Tiaa Cref Rollover Form

Tiaa Cref Rollover Form - Web annuity contracts and certificates are issued by teachers insurance and annuity association of america (tiaa) and college retirement equities fund (cref), new york, ny. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment. Traditional rollover ira (established only with funds received from. Rollover rollover deposit your tax refund into your tiaa mutual fund account Including mutual fund ira, retirement annuity, group retirement annuity, and more. Web before applying for a transfer, you need to contact your employer and find out what you need to do. Web you may also be able to leave money in your current plan, withdraw cash or roll over the assets to your new employer’s plan if one is available and rollovers are permitted. Federal or state taxes may apply for certain rollovers. Each is solely responsible for its own financial condition and contractual obligations. Provide your information first name last name social security number/ taxpayer identification number state of legal residence (if outside the u.s., write in country of residence) contact telephone number citizenship (if not u.s.)middle initial suffix extension 2.

Traditional rollover ira (established only with funds received from. Each is solely responsible for its own financial condition and contractual obligations. Web annuity contracts and certificates are issued by teachers insurance and annuity association of america (tiaa) and college retirement equities fund (cref), new york, ny. Provide your information first name last name social security number/ taxpayer identification number state of legal residence (if outside the u.s., write in country of residence) contact telephone number citizenship (if not u.s.)middle initial suffix extension 2. Including mutual fund ira, retirement annuity, group retirement annuity, and more. Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Federal or state taxes may apply for certain rollovers. Web find forms to withdraw or rollover funds from your tiaa accounts. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment. Tax information in this form is not intended as tax advice.

Web make this request within 60 days of your distribution to roll over your qualified retirement funds. And if you have a new employer and want a different plan, find out if the employer’s plan accepts rollovers. Web before applying for a transfer, you need to contact your employer and find out what you need to do. Tiaa does offer online forms that allow you to transfer your ira to another financial institution directly. Web find forms to withdraw or rollover funds from your tiaa accounts. Rollover rollover deposit your tax refund into your tiaa mutual fund account Web annuity contracts and certificates are issued by teachers insurance and annuity association of america (tiaa) and college retirement equities fund (cref), new york, ny. Web you may also be able to leave money in your current plan, withdraw cash or roll over the assets to your new employer’s plan if one is available and rollovers are permitted. Traditional rollover ira (established only with funds received from. Provide your information first name last name social security number/ taxpayer identification number state of legal residence (if outside the u.s., write in country of residence) contact telephone number citizenship (if not u.s.)middle initial suffix extension 2.

Form Tiaa Cref F11254 ≡ Fill Out Printable PDF Forms Online

Rollover rollover deposit your tax refund into your tiaa mutual fund account Web before applying for a transfer, you need to contact your employer and find out what you need to do. Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Federal or state taxes may apply for certain rollovers. Tax information.

Top Tiaa Cref Forms And Templates free to download in PDF format

Tax information in this form is not intended as tax advice. And if you have a new employer and want a different plan, find out if the employer’s plan accepts rollovers. Web before applying for a transfer, you need to contact your employer and find out what you need to do. Rollover rollover deposit your tax refund into your tiaa.

Tiaa f11340 Fill out & sign online DocHub

Each is solely responsible for its own financial condition and contractual obligations. Web find forms to withdraw or rollover funds from your tiaa accounts. Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Provide your information first name last name social security number/ taxpayer identification number state of legal residence (if outside.

Retirement planning with TIAA CREF Retirement Accounts Saverocity Finance

Including mutual fund ira, retirement annuity, group retirement annuity, and more. Each is solely responsible for its own financial condition and contractual obligations. Web you may also be able to leave money in your current plan, withdraw cash or roll over the assets to your new employer’s plan if one is available and rollovers are permitted. Web annuity contracts and.

Tiaa Spousal Waiver Form Fill Online, Printable, Fillable, Blank

Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment. Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Web you may also be able to leave money in your current plan, withdraw cash or roll over the assets to your.

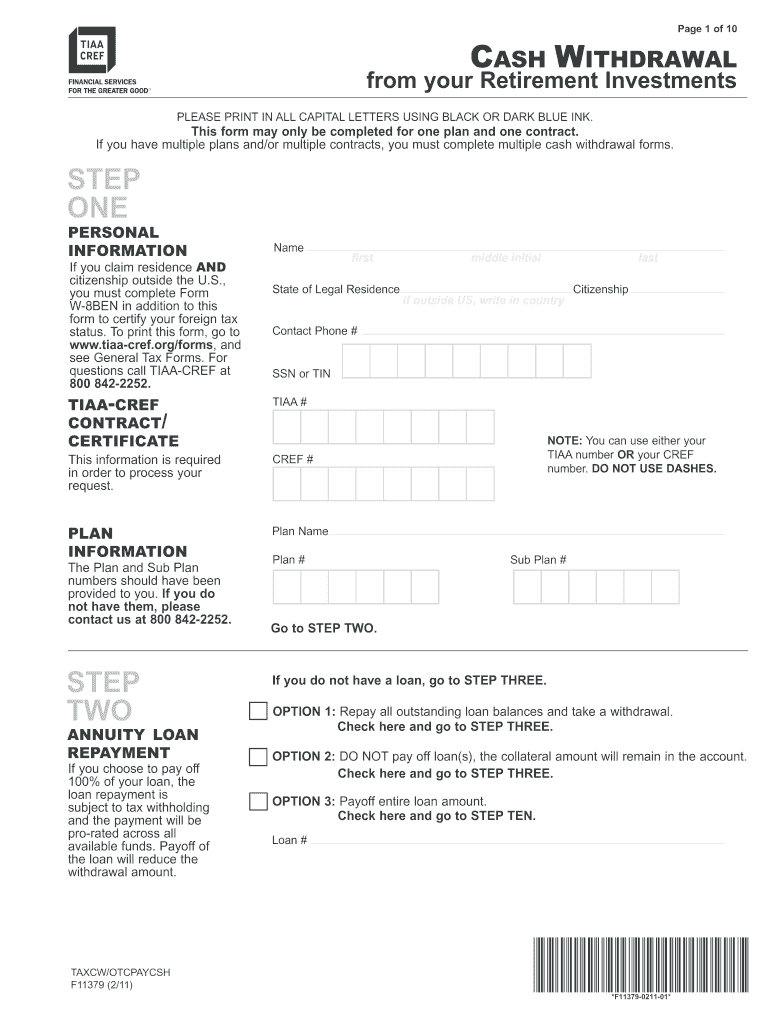

Taxcw otcpaycsh Fill out & sign online DocHub

Provide your information first name last name social security number/ taxpayer identification number state of legal residence (if outside the u.s., write in country of residence) contact telephone number citizenship (if not u.s.)middle initial suffix extension 2. Each is solely responsible for its own financial condition and contractual obligations. Traditional rollover ira (established only with funds received from. Compare the.

Fill Free fillable TIAA CREF Rollover Form F10462 trans exch 1912

Web you may also be able to leave money in your current plan, withdraw cash or roll over the assets to your new employer’s plan if one is available and rollovers are permitted. Federal or state taxes may apply for certain rollovers. And if you have a new employer and want a different plan, find out if the employer’s plan.

Fill Free fillable TIAA CREF Rollover Form F10462 trans exch 1912

Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Including mutual fund ira, retirement annuity, group retirement annuity, and more. Tiaa does offer online forms that allow you to transfer your ira to another financial institution directly. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions,.

