What Is Form 593

What Is Form 593 - Web form 2553 is an irs form. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web 593 escrow or exchange no. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. Web how do i enter ca form 593 real estate withholding? Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be. Escrow provides this form to the seller, typically when the escrow instructions. You must file form 2553 no later. Filing form 2553 on time is important if you want to take advantage of s corp treatment for the tax year.

Web california form 593 remitter information • reep • qualified intermediary • buyer/transferee other________________________________ part iii certifications. Web purpose of form 2553. It serves as a mechanism for the collections of state. Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Escrow provides this form to the seller, typically when the escrow instructions. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Web when is form 2553 due? Filing form 2553 on time is important if you want to take advantage of s corp treatment for the tax year. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation.

Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be. Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Escrow provides this form to the seller, typically when the escrow instructions. Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. Web form 2553 is an irs form. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013.

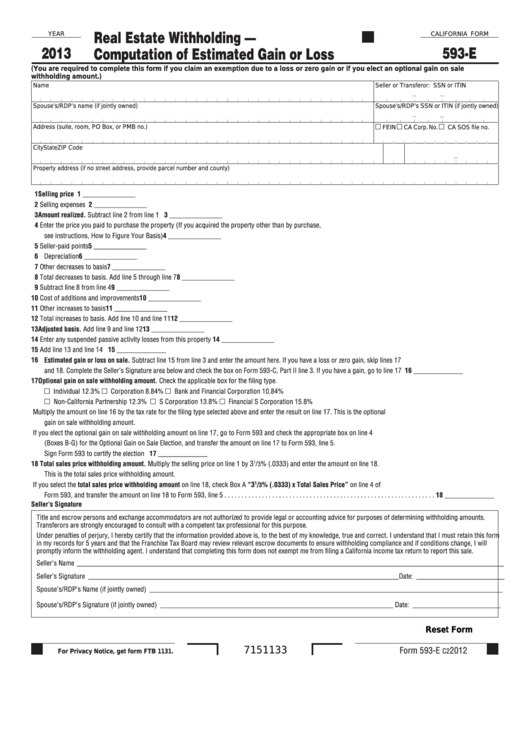

Fillable California Form 593E Real Estate Withholding Computation

Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be. Web how do i enter ca form 593 real estate withholding? Web form 2553 is required to be filed no later than two months and fifteen days.

