Tennessee Business Tax Form

Tennessee Business Tax Form - Brief business tax overview the business tax statutes are found in tenn. Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. • applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee The state business tax and the city business tax. Filing a business tax return. Watch this video to learn how to file your business tax return while you are logged into your tntap account. Business tax consists of two separate taxes: You may also follow these steps.

Web overview generally, if you conduct business within any county and/or incorporated municipality in tennessee, and your business grosses $100,000 or more, then you should register for and remit business tax. Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Once this tax is paid each year, the county clerk or city official will provide a license for the next year. The state business tax and the city business tax. Watch this video to learn how to file your business tax return while you are logged into your tntap account. Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. • applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. You may also follow these steps.

• applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Watch this video to learn how to file your business tax return while you are logged into your tntap account. Filing a business tax return. Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee Business tax consists of two separate taxes: The state business tax and the city business tax. Please visit the file and pay section of our website for more information on this process. 2 and the business tax rules and regulations are found in t enn. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer.

Sole Proprietorship Business License Tennessee Santos Czerwinski's

Watch this video to learn how to file your business tax return while you are logged into your tntap account. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. • applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local.

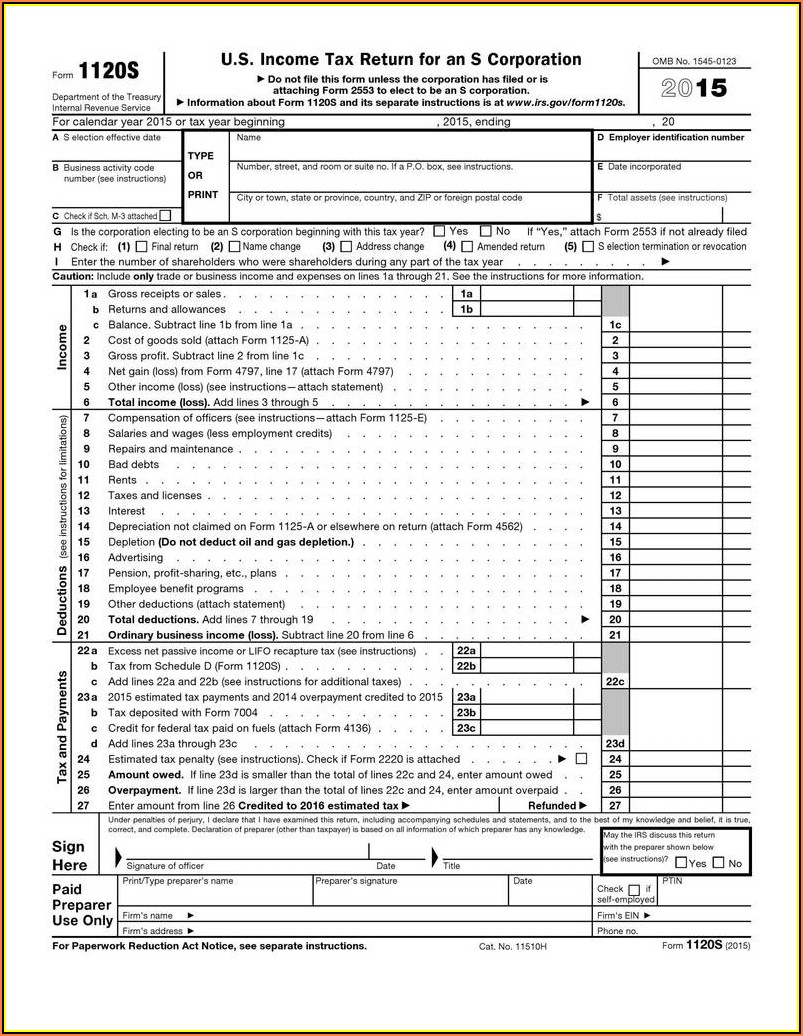

Irs Tax Form 1040ez 2020 Form Resume Examples qeYzgN5V8X

Watch this video to learn how to file your business tax return while you are logged into your tntap account. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. Business tax minimal activity licenses.

