Voluntary Payroll Deduction Form

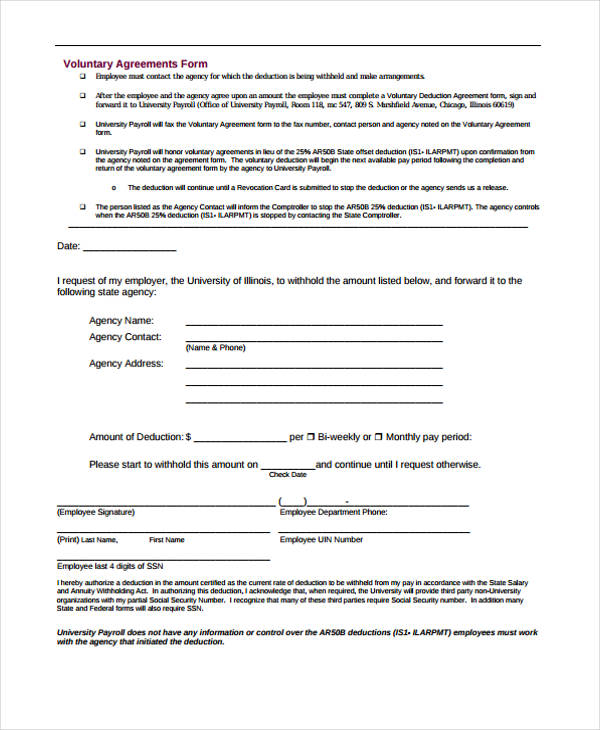

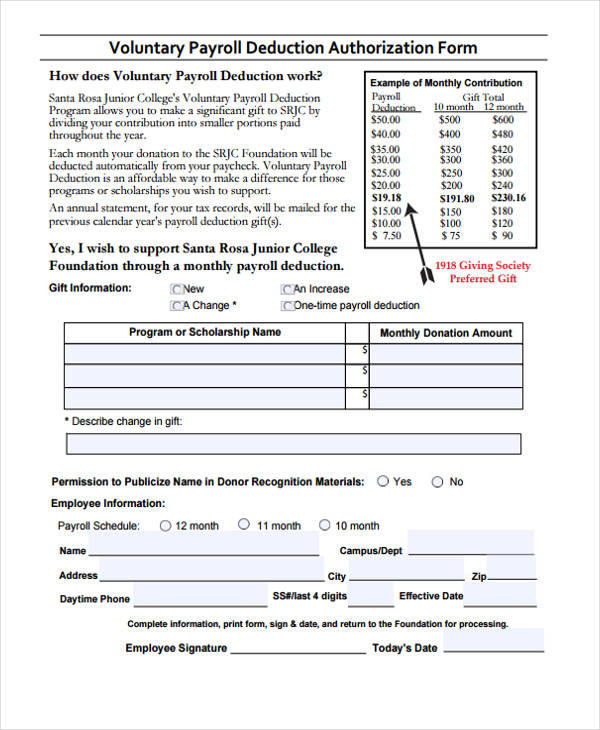

Voluntary Payroll Deduction Form - Ensure that the details you add to the voluntary payroll deduction authorization form. Say you make an annual salary of $100,000 and you have elected to make a voluntary deduction of 11% of your monthly earnings to a 401 (k). Voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and fica taxes. Web a payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. Turn on the wizard mode in the top toolbar to obtain extra pieces of advice. Web how to file a voluntary deduction agreement form step 1. These withholdings constitute the difference between gross pay and net pay and may include: (reason for the deduction) the sum of $ , beginning (amount) (date) and ending (date) until the total amount of $ (amount) has been deducted. Web the voluntary payroll deduction (vpd) program is a benefit offered to state and some educational employees so they may request payroll deductions from their paychecks to automatically be paid. Print the downloaded voluntary deduction agreement form after.

