What Is A 590 Form

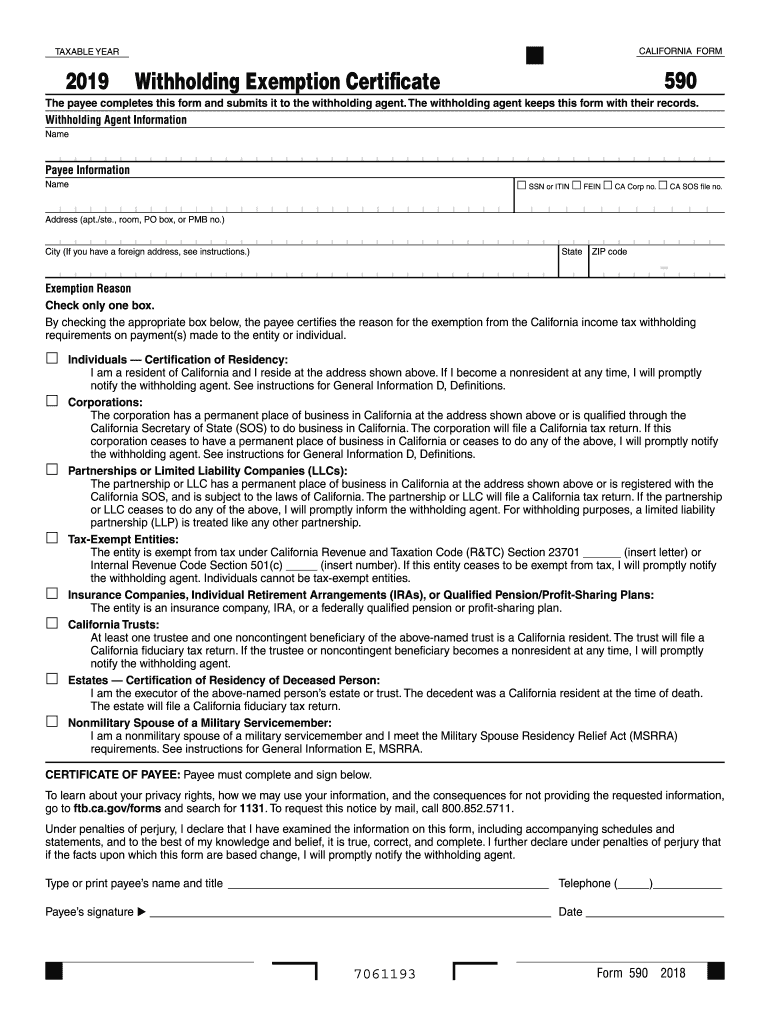

What Is A 590 Form - Form 590 does not apply to payments for wages to employees. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. For more information, go to ftb.ca.gov and search for backup withholding. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Individuals — certification of residency: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Am a resident of california and i reside at the address shown above. California residents or entities should complete and present form 590 to the withholding agent.

They are correctly providing this to you. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Form 590 does not apply to payments for wages to employees. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments of backup withholding. California residents or entities should complete and present form 590 to the withholding agent. Web exemption reason check only one box. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Am a resident of california and i reside at the address shown above.

California residents or entities should complete and present form 590 to the withholding agent. Form 590 does not apply to payments of backup withholding. Form 590 does not apply to payments for wages to employees. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Individuals — certification of residency: Form 590 does not apply to payments for wages to employees. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments of backup withholding. Am a resident of california and i reside at the address shown above.

