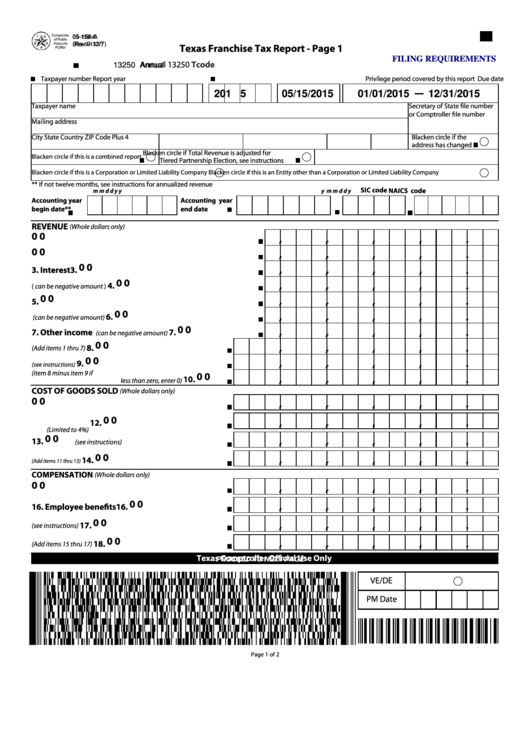

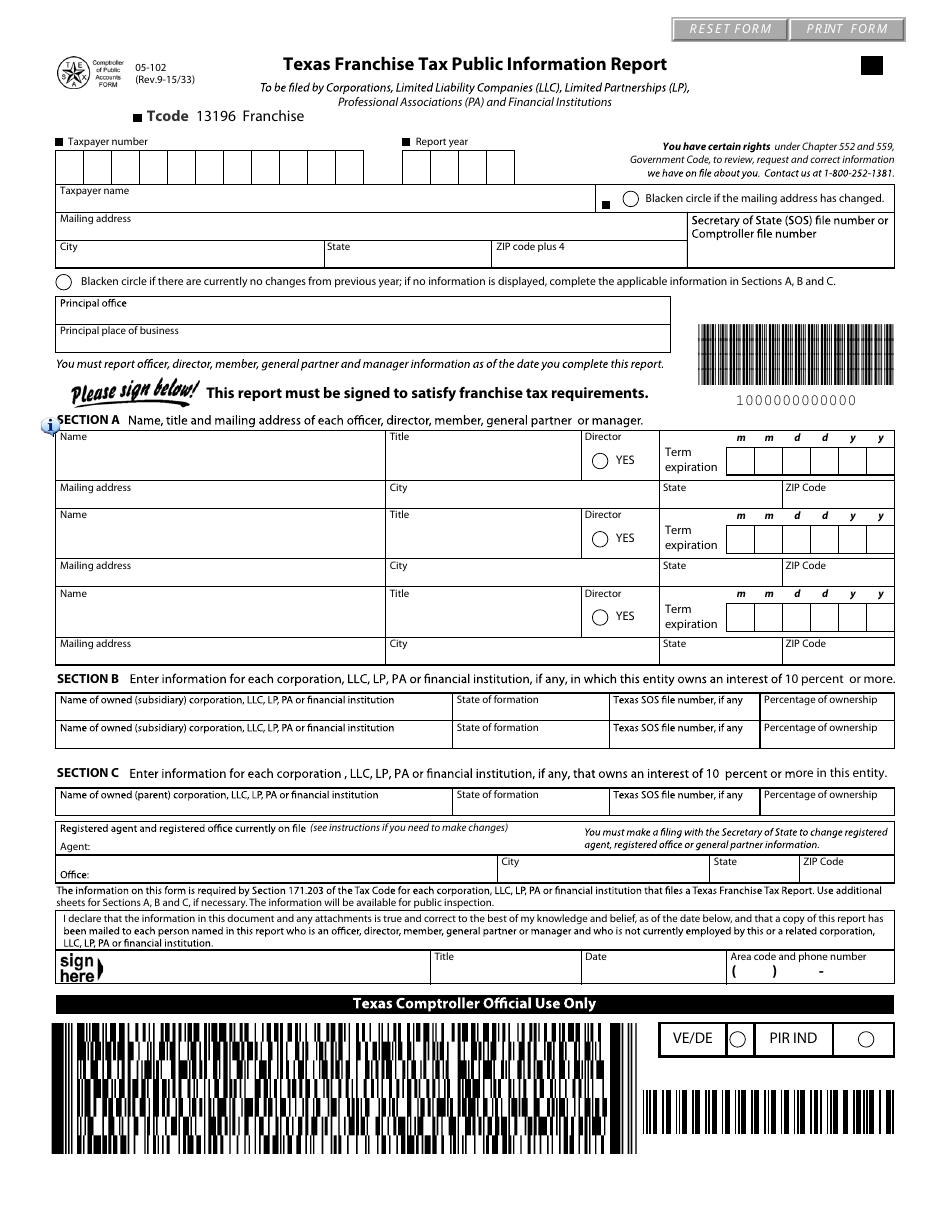

Texas Form 05-158 Instructions 2022

Texas Form 05-158 Instructions 2022 - Tax due before discount (item 31 minus item 32) 33. 2019 report year forms and instructions; 2016 report year forms and. Web while nearly all entities in texas need to file a franchise tax report, this page is strictly about an llc in texas. Get your online template and fill it in using progressive features. Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. Web m m d d y y sic code naics code revenue (whole dollars only) cost of goods sold (whole dollars only) compensation (whole dollars only) ve/de pm date page. Enjoy smart fillable fields and interactivity. 2021 report year forms and instructions;

Experience all the key benefits of. 2022 taxes are filed in 2023, so texas labels the forms for 2022. Web texas franchise tax reports for 2022 and prior years. Web 0.75% of your total revenue. Web while nearly all entities in texas need to file a franchise tax report, this page is strictly about an llc in texas. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. Texas labels their forms based on the year you file, instead of the year you are filing for. Web m m d d y y sic code naics code revenue (whole dollars only) cost of goods sold (whole dollars only) compensation (whole dollars only) ve/de pm date page. Tax due before discount (item 31 minus item 32) 33. 2016 report year forms and.

Web m m d d y y sic code naics code revenue (whole dollars only) cost of goods sold (whole dollars only) compensation (whole dollars only) ve/de pm date page. 2020 report year forms and instructions; 2022 taxes are filed in 2023, so texas labels the forms for 2022. Enjoy smart fillable fields and interactivity. Enter interest for the period upon which the tax is based. Get your online template and fill it in using progressive features. 2017 report year forms and instructions; 90% of texas llcs don’t owe any franchise tax since most llcs have annualized total revenue less than $1,230,000. Tax adjustments (dollars and cents) 32. Web texas franchise tax reports for 2022 and prior years.

