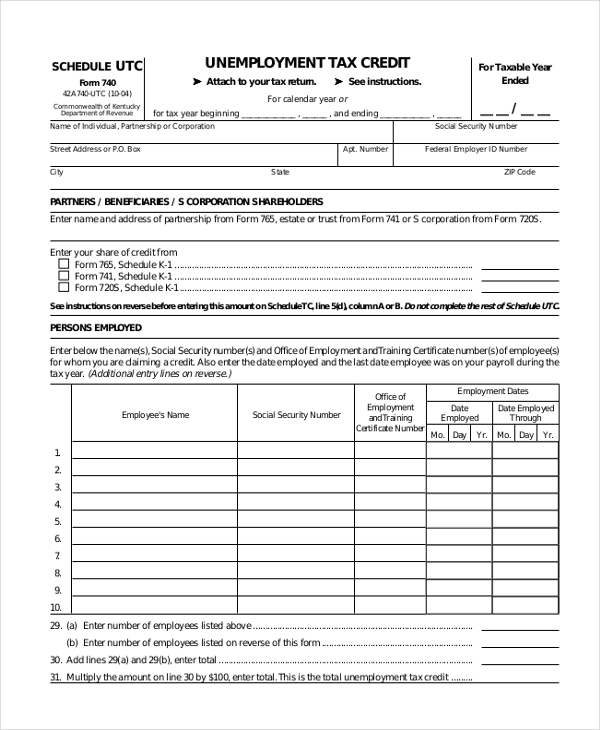

Unemployment Tax Form Texas

Unemployment Tax Form Texas - General information is the unemployment tax registration system compatible with all browsers. Find more information and helpful tutorials on unemployment benefits services. Web the unemployment tax program collects wage information and unemployment taxes from employers subject to the texas unemployment. Web in 2019, the taxable wage base for employees in texas is $9,000, and the tax rates range from.36% to 6.36%. Web unemployment benefit services twc updated password requirements for this system. Read the applying for unemployment benefits. Apply online at unemployment benefit services by selecting apply for benefits. If you make $70,000 a year living in texas you will be taxed $8,168. Assume that your company receives a good. Who can use unemployment tax registration?

Apply for benefits in one of two ways: Unemployment benefits (both regular and federal extended benefits) federal. If you already have a user id for another twc internet application, such as unemployment tax registration or workintexas.com, try. Who cannot use unemployment tax. Assume that your company receives a good. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web new to unemployment tax services? Web information required to register what information do i need to register? Web the unemployment tax program collects wage information and unemployment taxes from employers subject to the texas unemployment. If you make $70,000 a year living in texas you will be taxed $8,168.

Web information required to register what information do i need to register? If you make $70,000 a year living in texas you will be taxed $8,168. Apply for benefits in one of two ways: Bank account (online ach debit) or credit card (american. Apply online at unemployment benefit services by selecting apply for benefits. Web in 2019, the taxable wage base for employees in texas is $9,000, and the tax rates range from.36% to 6.36%. Your average tax rate is 11.67% and your marginal tax rate is 22%. Unemployment benefits (both regular and federal extended benefits) federal. Select the payments tab from the my home page. Web your effective tax rate for 2020 = general tax rate (gtr) + replenishment tax rate (rtr) + obligation assessment rate (oa) + deficit tax rate (dtr) +.

IRS Now Adjusting Tax Returns For 10,200 Unemployment Tax Break

Together with state unemployment tax systems, the futa tax provides. Bank account (online ach debit) or credit card (american. Web logon to unemployment tax services. Web new to unemployment tax services? Web your effective tax rate for 2020 = general tax rate (gtr) + replenishment tax rate (rtr) + obligation assessment rate (oa) + deficit tax rate (dtr) +.