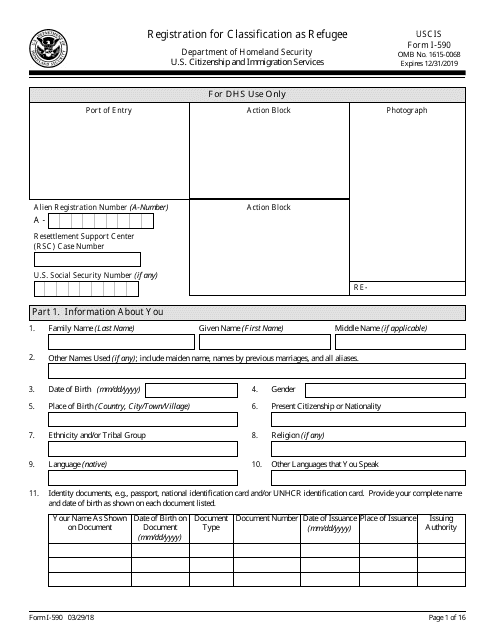

USCIS Form I590 Download Fillable PDF or Fill Online Registration for

For more information, go to ftb.ca.gov and search for backup withholding. Web exemption reason check only one box. Am a resident of california and i reside at the address shown above. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual..

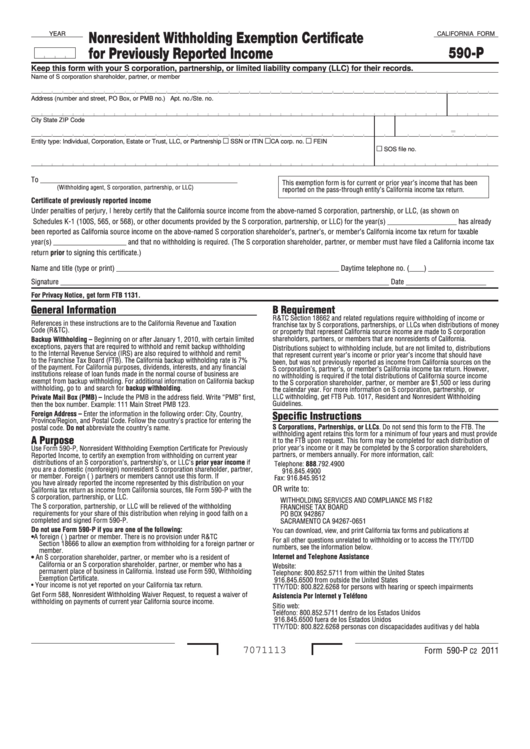

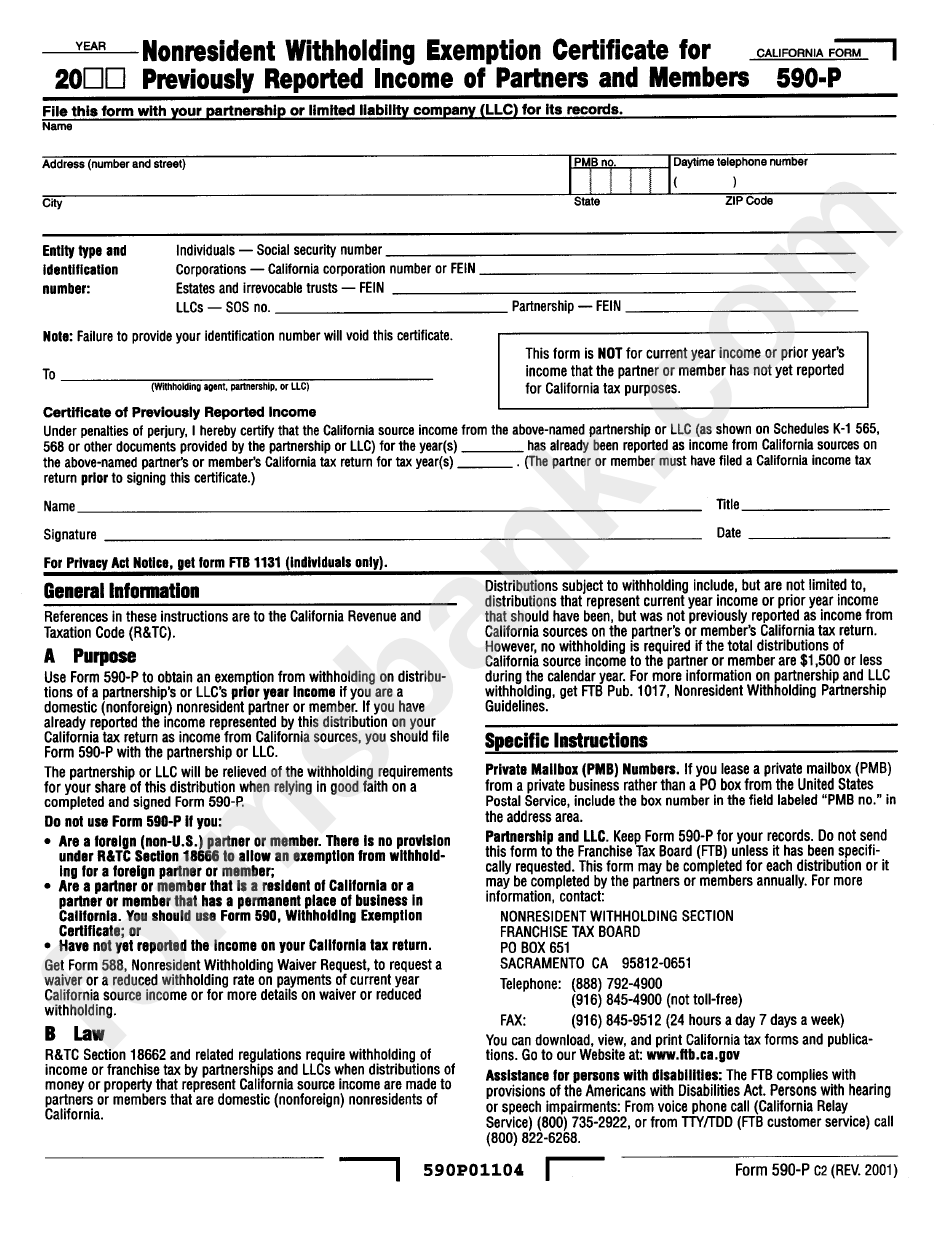

Fillable California Form 590P Nonresident Withholding Exemption

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. They are correctly providing this to you. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. By checking the appropriate box below, the payee certifies the reason for the exemption.

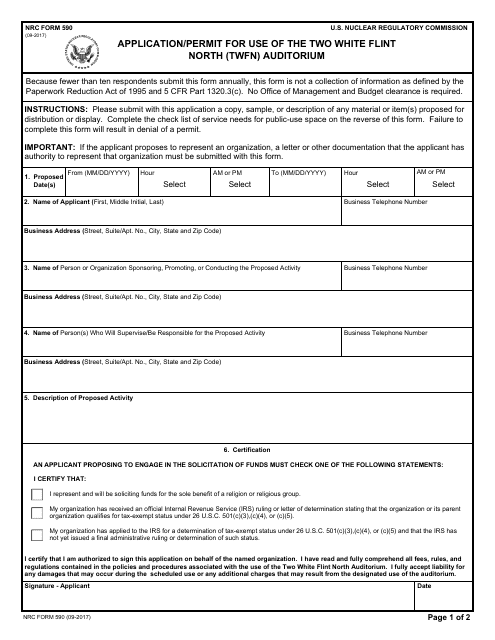

NRC Form 590 Download Fillable PDF or Fill Online Application/Permit

Individuals — certification of residency: They are correctly providing this to you. California residents or entities should complete and present form 590 to the withholding agent. Form 590 does not apply to payments for wages to employees. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement.

20182022 Form USCIS I590 Fill Online, Printable, Fillable, Blank

Am a resident of california and i reside at the address shown above. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual..

Fill Free fillable I590 Form I590, Registration for Classification

For more information, go to ftb.ca.gov and search for backup withholding. Web exemption reason check only one box. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. By checking the appropriate box below, the payee certifies the reason for the exemption from the california.

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Form 590 does not apply to payments for wages to employees. Am a resident of california and i reside at the address shown above. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do.

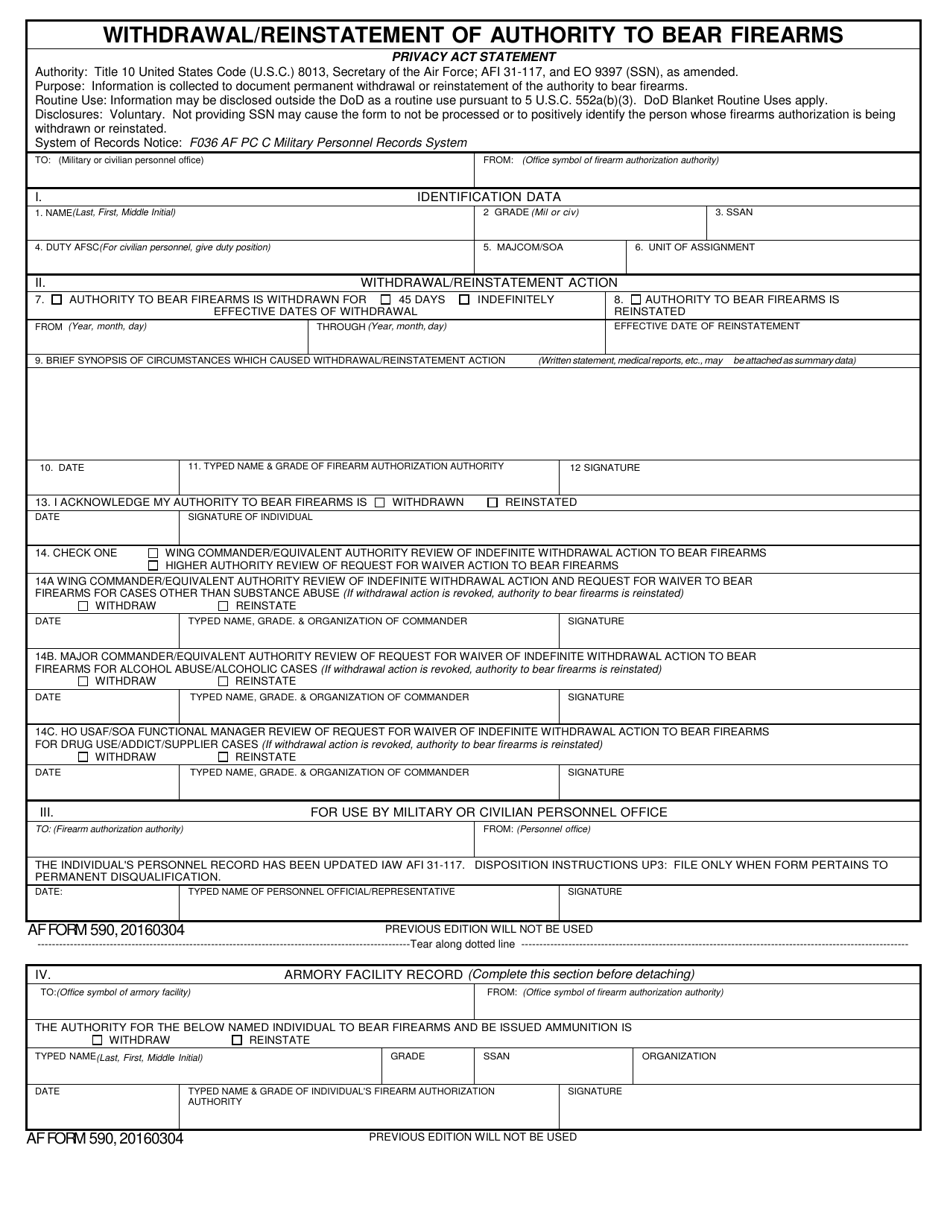

AF Form 590 Download Fillable PDF or Fill Online Withdrawal

The term individual retirement arrangement represents a wide variety of ira account types. California residents or entities should complete and present form 590 to the withholding agent. They are correctly providing this to you. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding.

