Tax Relief Application Form

Tax Relief Application Form - Tax return for seniors 2022 department of the treasury—internal revenue service. You may be eligible for tax relief if you meet certain age, income, and residency requirements. Web more than 870,000 homeowners with incomes up to $150,000 will be eligible to receive $1,500 in relief; Get prequalified for irs hardship program. Web foreign tax is eligible for a foreign tax credit under §§ 901 and 903 of the internal revenue code (code). Use this form to apply for tax relief under the county's tax relief program for seniors and people with disabilities. Web return, using only the form and form instructions as a guide to file a correct federal tax return. Services provided for elderly and disabled tax relief, veterans real estate and motor vehicle exemptions, and surviving spouse real estate. Get free, competing quotes from the best. Certification by the social security administration, which states the date the applicant or relatives were.

To apply, the applicant must be a resident. More than 290,000 homeowners with incomes over $150,000 and up to. Irs use only—do not write or staple in this. Get prequalified for irs hardship program. Web tax relief for seniors & people with disabilities is granted on an annual basis and a renewal application must be filed each year. Tax return for seniors 2022 department of the treasury—internal revenue service. Ad our experts did the work, so you don't have to! Use this form to apply for tax relief under the county's tax relief program for seniors and people with disabilities. Web more than 870,000 homeowners with incomes up to $150,000 will be eligible to receive $1,500 in relief; Certification by the social security administration, which states the date the applicant or relatives were.

If your adjusted gross income (agi) is $73,000 or. Get free, competing quotes from the best. This temporary relief, as described in section 3 of this notice, applies with. Web rev ghana revenue authority tax relief application form (to be completed by employer for an employee with only employment income) for first. Side by side vendor comparison. Web current tax relief recipients will receive a renewal application form in themail. Web the affidavit forms are provided by the tax relief office on request. Services provided for elderly and disabled tax relief, veterans real estate and motor vehicle exemptions, and surviving spouse real estate. Web a federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check (economic impact payment, or eip) under the. If you are required to file federal and state income taxes, you must include a signed copy of the.

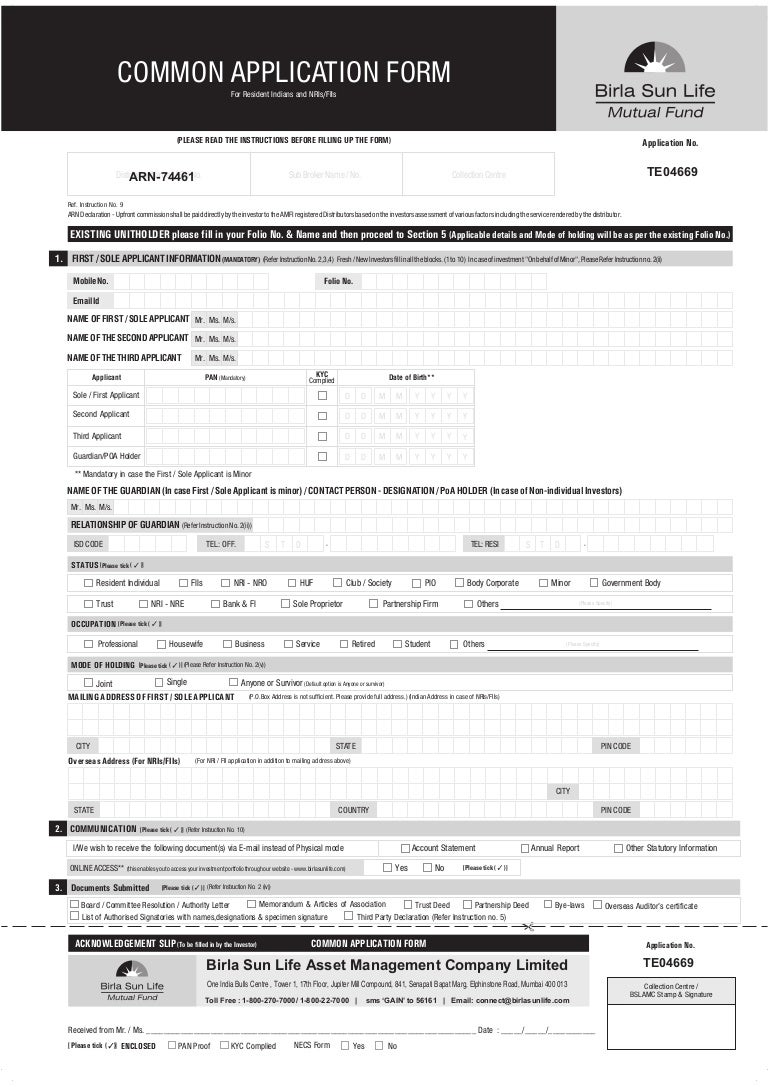

Birla sun life tax relief 96 application form

Ad our experts did the work, so you don't have to! Web more than 870,000 homeowners with incomes up to $150,000 will be eligible to receive $1,500 in relief; Web do i qualify for tax relief? Irs use only—do not write or staple in this. Web foreign tax is eligible for a foreign tax credit under §§ 901 and 903.