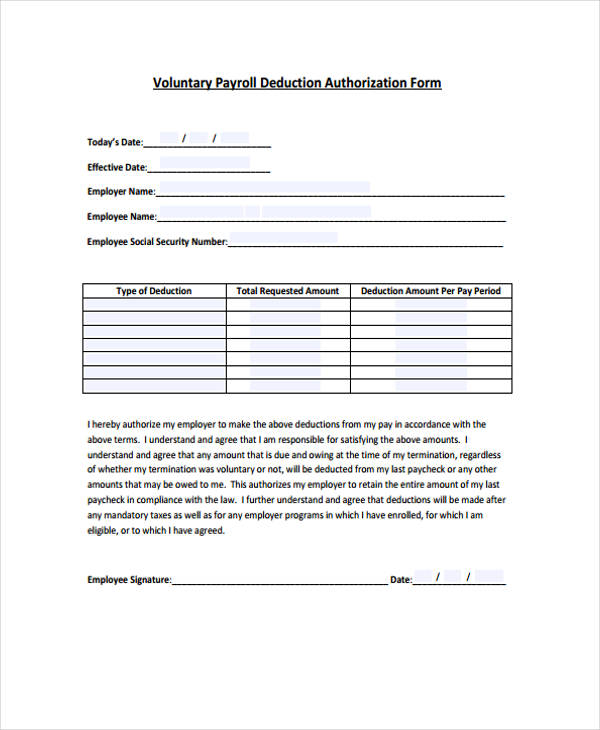

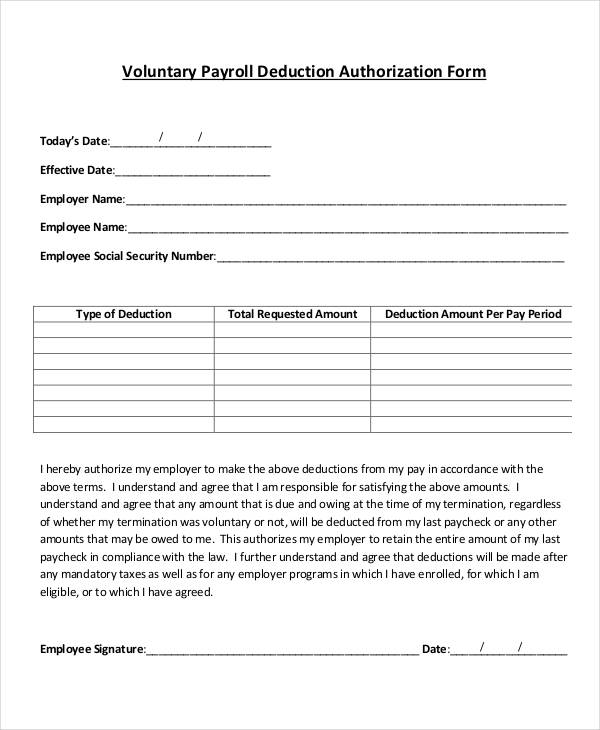

Web voluntary payroll deduction authorization form: Hit the get form button on this page. Web a payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. Turn on the wizard mode in the top toolbar to obtain extra pieces of advice. Say you make an annual salary of $100,000 and you have elected to make a voluntary deduction of 11% of your monthly earnings to a 401 (k). Web to change your tax withholding you should: This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Web there are two main types of payroll deductions: Mandatory deductions and voluntary deductions. We recommend downloading this file onto your computer.

Payroll tax deduction form dornc.com details file format pdf size: Web voluntary deductions charitable contributions credit union deductions deferred compensation plans employee organization membership fees insurance plans permanent life insurance premium deductions purchasing retirement service credit savings bonds purchases supplemental optional benefits programs texas prepaid higher education. These withholdings constitute the difference between gross pay and net pay and may include: Web to change your tax withholding you should: Web irs payroll deduction form osc.nc.gov details file format pdf size: Examples are group life insurance, healthcare and/or other benefit deductions, credit union deductions, etc. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Print the voluntary deduction agreement form. (taxpayer name and address) contact person’s name. Mandatory deductions are required by law and cannot be opted out of by the employee.

Voluntary Payroll Deduction Form How to create a Voluntary Payroll

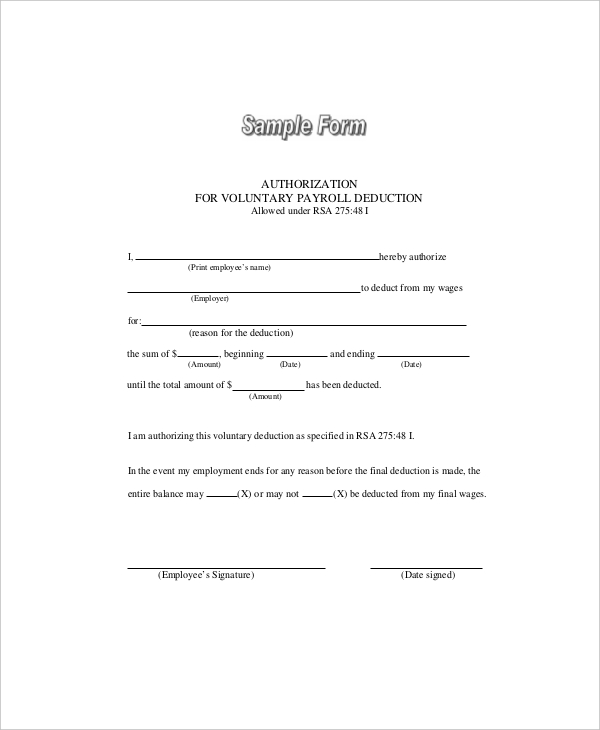

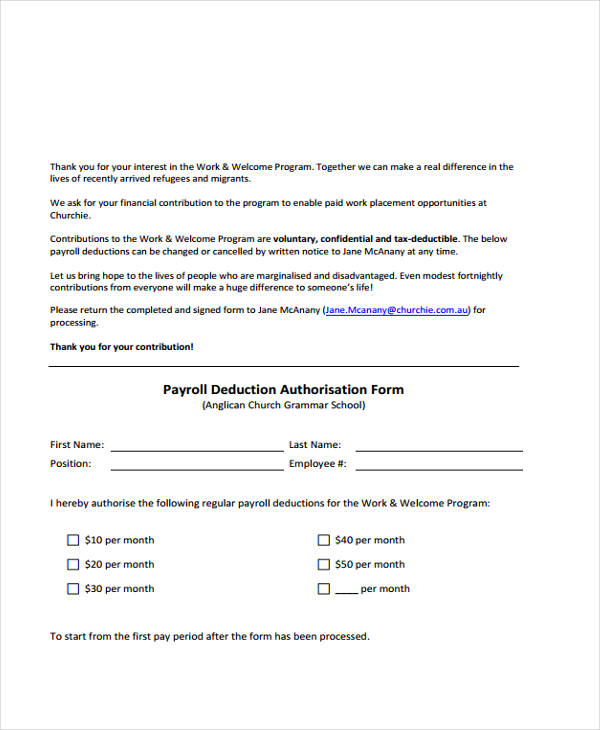

The payroll department processes a variety of voluntary deductions for permanent employees. Web standard procedure requires the employee to sign off on the deduction in an authorization form, also called a voluntary payroll deduction form. In the event my employment ends for any reason before the final deduction is made, the entire balance may or may not be deducted from.

FREE 12+ Sample Payroll Deduction Forms in PDF MS Word Excel

In the event my employment ends for any reason before the final deduction is made, the entire balance may or may not be deducted from my final wages. _____ please return completed form to kymberly group payroll solutions, inc. Web voluntary deductions are amounts which an employee has elected to have subtracted from gross pay. (reason for the deduction) the.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. _____ please return completed form to kymberly group payroll solutions, inc. Voluntary payroll deduction authorization form. 2 mb download by signing this form, an employee gives you the right to make deductions on their payments. Web how to fill out and.

Download Sample Authorization for Voluntary Payroll Deduction Form for

Voluntary payroll deduction authorization form. Fill out each fillable field. Click the get form button to begin editing. Web the voluntary payroll deduction (vpd) program is a benefit offered to state and some educational employees so they may request payroll deductions from their paychecks to automatically be paid. Web my termination was voluntary or not, will be deducted from my.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Fill & download for free get form download the form how to edit your voluntary payroll deduction authorization form online lightning fast follow these steps to get your voluntary payroll deduction authorization form edited for the perfect workflow: Web there are two types of deductions: Adobe acrobat (.pdf) this document has been certified by a professional. Web my termination was.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Web voluntary payroll deduction authorization form. _____ please return completed form to kymberly group payroll solutions, inc. Select the get form button on this. You will go to our pdf editor. This is a digital download (485.27 kb) language:

Payroll Deduction Form Template 14+ Sample, Example, Format

Say you make an annual salary of $100,000 and you have elected to make a voluntary deduction of 11% of your monthly earnings to a 401 (k). Download a voluntary deduction agreement form. Web my termination was voluntary or not, will be deducted from my last paycheck. Income tax social security tax 401 (k) contributions wage garnishments 1 child support.

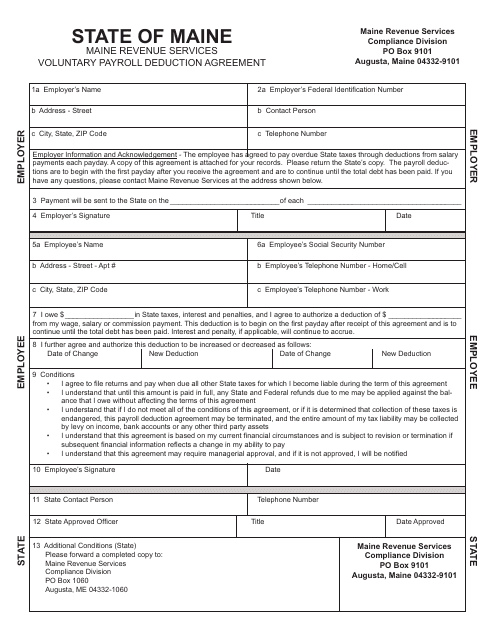

Maine Voluntary Payroll Deduction Agreement Form Download Fillable PDF

Voluntary payroll deduction authorization form. (reason for the deduction) the sum of $ , beginning (amount) (date) and ending (date) until the total amount of $ (amount) has been deducted. Print the voluntary deduction agreement form. They agree that they have given you the right to reduce their payment by a certain amount. We recommend downloading this file onto your.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Web download voluntary payroll deduction form. Web voluntary payroll deduction authorization form. Make an additional or estimated tax payment to the irs before the end of the. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Post tax deductions are withheld after all taxes have been calculated and withheld.

Payroll Deduction Authorization Form Template charlotte clergy coalition

(employer name and address) regarding: Some of these deductions are “tax deferred” which means they are exempt from federal and state withholding taxes. Print the downloaded voluntary deduction agreement form after. Select the get form button on this. Income tax social security tax 401 (k) contributions wage garnishments 1 child support payments

Web Download Voluntary Payroll Deduction Form.

Without having an employer match, your annual. Fill out each fillable field. Print the voluntary deduction agreement form. Fill & download for free download the form how to edit your voluntary payroll deduction online easily and quickly follow these steps to get your voluntary payroll deduction edited with ease:

Web Authorization For Voluntary Payroll Deduction Allowed Under Rsa 275:48 I I, (Print Employee’s Name) Hereby Authorize (Employer) To Deduct From My Wages For:

This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Mandatory deductions and voluntary deductions. Voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and fica taxes.

Hit The Get Form Button On This Page.

(employer name and address) regarding: Web irs payroll deduction form osc.nc.gov details file format pdf size: Web voluntary deductions charitable contributions credit union deductions deferred compensation plans employee organization membership fees insurance plans permanent life insurance premium deductions purchasing retirement service credit savings bonds purchases supplemental optional benefits programs texas prepaid higher education. (reason for the deduction) the sum of $ , beginning (amount) (date) and ending (date) until the total amount of $ (amount) has been deducted.

Web Voluntary Payroll Deduction Authorization Form.

Alert groups resources contact last modified on may 02, 2023 back to top back to top In the event my employment ends for any reason before the final deduction is made, the entire balance may or may not be deducted from my final wages. (taxpayer name and address) contact person’s name. Web there are two main types of payroll deductions: