Utah Solar Tax Credit Form

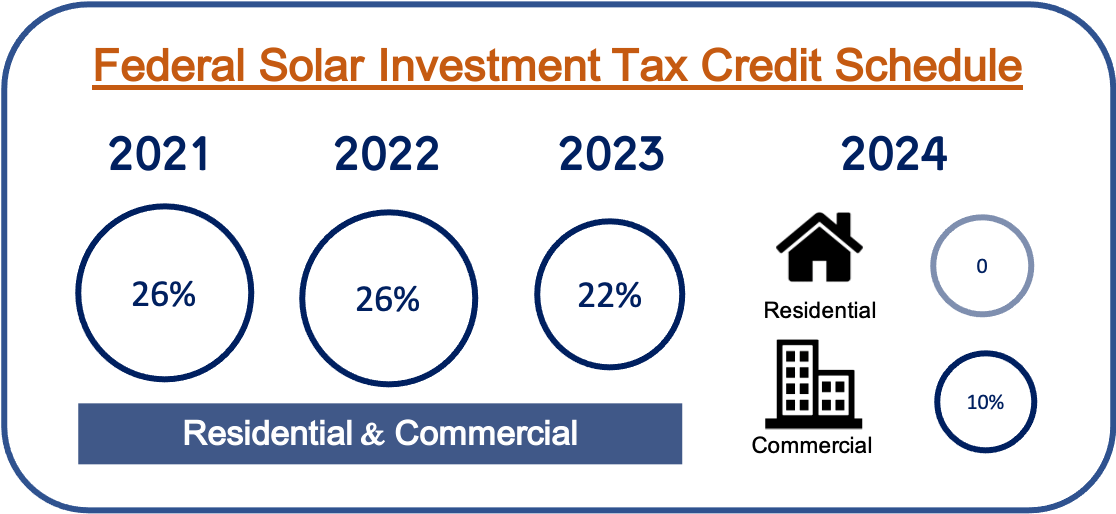

Utah Solar Tax Credit Form - The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: $2,000 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum. Web renewable energy systems tax credit application fee. Web if you install a solar panel system on your home in utah, the state government will give you a credit towards next year’s income taxes to reduce your solar costs. Web under the “amount” column, write in $1,600. Web (not utah) tax credit for certain people who work and have earned income. $1,600 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum credit. Web the ptc is calculated as $.0035 (.35¢) per kilowatt hour of electricity produced during the project's first 48 months of operation after the commercial operation date. Web home energy audits. We are accepting applications for the tax credit programs listed below.

The tax credit for a residential system is 25% of the purchase and installation costs up to a. This form is provided by the office of energy development if you qualify. We are accepting applications for the tax credit programs listed below. Web everyone in utah is eligible to take a personal tax credit when installing solar panels. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web to claim your solar tax credit in utah, you need to do 2 things: Web the utah solar tax credit (the renewable energy systems tax credit) covers up to 25% of the purchase and installation costs for residential solar pv projects. Arizona form 310 and instructions for completing can. Web the ptc is calculated as $.0035 (.35¢) per kilowatt hour of electricity produced during the project's first 48 months of operation after the commercial operation date. The credit can mean a larger refund or a reduction in your federal tax.

