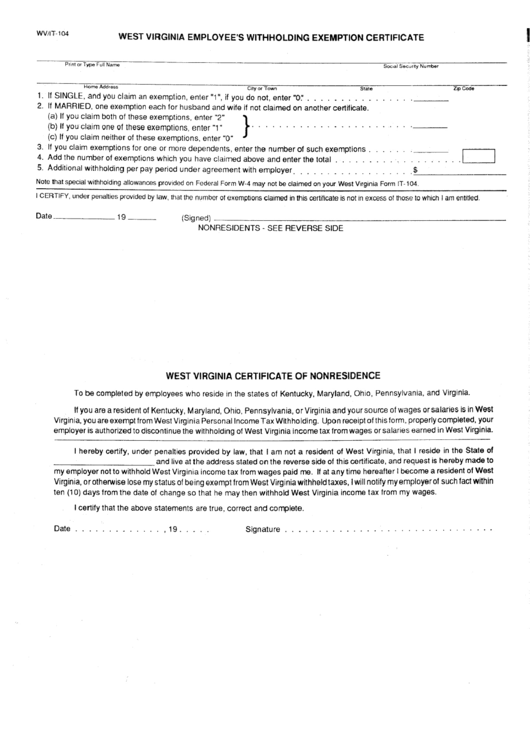

West Virginia Withholding Form

West Virginia Withholding Form - Web doing business in west virginia. West virginia secretary of state. Web july 20, 2023. Enter the amount you want withheld on line 6. Add lines 10 through 13. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor. Web tax information and assistance: Effective january 1, 2019, taxpayers who had annual remittance of any single. Snohomish county tax preparer pleads guilty to assisting in the. Web upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of west virginia income tax from your wages or salaries earned in.

Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web doing business in west virginia. West virginia secretary of state. Web tax services one waterfront place, po box 6005, morgantown, wv 26506 [email protected] operating hours: Web when requesting withholding from pension and annuity payments you must present this completed form to the payor. Department of commerce business and workforce. Web july 20, 2023. Enter the amount you want withheld on line 6. Web striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is to diligently collect and. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor.

Department of commerce business and workforce. To 4:45 p.m., closed on. Snohomish county tax preparer pleads guilty to assisting in the. Add lines 10 through 13. Enter the amount you want withheld on line 6. Web salaries, you are exempt from west virginia personal income tax withholding. Web july 20, 2023. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor. Enter the amount you want withheld on line 6. Effective january 1, 2019, taxpayers who had annual remittance of any single.

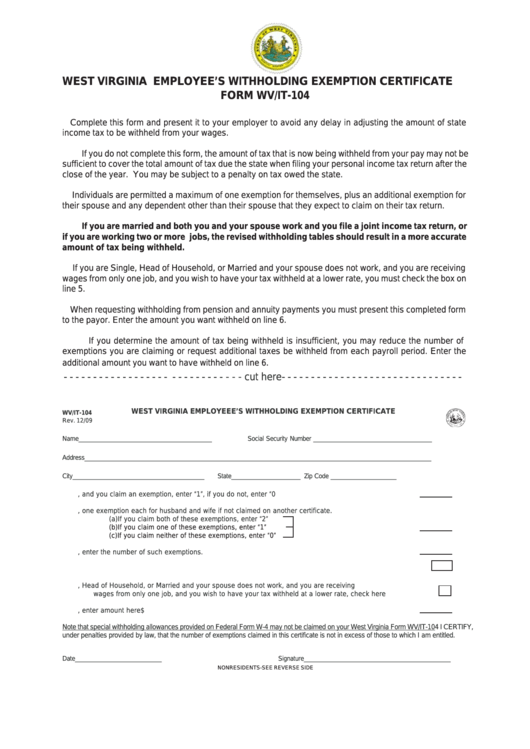

Wv Withholding Form Employee 2023

Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web july 20, 2023. Effective january 1, 2019, taxpayers who had annual remittance of any single. West virginia secretary of state. Web upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of west virginia income tax from your wages or salaries earned.

