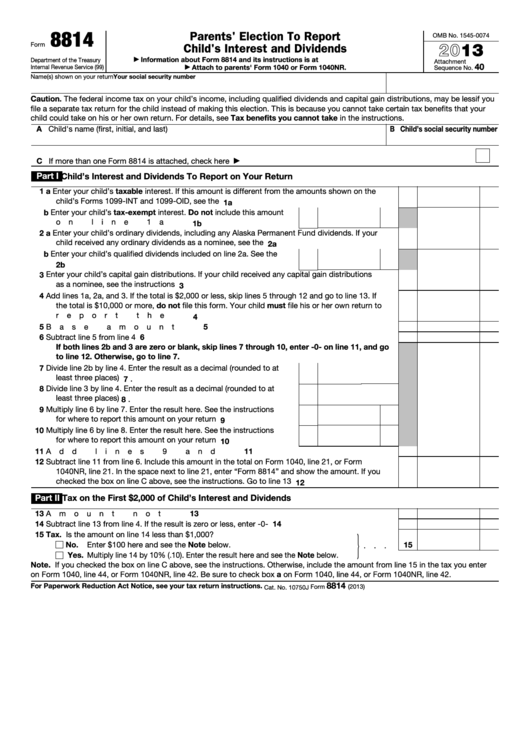

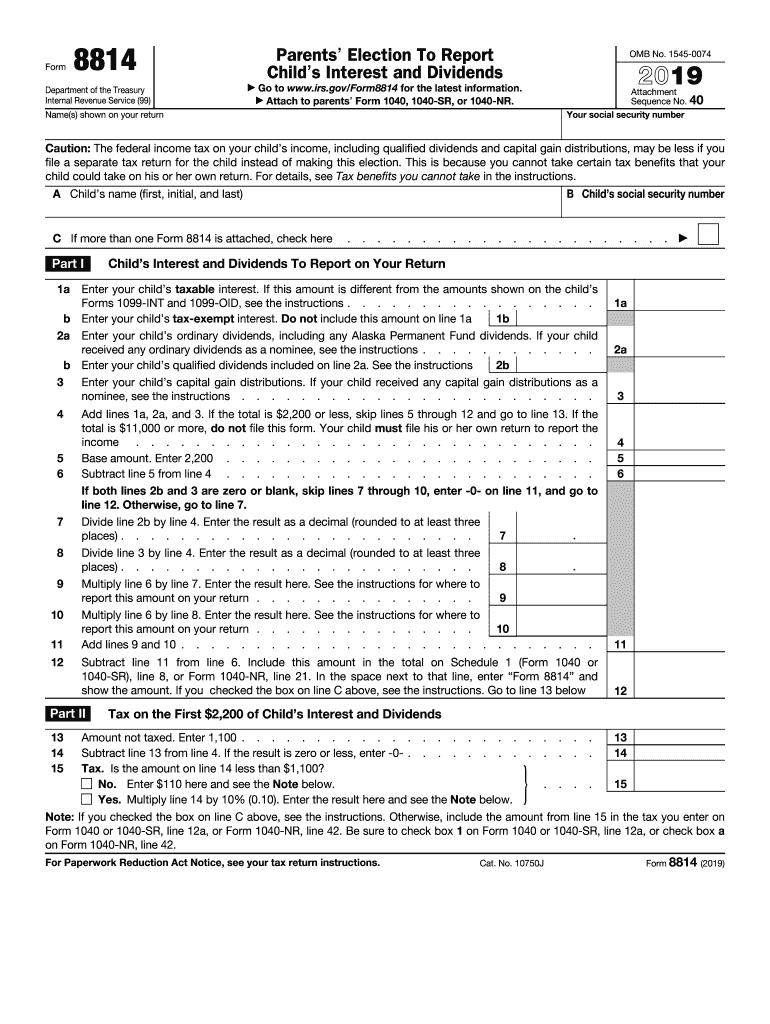

What Is Form 8814

What Is Form 8814 - Web use this form if you elect to report your child’s income on your return. Form 8615, tax for certain children who have unearned income. Solved•by intuit•15•updated july 12, 2022. If you choose this election, your child may not have to file a return. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. The child must not have made any estimated tax payments. Download this form print this form Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. The child's income must be less than $10,500. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest marginal tax rate (beginning in 2020).

