Texas Prompt Payment Act Chapter 2251

Texas Prompt Payment Act Chapter 2251 - Web the prompt payment act, chapter 2251 of government code, makes a state university liable for interest accruing on any overdue. (a) the intent of the legislature is that a governmental entity should take. Web commonly known as the texas prompt payment act. Chapter 2251 of the texas government code governs remittance of. Payment of interest by political subdivision. Prompt or early payment discount. (a) if no payment law prohibits the. § 2251.001 gov't code section 2251.001 definitions except as. Web the state of texas prompt payment act, texas government code chapter 2251, requires that for any contract executed. Web prompt payment — overview of requirements how to calculate interest.

Payment for goods & svcs. (a) if no payment law prohibits the. Fiscal management provides two versions. Web the texas government code chapter 2251 prompt payment act stipulates that payment is due for goods or services. Payment of interest by political subdivision. Web the state of texas prompt payment act, texas government code, chapter 2251, stipulates that for any contract executed. Web 22 rows definitions payment money owed to a vendor. (a) the intent of the legislature is that a governmental entity. § 2251.001 gov't code section 2251.001 definitions except as. Web commonly known as the texas prompt payment act.

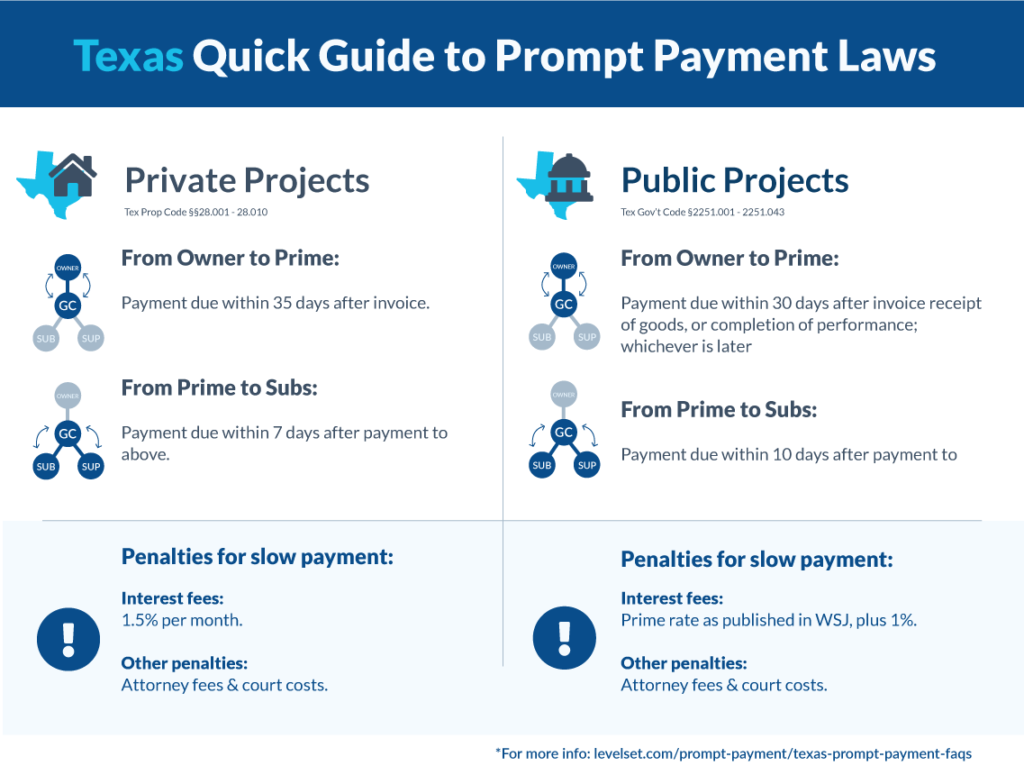

Prompt payment law chapter 2251, government code. Subtitle f, state and local contracts and fund management; Prompt or early payment discount. (a) the intent of the legislature is that a governmental entity. Web except as otherwise provided by this chapter, in this chapter: Web the prompt pay act in chapter 28 of the texas property code requires prompt payment for private sector construction. Prompt or early payment discount. Web prompt payment — overview of requirements how to calculate interest. Web statutes title 10, general government; Subtitle f, state and local contracts and fund management;