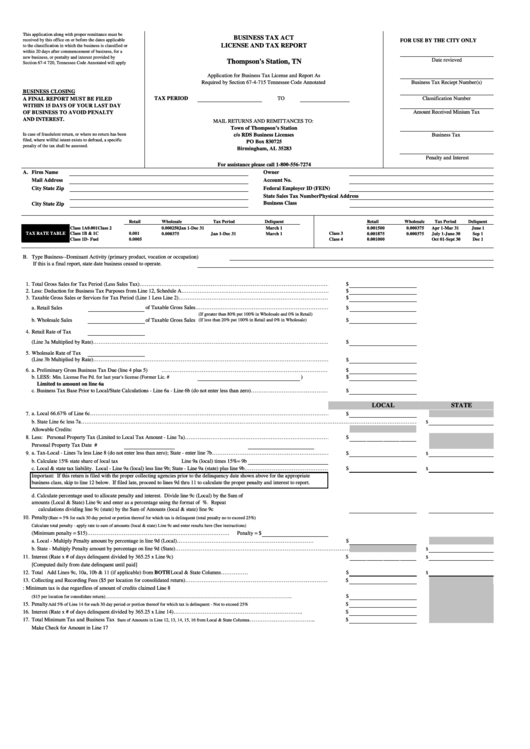

Business Tax Act / License And Tax Report Form Thompson'S Station, Tn

Web the business tax is a tax on the privilege of doing business by making sales of tangible personal property and services* within tennessee and its local jurisdictions. Watch this video to learn how to file your business tax return while you are logged into your tntap account. Paper returns will not be accepted unless filing electronically creates a hardship.

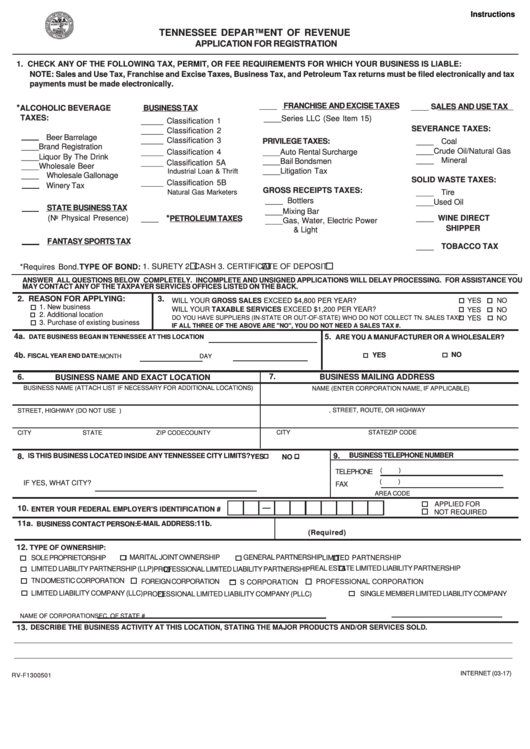

411 Tennessee Department Of Revenue Forms And Templates free to

Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. 2 and the business tax rules and regulations are found in t enn. The state business tax and the city business tax. Web the business tax is a tax on the privilege of doing business by making sales of tangible.

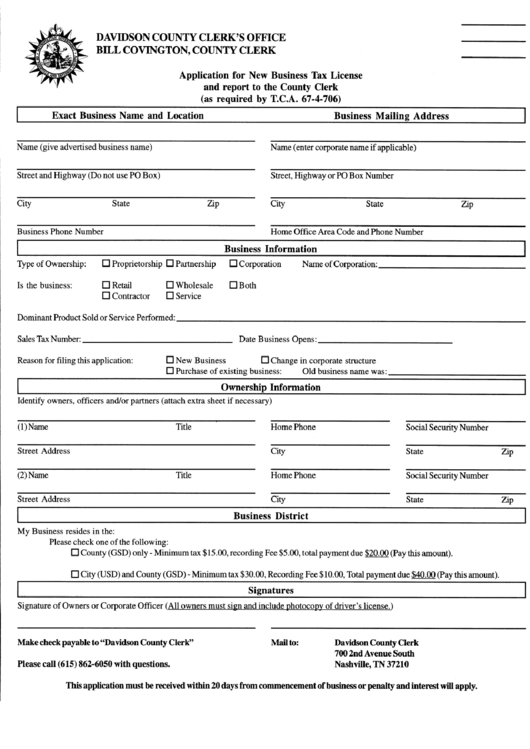

Application For New Business Tax License And Report To The County Clerk

You may also follow these steps. Filing a business tax return. Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Web overview generally, if you conduct business within any county and/or incorporated municipality in.