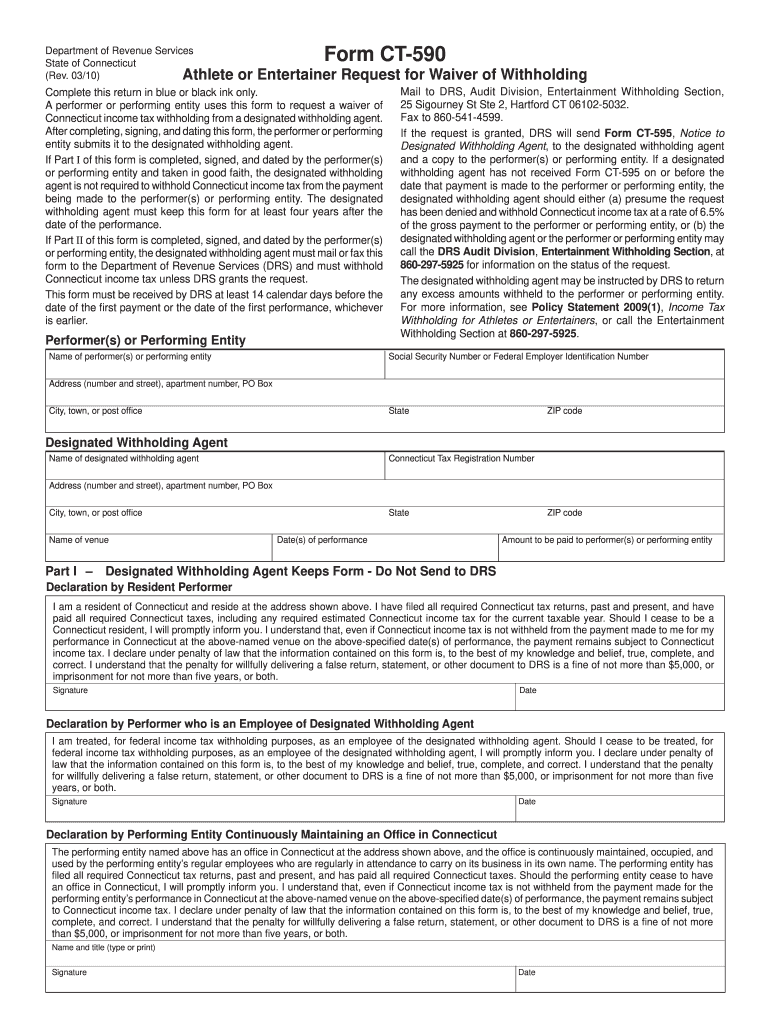

Ct 590 Fill Out and Sign Printable PDF Template signNow

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. Form 590 does not apply to payments for wages to employees. Am a resident of california and i reside at the address shown above. Web form 590 is a ca withholding exemption certificate that they are.

Ca 590 form 2018 Lovely San Bernardino County Ficial Website

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments for wages to employees. Form 590 does not apply to payments of backup withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Form 590P Nonresident Withholding Exemption Certificate For

Form 590 does not apply to payments of backup withholding. Web exemption reason check only one box. Form 590 does not apply to payments for wages to employees. For more information, go to ftb.ca.gov and search for backup withholding. Individuals — certification of residency:

Form 590 Does Not Apply To Payments Of Backup Withholding.

They are correctly providing this to you. Web exemption reason check only one box. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the entity or individual. Am a resident of california and i reside at the address shown above.

Web Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding. The term individual retirement arrangement represents a wide variety of ira account types. Individuals — certification of residency:

Web Use Form 590, Withholding Exemption Certificate, To Certify An Exemption From Nonresident Withholding.

Form 590 does not apply to payments for wages to employees. California residents or entities should complete and present form 590 to the withholding agent. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Form 590 Does Not Apply To Payments For Wages To Employees.

For more information, go to ftb.ca.gov and search for backup withholding. An ira is a personal savings plan that gives you tax advantages for setting aside money for retirement.