What Is Form 9465

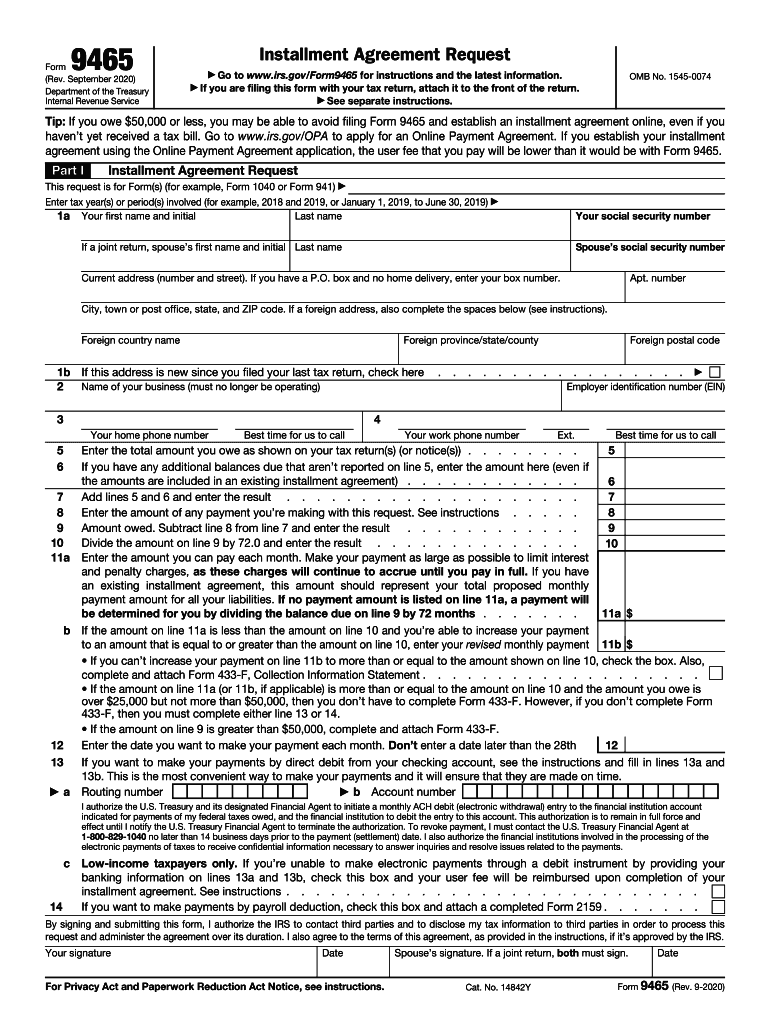

What Is Form 9465 - Web what is form 9465? September 2020) department of the treasury installment agreement request go to www.irs.gov/form9465 for instructions and the latest information. Ad fill your 9465 installment agreement request online, download & print. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should mail their form. Web federal communications commission 45 l street ne. Web no form necessary. September 2020)) department of the treasury internal revenue service section references are to the. If you do not qualify for. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Form 9465, installment agreement request, is used to request a monthly installment plan if you can't pay the full amount you owe shown on.

Web what is form 9465? Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. Web irs definition use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). September 2020) department of the treasury installment agreement request go to www.irs.gov/form9465 for instructions and the latest information. Web the 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe, an estimate. Complete this form to request an installment payment agreement with the irs for unpaid taxes. If you owe less than $50,000 on your taxes, you don’t need to file form 9465. Web form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment agreement by filing irs form 9465. September 2020)) department of the treasury internal revenue service section references are to the. Web federal communications commission 45 l street ne.

If you do not qualify for. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web more about the federal form 9465 individual income tax ty 2022. It is a good idea to at least pay a portion of our tax debt before asking for. September 2020)) department of the treasury internal revenue service section references are to the. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should mail their form. Ad download or email irs 9465 & more fillable forms, register and subscribe now! Ad fill your 9465 installment agreement request online, download & print. Web installment agreement request (for use with form 9465 (rev. Web form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment agreement by filing irs form 9465.

