Tn Form Fae 173

Tn Form Fae 173 - Web fae173 tennessee department of revenue application for extension of time to file franchise, excise tax file this form only if a payment is being made. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. The state of tennessee franchise and excise tax returns form fae170 and form fae174 are due by the 15th day following the 4th. New exemption renewal final taxpayer has filed for federal extension tax period covered: Go to the other > extensions worksheet. Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Search for another form here. Web up to $40 cash back tennessee form fae 173 is not the form you're looking for? Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return.

Web www.tn.gov/revenue under tax resources. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. This form is for income earned in tax year 2022, with tax. Web date tennessee operations began, whichever occurred first. Comments and help with tennessee fae 173 fillable. The state of tennessee franchise and excise tax returns form fae170 and form fae174 are due by the 15th day following the 4th. Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Web up to $40 cash back tennessee form fae 173 is not the form you're looking for? Total net worth schedule f1, line 5 or schedule f2, line 3.

New exemption renewal final taxpayer has filed for federal extension tax period covered: Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax administration. Comments and help with tennessee fae 173 fillable. The state of tennessee franchise and excise tax returns form fae170 and form fae174 are due by the 15th day following the 4th. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. Web date tennessee operations began, whichever occurred first. Web up to $40 cash back tennessee form fae 173 is not the form you're looking for? Use get form or simply click on the template preview to open it in the editor. Go to the other > extensions worksheet.

20172022 Form TN DoR FAE 173 Fill Online, Printable, Fillable, Blank

Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Comments and help with tennessee fae 173 fillable. Total net worth schedule f1, line 5 or schedule f2, line 3. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web www.tn.gov/revenue under tax resources.

TNForm

Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Penalty on estimated franchise and excise tax payments is calculated at a rate of 2% per month, or portion thereof, that an. Web tennessee state business tax extension. Web taxable entity that is incorporated, domesticated, qualified or otherwise registered to do business in tennessee that.

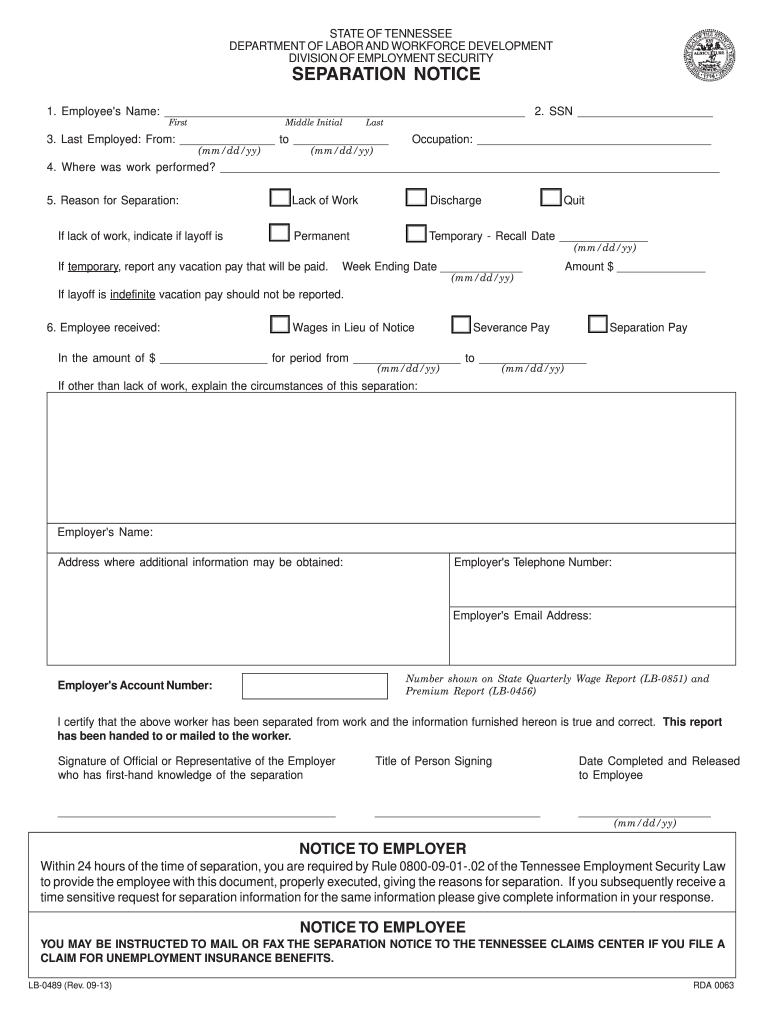

Separation Notice Tn Fill Online, Printable, Fillable, Blank pdfFiller

Web up to $40 cash back tennessee form fae 173 is not the form you're looking for? Web taxable entity that is incorporated, domesticated, qualified or otherwise registered to do business in tennessee that was inactive in tennessee for the entire taxable period and. The state of tennessee franchise and excise tax returns form fae170 and form fae174 are due.

