What Is Form 8996 Qualified Opportunity Fund

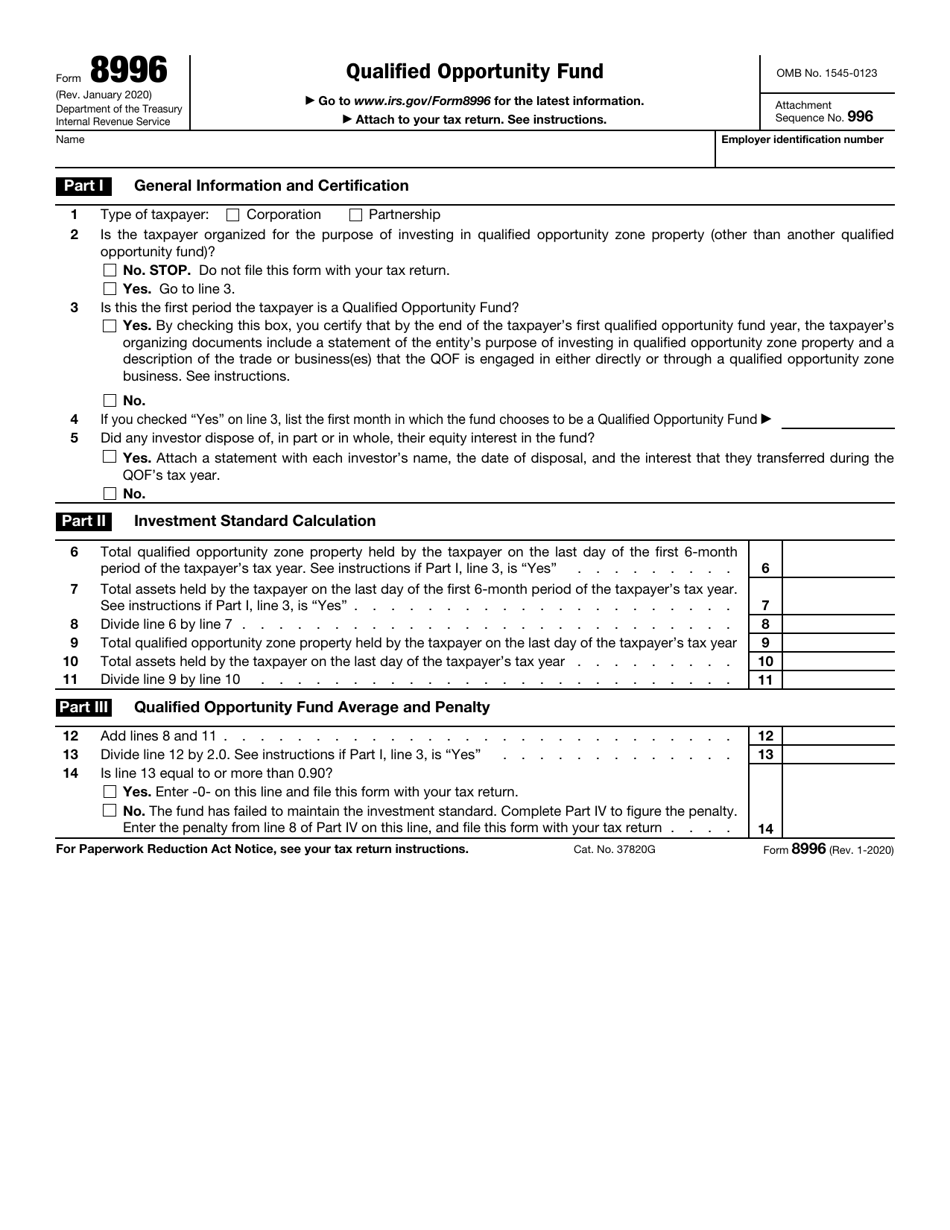

What Is Form 8996 Qualified Opportunity Fund - Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s. Web investment in qualified opportunity funds (qofs). Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than. Sign up and browse today. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. Use form 8997 to inform the irs of the qof investments and.

Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web qualified opportunity fund (qof). Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. Sign up and browse today. Use form 8997 to inform the irs of the qof investments and. Benefit from sizable tax advantages by investing in qualified opportunity funds. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information.

Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the. Web form 8996 is filed only by qualified opportunity funds. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Web qualified opportunity fund (qof). Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s. Sign up and browse today. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Use form 8997 to inform the irs of the qof investments and. Sign up and browse today. Web by checking this box, you certify that by the end of.

IRS Form 8996 Qualified Opportunity Fund Lies On Flat Lay Office Table

Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Use form 8997 to inform the irs of the qof investments and. Web investment in qualified opportunity funds (qofs). Benefit from sizable tax advantages by investing in qualified opportunity funds. Web by checking this box, you certify that by the end of the taxpayer’s first qualified.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. Web qualified opportunity fund (qof). Web investment in qualified opportunity funds (qofs). Web how a qualified opportunity fund.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Use form 8997 to inform the irs of the qof investments and. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if..

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web form 8996 is filed only by qualified opportunity funds. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web how a qualified opportunity fund.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. Web qualified opportunity fund (qof). Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web form 8996 is filed only by qualified opportunity funds. The tax cuts and jobs act of 2017 provided for the deferral of capital gains.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Sign up and browse today. Web investment in qualified opportunity funds (qofs). The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Benefit from sizable tax advantages by investing in qualified opportunity funds. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web qualified opportunity fund (qof). Web investment in qualified opportunity funds (qofs). A qof is an investment vehicle organized as a corporation or a partnership for the.

IRS form 8996 Qualified opportunity fund lies on flat lay office table

Sign up and browse today. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Benefit from sizable tax advantages by investing in qualified opportunity funds. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to.

IRS Form 8996 Download Fillable PDF or Fill Online Qualified

Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment.

Web The Percentage Computation Must Be Reported Annually On Form 8996, Qualified Opportunity Fund.

Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Web investment in qualified opportunity funds (qofs).

Web Qualified Opportunity Zones (Qozs) Enable Taxpayers To Defer And Reduce Capital Gains To Unlock Substantial Tax Incentives.

A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s. Web qualified opportunity fund (qof).

Web The Taxpayer Must Invest Proceeds From A Sale Resulting In Capital Gain In An Entity That Is A Qualified Opportunity Fund (“Qof”) Formed As A Corporation Or.

The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Web form 8996 is filed only by qualified opportunity funds. Use form 8997 to inform the irs of the qof investments and. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the.

Benefit From Sizable Tax Advantages By Investing In Qualified Opportunity Funds.

Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. Sign up and browse today.