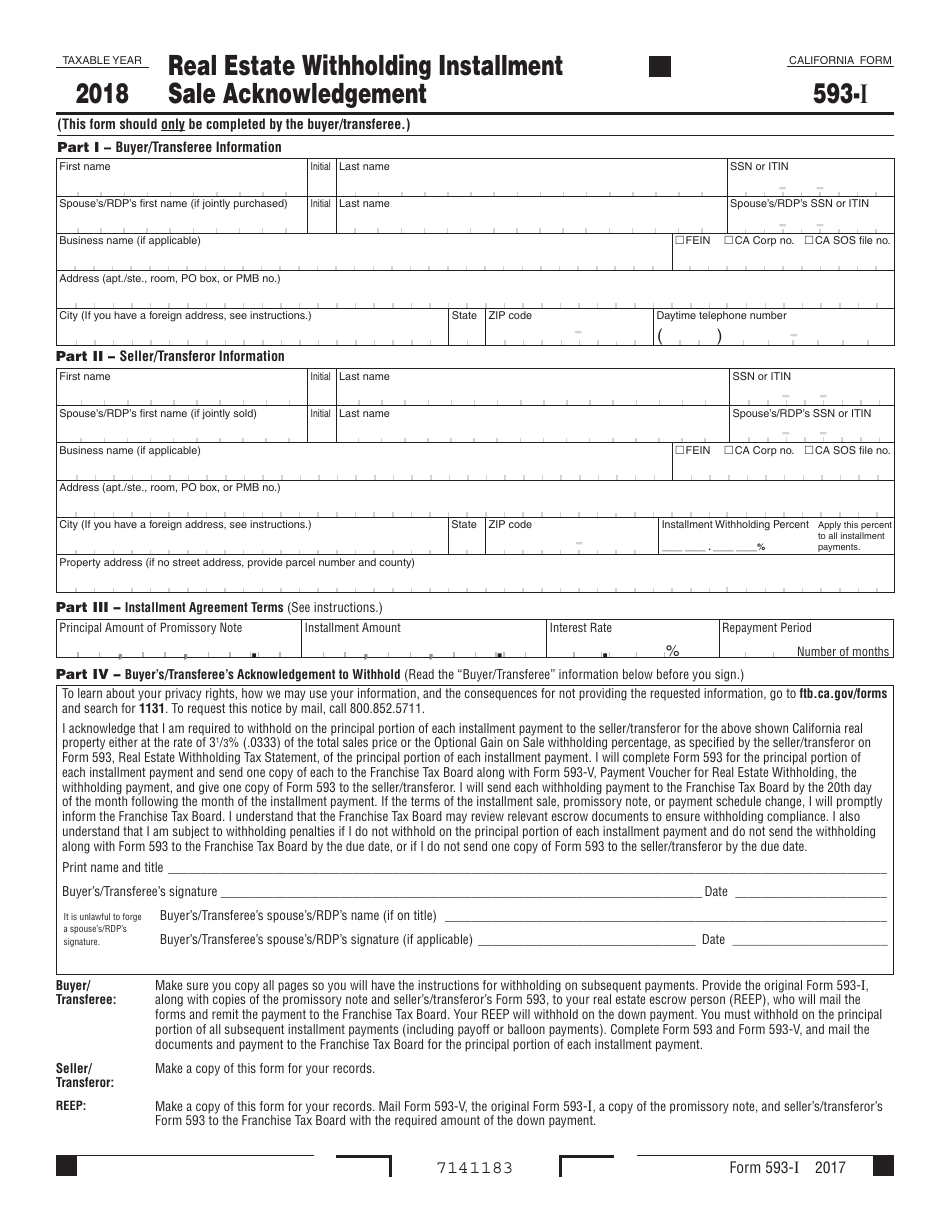

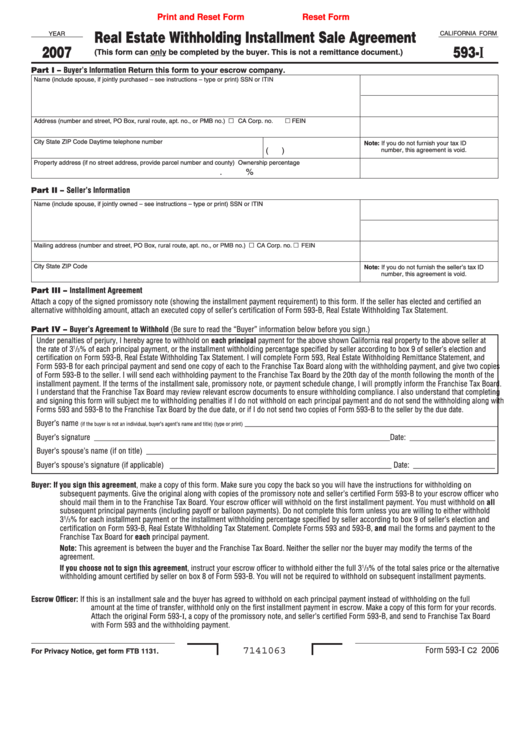

Form 593I Download Printable PDF or Fill Online Real Estate

Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Escrow provides this form to the seller, typically when the escrow instructions. Web california form 593 remitter information •.

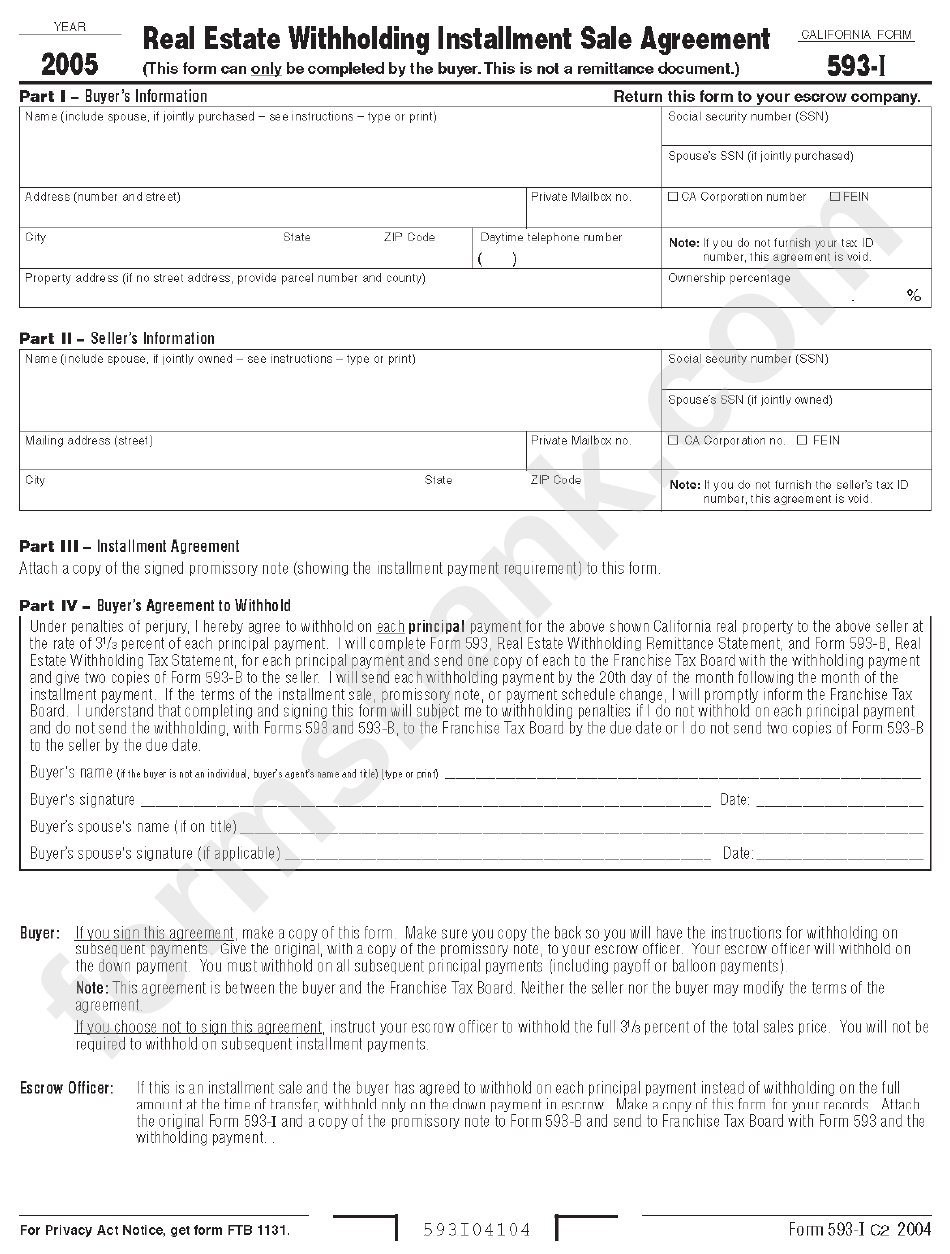

Form 593I Real Estate Withholding Installment Sale Agreement 2005

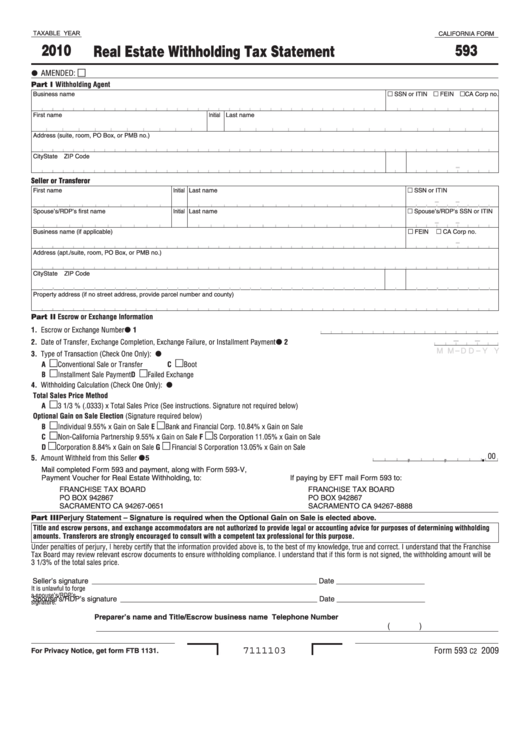

Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Web when is form 2553 due? Filing form 2553 on time is important if you want to take advantage of s corp treatment for the tax year. Escrow provides this.

