Tax Form From Daycare To Parents

Tax Form From Daycare To Parents - Edit, sign and save year end receipt form. Web completing form 2441, child and dependent care expenses, isn't difficult. Web do daycares give tax forms. Web daycare tax form for parents: You will use it to claim all income received. Deductions can reduce your taxable income before you. Web the child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with. To request a waiver online, please. Year end receipt & more fillable forms, register and subscribe now! Learn when to use it, how to fill it out, and how to include it when filing your tax return.

_____ _____ additional instructions for completing this form are on th e back of this sheet. Web child care tax credits on irs form 2441 the american rescue plan, signed by president biden on march 11, 2021, changed the child and dependent credit. Our records show we provided service (s) to <child's name>.</p> Ad care.com® homepay℠ can handle household payroll and nanny tax obligations. Year end receipt & more fillable forms, register and subscribe now! Web tax deduction for daycare. Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). Web 1 best answer. Web the child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with. Web this is a digital downloadable child care tax statement to be given to parents at the end of the year.

Web check out our daycare tax form for parents selection for the very best in unique or custom, handmade pieces from our templates shops. The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return. Web according to irs form 2441 (the form used for the child care tax credit), the credit itself is dependent on your income level, but the vast majority of families should. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web this is a digital downloadable child care tax statement to be given to parents at the end of the year. Web 1 best answer. Web parent</strong>/guardian’s name and address> re: Year end receipt & more fillable forms, register and subscribe now! _____ _____ additional instructions for completing this form are on th e back of this sheet. If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any.

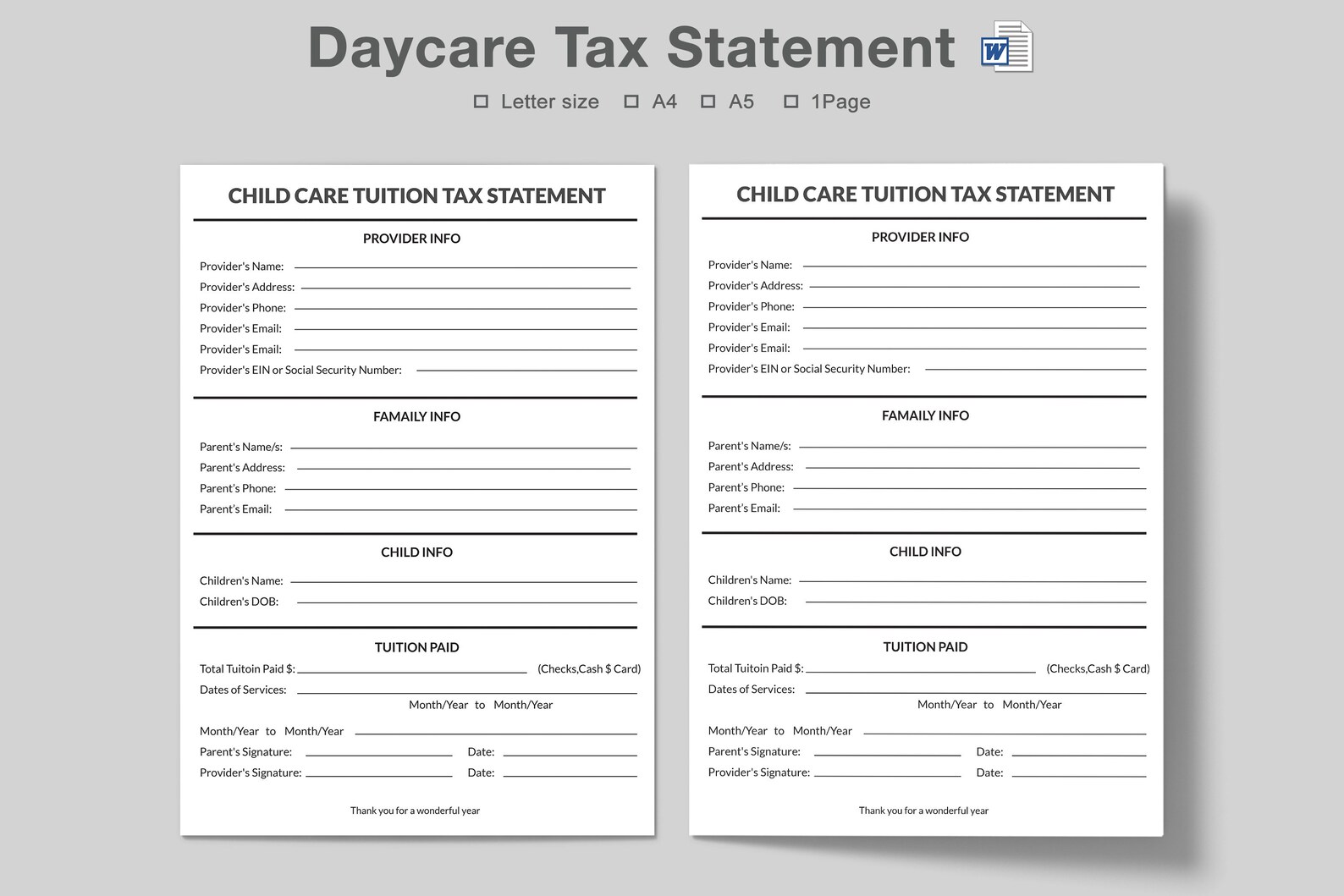

Daycare Tax Statement for Parents Form Fill Out and Sign Printable

Dependents, standard deduction, and filing information tax credits. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Edit, sign and save year end receipt form. This complete printable document is designed for licensed childcare centers, in..