Tn Form Ucc Fill Online, Printable, Fillable, Blank pdfFiller

Web fae173 tennessee department of revenue application for extension of time to file franchise, excise tax file this form only if a payment is being made. Web www.tn.gov/revenue under tax resources. This form is for income earned in tax year 2022, with tax. Application for extension of time to file franchise and excise tax return you may file this extension.

Tennessee Real Estate Counter Offer Form Fill Online, Printable

Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web date tennessee operations began, whichever occurred first. Web taxable entity that is incorporated, domesticated, qualified or otherwise registered to do business in tennessee that was inactive in.

Submittal Tn Gov Fill Online, Printable, Fillable, Blank pdfFiller

New exemption renewal final taxpayer has filed for federal extension tax period covered: The state of tennessee franchise and excise tax returns form fae170 and form fae174 are due by the 15th day following the 4th. Search for another form here. Use get form or simply click on the template preview to open it in the editor. Application for extension.

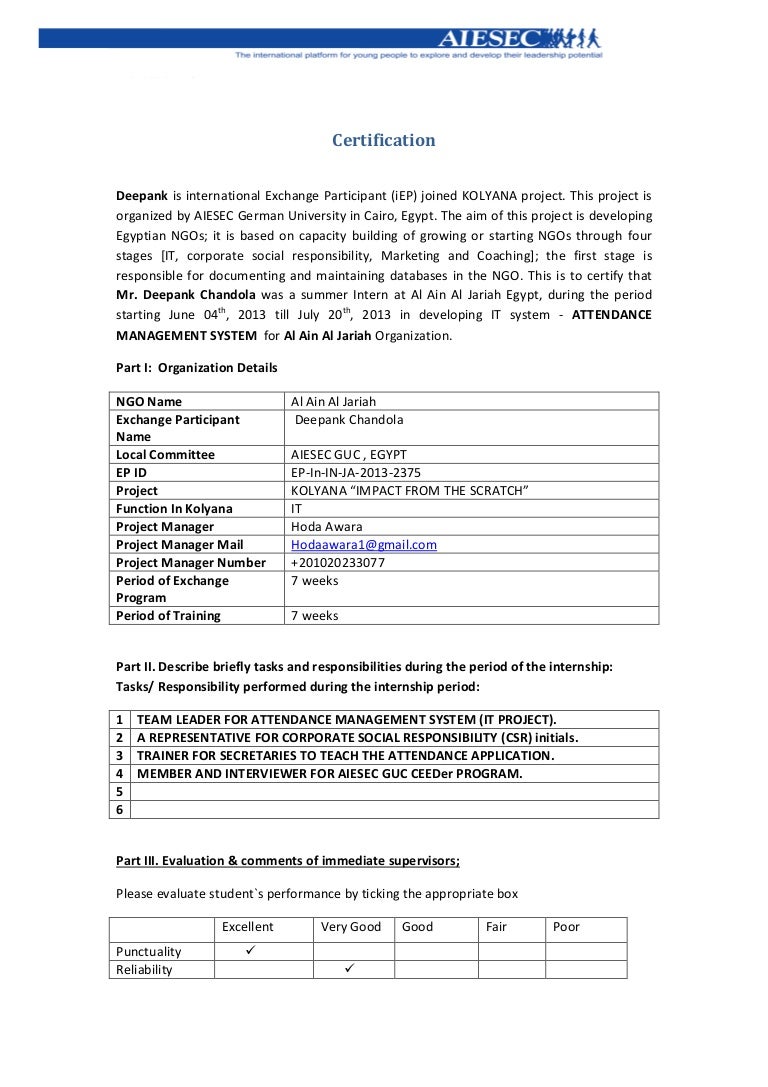

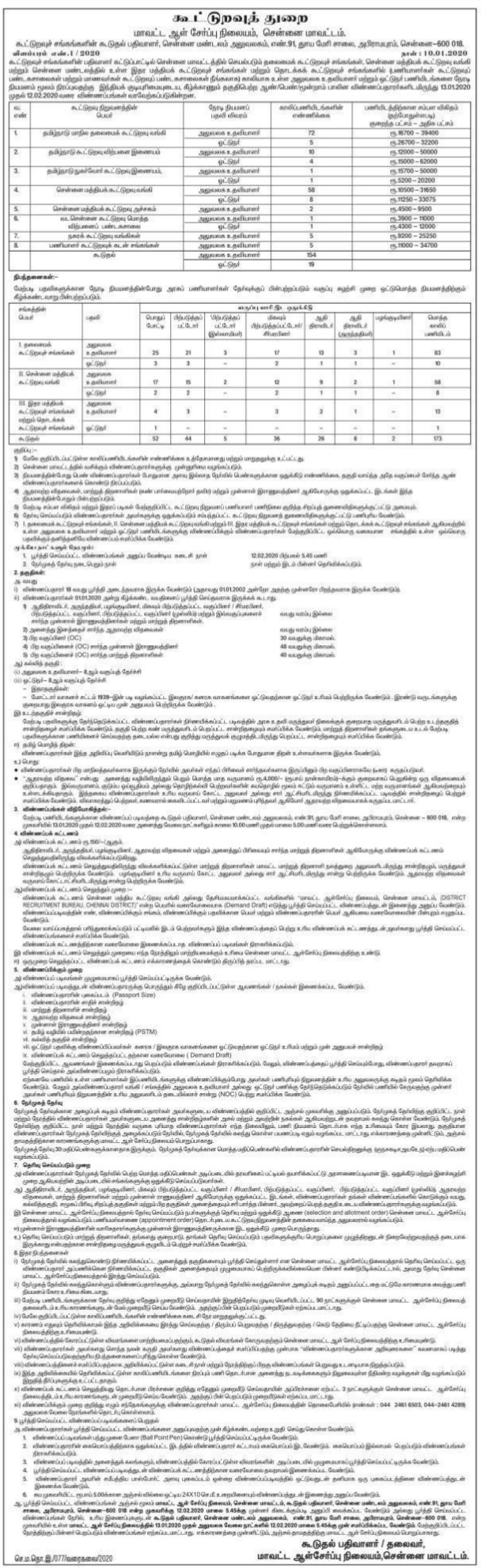

TN Cooperative Bank Recruitment 2020 173 Office Assistant, Driver posts

Web www.tn.gov/revenue under tax resources. Web up to $40 cash back tennessee form fae 173 is not the form you're looking for? Search for another form here. Go to the other > extensions worksheet. Web taxable entity that is incorporated, domesticated, qualified or otherwise registered to do business in tennessee that was inactive in tennessee for the entire taxable period.

Tennessee Fae 173 Form ≡ Fill Out Printable PDF Forms Online

Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web date tennessee operations began, whichever occurred first. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment.

Tn Simplified Reporting Form PDF Fill Out and Sign Printable PDF

Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax administration. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae.

Tn Fae 183 Fill Online, Printable, Fillable, Blank pdfFiller

Comments and help with tennessee fae 173 fillable. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax administration. Go to the other > extensions worksheet. Web fae173 tennessee department of revenue application for extension of time to file franchise, excise tax file.

Web How Do I Generate The Fae 173 For A Tennessee Corporation Using Worksheet View?

Go to the other > extensions worksheet. Web up to $40 cash back tennessee form fae 173 is not the form you're looking for? Total net worth schedule f1, line 5 or schedule f2, line 3. Web taxable entity that is incorporated, domesticated, qualified or otherwise registered to do business in tennessee that was inactive in tennessee for the entire taxable period and.

Taxpayers Incorporated Or Otherwise Formed Outside Tennessee Must Prorate The Franchise Tax On The Initial Return.

Comments and help with tennessee fae 173 fillable. Web tennessee state business tax extension. Use get form or simply click on the template preview to open it in the editor. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or through a mail service to meet the payment.

Web Date Tennessee Operations Began, Whichever Occurred First.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2% per month, or portion thereof, that an. The state of tennessee franchise and excise tax returns form fae170 and form fae174 are due by the 15th day following the 4th. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. This form is for income earned in tax year 2022, with tax.

Search For Another Form Here.

Web fae173 tennessee department of revenue application for extension of time to file franchise, excise tax file this form only if a payment is being made. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax administration. Web www.tn.gov/revenue under tax resources. New exemption renewal final taxpayer has filed for federal extension tax period covered: