What Is 1040 Nr Form

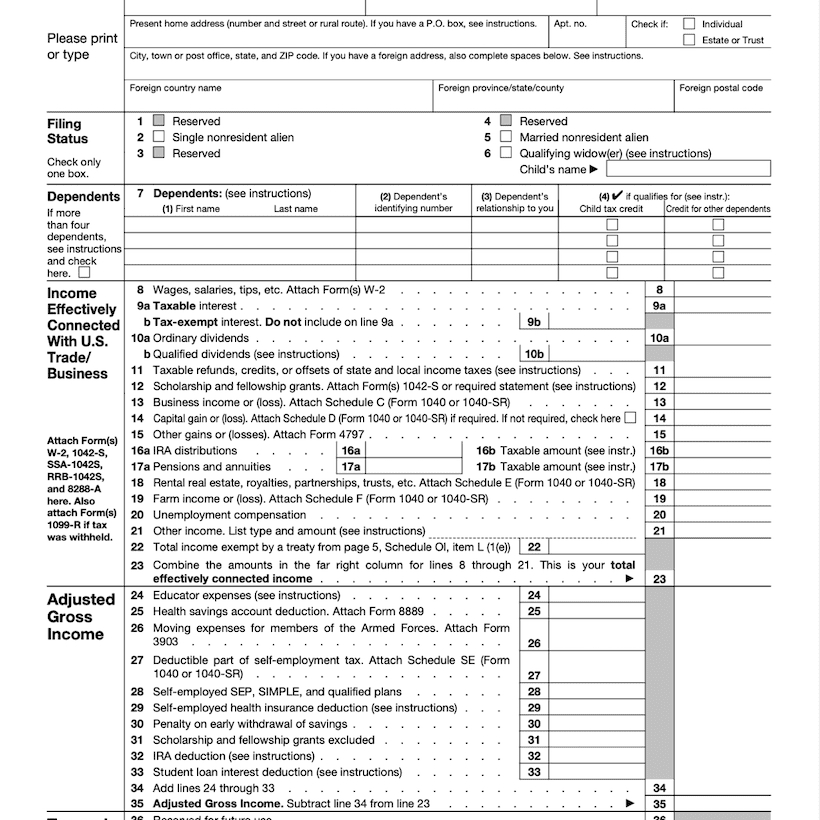

What Is 1040 Nr Form - Sourced income to report — this includes expatriates as well. On the last day of the tax year. It determines how much you owe the irs or if you're due for a tax refund. Nonresident if they do not have a green card or do not satisfy the substantial presence test. Nonresident alien income tax return 2020 department of the treasury—internal revenue service (99) omb no. See more details on nonresident aliens and taxes. Owner, on or before the 15th day of the 3rd month after the end of the trust’s tax year. Nonresident alien income tax return) is the income tax return form that nonresident aliens in the u.s. Married filing jointly generally, you cannot file as married filing jointly if either spouse was a nonresident alien at any time during the tax year. Filing status check only one box.

Resident during the year and who is a resident of the u.s. On the last day of the tax year. Have to file if they had any income from u.s. Web form 1040nr (u.s. Department of the treasury—internal revenue service. It determines how much you owe the irs or if you're due for a tax refund. Single married filing separately (mfs) qualifying widow(er) (qw) Attach a statement to your return to show the income for the part of the year you. Nonresident alien income tax return. Married filing separately (mfs) (formerly married) qualifying widow(er) (qw)

A taxpayer is considered a u.s. 31, 2022, or other tax year beginning, 2022, ending. Nonresident if they do not have a green card or do not satisfy the substantial presence test. Were a nonresident alien engaged in a trade or business in the united states. Persons, but still have certain u.s. These are itemized deductions such as state and local taxes you paid and gifts made to us charities. You do not claim any tax credits. This form is for taxpayers who need to make amendments to their tax return after previously filing a form 1040. Have to file if they had any income from u.s. To explain it simply, irs form 1040nr is a version of a tax return for nonresident aliens with an american earned income.