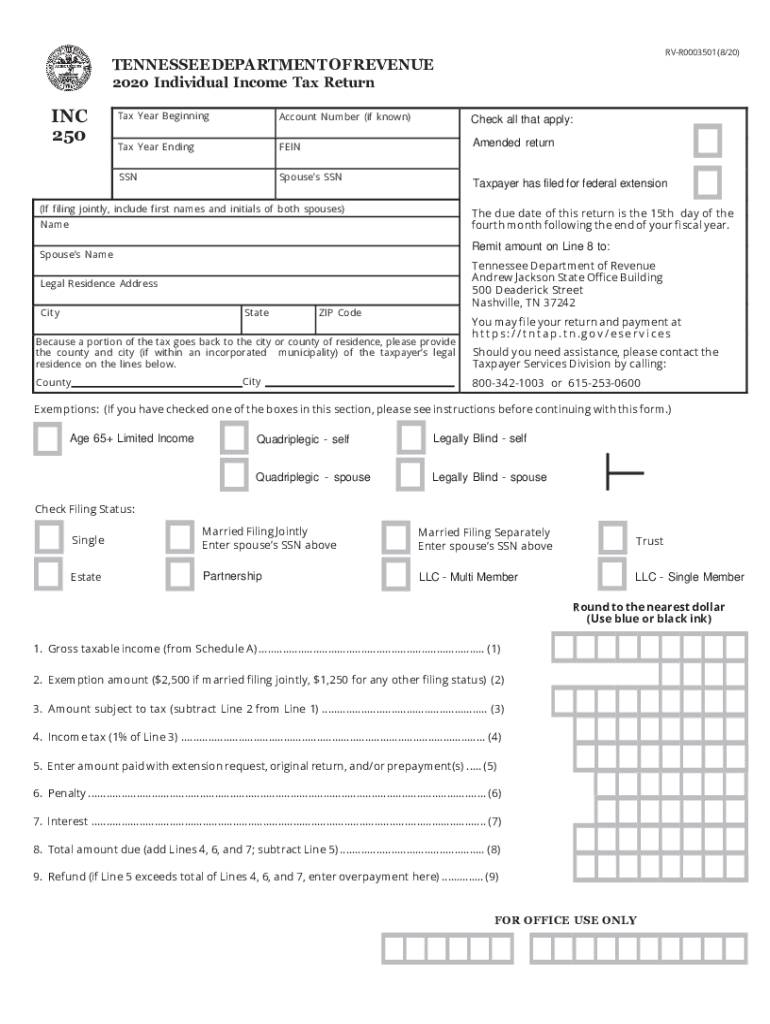

2020 Form TN DoR INC 250 Fill Online, Printable, Fillable, Blank

Web the business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may.

20202022 Form TN DoR SLS 450 Fill Online, Printable, Fillable, Blank

Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Web overview generally, if you conduct business within any county and/or incorporated municipality in tennessee, and your business grosses $100,000 or more, then you should register for and remit business tax. • applies to a taxpayer’s gross receipts •.

Tennessee Sales Tax Permit Application

Brief business tax overview the business tax statutes are found in tenn. • applies to a taxpayer’s gross receipts • derived from taxable sales per location by the appropriate state and local tax rates to calculate the amount of tax owed per. Web the business tax is a tax on the privilege of doing business by making sales of tangible.