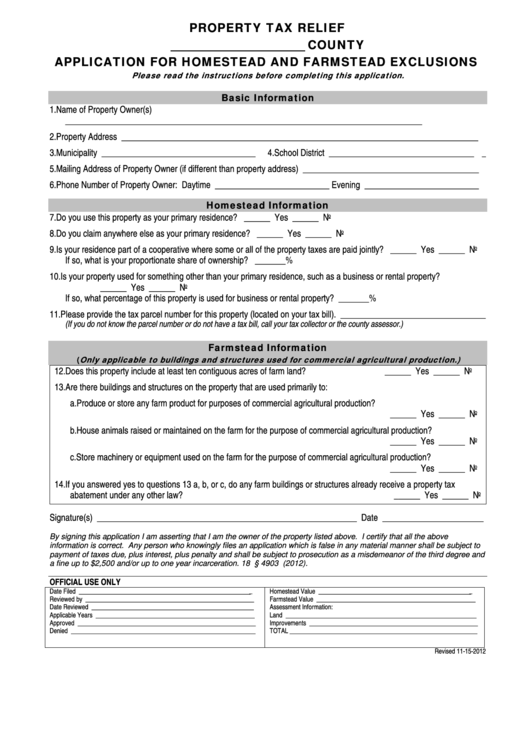

Property Tax Relief Application For Homestead And Farmstead Exclusions

Get free, competing quotes from leading irs relief experts. Web rev ghana revenue authority tax relief application form (to be completed by employer for an employee with only employment income) for first. Web (combines the tax return and tax account transcripts into one complete transcript), wage and income transcript (shows data from information returns we receive such as forms. Ad.

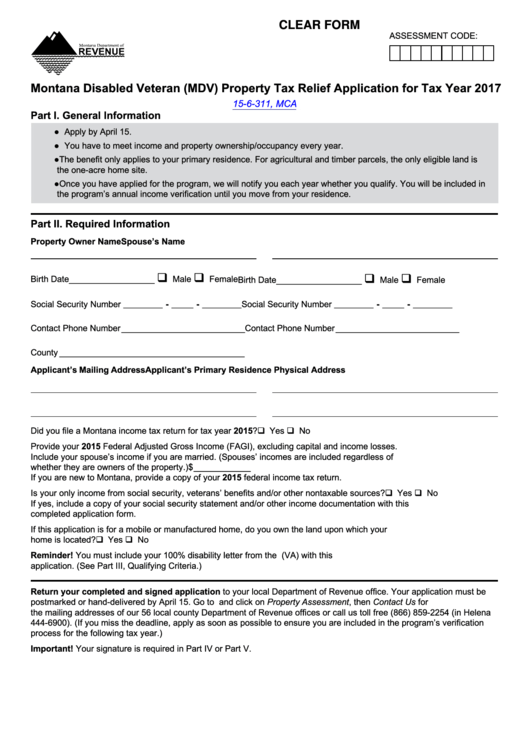

Fillable Montana Disabled Veteran Property Tax Relief Application

Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Ad need tax lien relief? Get free, competing quotes from leading irs relief experts. Side by side vendor comparison. More than 290,000 homeowners with incomes over $150,000 and up to.