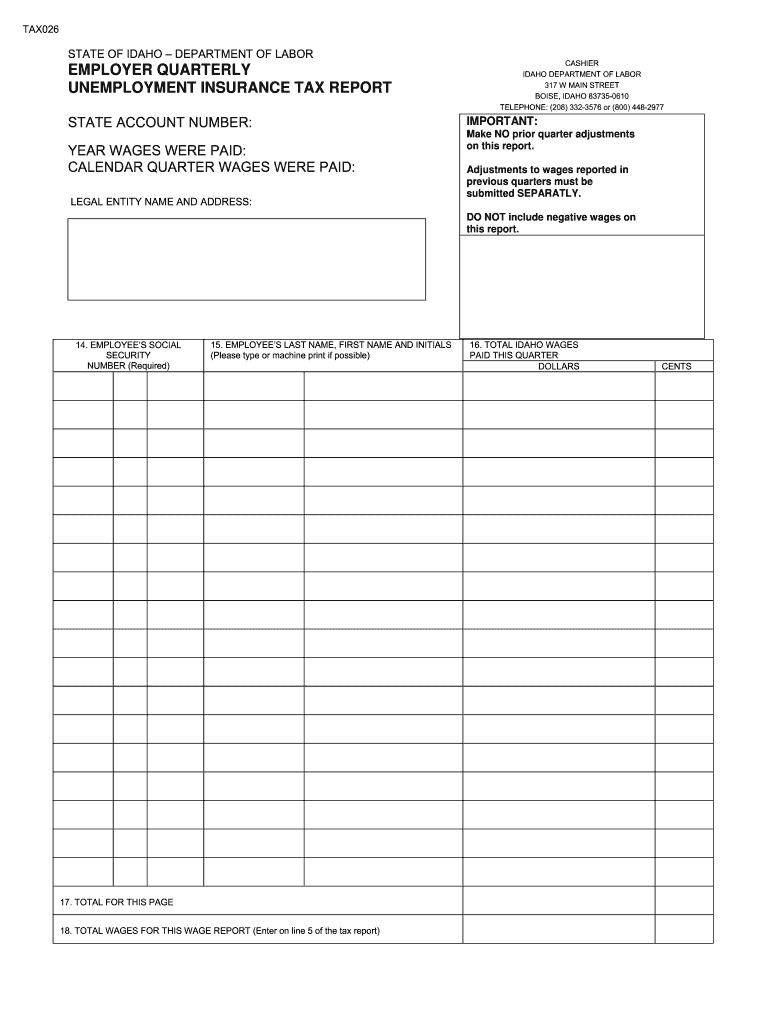

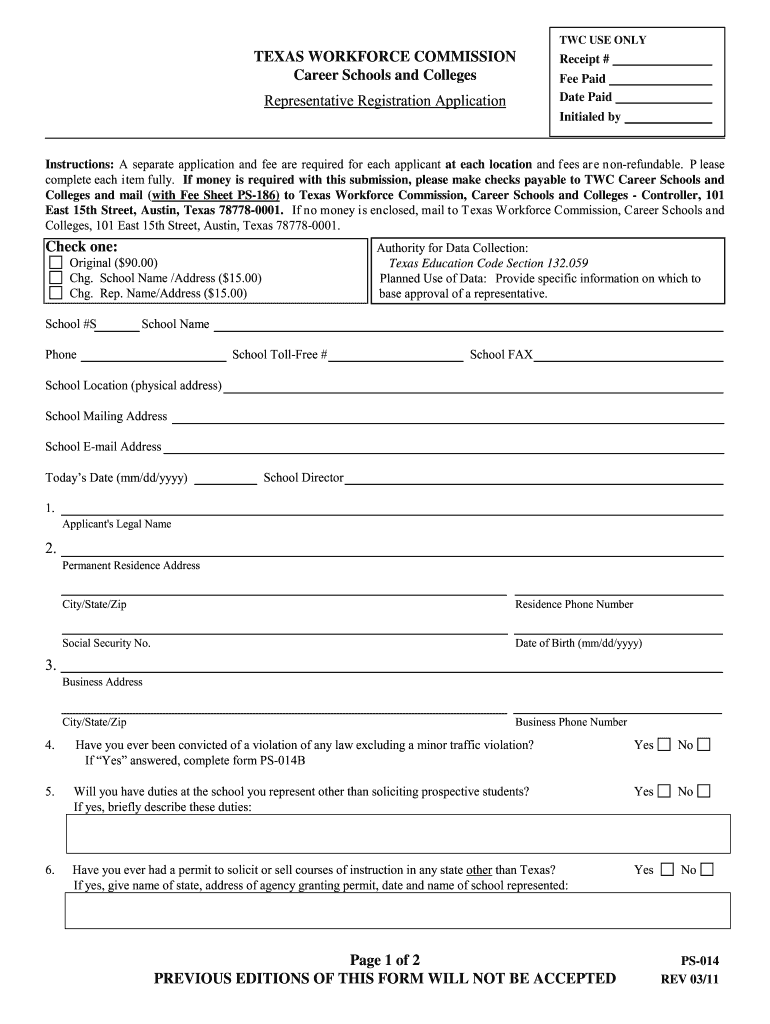

FREE 22+ Sample Tax Forms in PDF Excel MS Word

If you make $70,000 a year living in texas you will be taxed $8,168. Web new to unemployment tax services? General information is the unemployment tax registration system compatible with all browsers. Web your effective tax rate for 2020 = general tax rate (gtr) + replenishment tax rate (rtr) + obligation assessment rate (oa) + deficit tax rate (dtr) +..

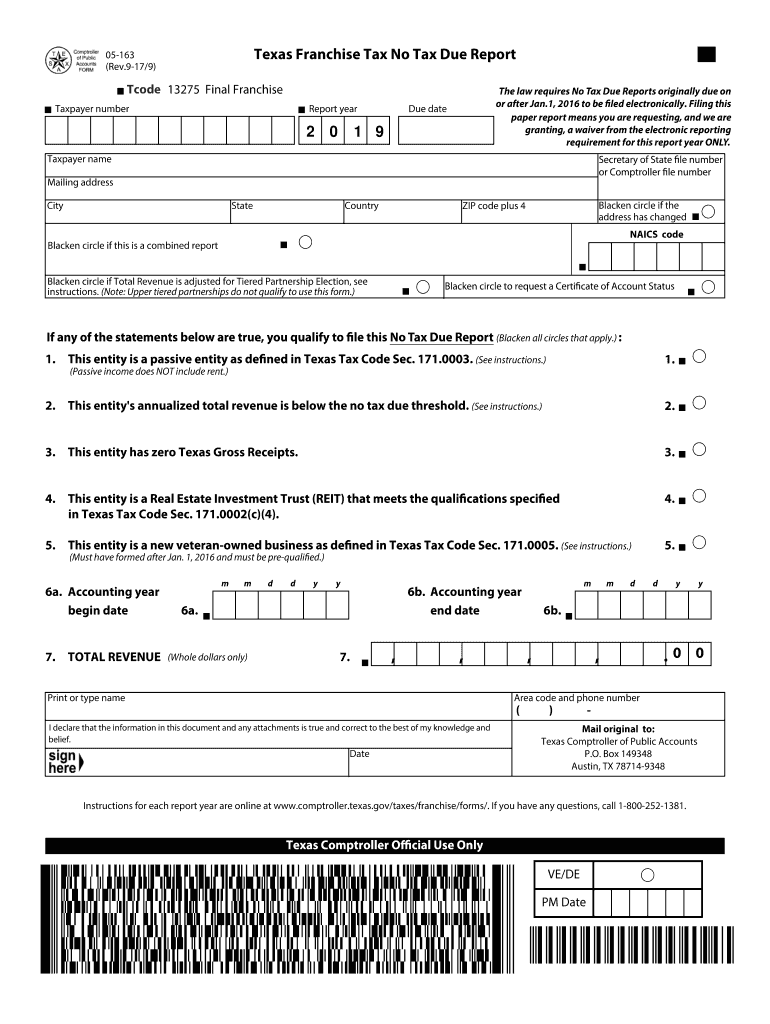

2019 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

Who can use unemployment tax registration? Web the unemployment tax program collects wage information and unemployment taxes from employers subject to the texas unemployment. If you already have a user id for another twc internet application, such as unemployment tax registration or workintexas.com, try. Your average tax rate is 11.67% and your marginal tax rate is 22%. Web your effective.

Texas Unemployment Tax Return Online NEMPLOY

General information is the unemployment tax registration system compatible with all browsers. Who cannot use unemployment tax. Read the applying for unemployment benefits. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Who can use unemployment tax registration?