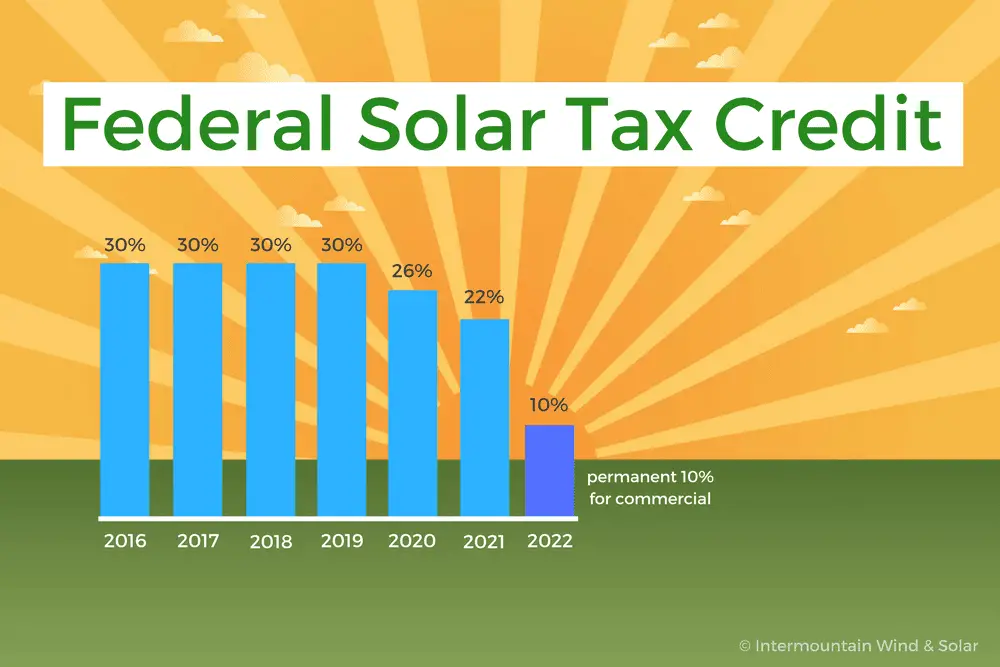

We are accepting applications for the tax credit programs listed below. Web if you install a solar panel system on your home in utah, the state government will give you a credit towards next year’s income taxes to reduce your solar costs. Web the utah solar tax credit (the renewable energy systems tax credit) covers up to 25% of the purchase and installation costs for residential solar pv projects. 30%, up to a lifetime. The utah solar tax credit is more favorable if you’re considering. When to file and pay you must fi le your return and pay any tax due: Web (not utah) tax credit for certain people who work and have earned income. The tax credit for a residential system is 25% of the purchase and installation costs up to a. Web 5 rows claiming the federal credit is simple and doesn’t take more than a few minutes for most. Do not complete part ii.

utah state solar tax credit Prodigy Blogosphere Pictures Gallery

Arizona form 310 and instructions for completing can. $2,000 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum. The credit can mean a larger refund or a reduction in your federal tax. Web everyone in utah is eligible to take a personal tax credit when.

2020 Guide to Utah Solar Tax Credits, Rebates, And Other Incentives

Web (not utah) tax credit for certain people who work and have earned income. $2,000 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum. Arizona form 310 and instructions for completing can. Web the utah solar tax credit (the renewable energy systems tax credit) covers.

Solar tax credit calculator ChayaAndreja

We are accepting applications for the tax credit programs listed below. $2,000 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum. Web 51 rows current forms. Web everyone in utah is eligible to take a personal tax credit when installing solar panels. Web if you.

2020 Guide to Utah Solar Tax Credits, Rebates, And Other Incentives

Web everyone in utah is eligible to take a personal tax credit when installing solar panels. We are accepting applications for the tax credit programs listed below. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web (not utah) tax credit for certain people who work and have earned income. Arizona form 310 and.

utah state solar tax credit Huber

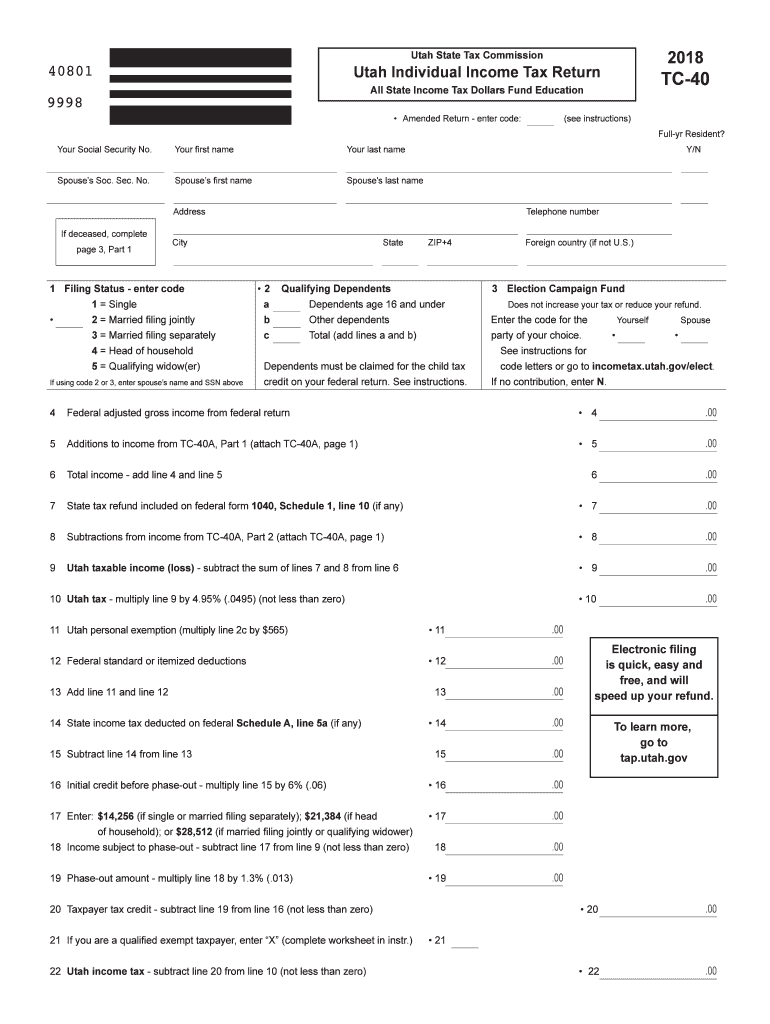

Web under the “amount” column, write in $1,600. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web arizona offers eligible solar owners a state income tax credit worth 25% of the total.

utah state solar tax credit Prodigy Blogosphere Pictures Gallery

Check the irs website at. Web home energy audits. Web under the “amount” column, write in $1,600. The tax credit for a residential system is 25% of the purchase and installation costs up to a. When to file and pay you must fi le your return and pay any tax due:

When Does Solar Tax Credit End (2022)

If you checked the “no” box, you cannot claim the energy efficient home improvement credit. 30%, up to a lifetime. Web home energy audits. Web to claim your solar tax credit in utah, you need to do 2 things: We are accepting applications for the tax credit programs listed below.

Tc 40 Fill Out and Sign Printable PDF Template signNow

Arizona form 310 and instructions for completing can. When to file and pay you must fi le your return and pay any tax due: The tax credit for a residential system is 25% of the purchase and installation costs up to a. Web if you install a solar panel system on your home in utah, the state government will give.

utah state solar tax credit Prodigy Blogosphere Pictures Gallery

Log in or click register in the upper right corner to get. $2,000 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum. If you checked the “no” box, you cannot claim the energy efficient home improvement credit. Web arizona offers eligible solar owners a state.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Do not complete part ii. You are not claiming a utah tax credit. Web everyone in utah is eligible to take a personal tax credit when installing solar panels. Check the irs website at. The credit can mean a larger refund or a reduction in your federal tax.

Web Arizona Offers Eligible Solar Owners A State Income Tax Credit Worth 25% Of The Total System Cost Up To A Maximum Of $1,000.

Web to claim your solar tax credit in utah, you need to do 2 things: Web the utah solar tax credit (the renewable energy systems tax credit) covers up to 25% of the purchase and installation costs for residential solar pv projects. $2,000 is the maximum amount of credit you can get for solar in the state of utah and all our systems qualify for the maximum. Arizona form 310 and instructions for completing can.

Check The Irs Website At.

Web 5 rows claiming the federal credit is simple and doesn’t take more than a few minutes for most. Web under the “amount” column, write in $1,600. Web welcome to the utah energy tax credit portal. Web (not utah) tax credit for certain people who work and have earned income.

Web Everyone In Utah Is Eligible To Take A Personal Tax Credit When Installing Solar Panels.

The credit can mean a larger refund or a reduction in your federal tax. When to file and pay you must fi le your return and pay any tax due: This form is provided by the office of energy development if you qualify. 30%, up to a lifetime.

Under The “Amount” Column, Write In $2,000 A.

Energy systems installation tax credit. Web renewable energy systems tax credit application fee. Web home energy audits. The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: