Tax Waiver Form Nj

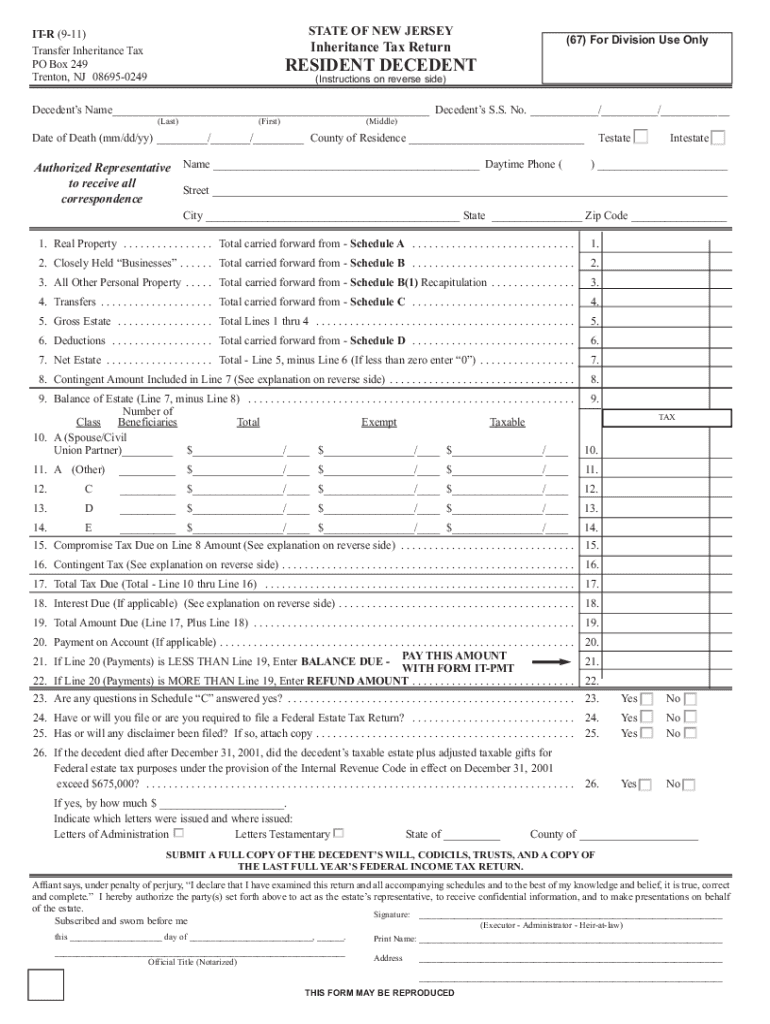

Tax Waiver Form Nj - Estimated income tax payment voucher for 4th quarter 2022. Underpayment of estimated tax by individuals and instructions. You may submit the form below in lieu of a written statement and declaration. The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable. Resident income tax return payment voucher. New jersey real property (such as real estate); Web a signed declaration that it is made under penalties of perjury. Brokerage accounts doing business in new jersey; Estimated income tax payment instructions. Landfill closure and contingency tax.