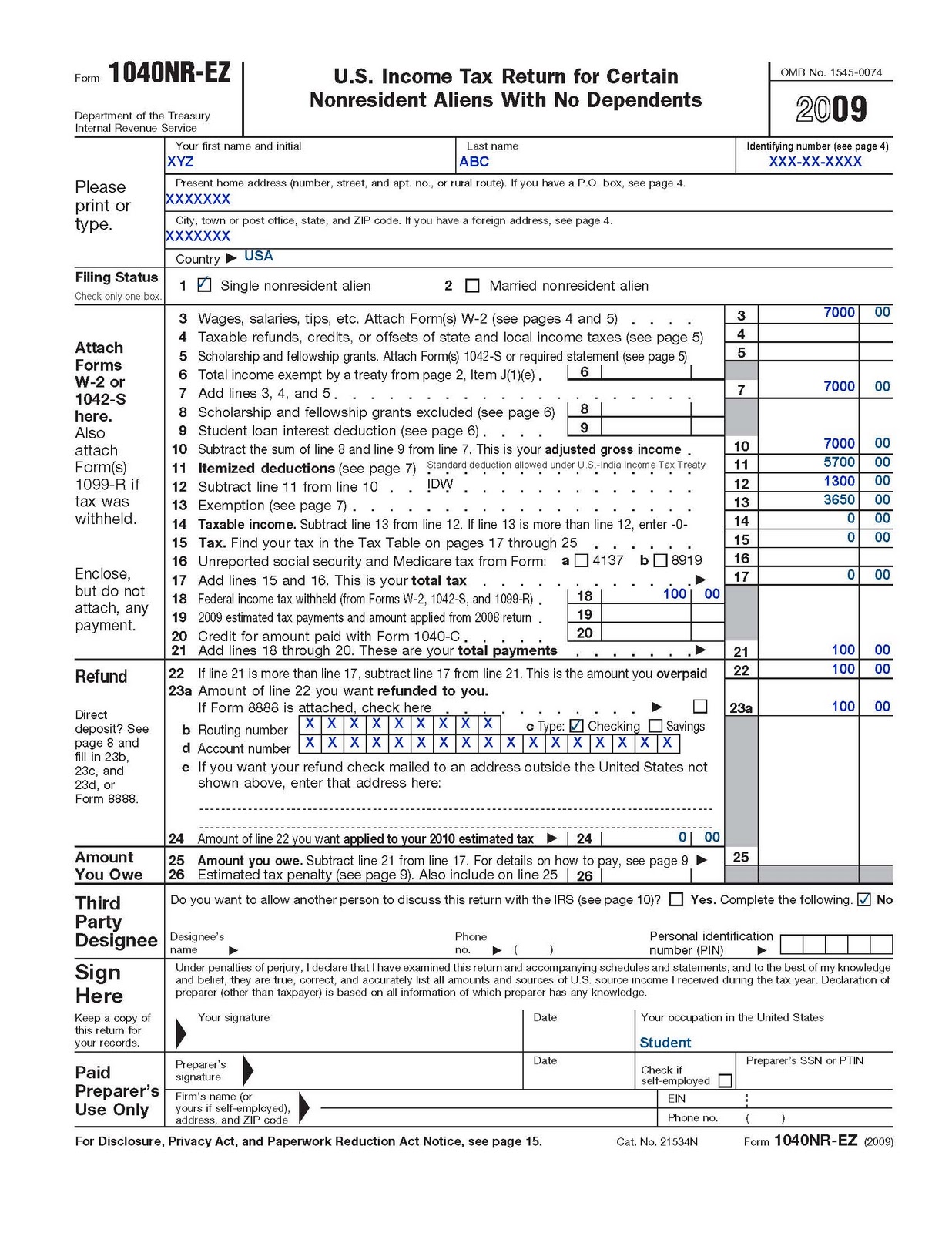

Form 1040NREZ U.S. Tax Return Form for Certain Nonresident

On the last day of the tax year. This form is for taxpayers who need to make amendments to their tax return after previously filing a form 1040. Attach a statement to your return to show the income for the part of the year you. The form calculates the total taxable income of the taxpayer and determines how much is.

1040 Nr Ex Form 1040 Form Printable

Tax guide for aliens, nonresident aliens cannot claim the standard deduction. On the last day of the tax year. Married filing jointly generally, you cannot file as married filing jointly if either spouse was a nonresident alien at any time during the tax year. Owner, on or before the 15th day of the 3rd month after the end of the.