The child must not have made any estimated tax payments. Web use this form if you elect to report your child’s income on your return. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Below are answers to frequently asked questions about using form 8615 and 8814 in proseries basic and proseries professional. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. The child's income must be less than $10,500. If you do, your child will not have to file a return. If income is reported on a parent's return, the child doesn't have to file a return. Solved•by intuit•15•updated july 12, 2022. Web common questions about form 8615 and form 8814.

Taxpayers can elect to apply the 2020 rules to tax years 2018 and 2019. Download this form print this form Form 8615, tax for certain children who have unearned income. Use this form if the parent elects to report their child’s income. The child must be a dependent. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. To report a child's income, the child must meet all of the following conditions: The kiddie tax rules apply to any child who: The child's income must be less than $10,500. If you do, your child will not have to file a return.

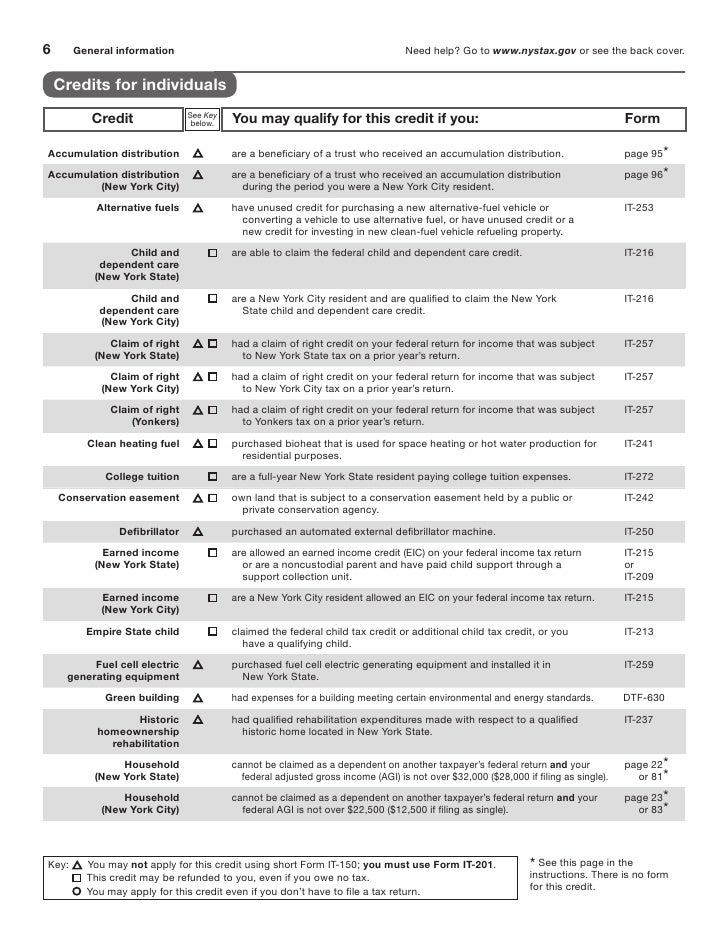

IT201 Resident Tax Return (long form) and instructions (inclu…

Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return. There are benefits and drawbacks to this election. The child must not file a separate tax return. The child must not have made any estimated tax payments. Form 8814 will be.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Solved•by intuit•15•updated july 12, 2022. Form 8615, tax for certain children who have unearned income. The child must be a dependent. To report a child's income, the child must meet all of the following conditions: Benefits to using irs form 8814 the primary benefit to using this form is simplicity.

Solved This is a taxation subject but chegg didn't give a

Form 8814 applies to a child’s unearned income in the form of investments, such. There are benefits and drawbacks to this election. Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Web use this form if you elect to report your child’s income on your return. Use this form if the.

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Form 8814 applies to a child’s unearned income in the form of investments, such. You can make this election if your child meets all of the following conditions. The child must not have made any estimated tax payments. Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not.

Kish2019_8814 Dun Laoghaire Motor Yacht Club

The child must be a dependent. Form 8615, tax for certain children who have unearned income. Use this form if the parent elects to report their child’s income. Parents use form 8814 to report their child’s income on their return, so their child will not have to file a. Taxpayers can elect to apply the 2020 rules to tax years.

Note This Problem Is For The 2017 Tax Year. Janic...

Download this form print this form If income is reported on a parent's return, the child doesn't have to file a return. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Taxpayers can elect to apply the 2020 rules to tax years 2018 and 2019. You.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return. The child must be a dependent. Download this form print this form Form 8814 applies to a child’s unearned income in the form of investments, such. The child must not have.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Use this form if the parent elects to report their child’s income. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions.