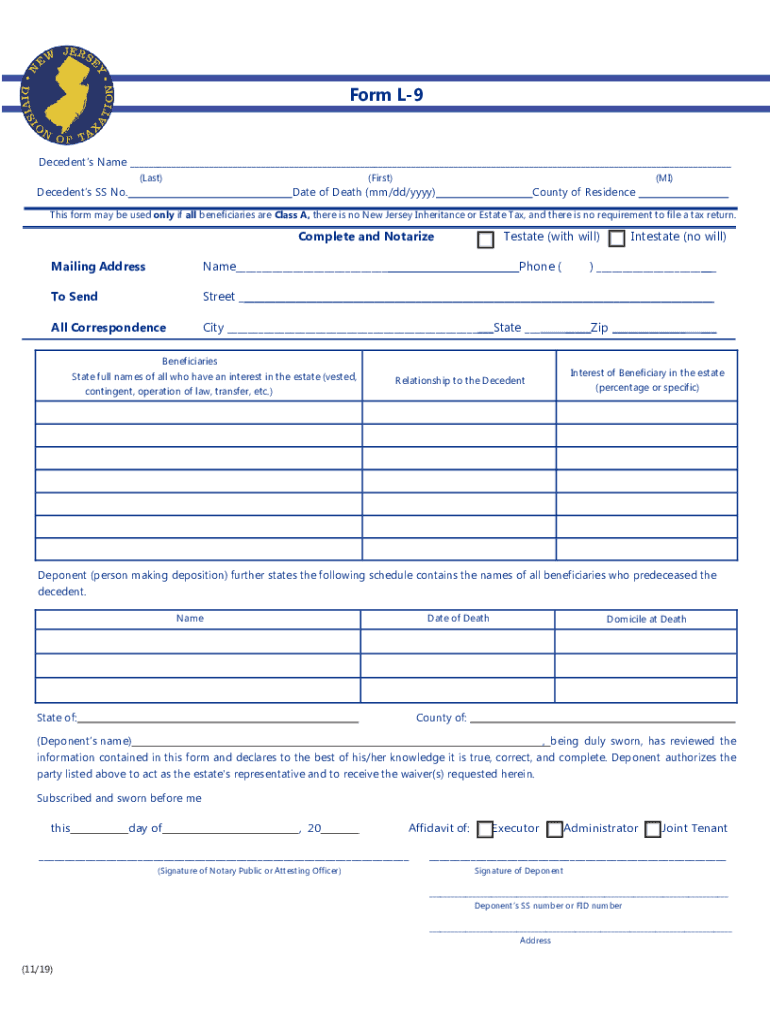

Estimated income tax payment instructions. Resident income tax return payment voucher. Estimated income tax payment voucher for 4th quarter 2022. Web a signed declaration that it is made under penalties of perjury. The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable. Resident decedent affidavit requesting real property tax waiver. Do not file with the county clerk. Web this form is not a tax waiver. Web if you determine that all of the beneficiaries and the estate are exempt from tax, you may use the following form to obtain a real estate waiver: Corporate business tax banking and financial institutions.

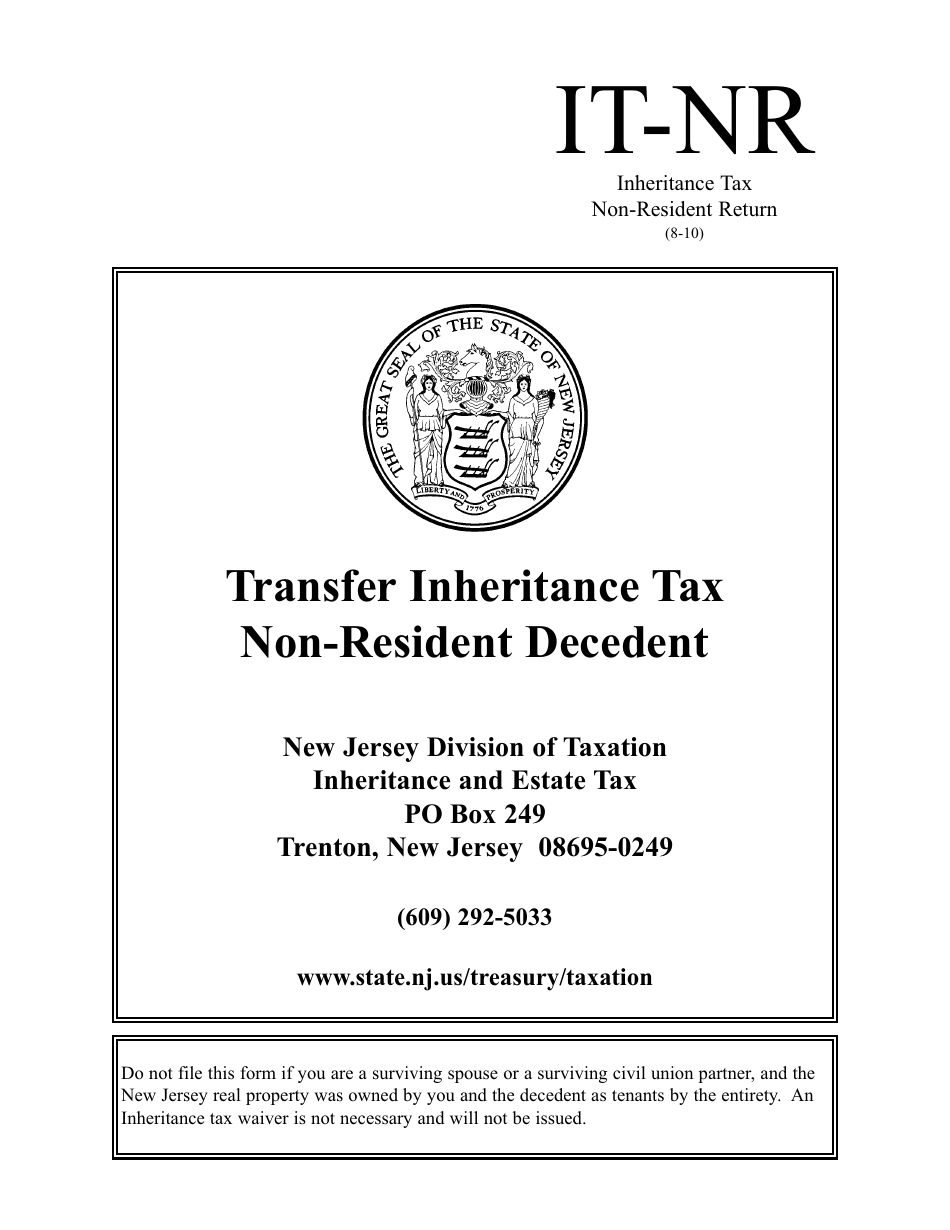

Web estimated income tax payment voucher for 2023. Do not file with the county clerk. Resident income tax return payment voucher. Web a signed declaration that it is made under penalties of perjury. New jersey property (such as real estate located in nj, nj bank and brokerage accounts, stocks of companies incorporated in nj, and nj bonds, etc.) cannot be transferred or. Estimated income tax payment voucher for 4th quarter 2022. You may submit the form below in lieu of a written statement and declaration. Funds held in new jersey financial institutions; This form can be used only when all beneficiaries of the entire estate, no matter where the assets of the estate are located, are class a beneficiaries or charities (n.j.s.a. Resident decedent affidavit requesting real property tax waiver.

Nj Inheritance Tax Waiver cloudshareinfo

Estimated income tax payment instructions. Resident income tax return payment voucher. Web estimated income tax payment voucher for 2023. Corporate business tax banking and financial institutions. Landfill closure and contingency tax.

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

Web this form is not a tax waiver. Web estimated income tax payment voucher for 2023. Landfill closure and contingency tax. Web a signed declaration that it is made under penalties of perjury. This form can be used only when all beneficiaries of the entire estate, no matter where the assets of the estate are located, are class a beneficiaries.

Nj Inheritance Tax Waiver cloudshareinfo

New jersey real property (such as real estate); Web this form is not a tax waiver. The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable. You may submit the form below in lieu of a written statement and declaration. Web alcoholic beverage tax.

L 9 Form Fill Out and Sign Printable PDF Template signNow

Corporate business tax banking and financial institutions. Web tax waivers are required for transfers to domestic partners. Web alcoholic beverage tax. New jersey property (such as real estate located in nj, nj bank and brokerage accounts, stocks of companies incorporated in nj, and nj bonds, etc.) cannot be transferred or. Funds held in new jersey financial institutions;

Form ITNR Download Fillable PDF or Fill Online Transfer Inheritance

New jersey real property (such as real estate); The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable. This form can be used only when all beneficiaries of the entire estate, no matter where the assets of the estate are located, are class a beneficiaries.

Inheritance Tax Waiver Form Nj Form Resume Examples N48mGvQKyz

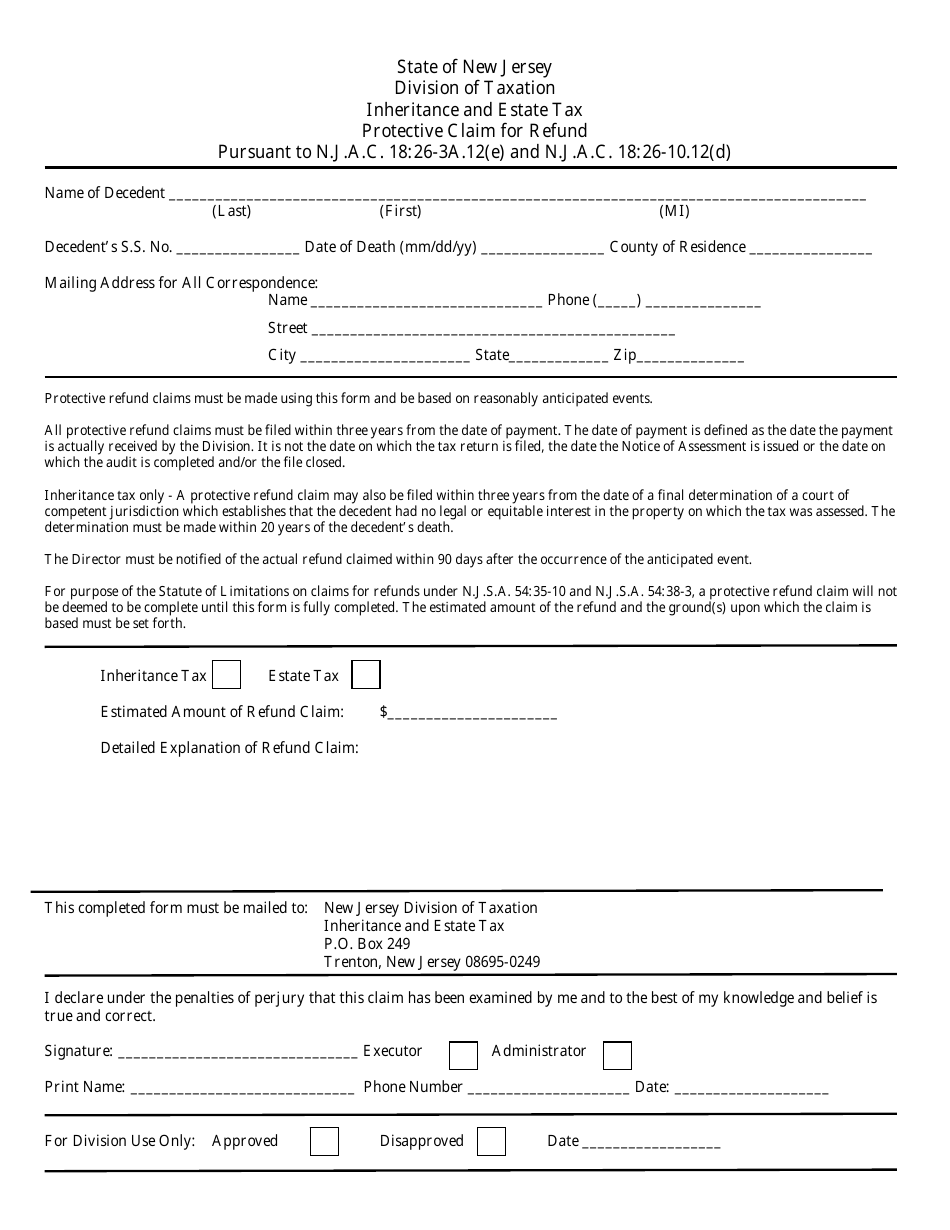

Web alcoholic beverage tax. The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable. Web if you determine that all of the beneficiaries and the estate are exempt from tax, you may use the following form to obtain a real estate waiver: Landfill closure and.

New Jersey Inheritance and Estate Tax Protective Claim for Refund

You may submit the form below in lieu of a written statement and declaration. Do not file with the county clerk. Resident decedent affidavit requesting real property tax waiver. Resident income tax return payment voucher. Estimated income tax payment voucher for 4th quarter 2022.

Inheritance Tax Waiver Form Missouri Form Resume Examples P32EdpZVJ8

This form can be used only when all beneficiaries of the entire estate, no matter where the assets of the estate are located, are class a beneficiaries or charities (n.j.s.a. Web if you determine that all of the beneficiaries and the estate are exempt from tax, you may use the following form to obtain a real estate waiver: Resident income.

Inheritance Tax Illinois ellieldesign

Corporate business tax banking and financial institutions. Resident decedent affidavit requesting real property tax waiver. Landfill closure and contingency tax. Brokerage accounts doing business in new jersey; Web a signed declaration that it is made under penalties of perjury.

Inheritance Tax Waiver Form New York State Form Resume Examples

Estimated income tax payment voucher for 4th quarter 2022. The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable. New jersey property (such as real estate located in nj, nj bank and brokerage accounts, stocks of companies incorporated in nj, and nj bonds, etc.) cannot.

Web Executor’s Guide To Inheritance And Estate Taxes Forms Pay Tax Tax Waiver Requirement Inheritance Tax New Jersey Has Had An Inheritance Tax Since 1892, When A Tax Was Imposed On Property Transferred From A Deceased Person To A Beneficiary.

Funds held in new jersey financial institutions; Web tax waivers are required for transfers to domestic partners. Web estimated income tax payment voucher for 2023. New jersey property (such as real estate located in nj, nj bank and brokerage accounts, stocks of companies incorporated in nj, and nj bonds, etc.) cannot be transferred or.

New Jersey Real Property (Such As Real Estate);

Estimated income tax payment instructions. Landfill closure and contingency tax. Brokerage accounts doing business in new jersey; The statement must be signed by the taxpayer, taxpayer representative, or other person against whom the penalty or penalties have been assessed or are assessable.

Underpayment Of Estimated Tax By Individuals And Instructions.

Do not file with the county clerk. Estimated income tax payment voucher for 4th quarter 2022. Resident decedent affidavit requesting real property tax waiver. You may submit the form below in lieu of a written statement and declaration.

Web A Signed Declaration That It Is Made Under Penalties Of Perjury.

Resident income tax return payment voucher. This form can be used only when all beneficiaries of the entire estate, no matter where the assets of the estate are located, are class a beneficiaries or charities (n.j.s.a. Web if you determine that all of the beneficiaries and the estate are exempt from tax, you may use the following form to obtain a real estate waiver: Web this form is not a tax waiver.