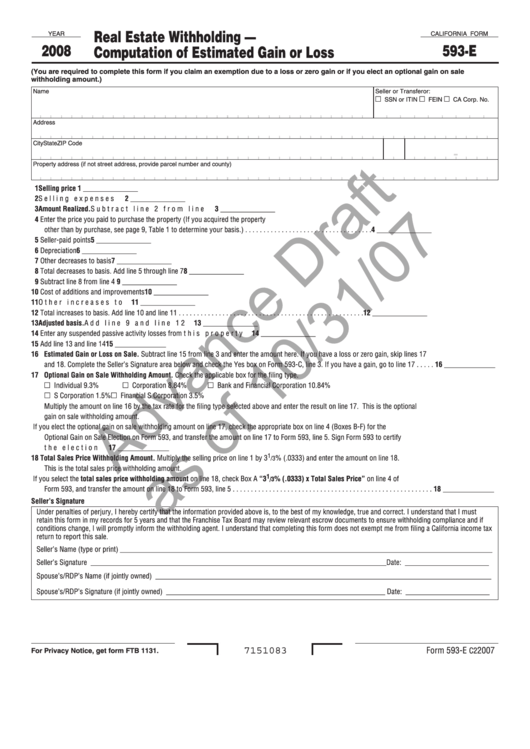

Form 593E Draft Real Estate Withholding Computation Of Estimated

The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Web form 2553 is an irs form. Web how do i enter ca form 593 real estate withholding? Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web.