Form 1040NR U.S. Nonresident Alien Tax Return Definition

Filing status check only one box. Web form 1040 is a federal tax form that us taxpayers use to report their annual income tax returns. Nonresident if they do not have a green card or do not satisfy the substantial presence test. Nonresident alien income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web forms 1040.

Form 1040NR U.S. Nonresident Alien Tax Return Form (2014

Tax guide for aliens, nonresident aliens cannot claim the standard deduction. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government. Nonresident alien income tax return) is the income tax return form that nonresident aliens in the u.s. Per irs publication 519 u.s. Filing your us.

Share 4 Fun Sample Federal tax returns for students on F1/OPT (1040NREZ)

Irs use only—do not write or staple in this space. Filing your us nonresident alien tax return And earn income in the country each year. Resident during the year and who is a resident of the u.s. If you are claiming a net qualified disaster loss on form 4684, see instructions for line 7.

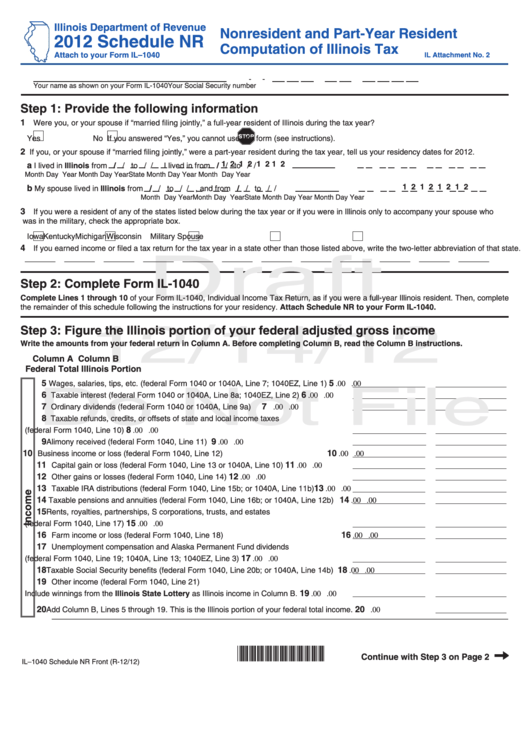

Form Il1040 Draft Schedule Nr Nonresident And PartYear Resident

Tax guide for aliens, nonresident aliens cannot claim the standard deduction. If you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Nonresident alien income tax return (99) 2021 omb no. Sourced income to report — this includes expatriates as well. Have to file if they had any income from u.s.