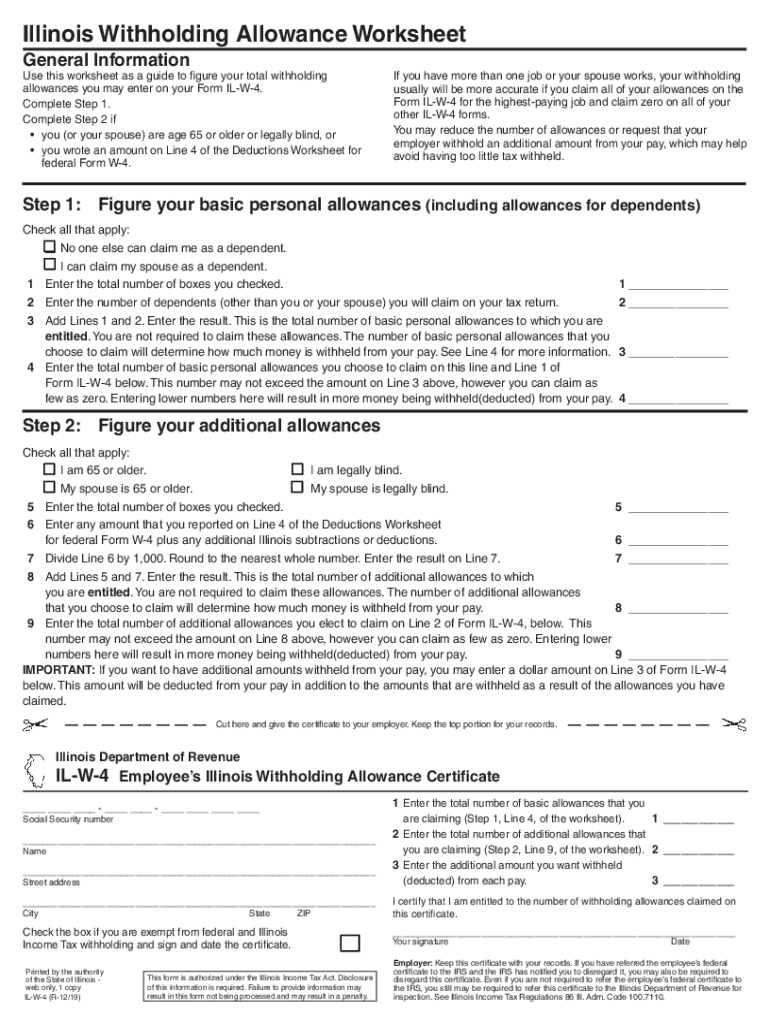

W2 State Withholding Universal Network

Web tax services one waterfront place, po box 6005, morgantown, wv 26506 [email protected] operating hours: Effective january 1, 2019, taxpayers who had annual remittance of any single. Enter the amount you want withheld on line 6. To 4:45 p.m., closed on. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor.

West Virginia Employers Withholding Tax Tables 2017 Awesome Home

Web doing business in west virginia. Web july 20, 2023. Check if no use tax due. Web tax information and assistance: Snohomish county tax preparer pleads guilty to assisting in the.

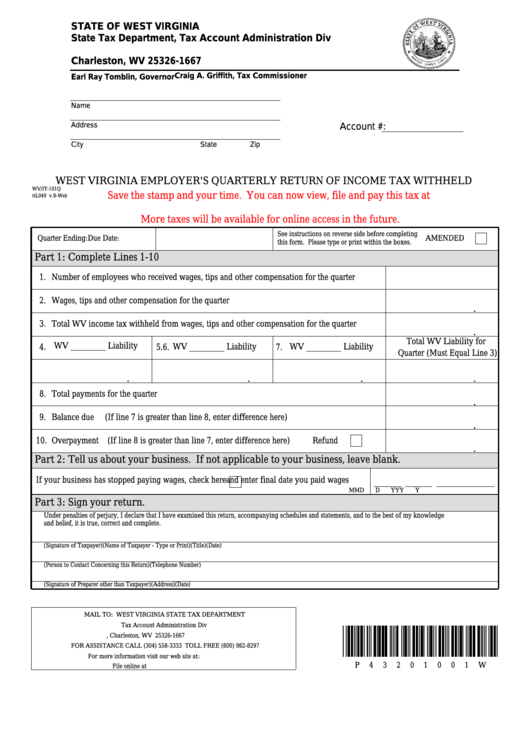

Form Wv/it101q West Virginia Employer'S Quarterly Return Of

Enter the amount you want withheld on line 6. Web doing business in west virginia. Check if no use tax due. Department of commerce business and workforce. Enter the amount you want withheld on line 6.

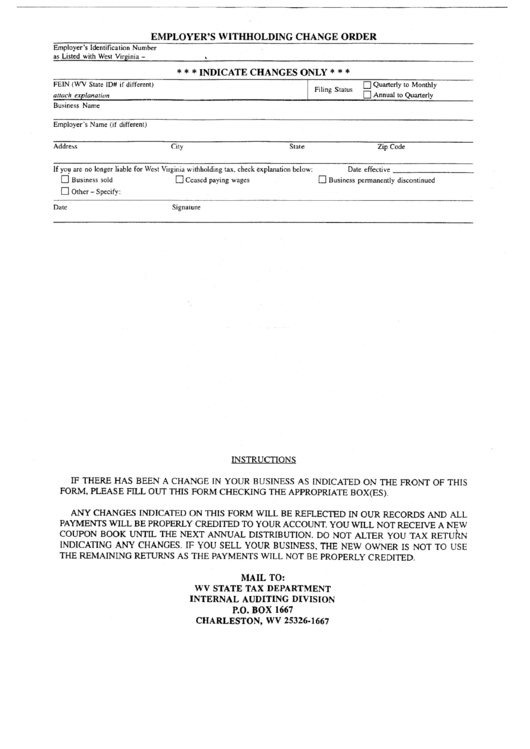

Employer'S Withholding Change Order Form State Of West Virginia

Web salaries, you are exempt from west virginia personal income tax withholding. 12/20 west virginia certificate of nonresidence this form is to be completed by employees who reside in kentucky, maryland, ohio, pennsylvania,. West virginia secretary of state. Web doing business in west virginia. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement.

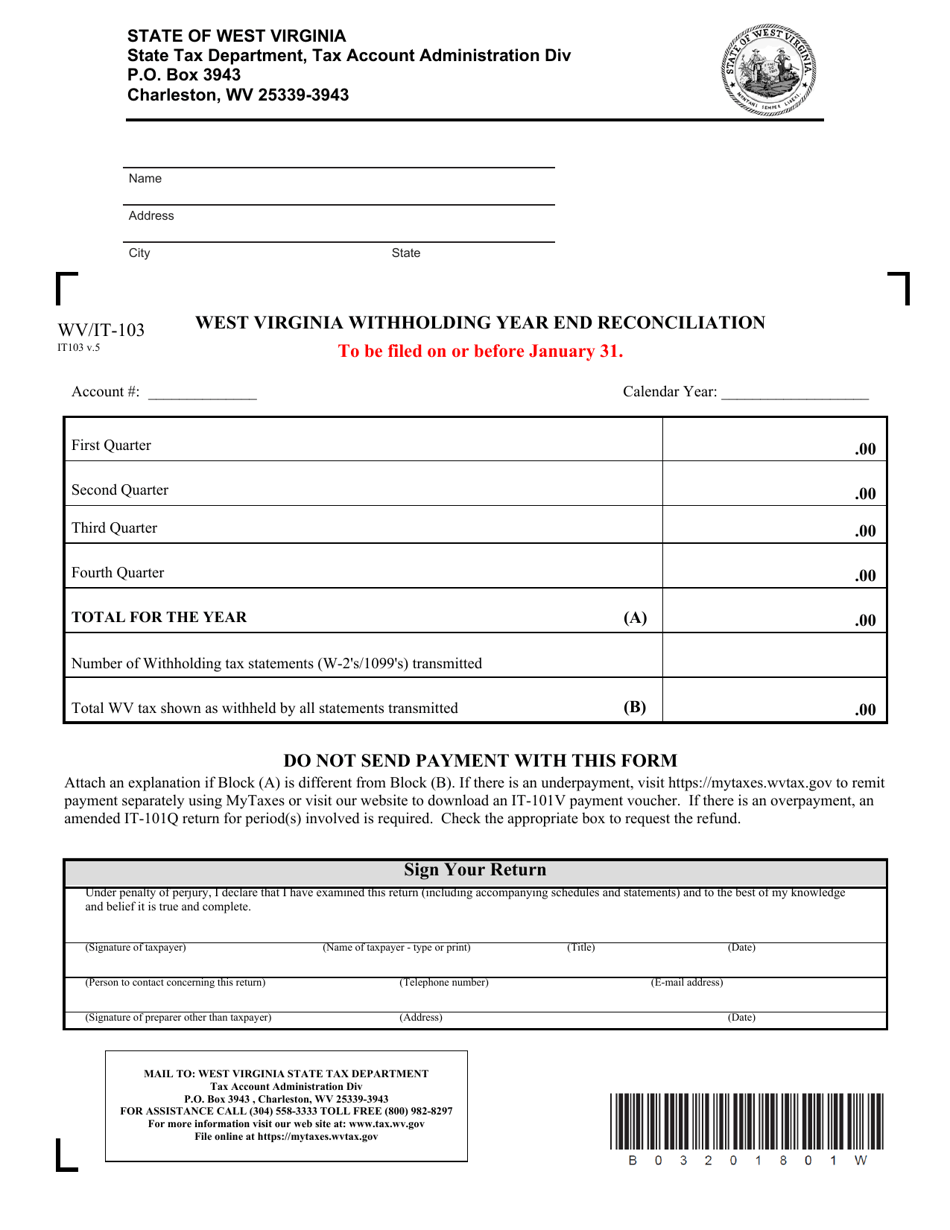

Form WV/IT103 Download Printable PDF or Fill Online West Virginia

Add lines 10 through 13. Web july 20, 2023. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor. Check if no use tax due. Effective january 1, 2019, taxpayers who had annual remittance of any single.

Form Wv/it104 West Virginia Employee'S Withholding Exemption

Check if no use tax due. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor. Enter the amount you want withheld on line 6. Web tax information and assistance: Web doing business in west virginia.

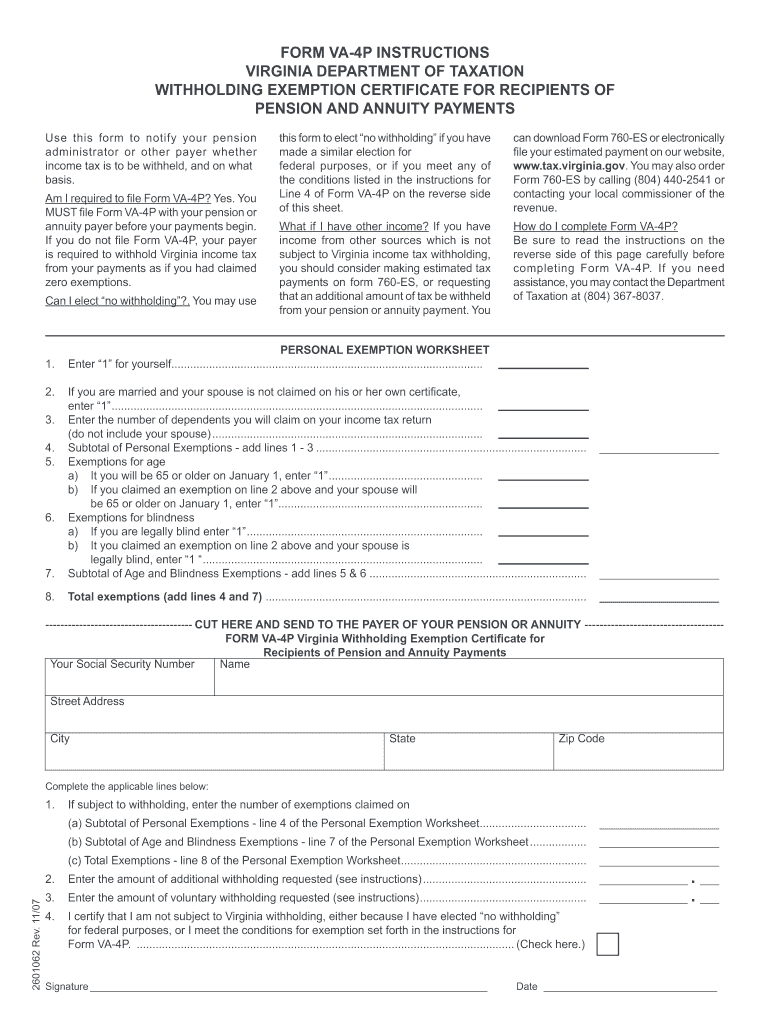

Virginia Employee Withholding Form 2022 2023

Department of commerce business and workforce. Add lines 10 through 13. Enter the amount you want withheld on line 6. Web tax services one waterfront place, po box 6005, morgantown, wv 26506 [email protected] operating hours: Enter the amount you want withheld on line 6.

20112022 Form VA DoT VA4 Fill Online, Printable, Fillable, Blank

Enter the amount you want withheld on line 6. Web striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is to diligently collect and. Web salaries, you are exempt from west virginia personal income tax withholding. Web tax information and assistance: Web when requesting withholding.

West Virginia Employee Tax Withholding Form 2023

Effective january 1, 2019, taxpayers who had annual remittance of any single. Web striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is to diligently collect and. Web july 20, 2023. Web upon receipt of this form, properly completed, your employer is authorized to discontinue.

Web Tax Services One Waterfront Place, Po Box 6005, Morgantown, Wv 26506 [email protected] Operating Hours:

West virginia secretary of state. Department of commerce business and workforce. Check if no use tax due. Snohomish county tax preparer pleads guilty to assisting in the.

12/20 West Virginia Certificate Of Nonresidence This Form Is To Be Completed By Employees Who Reside In Kentucky, Maryland, Ohio, Pennsylvania,.

Web upon receipt of this form, properly completed, your employer is authorized to discontinue the withholding of west virginia income tax from your wages or salaries earned in. Web when requesting withholding from pension and annuity payments you must present this completed form to the payor. Web july 20, 2023. Web salaries, you are exempt from west virginia personal income tax withholding.

Web When Requesting Withholding From Pension And Annuity Payments You Must Present This Completed Form To The Payor.

Web doing business in west virginia. Enter the amount you want withheld on line 6. Web striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's primary mission is to diligently collect and. Web tax information and assistance:

To 4:45 P.m., Closed On.

Enter the amount you want withheld on line 6. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Add lines 10 through 13. Effective january 1, 2019, taxpayers who had annual remittance of any single.