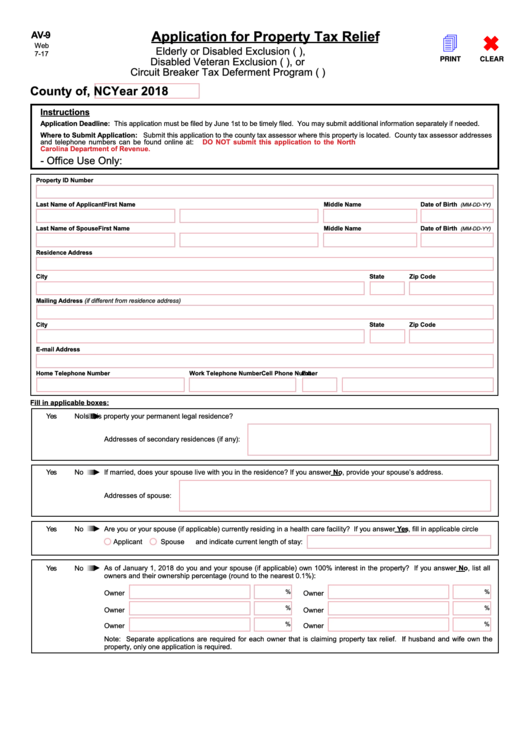

Fillable Form Av9 Application For Property Tax Relief 2018

Get prequalified for irs hardship program. A relief is an allowance given to a resident individual to reduce his or her tax burden. Web tax relief for seniors & people with disabilities is granted on an annual basis and a renewal application must be filed each year. Ad need tax lien relief? Web complete an application package:

Claim Form Vehicle Insurance Government Information

A relief is an allowance given to a resident individual to reduce his or her tax burden. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Ad our experts did the work, so you don't have to! Certification by the social security administration, which states the date the applicant or.

Birla sun life tax relief 96 application form

Our research has helped millions of users to get lowest prices from leading providers. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Get free, competing quotes from leading irs relief experts. Ad need tax lien relief? Get prequalified for irs hardship program.

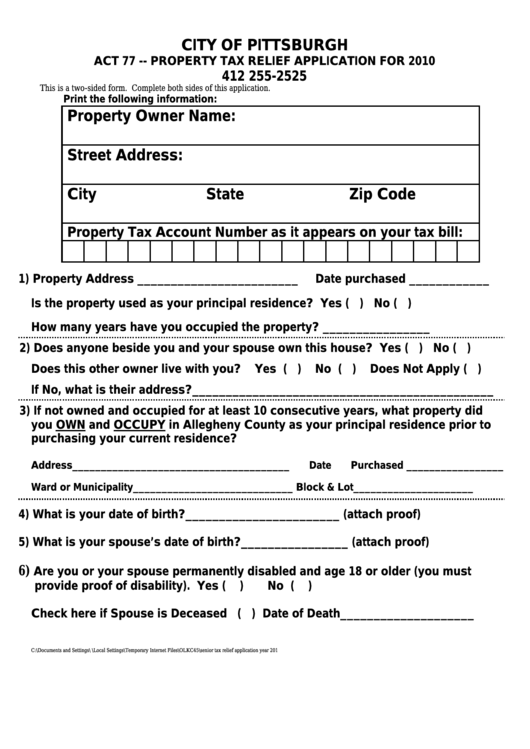

Property Tax Relief Application Form City Of Pittsburgh 2010

Tax return for seniors 2022 department of the treasury—internal revenue service. Get prequalified for irs hardship program. Certification by the social security administration, which states the date the applicant or relatives were. Web (combines the tax return and tax account transcripts into one complete transcript), wage and income transcript (shows data from information returns we receive such as forms. Ad.

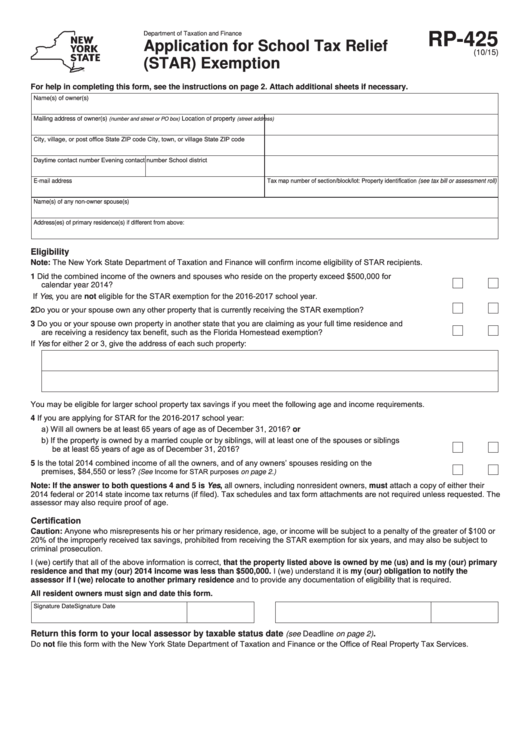

Fillable Form Rp425 Application For School Tax Relief (Star

Web a federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check (economic impact payment, or eip) under the. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Use this form to apply for tax relief under the county's tax relief program for seniors and.