Child Care Tax Credit Form TAXW

Web president joe biden on tuesday announced new action to guarantee access to mental health care, unveiling a proposed rule that would ensure mental health. You will use it to claim all income received. Web 1 best answer. _____ _____ additional instructions for completing this form are on th e back of this sheet. Web complete daycare tax form for.

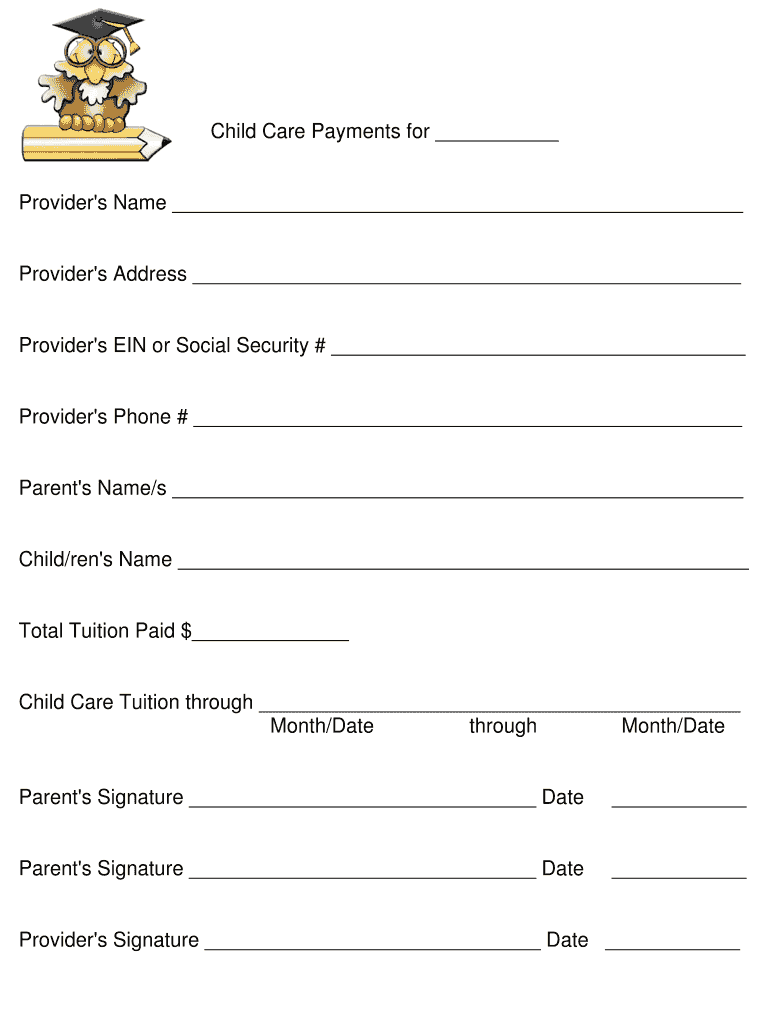

Pin by Britta on Daycare ideas Daycare forms, Daycare, Home daycare

Ad care.com® homepay℠ can handle household payroll and nanny tax obligations. Learn if you qualify for the. Edit, sign and save year end receipt form. Web 1 best answer. Year end receipt & more fillable forms, register and subscribe now!

ChildCare Tax StatementChild tax statementDaycare tax Etsy

Web the child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with. If you have questions, please contact the center director for help. Our records show we provided service (s) to <child's name>.</p> Learn if you qualify for the. A daycare tax statement.

A daycare tax statement must be given to parents at the end of the year

The irs offers childcare providers deductions and credits based on eligibility. _____ _____ additional instructions for completing this form are on th e back of this sheet. Web the child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with. Child</strong>'s name> to whom.

FREE 7+ Daycare Invoice Examples & Samples in Google Docs Google

Web eligible expenses include day care, before and after school care, babysitting and camp until the child is 13 years old. Our records show we provided service (s) to <child's name>.</p> Web tax deduction for daycare. Web this is a digital downloadable child care tax statement to be given to parents at the end of the year. You will use.

Daycare Tax Forms For Parents Universal Network

Web tax deduction for daycare. The irs offers childcare providers deductions and credits based on eligibility. Dependents, standard deduction, and filing information tax credits. Web check out our daycare tax form for parents selection for the very best in unique or custom, handmade pieces from our templates shops. Web parent</strong>/guardian’s name and address> re:

A daycare tax statement must be given to parents at the end of the year

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Year end receipt & more fillable forms, register and subscribe now! You will use it to claim all income received. Dependents, standard deduction, and filing information tax.

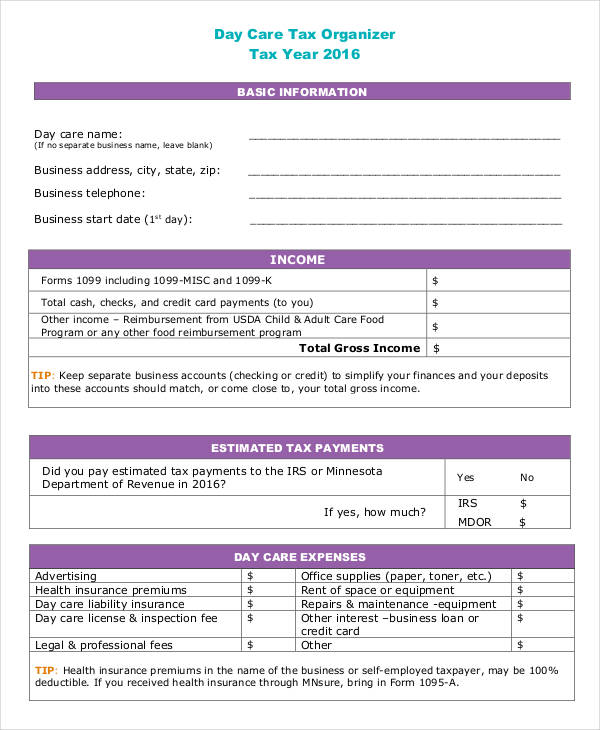

Daycare Business and Expense sheet to file your daycare business

Web president joe biden on tuesday announced new action to guarantee access to mental health care, unveiling a proposed rule that would ensure mental health. A daycare tax statement must be given to parents at the end of the year. The irs offers childcare providers deductions and credits based on eligibility. Web watch newsmax live for the latest news and.

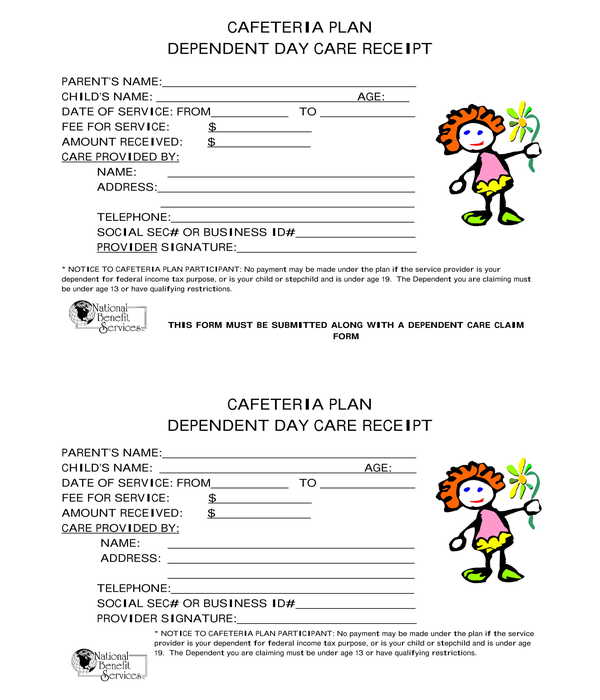

FREE 5+ Daycare Receipt Forms in PDF

To redeem, parents upload receipts and are. You will use it to claim all income received. Fill & download for free get form download the form a comprehensive guide to editing the daycare tax form for parents below you can get. Web daycare tax form daycare tax form get a daycare tax statement pdf 0 template with signnow and complete.

Web Find Out If You Can Claim A Child Or Relative As A Dependent;

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web according to irs form 2441 (the form used for the child care tax credit), the credit itself is dependent on your income level, but the vast majority of families should. Web daycare tax form daycare tax form get a daycare tax statement pdf 0 template with signnow and complete it in a few simple clicks. If you have questions, please contact the center director for help.

To Request A Waiver Online, Please.

Web the child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with. Web completing form 2441, child and dependent care expenses, isn't difficult. Web president joe biden on tuesday announced new action to guarantee access to mental health care, unveiling a proposed rule that would ensure mental health. Our records show we provided service (s) to

Web The Child And Dependent Care Credit Is A Tax Credit That May Help You Pay For The Care Of Eligible Children And Other Dependents (Qualifying Persons).

Web child care tax credits on irs form 2441 the american rescue plan, signed by president biden on march 11, 2021, changed the child and dependent credit. Nanny & household tax and payroll service The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return. Edit, sign and save year end receipt form.

Year End Receipt & More Fillable Forms, Register And Subscribe Now!

Web do daycares give tax forms. Show details we are not affiliated with. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. You will use it to claim all income received.