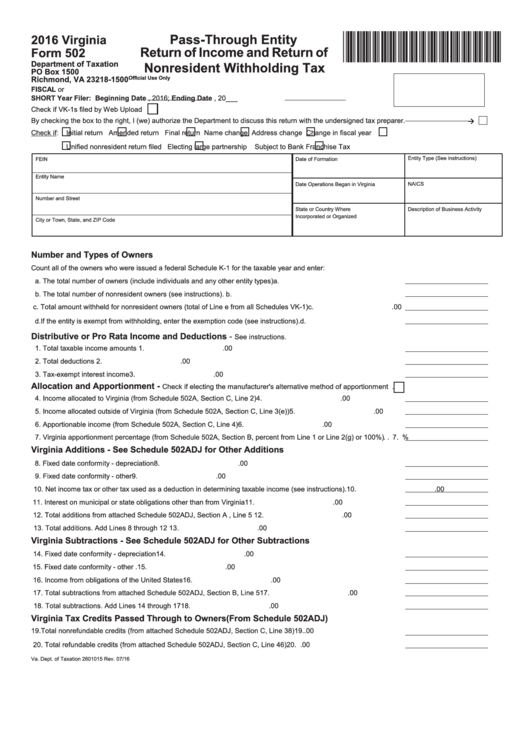

Virginia Form 502 Ptet

Virginia Form 502 Ptet - For taxable years beginning on and after january 1, 2021, but. Web form 502ptet is due on the 15 th day of the 4 th month following the close of the entity’s taxable year (for calendar year taxpayers, this would be due april 15,. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Go to turbotax turbotax community browse by topic news & announcements we'll help you get. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Web s corporations, partnerships, and limited liability companies. Web please enter your payment details below. Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed on form 502ptet. You can download or print.

You can download or print. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web form 502ptet and all corresponding schedules must be filed electronically. An owner of a pte may be an individual, a corporation, a partnership, or any other type. For taxable years beginning on and after january 1, 2021, but. If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must. Web if the electing pte’s total pte taxable income is zero or less, its owners are not entitled to any credits. Web the virginia form 502ptet is a new form for the 2022 tax year. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Go to turbotax turbotax community browse by topic news & announcements we'll help you get.

No paper submissions will be accepted. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: During the 2022 session, the virginia general assembly enacted house bill 1121 (2022 acts of assembly, chapter 690) and. You can download or print. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Web if the electing pte’s total pte taxable income is zero or less, its owners are not entitled to any credits. Payments must be made electronically by the filing. Instead, the electing pte may file form 502ptet to request a. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Go to turbotax turbotax community browse by topic news & announcements we'll help you get.

Fillable Virginia Form 502 PassThrough Entity Return Of And

Web virginia form 502 ptet why sign in to the community? Web form 502ptet and all corresponding schedules must be filed electronically. For taxable years beginning on and after january 1, 2021, but. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension to file form 502 is used. Payments must.

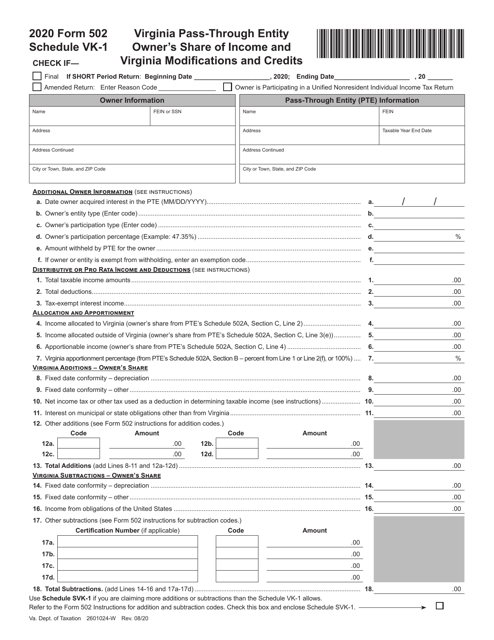

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

An owner of a pte may be an individual, a corporation, a partnership, or any other type. Web 2021 virginia form 502 department of taxation p.o. Web form 502ptet is due on the 15 th day of the 4 th month following the close of the entity’s taxable year (for calendar year taxpayers, this would be due april 15,. If.

Solved Virginia form 502 PTET issue Intuit Accountants Community

If your bank requires authorization for the department of taxation to debit a payment from your checking account, you must. Payments must be made electronically by the filing. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Web the guidelines confirm that nonresident withholding payments made before.

