Texas Property Tax Deferral Form

Texas Property Tax Deferral Form - Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. Web the law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when. Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax. The taxpayer should be able to complete the form. Web for many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. The texas tax code, section. Web obtain the tax deferral affidavit from the appraisal district; Web to obtain a deferral, an individual must file with the chief appraiser for the appraisal district in which the property is located an affidavit stating the facts required to. Web residence homestead exemption application (includes age 65 or older, age 55 or older surviving spouse, and disabled person exemption) transfer request for tax ceiling of.

Web the law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when. Web obtain the tax deferral affidavit from the appraisal district; Web this is a potential problem for senior citizens with limited income, and many may require help paying their property tax. Web to obtain a deferral, an individual must file with the chief appraiser for the appraisal district in which the property is located an affidavit stating the facts required to. A 5% increase would have resulted in a value of $105,000. Web the law allows you to defer paying property taxes on any amount of increase over 5%. Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first year, the new tax ceiling would be $250, or 25 percent of. Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. Web for many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off.

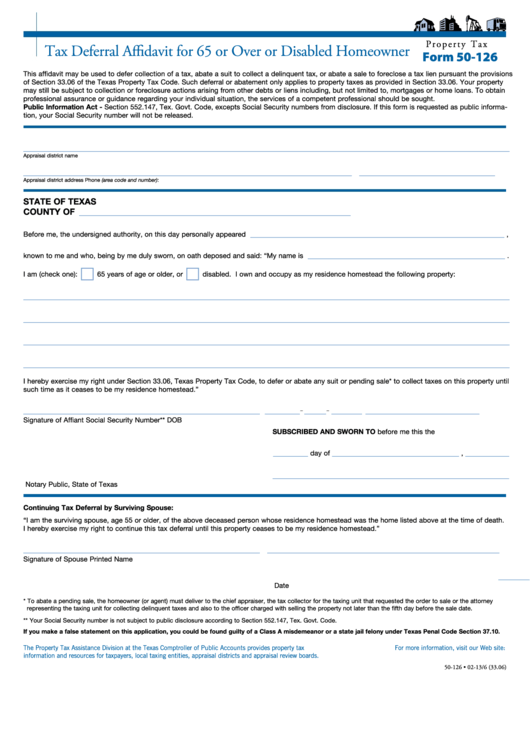

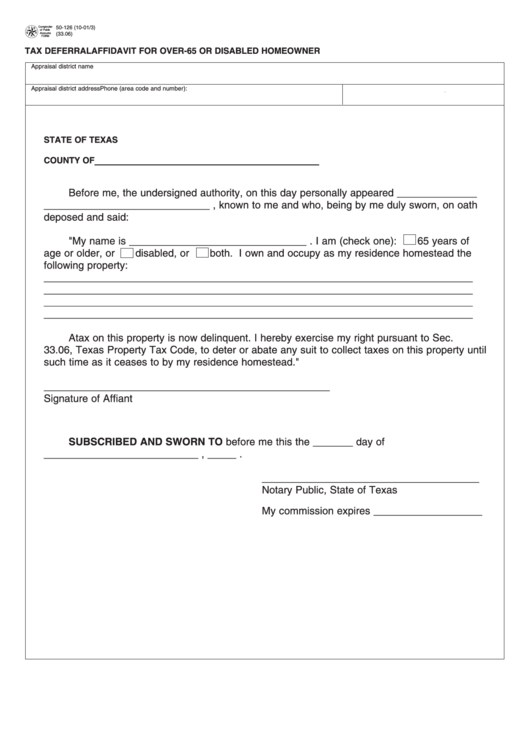

Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. And pay the current taxes on all but the value over. Waiver of delinquent penalty & interest: A 5% increase would have resulted in a value of $105,000. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax. Web to apply for a deferral, you will need to complete one or more of the following forms found in your county tax assessor collector’s office: Web this is a potential problem for senior citizens with limited income, and many may require help paying their property tax. Web obtain the tax deferral affidavit from the appraisal district; Web this affidavit may be used to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a tax lien pursuant the provisions of section 33.06 of the.

What is the Alberta Seniors Property Tax Deferral Program Verhaeghe

This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. The taxpayer should be able to complete the form. Web the law allows you to defer paying property taxes on any amount of increase over 5%. Web (f) notwithstanding the other provisions of this section, if an individual.

DELINQUENT TAXES Alamo Note Buyers

Donotpay is here to help with information and advice on. Web an individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled (as defined by section 11.13 (m) of the texas. Web before using the appraisal increase deferral, homeowners should first contact the tax offices for.

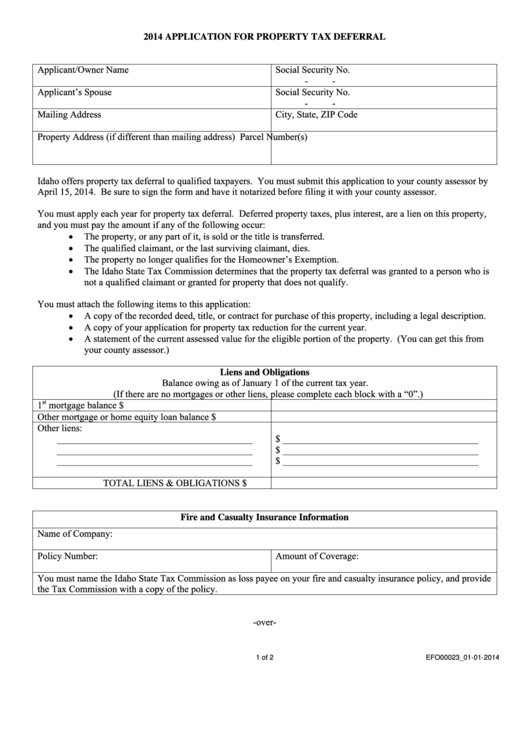

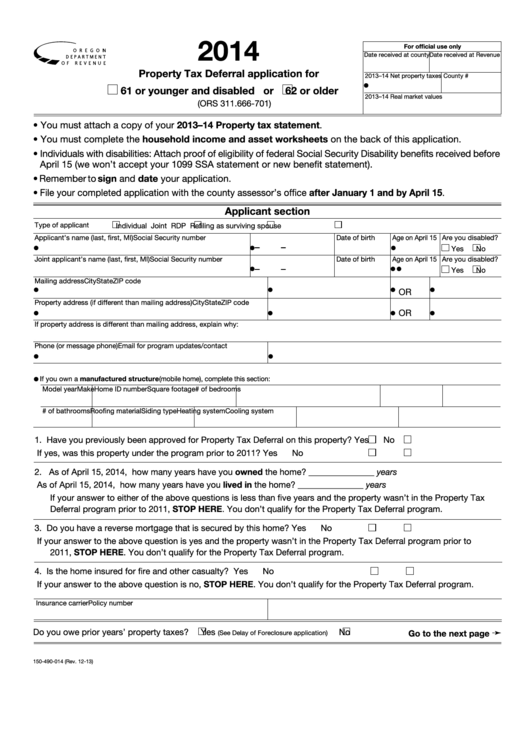

Form Efo00023 Application For Property Tax Deferral 2014 printable

Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. A 5% increase would have resulted in a value of $105,000. Waiver of delinquent penalty & interest: Web the law allows you to defer paying property taxes on any amount of increase over 5%. Donotpay.

