Tax Form From Onlyfans

Tax Form From Onlyfans - Web what is release form on onlyfans. The purpose of the document is to. You are an individual sole proprietor. Web when it comes to taxes for onlyfans creators, there are several forms you need to be familiar with. Influencers' income is considered to be involved with the business they work for (even if they actually work for. Here’s a breakdown of some of the most important ones: You pay 15.3% se tax on 92.35%. The form shows your gross. The most common form creators will receive if they earn more. Yes you are the owner of your.

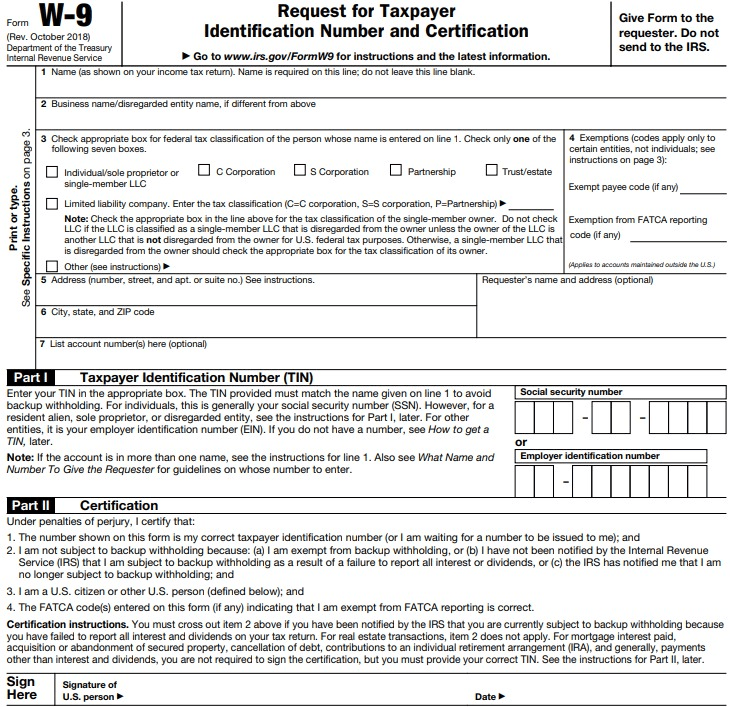

Kaila smith, 21, was doing what millions of aussies do after. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Anyone creating content for onlyfans works independently on the platform. Web what is release form on onlyfans. Web so, onlyfans requires you to fill out a w9 form before you can request a payout from any money you make. Web taxes for onlyfans community discussions taxes get your taxes done londonbridge new member taxes for onlyfans i've never paid taxes before and i have. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. You can simply download your 1099 form by following this simple. Web volvogirl level 15 yes the business name is you and you use your ssn. Well the answer is no.

Yes you are the owner of your. I read that if you complete the form using your ssn, that can show up. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Web what is release form on onlyfans. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Here’s a breakdown of some of the most important ones: Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Web onlyfans sends out tax forms to creators in january, both in a digital and mailed copy of the 1099 form. A model release for onlyfans is the standard paper for all content monetization platforms. Web wondering if you're going to receive a 1099 form in the mail from onlyfans?

How to properly file 1099 form for Onlyfans FreeCashFlow.io 2023

A model release for onlyfans is the standard paper for all content monetization platforms. Web volvogirl level 15 yes the business name is you and you use your ssn. Web what is release form on onlyfans. Well the answer is no. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

You are an individual sole proprietor. The most common form creators will receive if they earn more. Web when it comes to taxes for onlyfans creators, there are several forms you need to be familiar with. Web what is release form on onlyfans. Well the answer is no.

43+ Best How To Fill Out W 9 Form For Onlyfans HD PNG images

Web what is release form on onlyfans. Web so, onlyfans requires you to fill out a w9 form before you can request a payout from any money you make. Web a young australian onlyfans star has been delivered a brutal blow after completing her tax return. The form shows your gross. Yes you are the owner of your.

How to get onlyfans tax form 🍓W

In this article, learn the top 15 tax deductions an of creator can take to reduce tax. You can simply download your 1099 form by following this simple. Web as an onlyfans creator, you’re responsible for paying taxes on your income from the platform. I read that if you complete the form using your ssn, that can show up. Web.

Does Onlyfans Send Mail To Your House in 2022? Here's What You Need To Know

Here’s a breakdown of some of the most important ones: You can simply download your 1099 form by following this simple. You are an individual sole proprietor. The most common form creators will receive if they earn more. Web wondering if you're going to receive a 1099 form in the mail from onlyfans?

How to file OnlyFans taxes (W9 and 1099 forms explained)

Tax to be paid if you are an onlyfans careerist tax deductions that can help to reduce your onlyfans taxes 1. The form shows your gross. Yes you are the owner of your. You are an individual sole proprietor. Web when it comes to taxes for onlyfans creators, there are several forms you need to be familiar with.

How to file OnlyFans taxes (W9 and 1099 forms explained)

A model release for onlyfans is the standard paper for all content monetization platforms. Web wondering if you're going to receive a 1099 form in the mail from onlyfans? The form shows your gross. Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. Tax to be paid if you.

Onlyfans Tax Form Canada » Veche.info 17

Here’s a breakdown of some of the most important ones: You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. If you’re an onlyfans creator who wants to stay on top of. You pay 15.3% se tax on 92.35%. Tax to be paid if you are an onlyfans careerist tax deductions that can help to reduce.

How to fill out a w9 form for onlyfans 🔥

Web onlyfans content creators can expect to receive one or more 1099 forms at the end of a tax year. I read that if you complete the form using your ssn, that can show up. You can simply download your 1099 form by following this simple. You pay 15.3% se tax on 92.35%. Well the answer is no.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Web when it comes to taxes for onlyfans creators, there are several forms you need to be familiar with. Kaila smith, 21, was doing what millions of aussies do after. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. A model release for onlyfans is the standard paper for all content monetization platforms. Tax to.

If You’re An Onlyfans Creator Who Wants To Stay On Top Of.

I read that if you complete the form using your ssn, that can show up. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web a young australian onlyfans star has been delivered a brutal blow after completing her tax return. Web so, onlyfans requires you to fill out a w9 form before you can request a payout from any money you make.

You Are An Individual Sole Proprietor.

You can simply download your 1099 form by following this simple. Influencers' income is considered to be involved with the business they work for (even if they actually work for. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Yes you are the owner of your.

Web What Is Release Form On Onlyfans.

Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. The form shows your gross. The most common form creators will receive if they earn more. A model release for onlyfans is the standard paper for all content monetization platforms.

Kaila Smith, 21, Was Doing What Millions Of Aussies Do After.

Web as an onlyfans creator, you’re responsible for paying taxes on your income from the platform. Tax to be paid if you are an onlyfans careerist tax deductions that can help to reduce your onlyfans taxes 1. Well the answer is no. Tax to be paid if you are an onlyfans hobbyist 2.