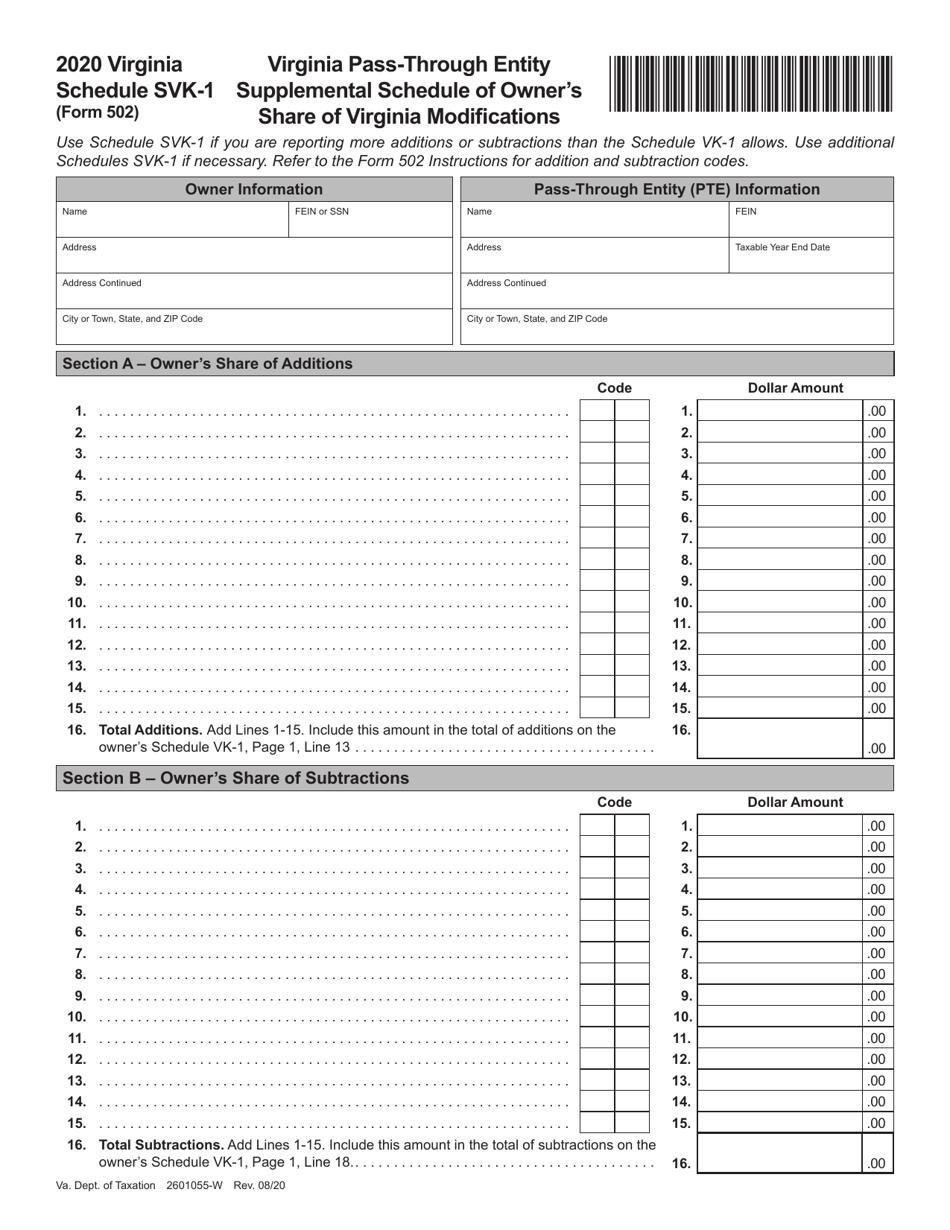

Form 502 Schedule SVK1 Download Fillable PDF or Fill Online Virginia

Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web form 502ptet is due on the 15 th day of the 4 th month following the close of the entity’s taxable year (for calendar year taxpayers, this would be due april 15,. Payments must.