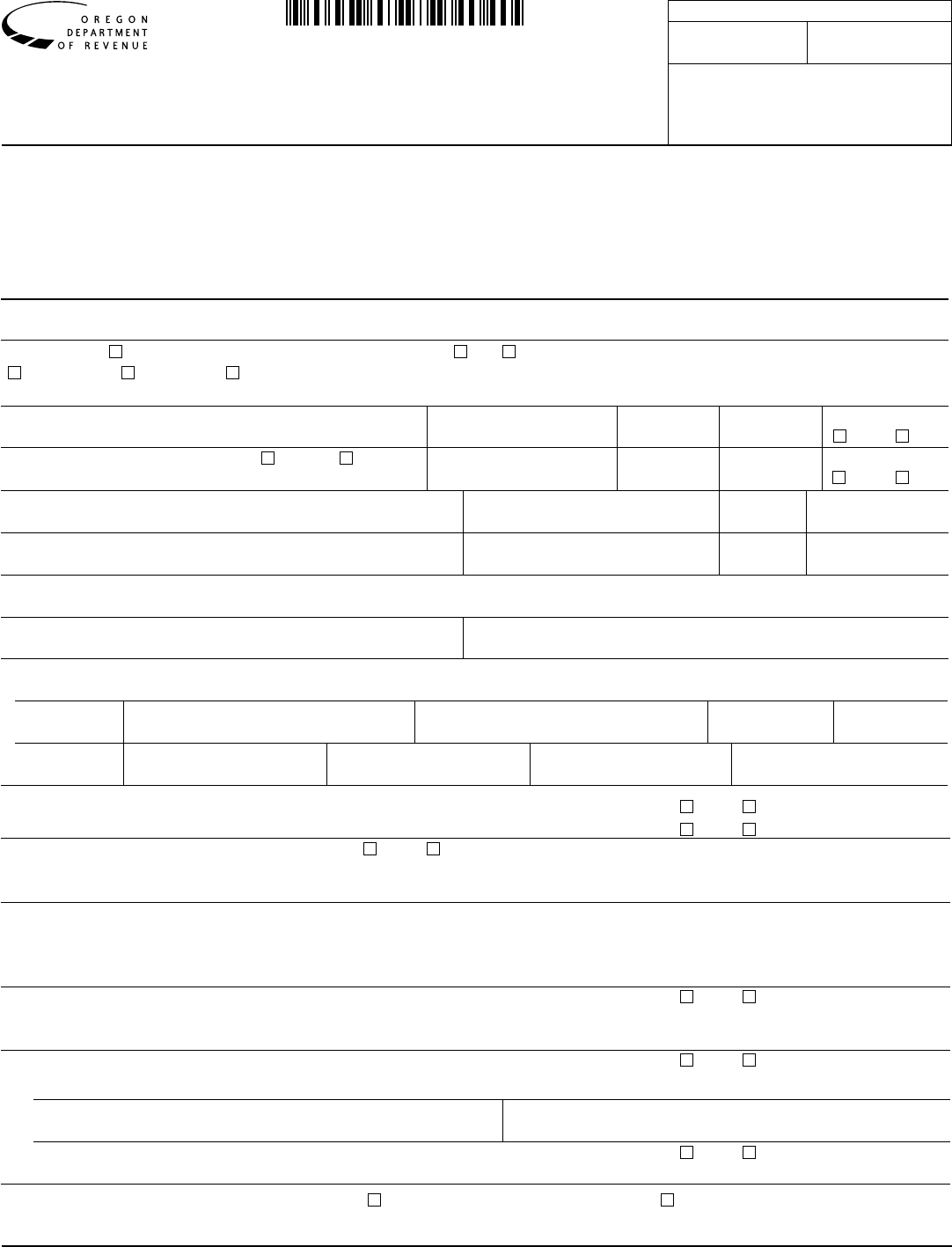

Property Tax Deferral Application Edit, Fill, Sign Online Handypdf

Donotpay is here to help with information and advice on. And pay the current taxes on all but the value over. Web the law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when. A 5% increase would have resulted in a.

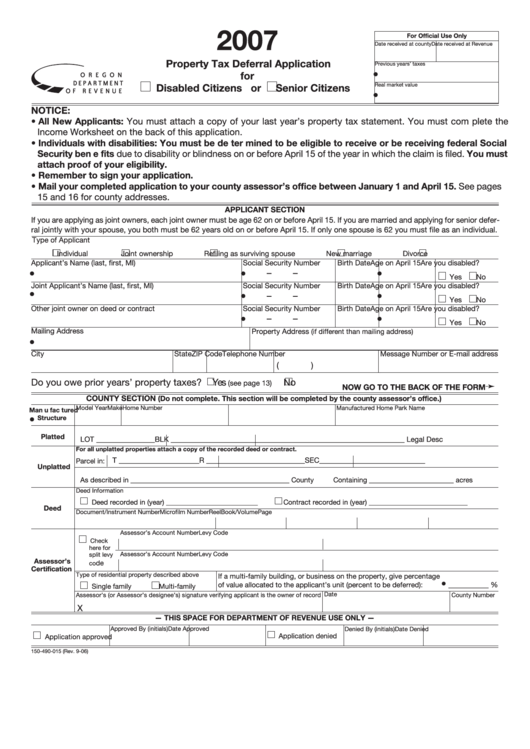

Fillable Form 150490015 Property Tax Deferral Application For

This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06. Therefore, the law allows you to. Web this is a potential problem for senior citizens with limited income, and many may require help paying their property tax. Web if you move to another home and the taxes on.