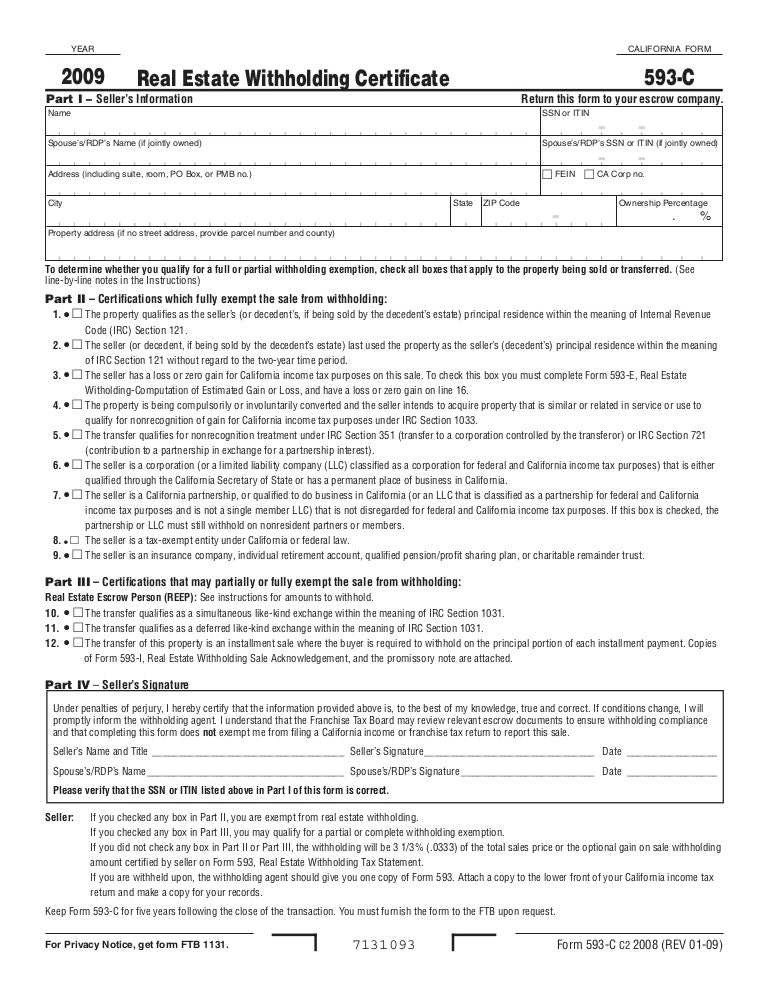

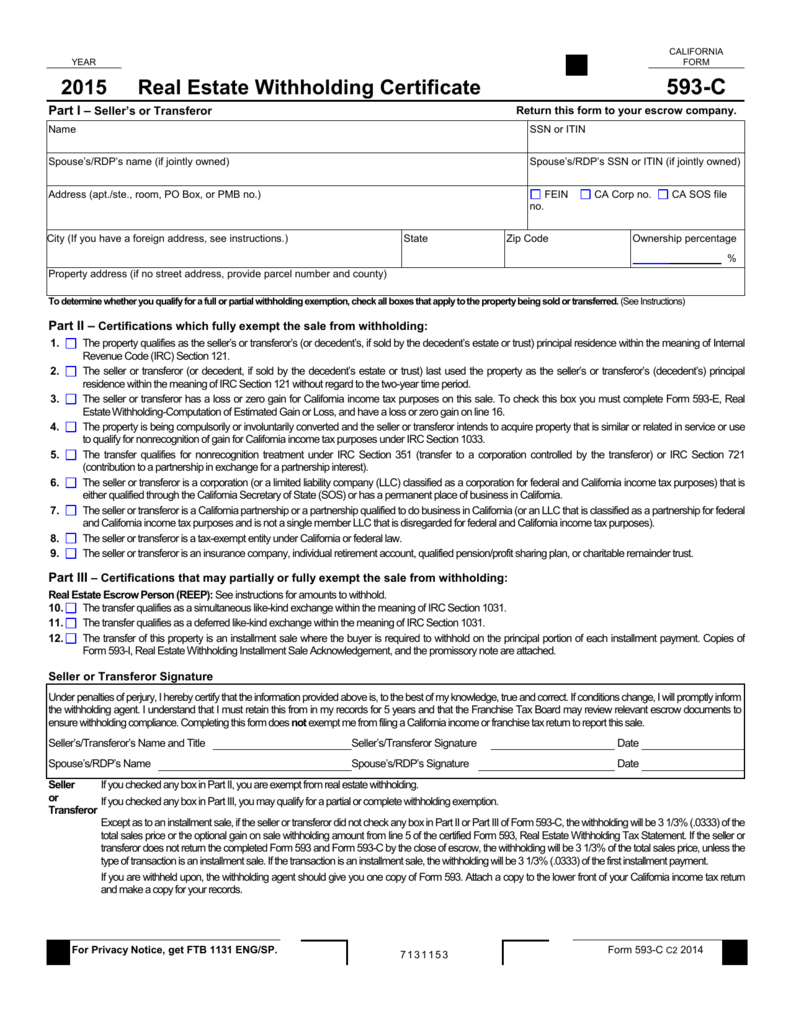

Form 593 C slidesharetrick

Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. _________________________ part i remitter information • reep • qualified intermediary buyer/transferee. It serves as a mechanism for the collections of state. Web when is form 2553 due? Escrow provides this form to the seller, typically when the escrow instructions.