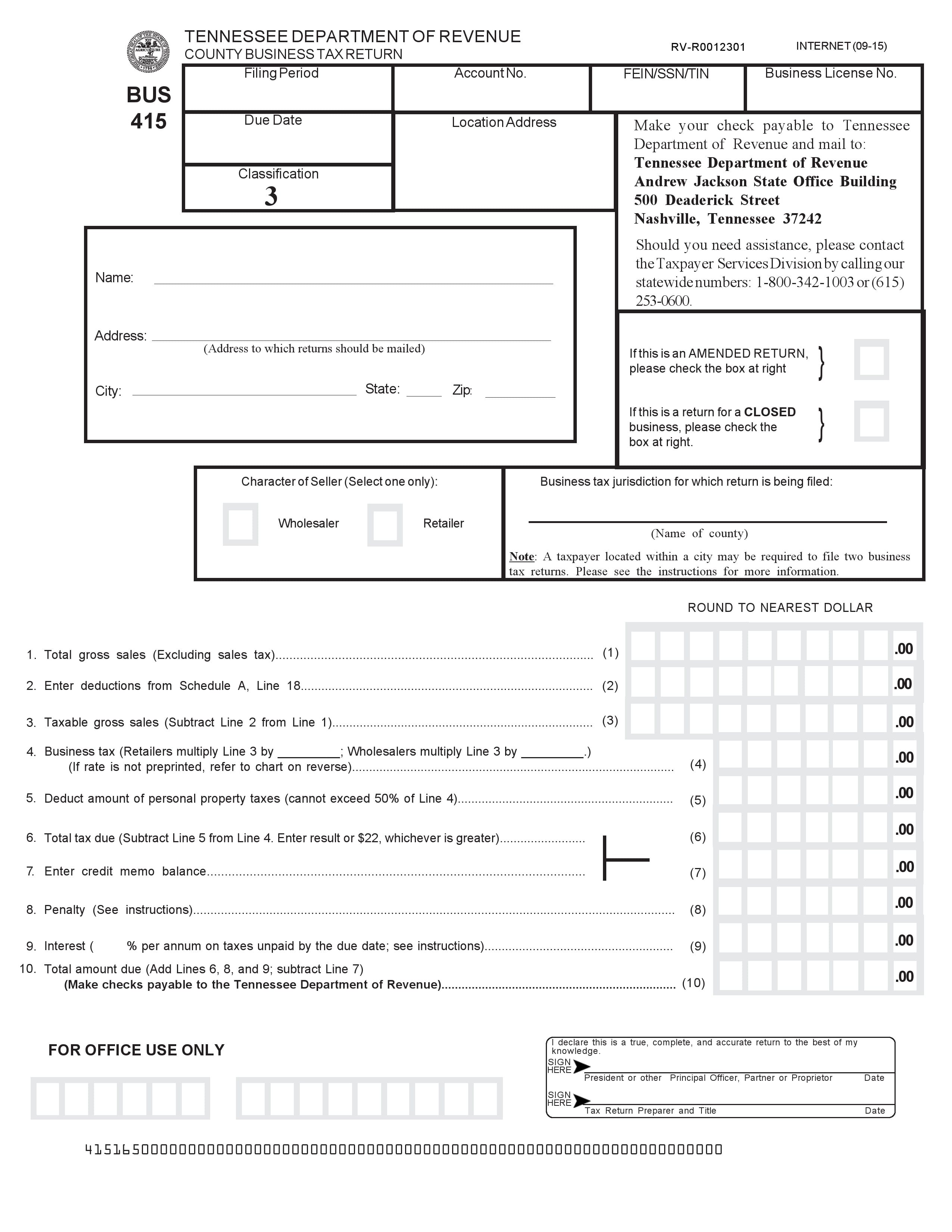

Free Tennessee Department of Revenue County Business Tax Return RV

Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each Once this tax is paid each year, the county clerk or city official will provide a license for the next year. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of.

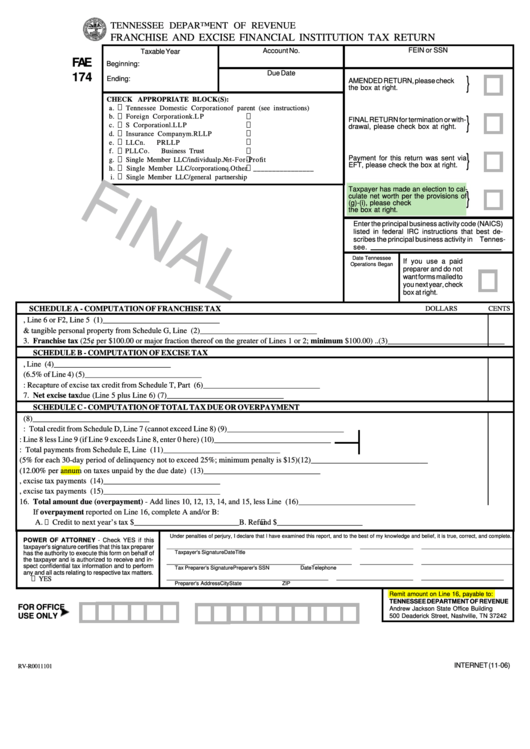

Form Fae 174 Franchise And Excise Financial Institution Tax Return

Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Web the business tax is a tax on the privilege of doing business by making sales of tangible personal property and services* within tennessee and its local jurisdictions. Web a standard business license is renewed by the annual payment of business tax to the tennessee.

• Applies To A Taxpayer’s Gross Receipts • Derived From Taxable Sales Per Location By The Appropriate State And Local Tax Rates To Calculate The Amount Of Tax Owed Per.

Watch this video to learn how to file your business tax return while you are logged into your tntap account. Web the business tax is a tax on the privilege of doing business by making sales of tangible personal property and services* within tennessee and its local jurisdictions. Web business forms & fees county register of deeds fraudulent lien filings uncontested lien affidavit (pdf, 733.0kb) notarized affidavit register of deeds (pdf, 721.1kb) certification form (pdf, 660.1kb) certification form no listing of secured party (pdf, 672.3kb) * additional fees may apply + additional form fee Please visit the file and pay section of our website for more information on this process.

Filing A Business Tax Return.

Brief business tax overview the business tax statutes are found in tenn. Business tax consists of two separate taxes: 2 and the business tax rules and regulations are found in t enn. Business tax minimal activity licenses are renewed each year by payment of an annual $15 lic ense fee to each

You May Also Follow These Steps.

Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. Web a standard business license is renewed by the annual payment of business tax to the tennessee department of revenue. The state business tax and the city business tax. Web overview generally, if you conduct business within any county and/or incorporated municipality in tennessee, and your business grosses $100,000 or more, then you should register for and remit business tax.

Web The Business Tax Rates Vary, Depending On Your Classification And Whether You Are A Retailer Or A Wholesaler.

Web sixteen different business tax rules and regulations, including three rules repealed in their entirety. Once this tax is paid each year, the county clerk or city official will provide a license for the next year.