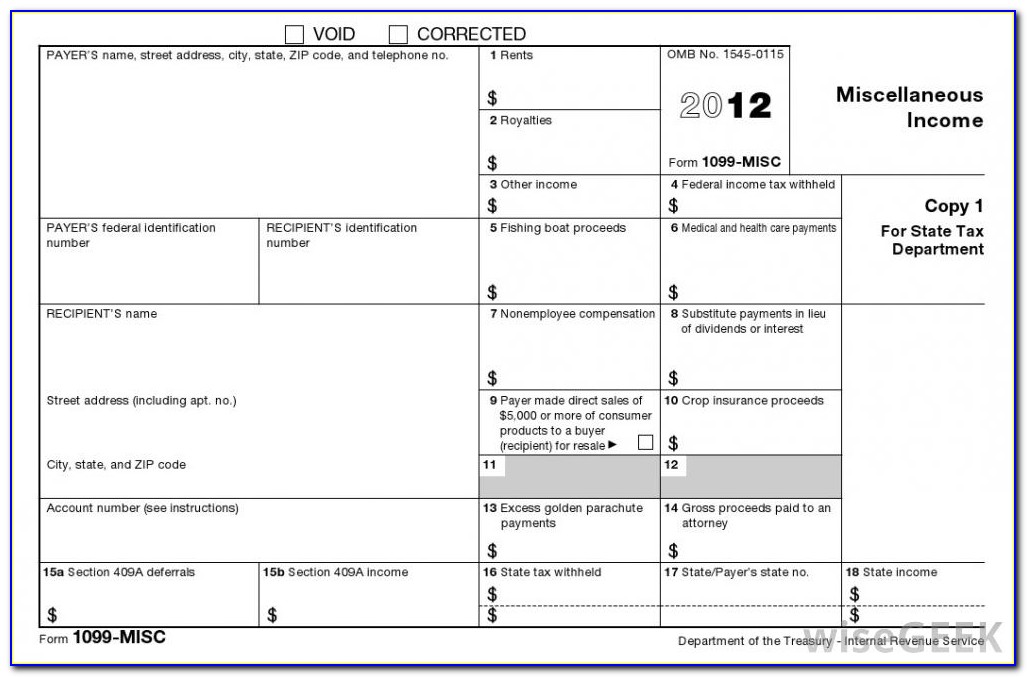

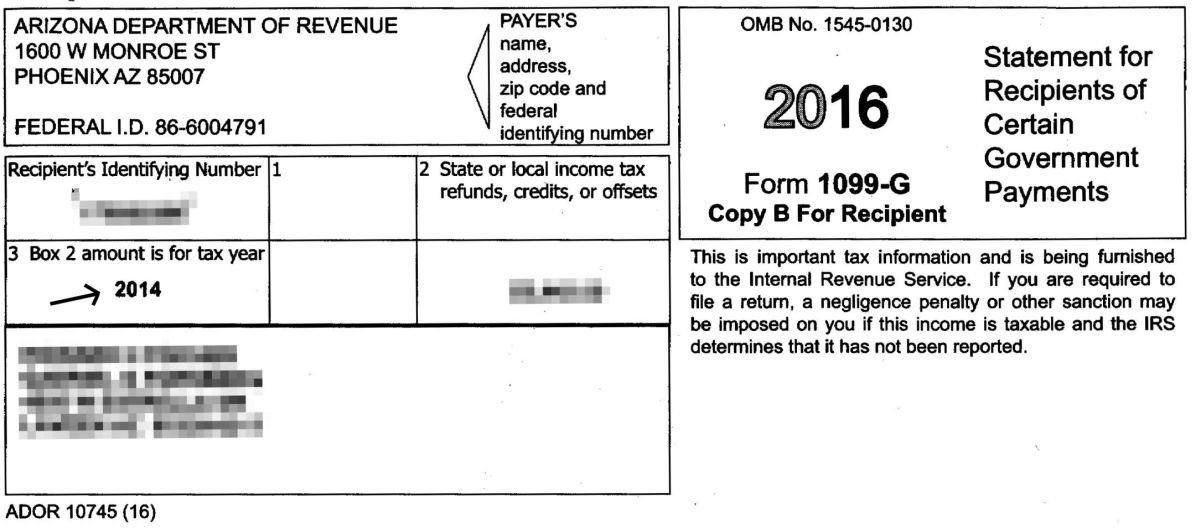

Arizona Unemployment Form 1099 G Form Resume Examples YL5zgqqOzV

Web information required to register what information do i need to register? If you make $70,000 a year living in texas you will be taxed $8,168. Who can use unemployment tax registration? Web new to unemployment tax services? Web the unemployment tax program collects wage information and unemployment taxes from employers subject to the texas unemployment.

Unemployment Tax Form Virginia YUNEMPLO

Web new to unemployment tax services? Bank account (online ach debit) or credit card (american. Web logon to unemployment tax services. If you already have a user id for another twc internet application, such as unemployment tax registration or workintexas.com, try. Web use form 940 to report your annual federal unemployment tax act (futa) tax.

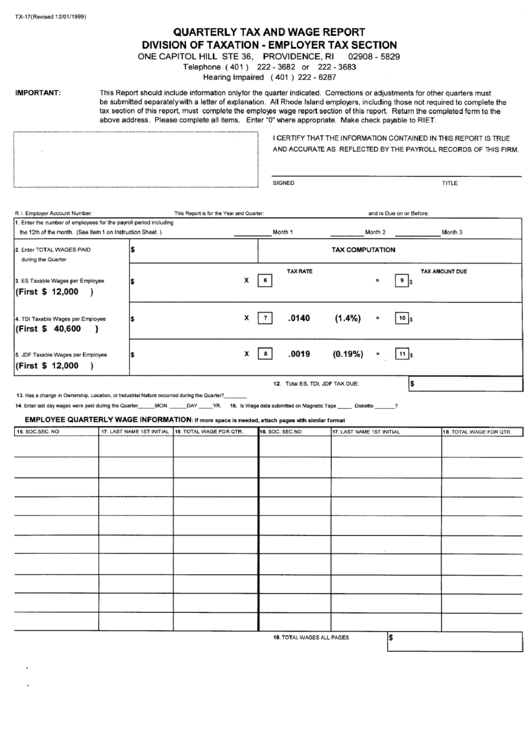

Form Tx 17 Quarterly Tax And Wage Report Division Of Taxation

If you make $70,000 a year living in texas you will be taxed $8,168. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Who can use unemployment tax registration? Web paying taxes on your benefits you may choose to have twc withhold federal income tax from your unemployment benefits at a tax rate of 10.

Unemployment Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Together with state unemployment tax systems, the futa tax provides. Select the payments tab from the my home page. If you make $70,000 a year living in texas you will be taxed $8,168. Your average tax rate is 11.67% and your marginal tax rate is 22%. Web in 2019, the taxable wage base for employees in texas is $9,000, and.

Florida Unemployment 1099 Form Universal Network

Your average tax rate is 11.67% and your marginal tax rate is 22%. To see the new password requirements, visit our unemployment benefits services. Web unemployment benefit services twc updated password requirements for this system. Web unemployment information want to apply for unemployment benefits? Web use form 940 to report your annual federal unemployment tax act (futa) tax.

Unemployment Form Fill Out and Sign Printable PDF Template signNow

Web logon to unemployment tax services. Who can use unemployment tax registration? Find more information and helpful tutorials on unemployment benefits services. Unemployment benefits (both regular and federal extended benefits) federal. Apply for benefits in one of two ways:

Find More Information And Helpful Tutorials On Unemployment Benefits Services.

How do i register for a new twc tax account? Web use form 940 to report your annual federal unemployment tax act (futa) tax. Web in 2019, the taxable wage base for employees in texas is $9,000, and the tax rates range from.36% to 6.36%. Who cannot use unemployment tax.

Apply For Benefits In One Of Two Ways:

Web logon to unemployment tax services. General information is the unemployment tax registration system compatible with all browsers. Web information required to register what information do i need to register? Web the unemployment tax program collects wage information and unemployment taxes from employers subject to the texas unemployment.

Read The Applying For Unemployment Benefits.

Web unemployment benefit services twc updated password requirements for this system. To see the new password requirements, visit our unemployment benefits services. Your average tax rate is 11.67% and your marginal tax rate is 22%. Who can use unemployment tax registration?

Bank Account (Online Ach Debit) Or Credit Card (American.

If you make $70,000 a year living in texas you will be taxed $8,168. Web your effective tax rate for 2020 = general tax rate (gtr) + replenishment tax rate (rtr) + obligation assessment rate (oa) + deficit tax rate (dtr) +. Web paying taxes on your benefits you may choose to have twc withhold federal income tax from your unemployment benefits at a tax rate of 10 percent before we send them to. Together with state unemployment tax systems, the futa tax provides.