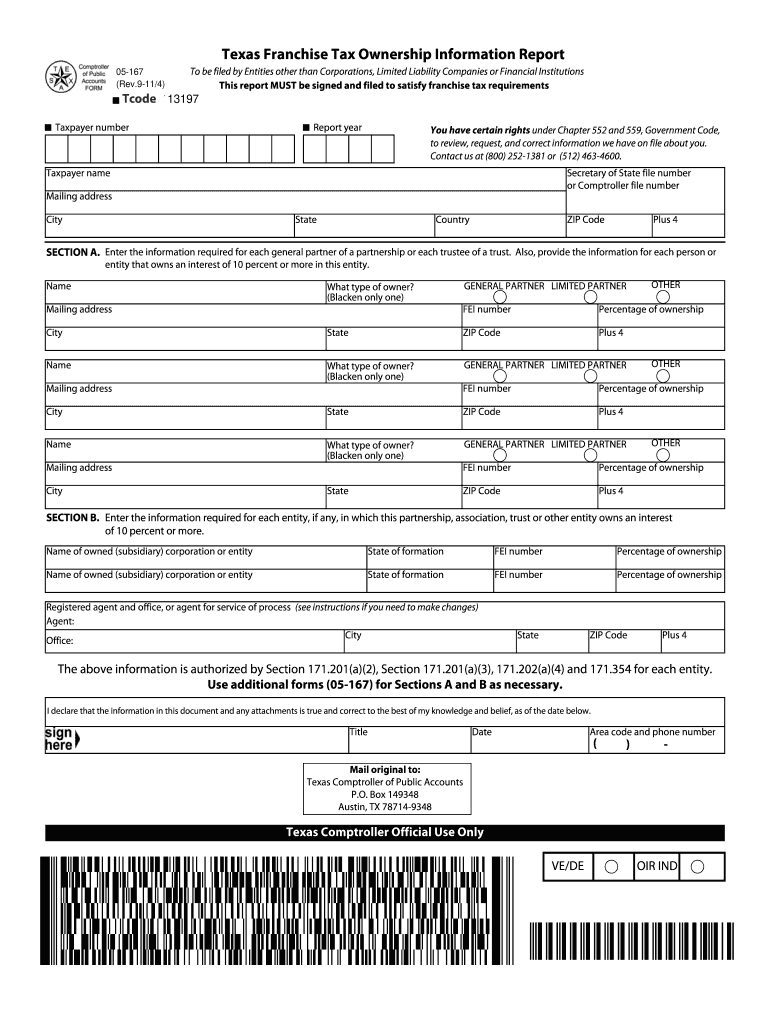

Texas form 05 167 2011 Fill out & sign online DocHub

Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31. 2018 report year forms and instructions; Web 0.75% of your total revenue. Web how to fill out and sign texas 05 158 instructions 2022 online? Tax due before discount (item 31 minus item 32) 33.

Form 05 167 Fill Out and Sign Printable PDF Template signNow

Experience all the key benefits of. Texas labels their forms based on the year you file, instead of the year you are filing for. 90% of texas llcs don’t owe any franchise tax since most llcs have annualized total revenue less than $1,230,000. Follow the simple instructions below: 2022 report year forms and instructions;

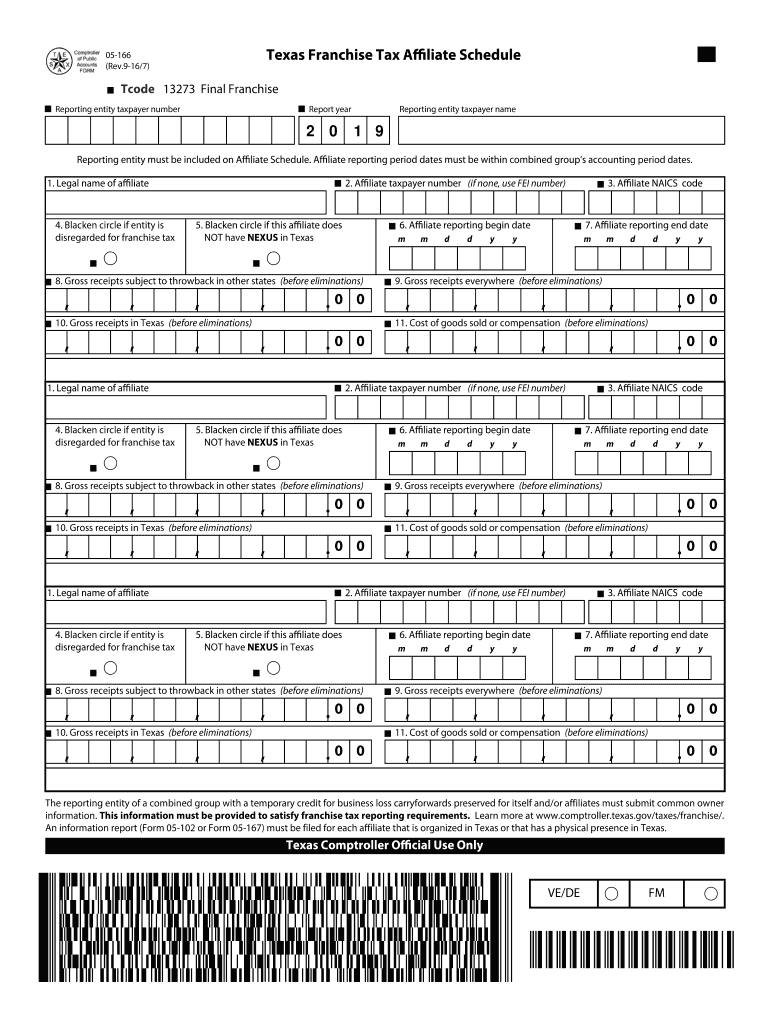

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. Experience all the key benefits of. Web texas franchise tax reports for 2022 and prior years. 2021 report year forms and instructions; 2022 report year forms and instructions;

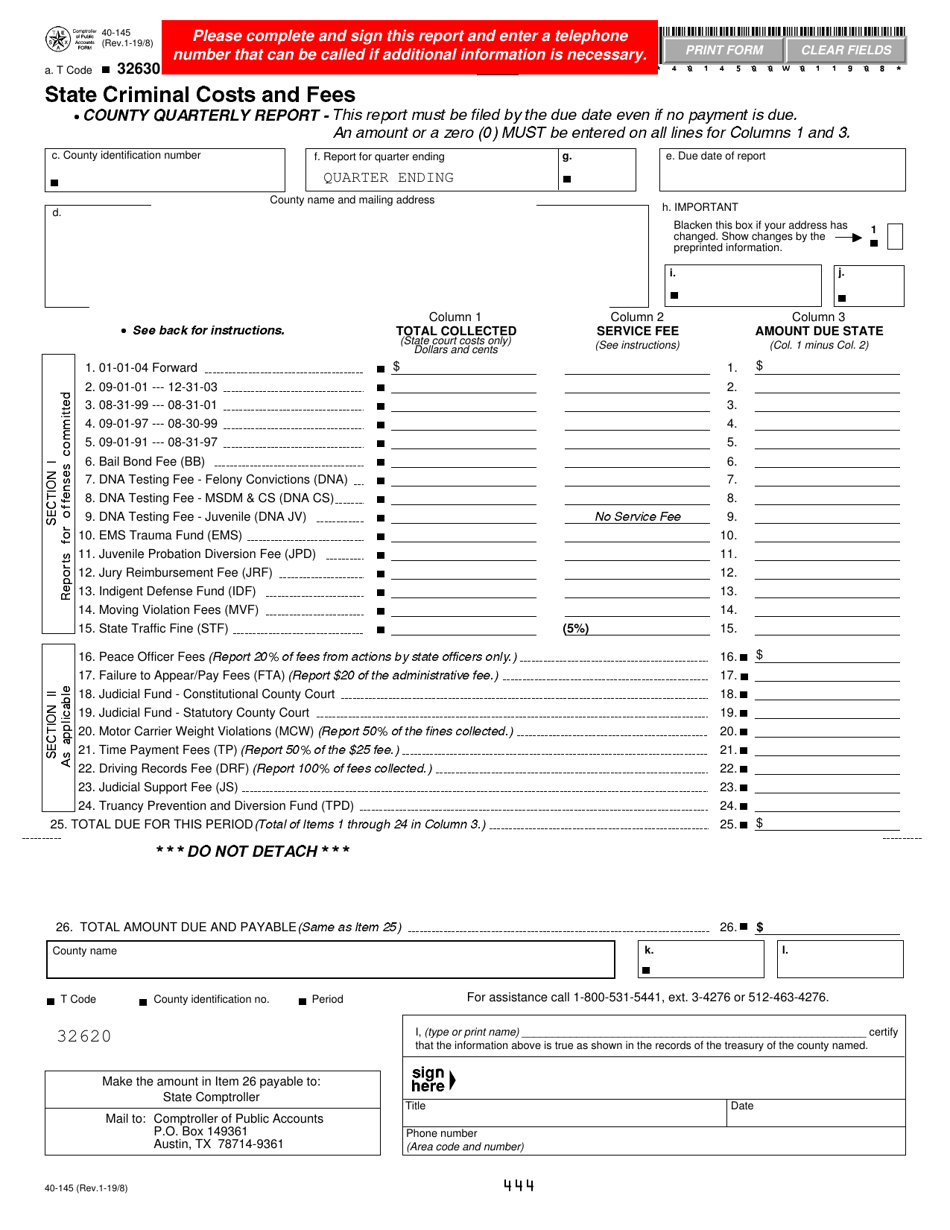

Form 40145 Download Fillable PDF or Fill Online State Criminal Costs

2020 report year forms and instructions; Web how to fill out and sign texas 05 158 instructions 2022 online? 2022 report year forms and instructions; Follow the simple instructions below: Tax rate (see instructions for determining the appropriate tax rate) x xx x 30.

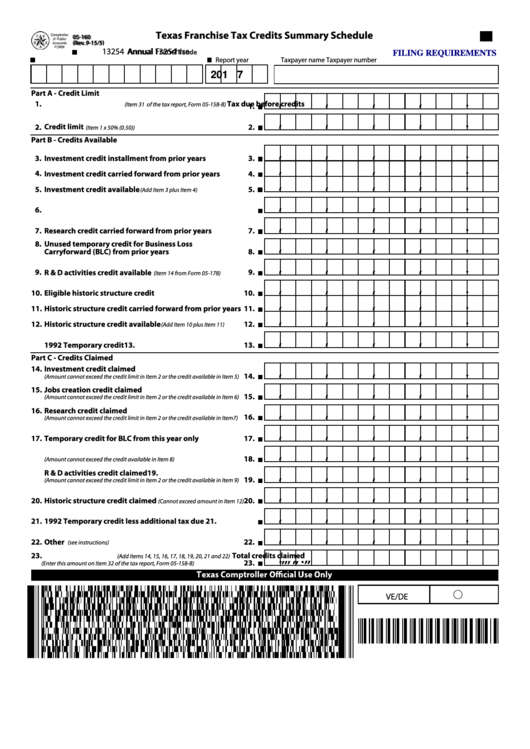

Fillable Form 05160, 2015, Texas Franchise Tax Credits Summary

Enter interest for the period upon which the tax is based. 2016 report year forms and. 2022 report year forms and instructions; 90% of texas llcs don’t owe any franchise tax since most llcs have annualized total revenue less than $1,230,000. Tax due (multiply item 29 by the tax rate in item 30) (dollars and cent s) 31.

Fillable 05158A, 2015, Texas Franchise Tax Report printable pdf download

2022 report year forms and instructions; 2021 report year forms and instructions; Web texas franchise tax reports for 2022 and prior years. (if may 15th falls on a weekend, the due date will be the following business day.) the no tax due information report must be filed online. Follow the simple instructions below:

Form 05 169 texas instruction 2011 Fill out & sign online DocHub

Web how to fill out and sign texas 05 158 instructions 2022 online? No matter which form you file, your texas franchise tax report is due may 15th each year. 2018 report year forms and instructions; Follow the simple instructions below: 2019 report year forms and instructions;

Form 05102 Download Fillable PDF or Fill Online Texas Franchise Tax

Get your online template and fill it in using progressive features. Web m m d d y y sic code naics code revenue (whole dollars only) cost of goods sold (whole dollars only) compensation (whole dollars only) ve/de pm date page. Enjoy smart fillable fields and interactivity. Web while nearly all entities in texas need to file a franchise tax.

Form 05 158 a Fill out & sign online DocHub

2022 report year forms and instructions; Web m m d d y y sic code naics code revenue (whole dollars only) cost of goods sold (whole dollars only) compensation (whole dollars only) ve/de pm date page. No matter which form you file, your texas franchise tax report is due may 15th each year. Enter interest for the period upon which.

Document 11321137

Web 0.75% of your total revenue. Web m m d d y y sic code naics code revenue (whole dollars only) cost of goods sold (whole dollars only) compensation (whole dollars only) ve/de pm date page. 2022 report year forms and instructions; Tax rate (see instructions for determining the appropriate tax rate) x xx x 30. No matter which form.

2020 Report Year Forms And Instructions;

(if may 15th falls on a weekend, the due date will be the following business day.) the no tax due information report must be filed online. 90% of texas llcs don’t owe any franchise tax since most llcs have annualized total revenue less than $1,230,000. No matter which form you file, your texas franchise tax report is due may 15th each year. 2019 report year forms and instructions;

Experience All The Key Benefits Of.

Follow the simple instructions below: 2022 report year forms and instructions; Web texas franchise tax reports for 2022 and prior years. Tax rate (see instructions for determining the appropriate tax rate) x xx x 30.

Web While Nearly All Entities In Texas Need To File A Franchise Tax Report, This Page Is Strictly About An Llc In Texas.

Enjoy smart fillable fields and interactivity. 2017 report year forms and instructions; 2016 report year forms and. 2018 report year forms and instructions;

Texas Labels Their Forms Based On The Year You File, Instead Of The Year You Are Filing For.

Tax adjustments (dollars and cents) 32. 2022 taxes are filed in 2023, so texas labels the forms for 2022. Web any entity that does not elect to file using the ez computation, or that does not qualify to file a no tax due report, should file the long form report. 2021 report year forms and instructions;