What Is Form 7203 Used For

What Is Form 7203 Used For - Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Stock basis at the beginning of the corporation’s tax year. Web purpose of form. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. In 2022, john decides to sell 50 shares of company a stock. Web form 7203 (december 2021) department of the treasury internal revenue service. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. This includes their name, address, employer identification number (ein),.

Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web up to 10% cash back draft form 7203 for 2022 includes few changes. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. This includes their name, address, employer identification number (ein),. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Attach to your tax return. Web form 7203 (december 2021) department of the treasury internal revenue service. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. View solution in original post february 23,.

Stock basis at the beginning of the corporation’s tax year. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web purpose of form. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Web up to 10% cash back draft form 7203 for 2022 includes few changes.

Form7203PartI PBMares

Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc. The draft form 7203 for tax year 2022 makes only two changes to the 2021 form: The irs changes for s corporations form 7203 was developed.

National Association of Tax Professionals Blog

Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web starting with the 2021 tax year, a new form 7203.

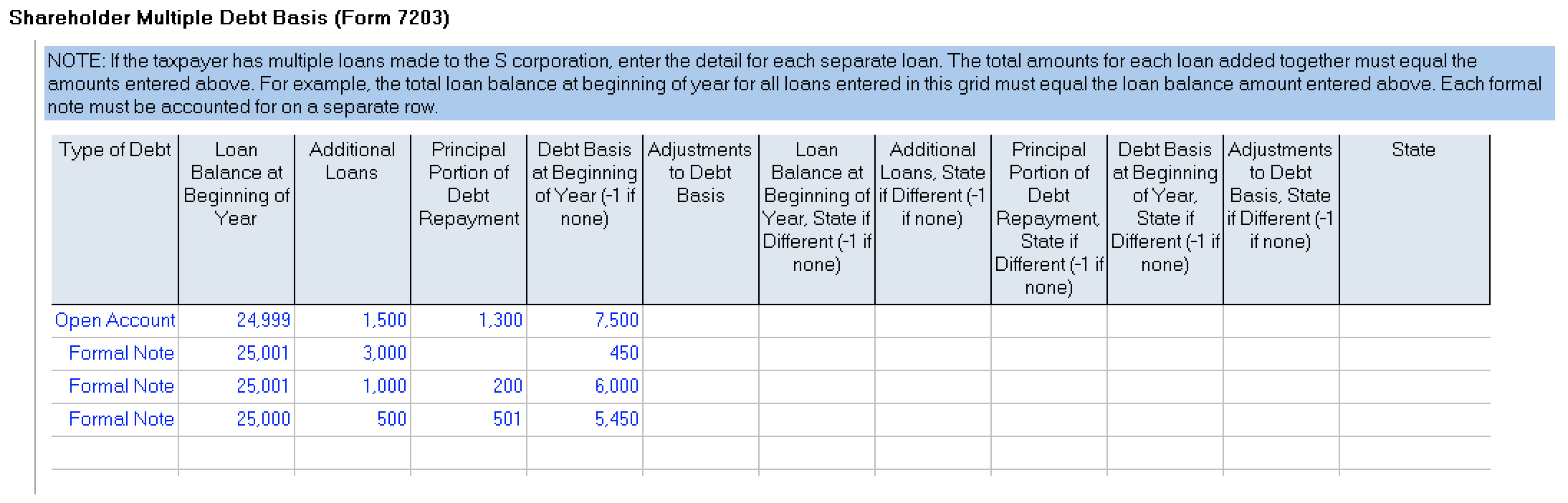

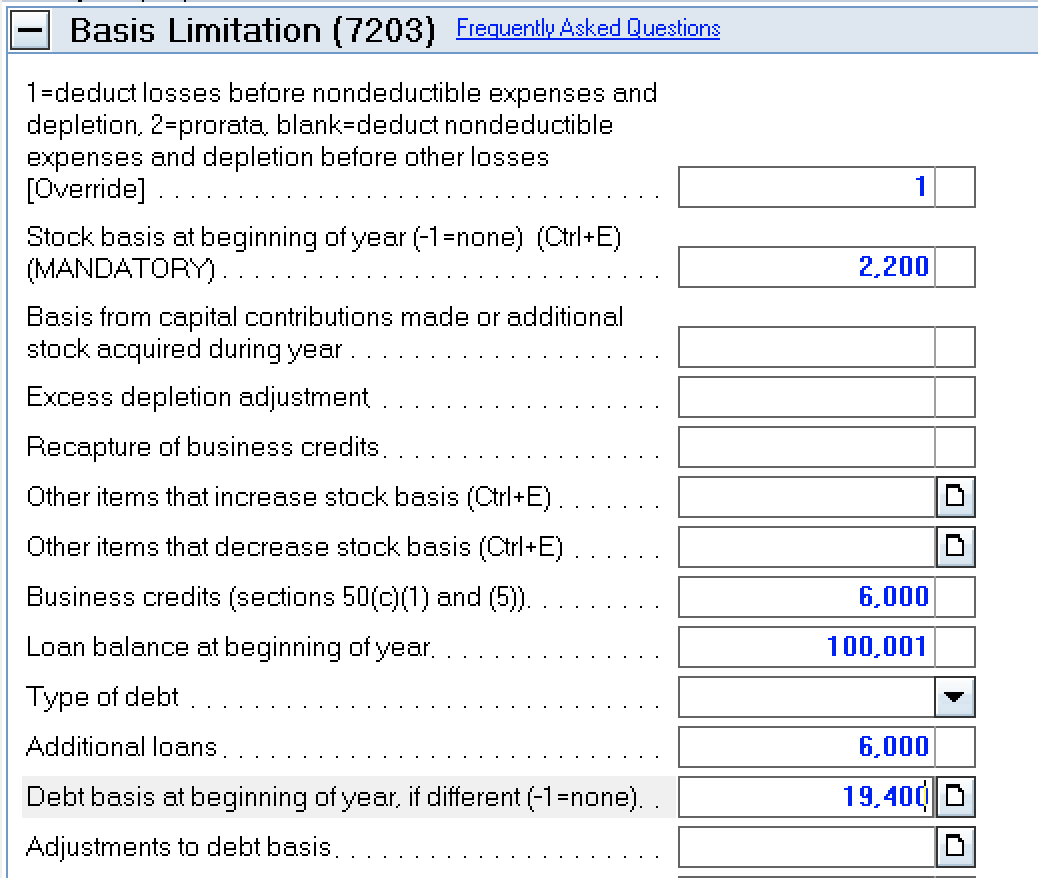

How to complete Form 7203 in Lacerte

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Basis from any capital contributions made or additional stock. Web form 7203 (december 2021) department of the treasury internal revenue service. Web starting with the 2021 tax year, a new form 7203 replaces.

Peerless Turbotax Profit And Loss Statement Cvp

Web s corporation shareholders use form 7203 to calculate their stock and debt basis. Web purpose of form. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Basis from any capital contributions made or additional stock. Web purpose of form use form 7203 to figure potential limitations of your.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web purpose of form. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. The draft form 7203 for tax.

More Basis Disclosures This Year for S corporation Shareholders Need

Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Stock basis at the beginning of the corporation’s tax year. Web up to 10% cash back draft form 7203 for 2022 includes few changes. The draft form 7203 for tax year 2022 makes only two changes to.

How to complete Form 7203 in Lacerte

Attach to your tax return. Web up to 10% cash back draft form 7203 for 2022 includes few changes. Web form 7203 (december 2021) department of the treasury internal revenue service. This includes their name, address, employer identification number (ein),. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits,.

IRS Issues New Form 7203 for Farmers and Fishermen

Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. S corporation shareholder stock and debt basis limitations. This includes their name, address, employer identification number (ein),. Web up to 10% cash back draft form 7203 for 2022 includes few changes. The irs changes for s corporations.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web s corporation shareholders use form 7203 to calculate their stock and debt basis. View solution in original post february 23,. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions,.

National Association of Tax Professionals Blog

Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. View solution in original post february 23,. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be.

This Includes Their Name, Address, Employer Identification Number (Ein),.

In 2022, john decides to sell 50 shares of company a stock. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your. Web purpose of form. View solution in original post february 23,.

Stock Basis At The Beginning Of The Corporation’s Tax Year.

Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. The irs changes for s corporations form 7203 was developed to replace the worksheet for figuring a shareholder’s stock and debt basis that was formerly found in. Web form 7203 (december 2021) department of the treasury internal revenue service.

S Corporation Shareholder Stock And Debt Basis Limitations.

Attach to your tax return. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web abraham finberg tax tips form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been. Web form 7203 is used to figure potential limitations of a shareholder's share of an s corporation's deductions, credits, etc.

The Draft Form 7203 For Tax Year 2022 Makes Only Two Changes To The 2021 Form:

Web up to 10% cash back draft form 7203 for 2022 includes few changes. Basis from any capital contributions made or additional stock. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your.