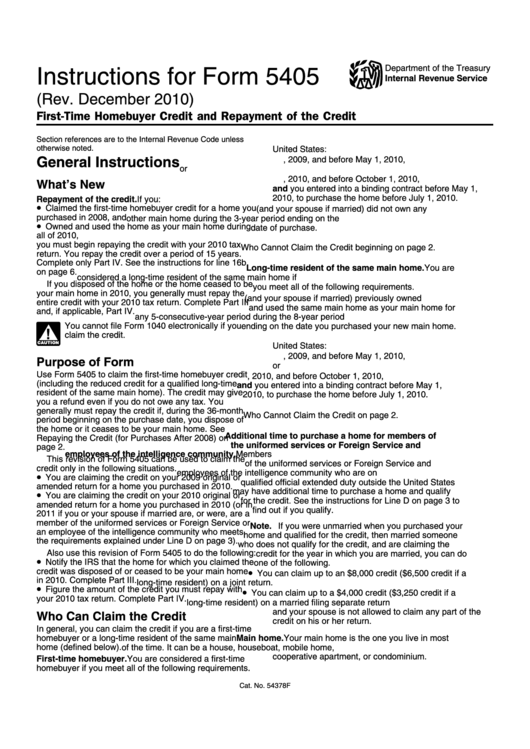

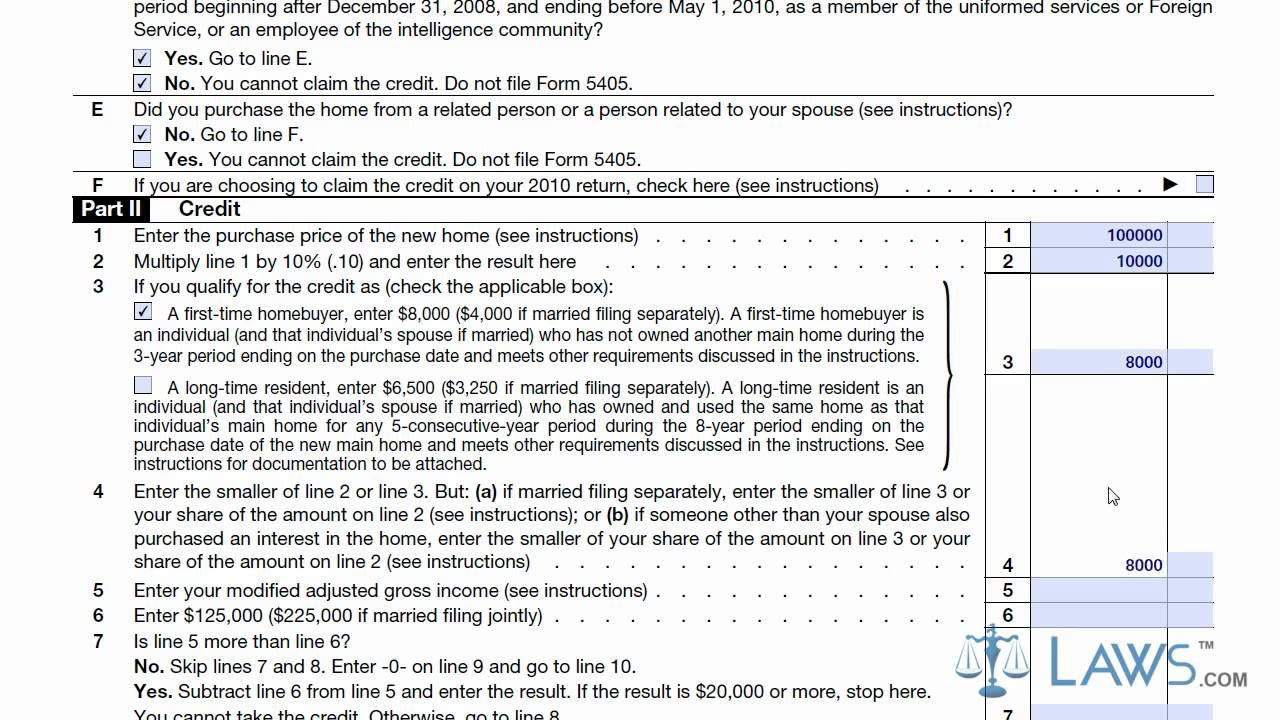

If you are choosing to claim the credit on your 2010 return, check here (see instructions). Web if you are filing joint return for 2014 with the deceased taxpayer, see instructions. In the case of a sale, including through foreclosure, this is the year in which. Do not file form 5405. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. Web purpose of form. I sold the home, or it ceased to. Use form 5405 to do the following. Web easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the home screen. Web enter the amount of the credit you claimed on form 5405 for a prior year.