Ca Form 593 slidesharetrick

Web 593 escrow or exchange no. Web form 2553 is an irs form. The main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges.

Fillable California Form 593I Real Estate Withholding Installment

Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the beginning of the tax year in which the s corporation will take. Web purpose of form 2553. An explanation for sellers when.

Fillable California Form 593 Real Estate Withholding Tax Statement

Escrow provides this form to the seller, typically when the escrow instructions. An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. You must file form 2553 no later. Web how do i enter ca form 593 real estate withholding? Web when selling a property in california, the.

Form 593 C slidesharetrick

Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web california form 593 remitter information • reep • qualified intermediary • buyer/transferee other________________________________ part iii certifications. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web use form 593 to report real estate.

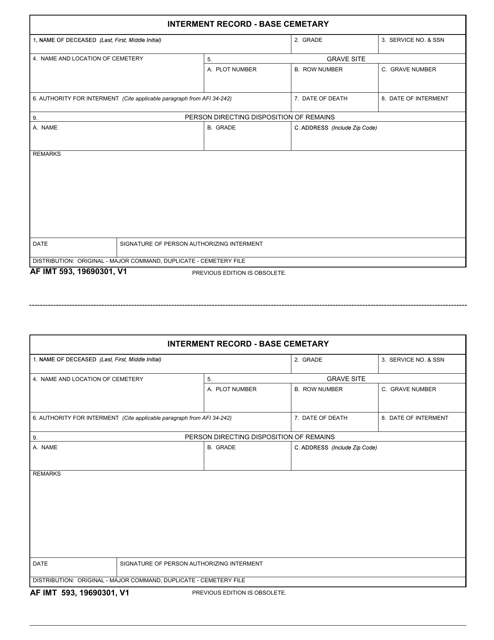

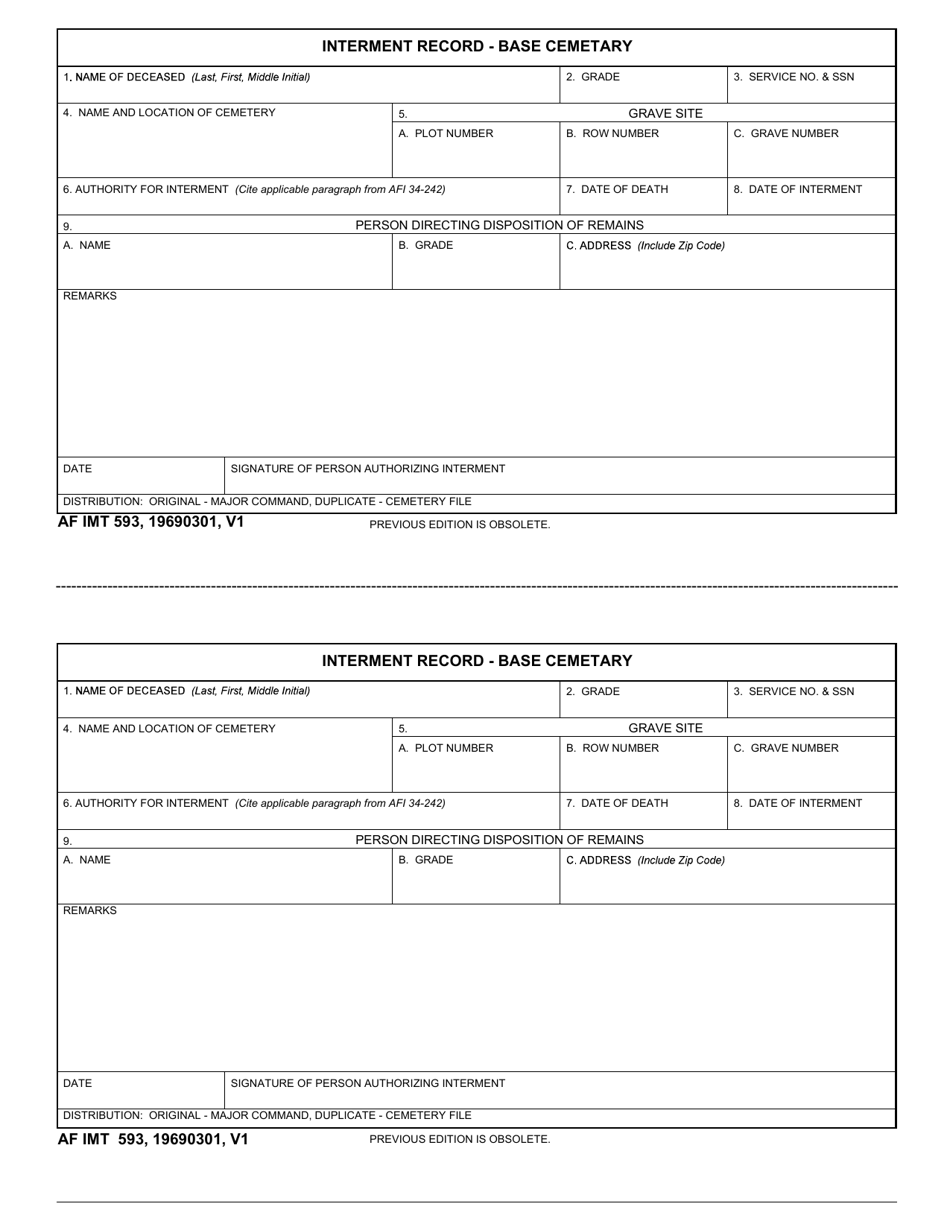

AF IMT Form 593 Download Fillable PDF or Fill Online Interment Record

Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has. Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. You must file form 2553 no later. Web when is form 2553 due? Web the 593 form is a california specific form used.

It Must Be Filed When An Entity Wishes To Elect “S” Corporation Status Under The Internal Revenue Code.

Web how do i enter ca form 593 real estate withholding? Web form 2553 is an irs form. Web when is form 2553 due? Web form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions.