8814 Fill Out and Sign Printable PDF Template signNow

You can make this election if your child meets all of the following conditions. The kiddie tax rules apply to any child who: Download this form print this form Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. If you do, your child will not.

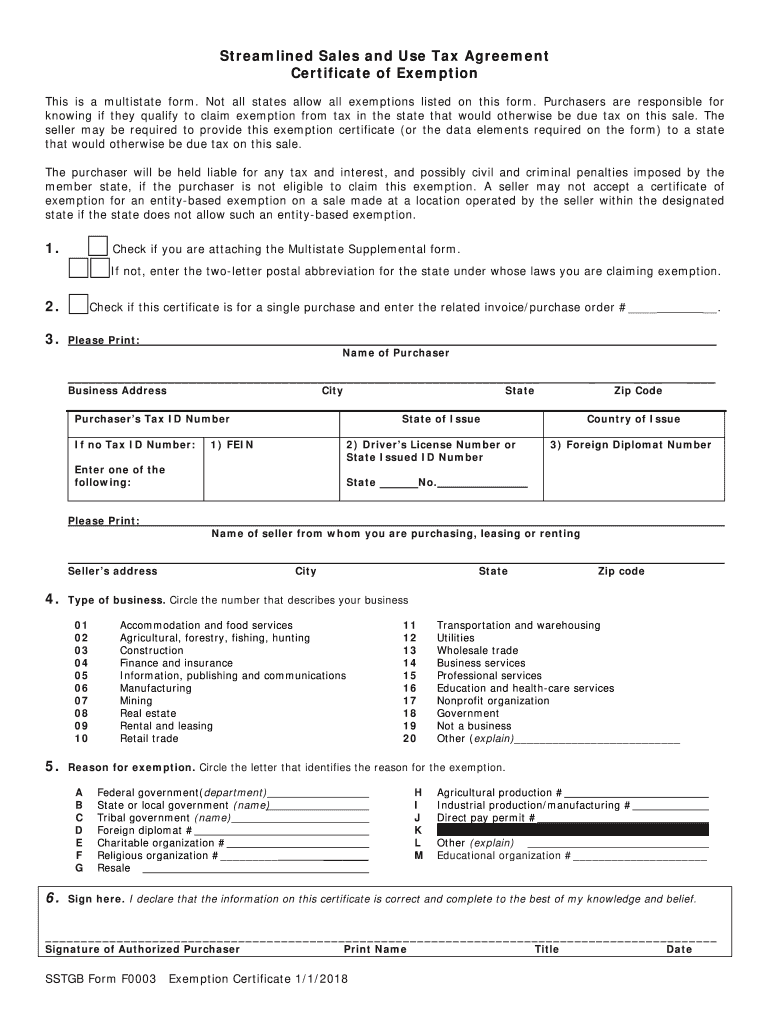

SSTGB F0003 20182021 Fill and Sign Printable Template Online US

There are benefits and drawbacks to this election. To report a child's income, the child must meet all of the following conditions: Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Web federal parents' election to report child's interest and dividends form 8814 pdf form content.

The Child Must Not File A Separate Tax Return.

Form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. The child's income must be less than $10,500. The child must not have made any estimated tax payments. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file.

There Are Benefits And Drawbacks To This Election.

Download this form print this form Web common questions about form 8615 and form 8814. Taxpayers can elect to apply the 2020 rules to tax years 2018 and 2019. You can make this election if your child meets all of the following conditions.

The Child Must Be A Dependent.

Form 8814 applies to a child’s unearned income in the form of investments, such. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Web irs form 8814 allows tax filers to pay a “kiddie tax” on their child’s unearned income, so the child does not have to file a separate tax return. If income is reported on a parent's return, the child doesn't have to file a return.

Web It Means That If Your Child Has Unearned Income More Than $2,200, Some Of It Will Be Taxed At Estate And Trust Tax Rates (For Tax Years 2018 And 2019) Or At The Parent’s Highest Marginal Tax Rate (Beginning In 2020).

Below are answers to frequently asked questions about using form 8615 and 8814 in proseries basic and proseries professional. Form 8615, tax for certain children who have unearned income. If you do, your child will not have to file a return. If you choose this election, your child may not have to file a return.