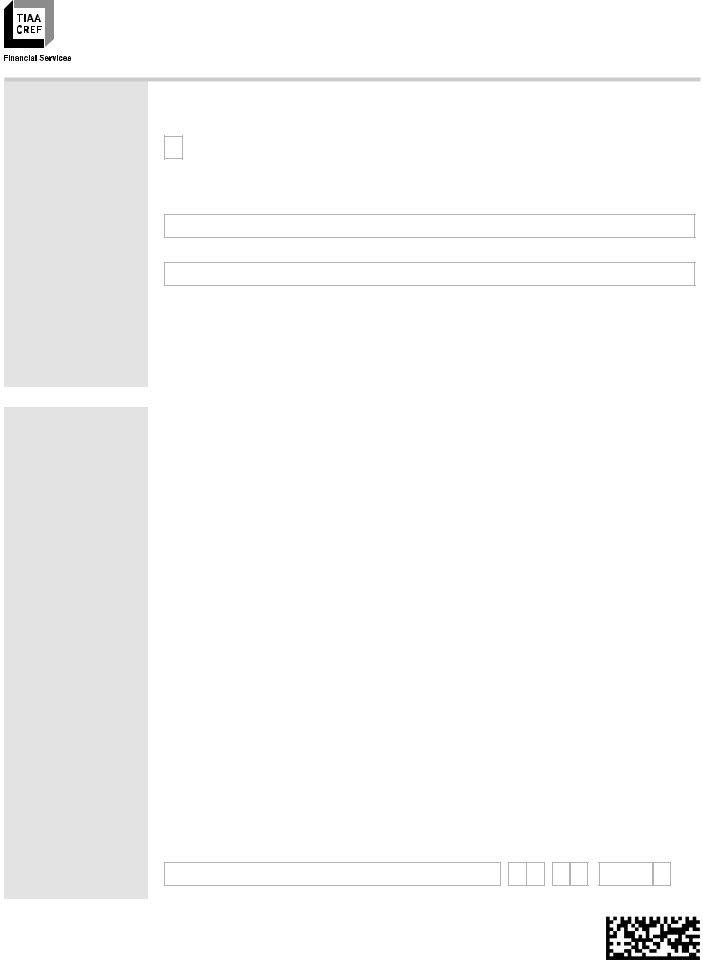

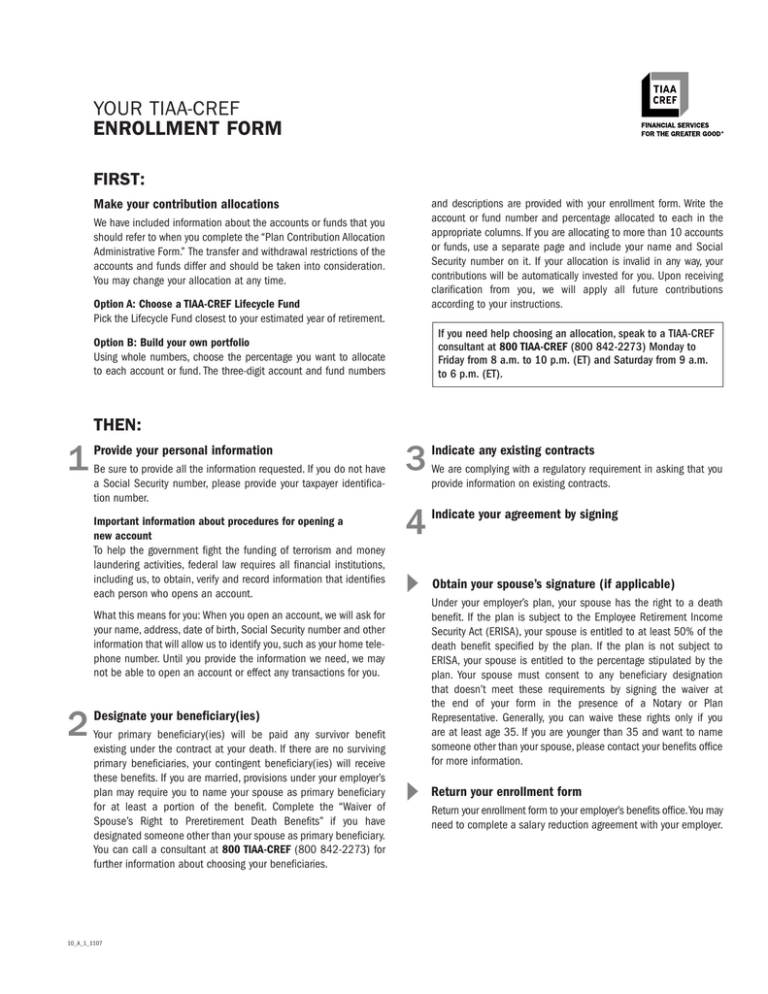

YOUR TIAACREF ENROLLMENT FORM FIRST

Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Web you may also be able to leave money in your current plan, withdraw cash or roll over the assets to your new employer’s plan if one is available and rollovers are permitted. Federal or state taxes may apply for certain rollovers. Traditional.

Lactation Room Human Resources

Web annuity contracts and certificates are issued by teachers insurance and annuity association of america (tiaa) and college retirement equities fund (cref), new york, ny. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment. And if you have a new employer and want a different plan, find out.

Each Is Solely Responsible For Its Own Financial Condition And Contractual Obligations.

Web make this request within 60 days of your distribution to roll over your qualified retirement funds. Provide your information first name last name social security number/ taxpayer identification number state of legal residence (if outside the u.s., write in country of residence) contact telephone number citizenship (if not u.s.)middle initial suffix extension 2. Tax information in this form is not intended as tax advice. Web before applying for a transfer, you need to contact your employer and find out what you need to do.

Federal Or State Taxes May Apply For Certain Rollovers.

Web annuity contracts and certificates are issued by teachers insurance and annuity association of america (tiaa) and college retirement equities fund (cref), new york, ny. Traditional rollover ira (established only with funds received from. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment. And if you have a new employer and want a different plan, find out if the employer’s plan accepts rollovers.

Tiaa Does Offer Online Forms That Allow You To Transfer Your Ira To Another Financial Institution Directly.

Web if you wish to make a rollover from your tiaa traditional account, please call us to obtain the correct form. Including mutual fund ira, retirement annuity, group retirement annuity, and more. Rollover rollover deposit your tax refund into your tiaa mutual fund account Web find forms to withdraw or rollover funds from your tiaa accounts.