_________________________ Part I Remitter Information • Reep • Qualified Intermediary Buyer/Transferee.

Any remitter (individual, business entity, trust, estate, or reep) who withheld on the. Web california form 593 remitter information • reep • qualified intermediary • buyer/transferee other________________________________ part iii certifications. Filing form 2553 on time is important if you want to take advantage of s corp treatment for the tax year. You must file form 2553 no later.

Web The 593 Form Is A California Specific Form Used To Determine Whether Or Not There Should Be State Tax Withheld On A Property Sale By The Seller (Individual, Business Entity, Trust,.

An explanation for sellers when real estate is sold in california, the state requires that income tax for that sale must be. Web form 2553 is required to be filed no later than two months and fifteen days (75 days) subsequent to the beginning of the tax year in which the s corporation will take. Escrow provides this form to the seller, typically when the escrow instructions. Web when selling a property in california, the state requires a seller to fill out a 593 real estate withholding statement to help the state calculate what tax if any you will be.

The Main Purpose Of Irs Form 2553 Is For A Small Business To Register As An S Corporation Rather Than The Default C Corporation.

Web use form 593 to report real estate withholding on sales closing in 2013, on installment payments made in 2013, or on exchanges that were completed or failed in 2013. Web a seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web 593 escrow or exchange no. Solved • by turbotax • 471 • updated january 13, 2023 your california real estate withholding has.