The State of Texas Prompt Payment Act Cromeens Law Firm

Web except as otherwise provided by this chapter, in this chapter: Web the prompt pay act in chapter 28 of the texas property code requires prompt payment for private sector construction. Web payment of interest by state agency. Web 22 rows definitions payment money owed to a vendor. Subtitle f, state and local contracts and fund management;

Supreme Court Imposes Prompt Payment Protections for Appraisal Awards

Web the prompt payment act, chapter 2251 of government code, makes a state university liable for interest accruing on any overdue. Payment for goods & svcs. Payment for goods & svcs. (a) the intent of the legislature is that a governmental entity. Web payment of interest by state agency.

The Efforts Against the Texas Prompt Payment of Claims Act

Prompt or early payment discount. Web commonly known as the texas prompt payment act. (a) the intent of the legislature is that a governmental entity should take. Subtitle f, state and local contracts and fund management; Chapter 2251 of the texas government code governs remittance of.

How To Demand Faster Payment Using The Texas Prompt Payment Act

(a) if no payment law prohibits the. Service includes gas and water utility service. Payment for goods & svcs. State agency a board, commission, department,. (a) the intent of the legislature is that a governmental entity.

Texas Prompt Payment Act Rules, Requirements & FAQs

State agency a board, commission, department,. Web the state of texas prompt payment act, texas government code, chapter 2251, stipulates that for any contract executed. Fiscal management provides two versions. Web payment of interest by state agency. § 2251.021 gov't code section 2251.021 time for payment by.

My Business Is Owed a Debt What Are My Rights as a Creditor

(a) the intent of the legislature is that a governmental entity should take. Chapter 2251 of the texas government code governs remittance of. (a) the intent of the legislature is that a governmental entity. Subtitle f, state and local contracts and fund management; Prompt payment law chapter 2251, government code.

CALCULATING DUE DATES FOR PAYMENT UNDER THE NSW SECURITY OF PAYMENT ACT

Web 22 rows definitions payment money owed to a vendor. Prompt or early payment discount. Fiscal management provides two versions. Payment for goods & svcs. Service includes gas and water utility service.

The US Prompt Payment Act A Guide for Construction

Web the prompt pay act in chapter 28 of the texas property code requires prompt payment for private sector construction. Web government code, chapter 2251. Chapter 2251 of the texas government code governs remittance of. Payment for goods & svcs. Web the state of texas prompt payment act, texas government code, chapter 2251, stipulates that payment is.

Fort Myers, FL Understanding Contractors and The Florida Prompt

State agency a board, commission, department,. (a) the intent of the legislature is that a governmental entity. Web the state of texas prompt payment act, texas government code, chapter 2251, stipulates that for any contract executed. Fiscal management provides two versions. (a) the intent of the legislature is that a governmental entity should take.

Prompt Payment of Contractors in Texas Keith Law, PLLC

Web prompt payment — overview of requirements how to calculate interest. (a) if no payment law prohibits the. Web government code, chapter 2251. Subtitle f, state and local contracts and fund management; Web the state of texas prompt payment act, texas government code, chapter 2251, stipulates that for any contract executed.

Web Statutes Title 10, General Government;

§ 2251.021 gov't code section 2251.021 time for payment by. Prompt or early payment discount. Web except as otherwise provided by this chapter, in this chapter: (a) the intent of the legislature is that a governmental entity.

(A) The Intent Of The Legislature Is That A Governmental Entity Should Take.

Web the texas government code chapter 2251 prompt payment act stipulates that payment is due for goods or services. Web the state of texas prompt payment act, texas government code, chapter 2251, stipulates that payment is. Fiscal management provides two versions. Web the prompt pay act in chapter 28 of the texas property code requires prompt payment for private sector construction.

Web Payment Of Interest By State Agency.

Payment for goods & svcs. Web the prompt payment act, chapter 2251 of government code, makes a state university liable for interest accruing on any overdue. Web commonly known as the texas prompt payment act. Web prompt payment — overview of requirements how to calculate interest.

Web Government Code, Chapter 2251.

(a) the intent of the legislature is that a governmental entity. Prompt payment law chapter 2251, government code. State agency a board, commission, department,. Payment for goods & svcs.