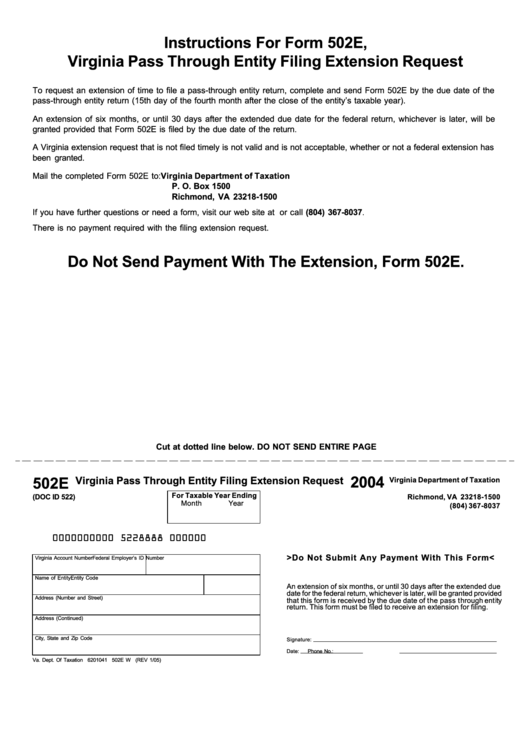

Form 502e Virginia Pass Through Entity Filing Extension Request

You can download or print. Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed on form 502ptet. (1) during tax year 2022, filing form 502v and submitting a. Web form 502ptet and all corresponding schedules must be filed electronically. For calendar year filers, the.

Ckht 502 Form 2019 / CA Olympic Archery In Schools New School

For taxable years beginning on and after january 1, 2021, but. Web the virginia form 502ptet is a new form for the 2022 tax year. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. For calendar year filers, the. Web and trusts that file.

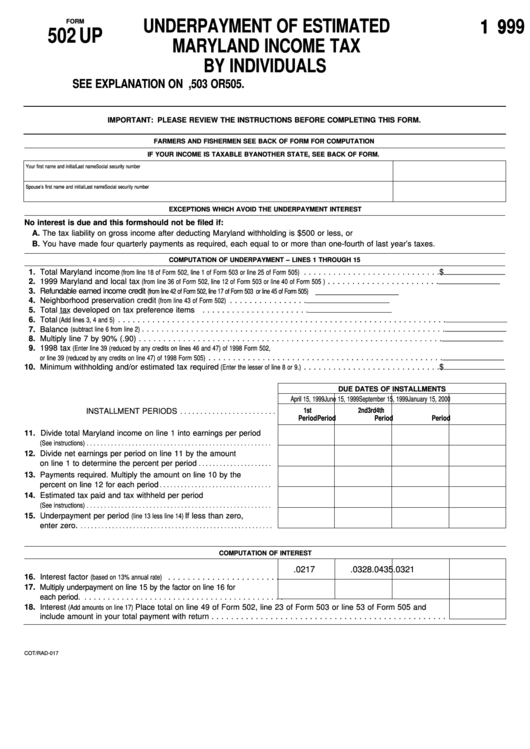

Maryland Tax Form 502

Web the virginia form 502ptet is a new form for the 2022 tax year. (1) during tax year 2022, filing form 502v and submitting a. During the 2022 session, the virginia general assembly enacted house bill 1121 (2022 acts of assembly, chapter 690) and. Web please enter your payment details below. Payments must be made electronically by the filing.

Form 502 Download Printable PDF or Fill Online Writ of Execution

Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension to file form 502 is used. During the 2022 session, the virginia general assembly enacted house bill 1121 (2022 acts of assembly, chapter 690).

Rajasthan PTET B.ED Topper List 2020 Cut Off Marks, Merit List

Web 2021 virginia form 502 department of taxation p.o. Web the virginia form 502ptet is a new form for the 2022 tax year. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Web s corporations, partnerships, and limited liability companies. (1) during tax year 2022, filing form 502v and submitting a.

Form 502 Up Underpayment Of Estimated Maryland Tax By

Web please enter your payment details below. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. For taxable years beginning on and after january 1, 2021, but. Web virginia form 502 ptet why sign in.

No Paper Submissions Will Be Accepted.

During the 2022 session, the virginia general assembly enacted house bill 1121 (2022 acts of assembly, chapter 690) and. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension to file form 502 is used. An owner of a pte may be an individual, a corporation, a partnership, or any other type. You can download or print.

For Taxable Years Beginning On And After January 1, 2021, But.

Go to turbotax turbotax community browse by topic news & announcements we'll help you get. Web virginia form 502 ptet why sign in to the community? For calendar year filers, the. Web form 502ptet and all corresponding schedules must be filed electronically.

Payments Must Be Made Electronically By The Filing.

Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Web s corporations, partnerships, and limited liability companies. Web if the electing pte’s total pte taxable income is zero or less, its owners are not entitled to any credits.

If Your Bank Requires Authorization For The Department Of Taxation To Debit A Payment From Your Checking Account, You Must.

Web form 502ptet is due on the 15 th day of the 4 th month following the close of the entity’s taxable year (for calendar year taxpayers, this would be due april 15,. Web please enter your payment details below. Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed on form 502ptet. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements.