The Debt Snowball Chapter 4 Lesson 6 Answers

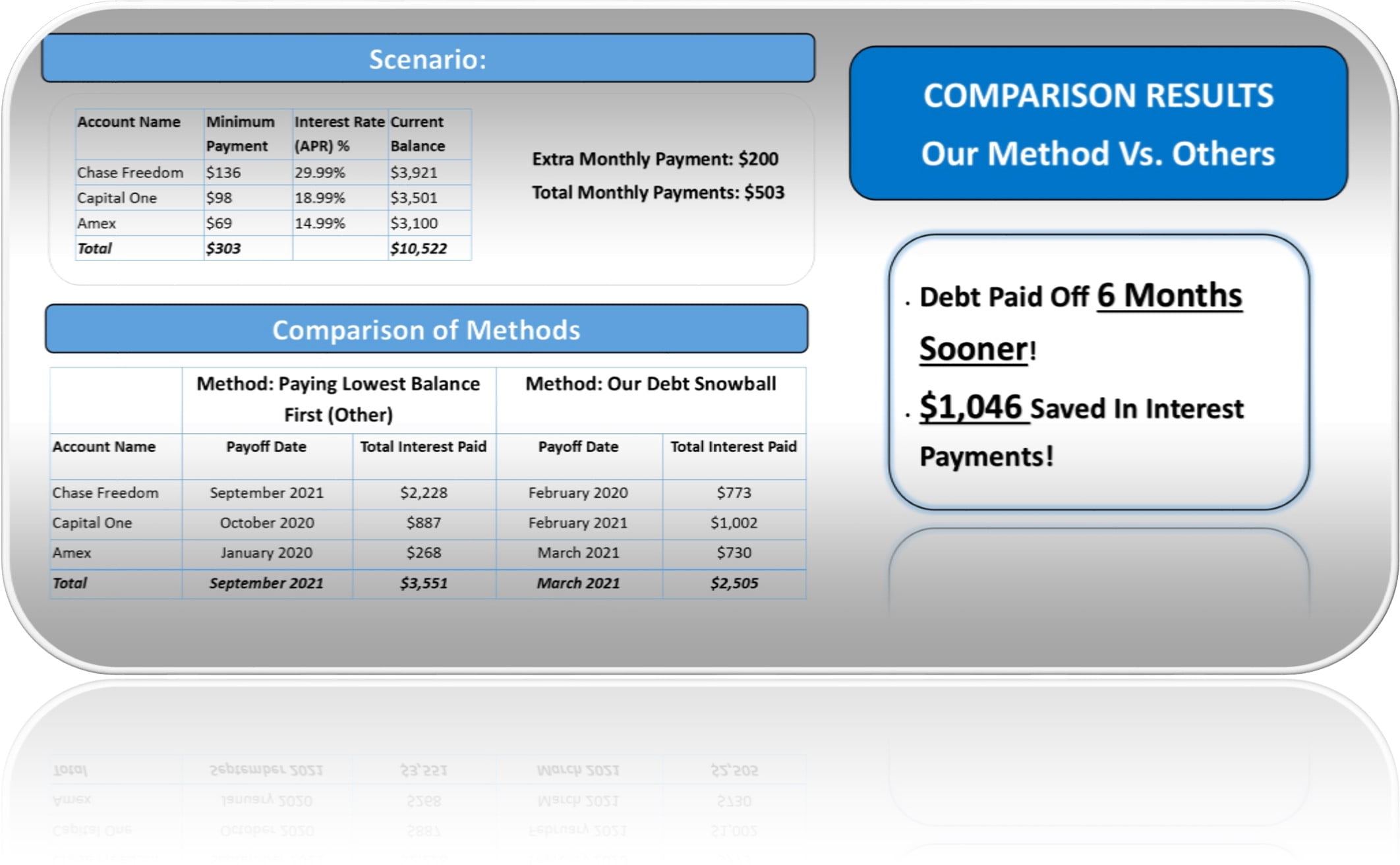

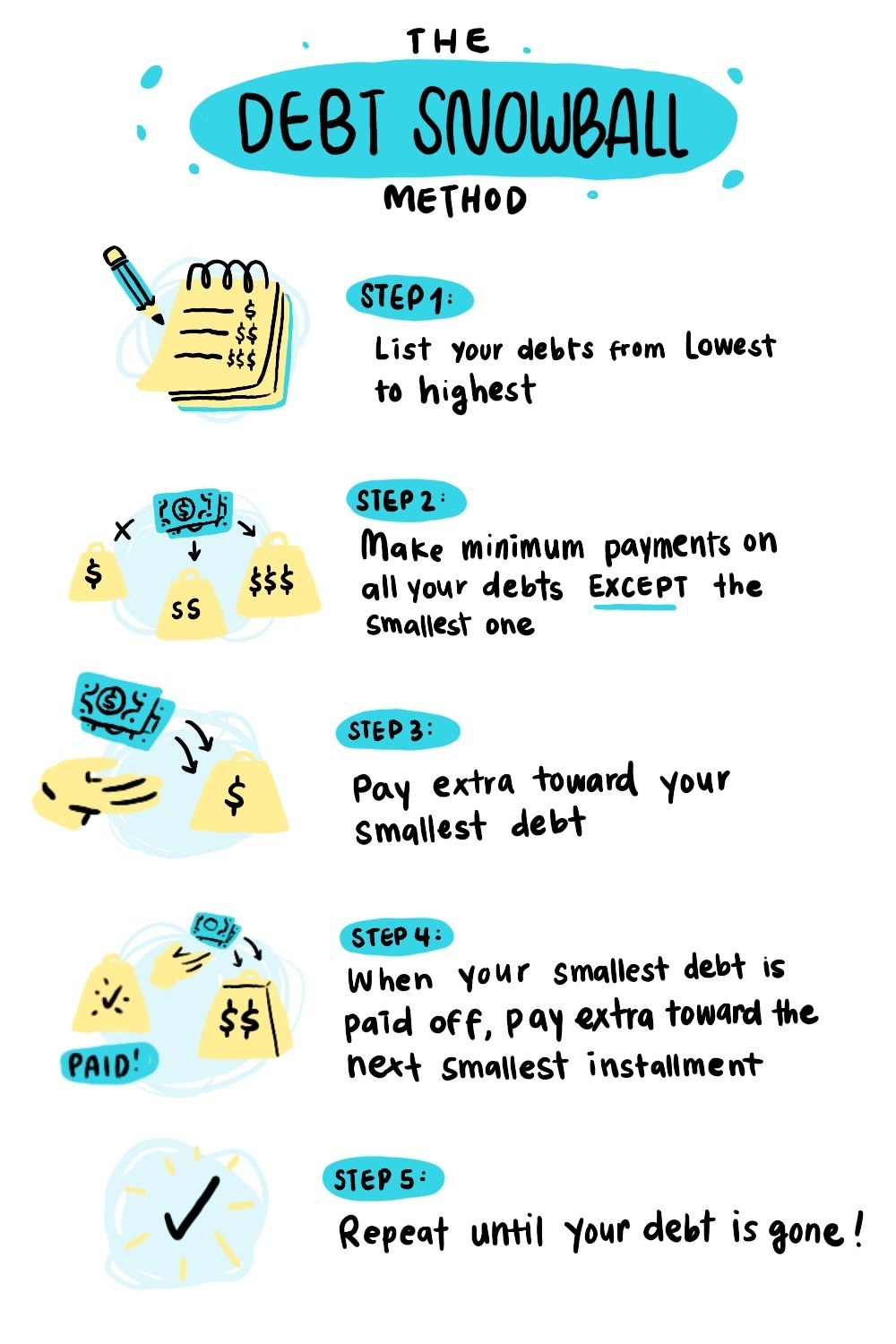

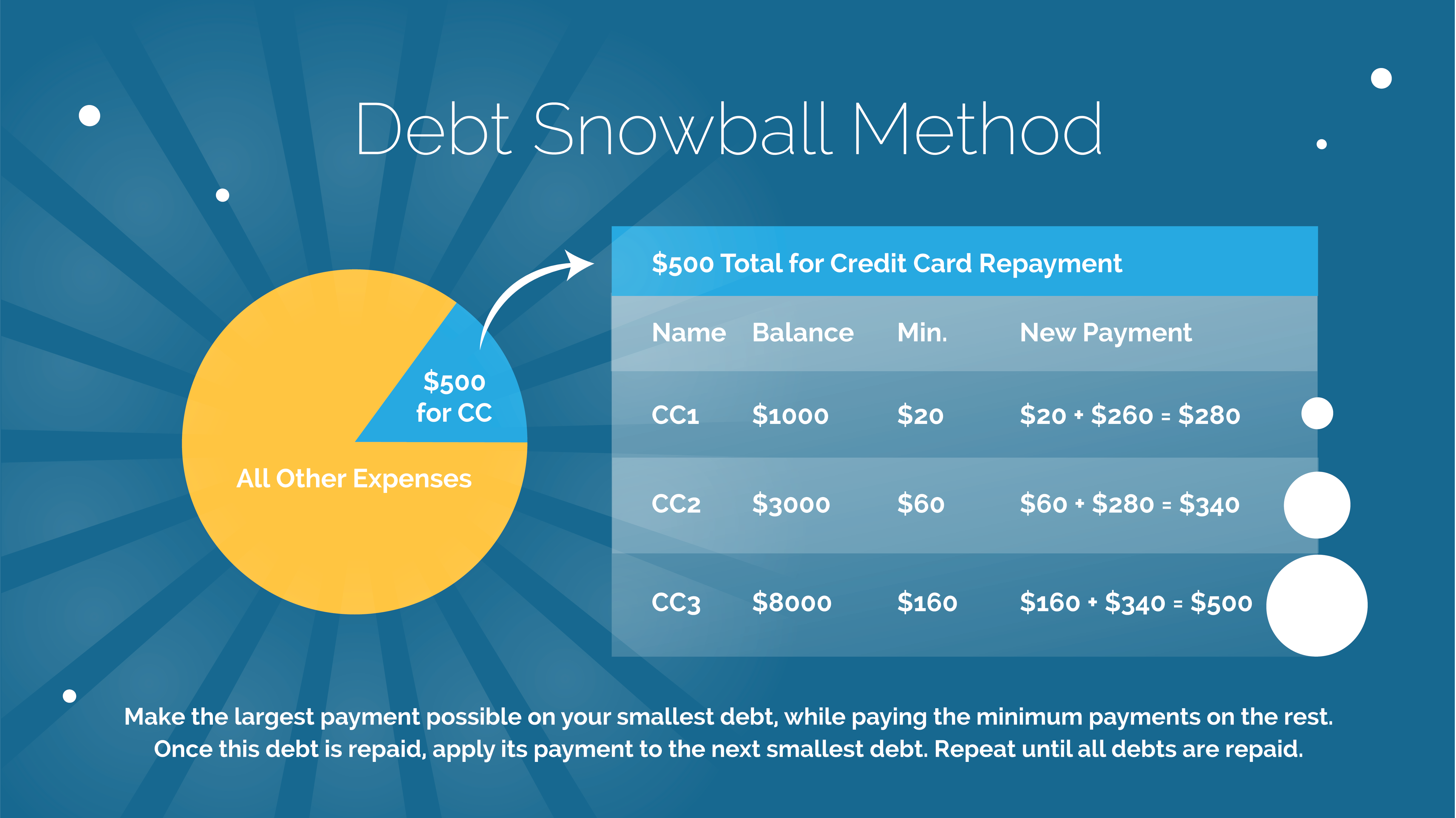

The Debt Snowball Chapter 4 Lesson 6 Answers - Minimum payments are made to all debts. Web what is the debt snowball? Includes a list of all debts organized from smallest to largest balance; A decrease or loss in value. Do not be concerned at this time with the. List your debts from smallest to largest regardless of interest rate. Web the debt snowball chapter 4, lesson 6 directions for these questions, complete the calculations using the current balance and the minimum or new payment amounts. Web debt snowball preferred method of debt repayment; Edit your chapter 4 the debt snowball worksheet answers online type text, add images, blackout confidential details, add comments, highlights and more. Pay as much as possible on your smallest debt.

Minimum payments are made to all debts. A method of debt repayment in which the debtor lists each of his/her debts from smallest to largest (not including the mortgage), then devotes extra money each month to. A measure of an individual's credit risk; Edit your chapter 4 the debt snowball worksheet answers online type text, add images, blackout confidential details, add comments, highlights and more. Enjoy smart fillable fields and interactivity. Includes a list of all debts organized from smallest to largest balance; Pay as much as possible on your smallest debt. Web fill the debt snowball chapter 4 student activity sheet answers, edit online. Web preferred method of debt repayment; List your debts from smallest to largest regardless of interest rate.

Web page 4 of 4the debt snowball chapter 4,lesson 6 directions for these questions, complete the calculations using the current balance and the minimum or new payment amounts. Encourage readers to explore chapter 4, lesson 6 for more detailed answers and guidance on the debt snowball method. A decrease or loss in value. The risk of you not repaying debt. Includes a list of all debts organized from smallest to largest balance; Which of the following is not recommended in the debt snowball method of getting out of debt. The chapter 4 the debt snowball worksheet answer. Do not be concerned at. Edit your chapter 4 the debt snowball worksheet answers online type text, add images, blackout confidential details, add comments, highlights and more. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.

How To Get Out Of Debt With The Debt Snowball Method Free Worksheet

Web chapter 4 student activity sheet the debt snowball answers as recognized, adventure as capably as experience nearly lesson, amusement, as well as promise can be gotten by just checking out a books chapter 4 student activity sheet the debt snowball answers. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Includes a list of all.

Debt Snowball Worksheet Download worksSheet list

The chapter 4 the debt snowball worksheet answer. Do not be concerned at this time with the. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Calculated from a credit report using a standardized formula. Web chapter 4 student activity sheet the debt snowball answers as recognized, adventure as capably as experience nearly lesson, amusement, as.

Debt Snowball Calculator Spreadsheet Our Debt Free Lives

You are unauthorized to view this page. Web ★ 4.8 satisfied 59 votes how to fill out and sign chapter 4 lesson 6 the debt snowball online? Calculated from a credit report using a standardized formula. The chapter 4 the debt snowball worksheet answer. Enjoy smart fillable fields and interactivity.

Debt Snowball Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Course materials and the activity handout objectives. Do not be concerned at. Preferred method of debt repayment; The risk of you not repaying debt. Do not be concerned at.

Debt Snowball Worksheet DocTemplates

1 of 4 the debt snowball 4 activity: Web 4.7 satisfied 62 votes what makes the the debt snowball chapter 4 lesson 6 answer key legally binding? Web page 4 of 4the debt snowball chapter 4,lesson 6 directions for these questions, complete the calculations using the current balance and the minimum or new payment amounts. Summarize the benefits and effectiveness.

How To Do A Debt Snowball Or A Debt Avalanche

Get your online template and fill it in using progressive features. Includes a list of all debts organized from smallest to largest balance; You are unauthorized to view this page. Course materials and the activity handout objectives. Web 4.7 satisfied 62 votes what makes the the debt snowball chapter 4 lesson 6 answer key legally binding?

Debt Snowball Form charlotte clergy coalition

A measure of an individual's credit risk; Pay as much as possible on your smallest debt. Sign it in a few clicks draw your signature, type it,. Minimum payments are made to all debts. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

Web terms in this set (35) a credit score is intended to measure: Web ★ 4.8 satisfied 59 votes how to fill out and sign chapter 4 lesson 6 the debt snowball online? Do not be concerned at. Calculated from a credit report using a standardized formula. Summarize the benefits and effectiveness of the debt snowball method b.

Debt Snowball Example YouTube

Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. List your debts from smallest to largest regardless of interest rate. Includes a list of all debts organized from smallest to largest balance; Pay as much as possible on your smallest debt. Web terms in this set (35) a credit score is intended to measure:

The Debt Snowball Method A Wise Trick For Debt Reduction Cashry

Do not be concerned at. Web the debt snowball chapter 4, lesson 6 directions for these questions, complete the calculations using the current balance and the minimum or new payment amounts. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web common questions about the debt snowball. Which of the following is not recommended in the.

Web Page 4 Of 4The Debt Snowball Chapter 4,Lesson 6 Directions For These Questions, Complete The Calculations Using The Current Balance And The Minimum Or New Payment Amounts.

Do not be concerned at. The debt snowball method is the best way to get out of debt. Web the debt snowball chapter 4, lesson 6 directions for these questions, complete the calculations using the current balance and the minimum or new payment amounts. Do not be concerned at this time with the.

A Word About Student Loans;

Small groups of three to four students 30 minutes material: Web common questions about the debt snowball. Web page 4 of 4the debt snowball chapter 4,lesson 6 directions for these questions, complete the calculations using the current balance and the minimum or new payment amounts. The chapter 4 the debt snowball worksheet answer.

Web Fill The Debt Snowball Chapter 4 Student Activity Sheet Answers, Edit Online.

Summarize the benefits and effectiveness of the debt snowball method b. Includes a list of all debts organized from smallest to largest balance; Calculated from a credit report using a standardized formula. Do not be concerned at.

Get Your Online Template And Fill It In Using Progressive Features.

A decrease or loss in value. Web terms in this set (35) a credit score is intended to measure: Which of the following is not recommended in the debt snowball method of getting out of debt. Encourage readers to explore chapter 4, lesson 6 for more detailed answers and guidance on the debt snowball method.