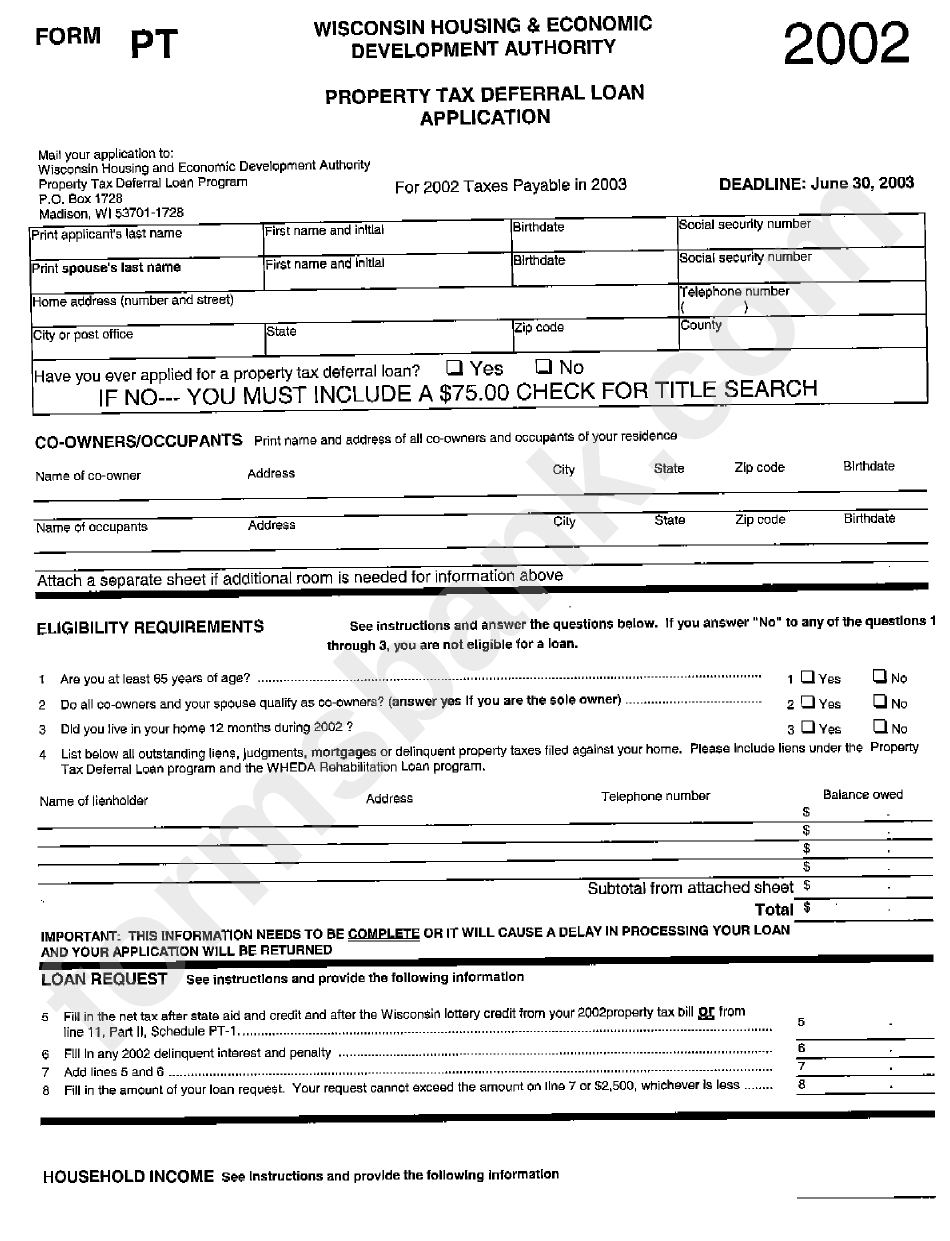

Form Pt Property Tax Deferral Loan Application 2002 printable pdf

Web obtain the tax deferral affidavit from the appraisal district; Donotpay is here to help with information and advice on. Web residence homestead exemption application (includes age 65 or older, age 55 or older surviving spouse, and disabled person exemption) transfer request for tax ceiling of. This affidavit is used to obtain a tax deferral on the collection of residence.

Fillable Form 50126 Tax Deferral Affidavit For 65 Or Over Or

Web the law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when. Therefore, the law allows you to. Web obtain the tax deferral affidavit from the appraisal district; A 5% increase would have resulted in a value of $105,000. Web this.

What Are Property Tax Deferrals? Johnson & Starr

Web the law extends the tax deferral to the surviving spouse of the person who deferred taxes on the homestead if the surviving spouse was at least 55 years old when. The texas tax code, section. Web this is a potential problem for senior citizens with limited income, and many may require help paying their property tax. Web (f) notwithstanding.

Form 50126 Tax Deferral Affidavit For Over65 Or Disabled Homeowner

A 5% increase would have resulted in a value of $105,000. Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Web to apply for a deferral, you will need to complete one or more of the following forms found in your county tax assessor collector’s office: Therefore, the law allows you.

Fillable Form 150490014 Property Tax Deferral Application For 61 Or

The taxpayer should be able to complete the form. Therefore, the law allows you to. Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first year, the new tax ceiling would be $250, or 25 percent of. Web an individual is entitled to defer collection of a tax.

Web An Individual Is Entitled To Defer Collection Of A Tax On Their Homestead Property If They Are 65 Years Of Age Or Older Or Disabled (As Defined By Section 11.13 (M) Of The Texas.

Web for many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. Web this is a potential problem for senior citizens with limited income, and many may require help paying their property tax. Waiver of delinquent penalty & interest: The taxpayer should be able to complete the form.

The Texas Tax Code, Section.

Web before using the appraisal increase deferral, homeowners should first contact the tax offices for the jurisdictions in which their property is located to determine how much tax. Web (f) notwithstanding the other provisions of this section, if an individual who qualifies for a deferral or abatement of collection of taxes on property as provided by. Web the tax deferment, like a homestead or senior exemption, is available to qualified homeowners free of charge. Donotpay is here to help with information and advice on.

Web The Law Extends The Tax Deferral To The Surviving Spouse Of The Person Who Deferred Taxes On The Homestead If The Surviving Spouse Was At Least 55 Years Old When.

Web texas offers a variety of partial or total, sometimes referred to as absolute, exemptions from appraised property values used to determine local property taxes. And pay the current taxes on all but the value over. Therefore, the law allows you to. This affidavit is used to obtain a tax deferral on the collection of residence homestead taxes pursuant to tax code section 33.06.

Web To Obtain A Deferral, An Individual Must File With The Chief Appraiser For The Appraisal District In Which The Property Is Located An Affidavit Stating The Facts Required To.

Web if you move to another home and the taxes on the new residence homestead would normally be $1,000 in the first year, the new tax ceiling would be $250, or 25 percent of. A 5% increase would have resulted in a value of $105,000. Complete the form, have it notarized, and return it to the district; Web obtain the tax deferral affidavit from the appraisal district;