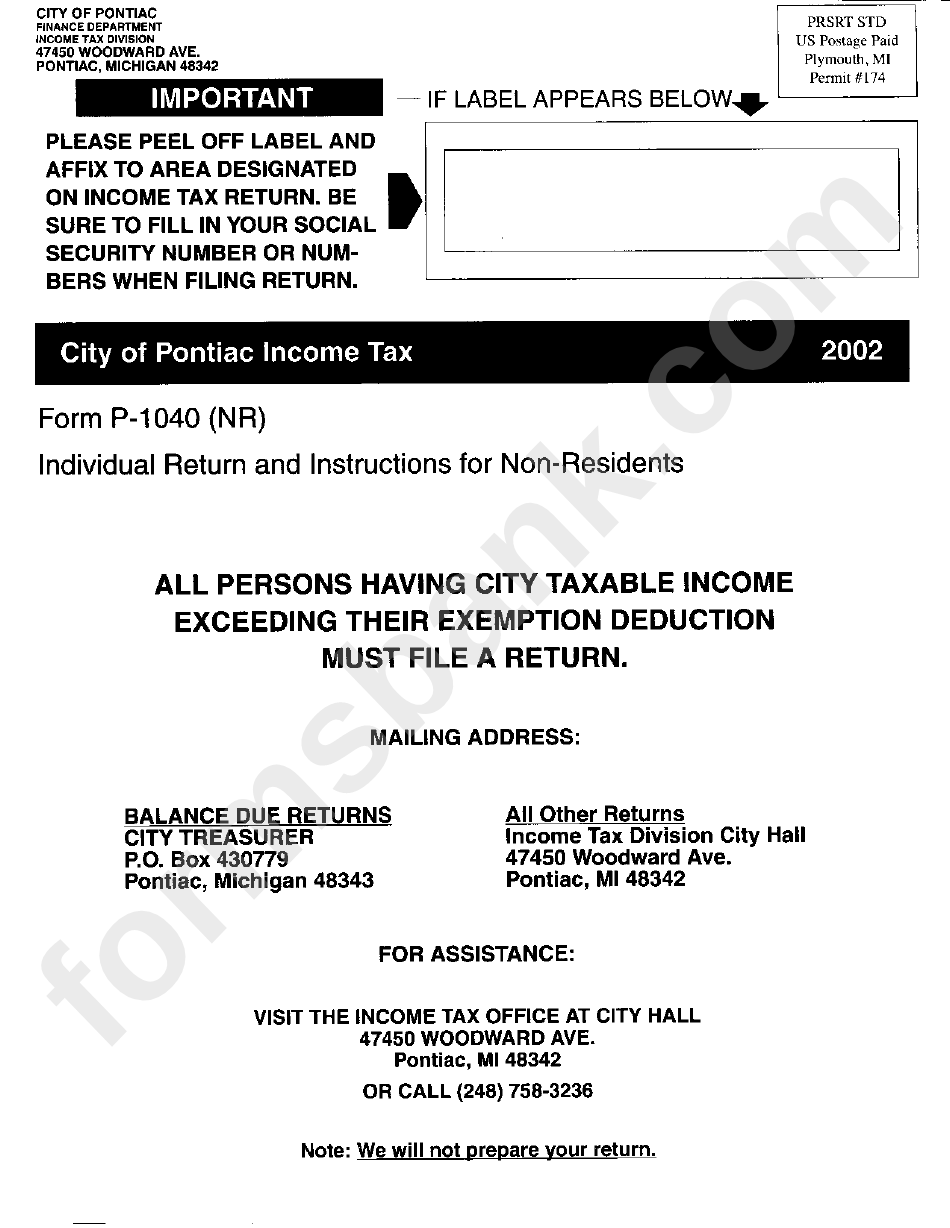

Form P1040(Nr) Individual Return Instructions For NonResidents

Nonresident alien income tax return (99) 2021 omb no. Filing status check only one box. If you are claiming a net qualified disaster loss on form 4684, see instructions for line 7. Nonresident alien income tax return) is the income tax return form that nonresident aliens in the u.s. The only exclusion you can take is the exclusion for scholarship.