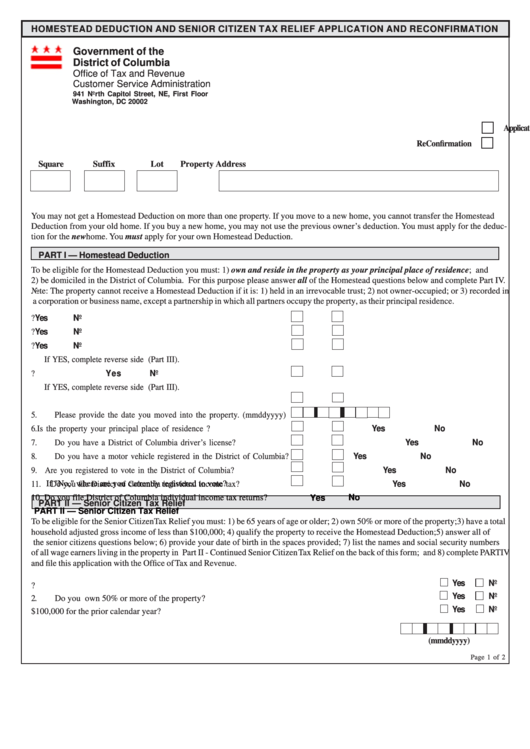

Homestead Deduction And Senior Citizen Tax Relief Application

A relief is an allowance given to a resident individual to reduce his or her tax burden. Never add forms that do not. Web rev ghana revenue authority tax relief application form (to be completed by employer for an employee with only employment income) for first. Web more than 870,000 homeowners with incomes up to $150,000 will be eligible to.

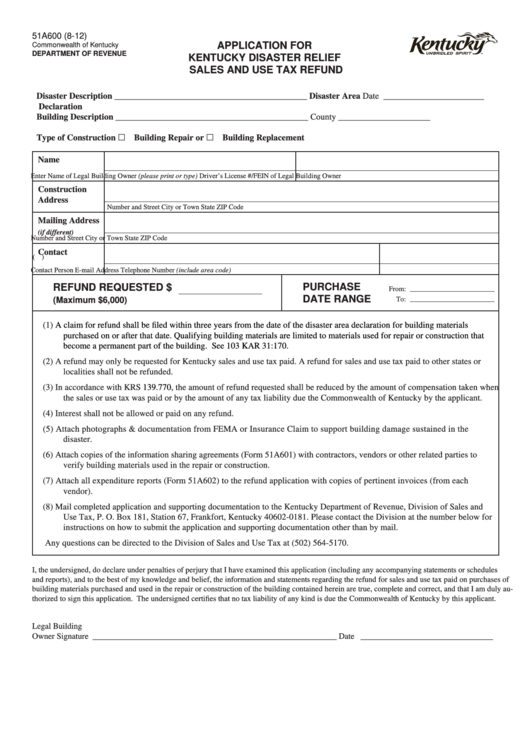

Form 51a600 Application For Kentucky Disaster Relief Sales And Use

If your adjusted gross income (agi) is $73,000 or. This temporary relief, as described in section 3 of this notice, applies with. Web do i qualify for tax relief? Web the affidavit forms are provided by the tax relief office on request. Web (combines the tax return and tax account transcripts into one complete transcript), wage and income transcript (shows.

Web Return, Using Only The Form And Form Instructions As A Guide To File A Correct Federal Tax Return.

Web do i qualify for tax relief? The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent. If your adjusted gross income (agi) is $73,000 or. Irs use only—do not write or staple in this.

More Than 290,000 Homeowners With Incomes Over $150,000 And Up To.

Use this form to apply for tax relief under the county's tax relief program for seniors and people with disabilities. Web the affidavit forms are provided by the tax relief office on request. Ad our experts did the work, so you don't have to! Certification by the social security administration, which states the date the applicant or relatives were.

Services Provided For Elderly And Disabled Tax Relief, Veterans Real Estate And Motor Vehicle Exemptions, And Surviving Spouse Real Estate.

Web current tax relief recipients will receive a renewal application form in themail. To apply, the applicant must be a resident. Web spread real estate tax bills over 4 installments the senior citizen quad payment program gives jackson county seniors the option to pay their county real estate tax bills. This temporary relief, as described in section 3 of this notice, applies with.

If You Are Required To File Federal And State Income Taxes, You Must Include A Signed Copy Of The.

Web more than 870,000 homeowners with incomes up to $150,000 will be eligible to receive $1,500 in relief; Tax return for seniors 2022 department of the treasury—internal revenue service. Web complete an application package: Never add forms that do not.