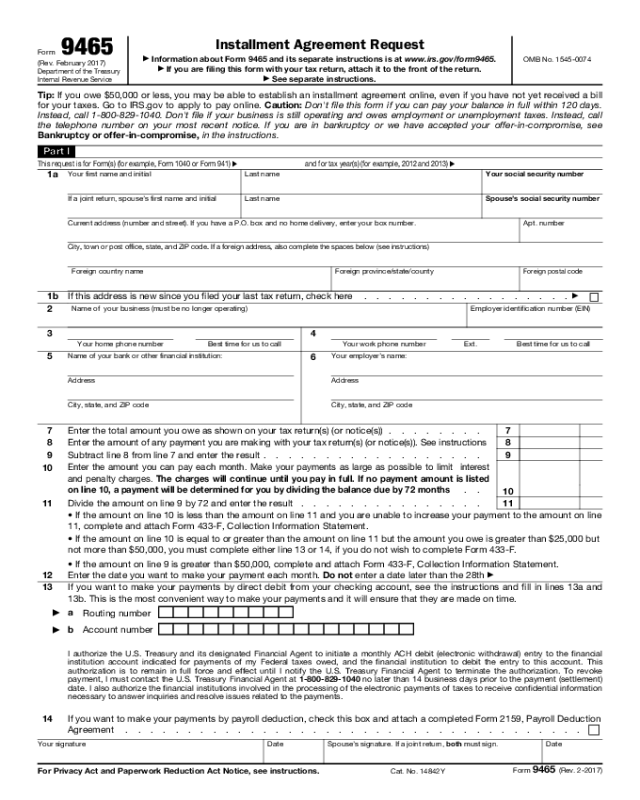

form_9465_Installment_Agreement_Request Stop My IRS Bill

Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should mail their form. Web federal communications commission 45 l street ne. September 2020)) department of the treasury internal revenue service section references are to the. Web the 9465 form is rather short.

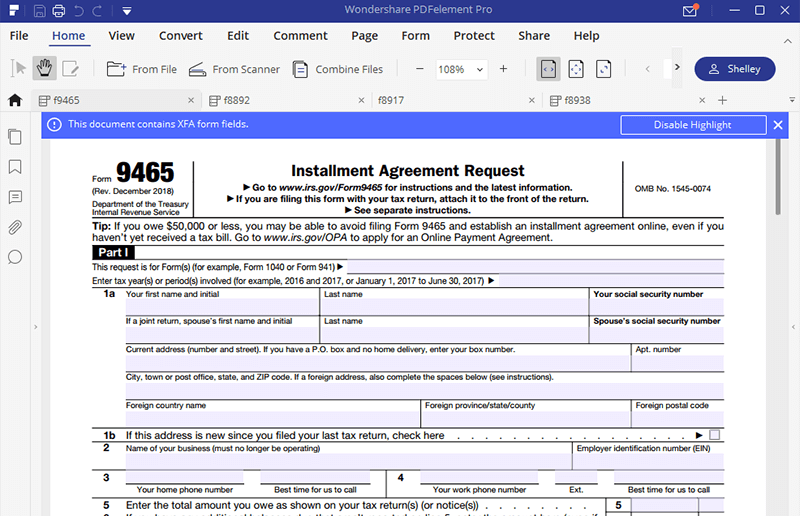

Form 9465 Edit, Fill, Sign Online Handypdf

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Ad download or email irs 9465 & more fillable forms, register and subscribe now! Web all individual taxpayers who mail form 9465 separate from their returns and.

IRS Form 9465 Instructions for How to Fill it Correctly

Complete this form to request an installment payment agreement with the irs for unpaid taxes. Form 9465 (installment agreement request) is used by taxpayers who cannot pay their federal tax liability and would like a. Web installment agreement request (for use with form 9465 (rev. September 2020)) department of the treasury internal revenue service section references are to the. It.

IRS Form 9465 Instructions for How to Fill it Correctly File

Ad download or email irs 9465 & more fillable forms, register and subscribe now! Web form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment agreement by filing irs form 9465. Web what is form 9465? Web irs form payment plan 9465 is a document you can.