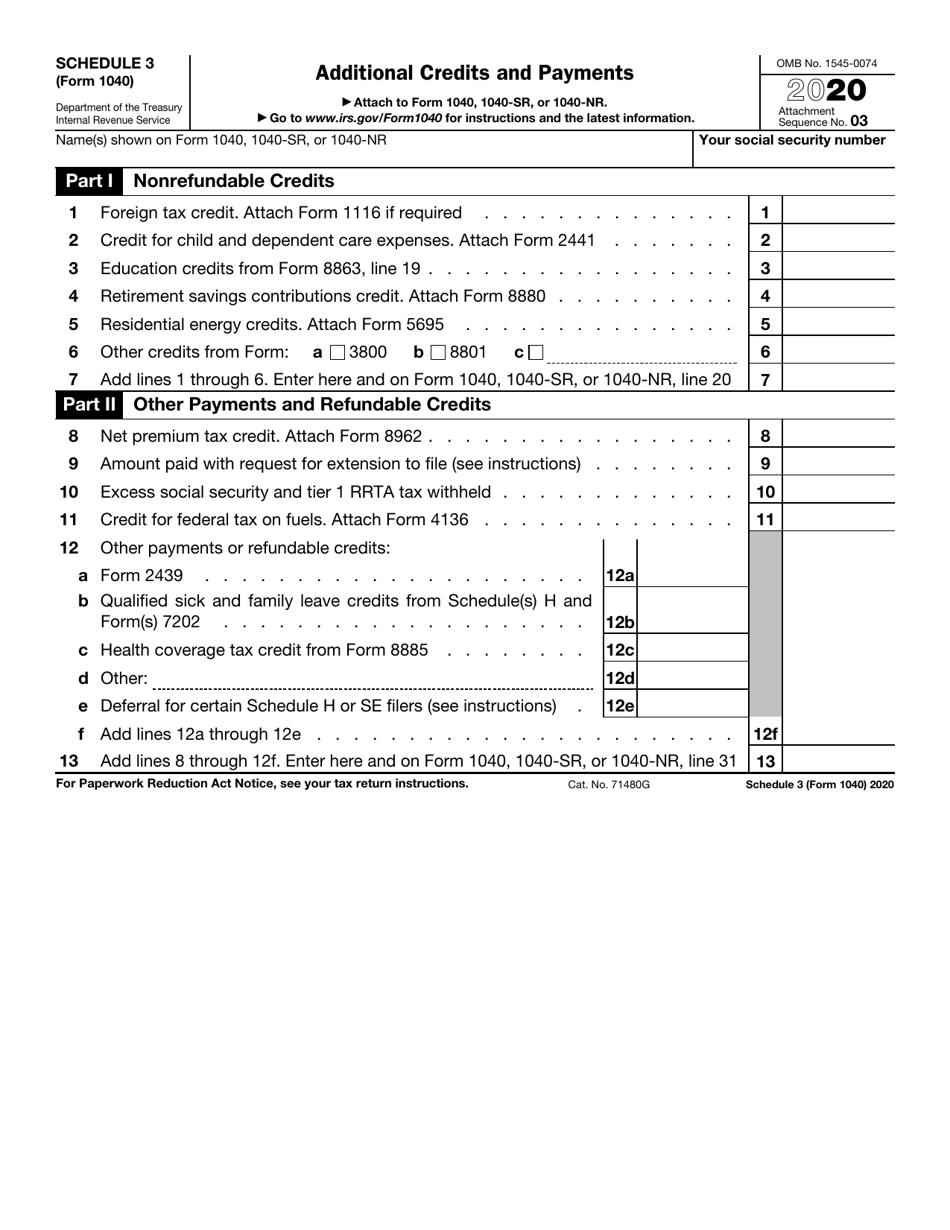

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

Fillable forms 1040 1040 vs 1040nr Web you must file form 1040, u.s. Irs use only—do not write or staple in this space. Single, married filing separately (mfs), or qualifying surviving spouse (qss). Irs use only—do not write or staple in this space.

Electronic IRS Form 1040NR 2018 2019 Printable PDF Sample

Filing status check only one box. Election to be taxed as a resident alien Tax guide for aliens, nonresident aliens cannot claim the standard deduction. But it also comes with three schedules as follows: Nonresident alien income tax return 2020 department of the treasury—internal revenue service (99) omb no.