For paperwork reduction act notice, see your tax return instructions. See instructions if you filed a joint. Web county official contact information internet access to motor vehicle and marine records and personal property tax payment records: Get ready for tax season deadlines by completing any required tax forms today. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of. You cannot claim the credit. Request for copy of tax return. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Notify the irs that the home for which you claimed the credit was. Web the irs requires you to prepare irs form 5405 before you can claim the credit.

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Do not file form 5405. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Web enter the amount of the credit you claimed on form 5405 for a prior year. Complete, edit or print tax forms instantly. Notify the irs that the home you purchased in 2008 and for which you claimed the.

Draft Instructions For Form 5405 FirstTime Homebuyer Credit And

Web enter the amount of the credit you claimed on form 5405 for a prior year. Part ii repayment of the credit 4 enter the amount of the credit you claimed. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax.

Learn How to Fill the Form 5405 FirstTime Homebuyer Credit and

Web enter the amount of the credit you claimed on form 5405 for a prior year. Web county official contact information internet access to motor vehicle and marine records and personal property tax payment records: I sold the home, or it ceased to. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web purpose of form.

540 Introduction Fall 2016 YouTube

The form is used for the credit received if you bought a. Request for copy of tax return. If you dispose of the home or if you (and your spouse if married) stopped using it as your. Get ready for tax season deadlines by completing any required tax forms today. You cannot claim the credit.

FirstTime Homebuyer Credit and Repayment of the Credit

Web i (or my spouse if married) am, or was, a member of the uniformed services or foreign service, or an employee of the intelligence community. If you dispose of the home or if you (and your spouse if married) stopped using it as your. Web enter the amount of the credit you claimed on form 5405 for a prior.

O.C. Real Estate Notes On Tax Credit Extension

If you are choosing to claim the credit on your 2010 return, check here (see instructions). Get ready for tax season deadlines by completing any required tax forms today. If you dispose of the home or if you (and your spouse if married) stopped using it as your. Web form 4506 (novmeber 2021) department of the treasury internal revenue service..

Form 5405 FirstTime Homebuyer Credit

Web enter the amount of the credit you claimed on form 5405 for a prior year. Web purpose of form. If you are choosing to claim the credit on your 2010 return, check here (see instructions). Other videos from the same category In the case of a sale, including through foreclosure, this is the year in which.

Form 5405 Edit, Fill, Sign Online Handypdf

Web if you are filing joint return for 2014 with the deceased taxpayer, see instructions. In the case of a sale, including through foreclosure, this is the year in which. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of. Web county official contact information internet access to motor vehicle.

Form 5405 Repayment of the FirstTime Homebuyer Credit (2014) Free

Complete, edit or print tax forms instantly. Do not sign this form unless all applicable lines have. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Notify the irs that the home for which you claimed the credit was. Web form 5405 is used to report the sale or disposal of a home.

Form 5405 Fill Out and Sign Printable PDF Template signNow

If you are choosing to claim the credit on your 2010 return, check here (see instructions). Web go to line f. For paperwork reduction act notice, see your tax return instructions. Web i (or my spouse if married) am, or was, a member of the uniformed services or foreign service, or an employee of the intelligence community. Part ii repayment.

Web Form 5405 Needs To Be Completed In The Year The Home Is Disposed Of Or Ceases To Be The Main Home.

I sold the home, or it ceased to. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of. Web purpose of form. See instructions if you filed a joint.

You Cannot Claim The Credit.

Use form 5405 to do the following. In the case of a sale, including through foreclosure, this is the year in which. For paperwork reduction act notice, see your tax return instructions. If you dispose of the home or if you (and your spouse if married) stopped using it as your.

The Form Is Used For The Credit Received If You Bought A.

Do not sign this form unless all applicable lines have. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Web i (or my spouse if married) am, or was, a member of the uniformed services or foreign service, or an employee of the intelligence community. Web if you are filing joint return for 2014 with the deceased taxpayer, see instructions.

Web Enter The Amount Of The Credit You Claimed On Form 5405 For A Prior Year.

Request for copy of tax return. Part ii repayment of the credit 4 enter the amount of the credit you claimed. Do not file form 5405. Notify the irs that the home for which you claimed the credit was.

/GettyImages-185121670-be12b2817ff9419497195a93e62632cc.jpg)