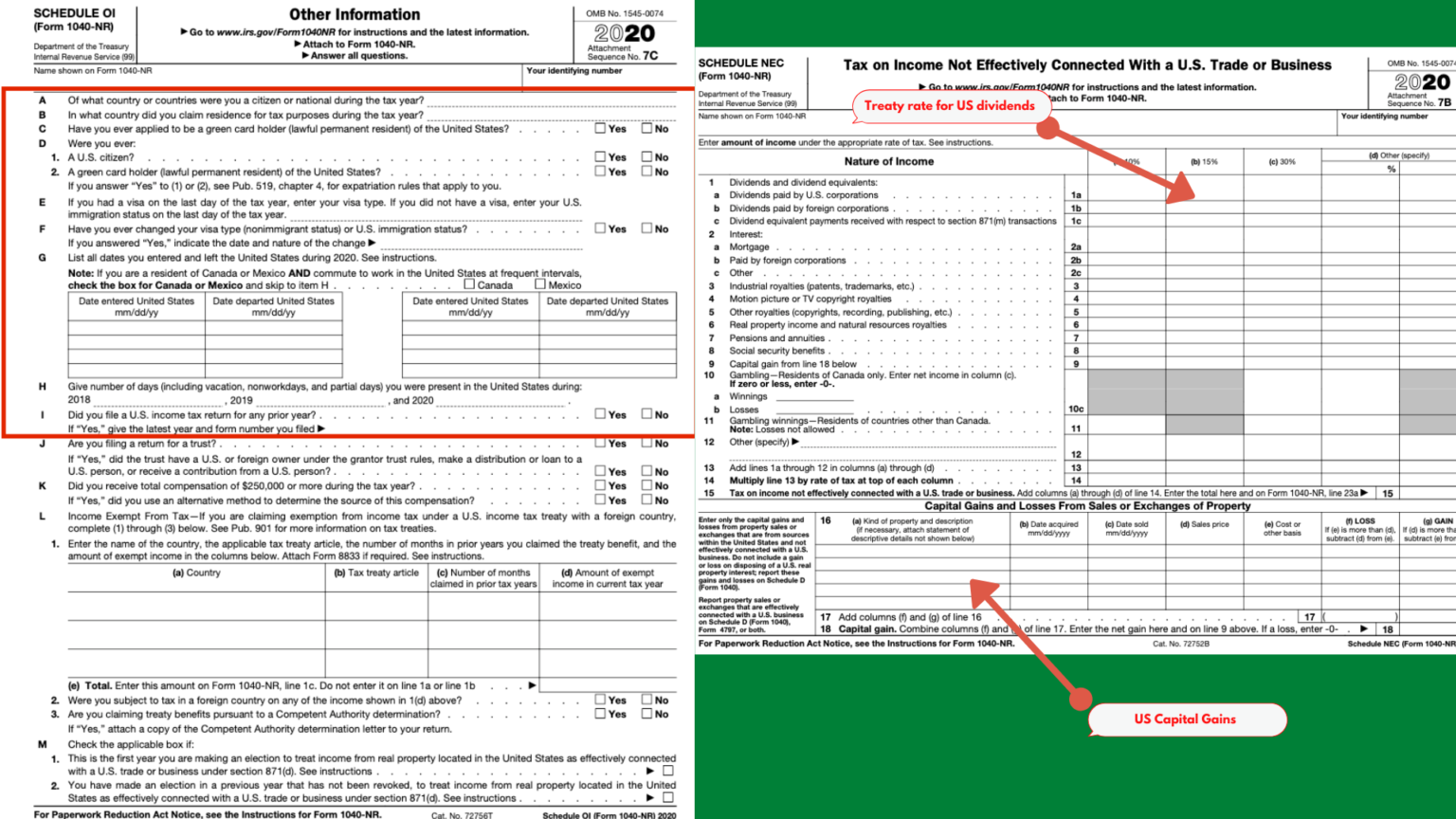

NonResident US Tax Return Form 1040NR Things you must know

These are itemized deductions such as state and local taxes you paid and gifts made to us charities. Nonresident if they do not have a green card or do not satisfy the substantial presence test. Nonresident alien income tax return (99) 2021 omb no. Only the schedules that ae right for you! And earn income in the country each year.

Single, Married Filing Separately (Mfs), Or Qualifying Surviving Spouse (Qss).

Irs use only—do not write or staple in this space. It determines how much you owe the irs or if you're due for a tax refund. The only exclusion you can take is the exclusion for scholarship and fellowship grants, and the only adjustment to income you can take is the student loan interest deduction. You do not claim any tax credits.

Sourced Income To Report — This Includes Expatriates As Well.

Persons, but still have certain u.s. Web form 1040 is the main tax form used to file a u.s. Have to file if they had any income from u.s. Web forms 1040 and 1040 nr are the two most commonly used documents in the us.

The Form Calculates The Total Taxable Income Of The Taxpayer And Determines How Much Is To Be Paid To Or Refunded By The Government.

Tax guide for aliens, nonresident aliens cannot claim the standard deduction. Nonresident alien income tax return. But it also comes with three schedules as follows: Filing your us nonresident alien tax return

It’s How Nonresident Aliens Report Their Earned Income To The Irs And Receive A Tax Refund.

Only the schedules that ae right for you! These are itemized deductions such as state and local taxes you paid and gifts made to us charities. To explain it simply, irs form 1040nr is a version of a tax return for nonresident aliens with an american earned income. Individual income tax return) is an irs tax form used for personal federal income tax returns filed by united states residents.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at10.43.53AM-9e425788de3d4ad493784be2f13f752d.png)