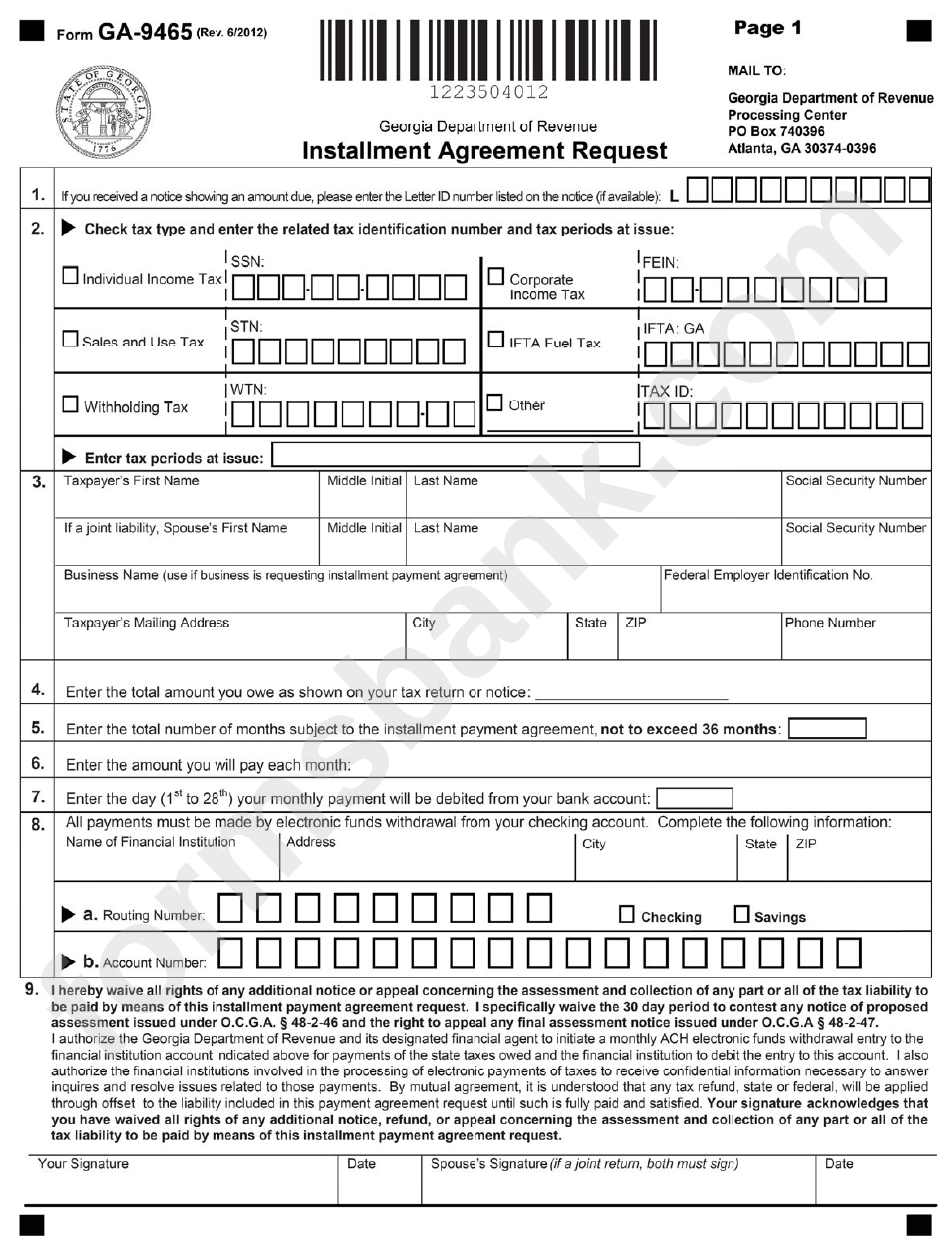

Form Ga9465 Installment Agreement Request printable pdf download

If you do not qualify for. Web the 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe, an estimate. Ad fill your 9465 installment agreement request online, download & print. Web more about the federal form 9465 individual income tax ty 2022. Web.

Form 9465 Edit, Fill, Sign Online Handypdf

Web irs definition use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web irs form payment plan 9465 is a document you can file to request said payment plan. Web federal communications commission 45 l street ne. It is.

20202022 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

Web irs definition use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Ad fill your 9465 installment agreement request online, download & print. Web form 9465, installment agreement request if you can’t pay your federal income taxes in full,.

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

Web installment agreement request (for use with form 9465 (rev. Web federal communications commission 45 l street ne. Web federal communications commission 45 l street ne. If you owe less than $50,000 on your taxes, you don’t need to file form 9465. Web no form necessary.

IRS Form 9465 Installment Agreement Request

Form 9465, installment agreement request, is used to request a monthly installment plan if you can't pay the full amount you owe shown on. Ad fill your 9465 installment agreement request online, download & print. Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more.

IRS Form 9465 Guide to Installment Agreement Request

Web form 9465 is used to request an installment agreement with the irs when you can’t pay your tax bill when due and need more time to pay. Complete this form to request an installment payment agreement with the irs for unpaid taxes. Web what is form 9465? Web what is the purpose of form 9465? Web installment agreement request.

Web Form 9465, Installment Agreement Request If You Can’t Pay Your Federal Income Taxes In Full, You May Be Eligible To Request An Installment Agreement By Filing Irs Form 9465.

Web installment agreement request (for use with form 9465 (rev. Web more about the federal form 9465 individual income tax ty 2022. Web irs form payment plan 9465 is a document you can file to request said payment plan. It is a good idea to at least pay a portion of our tax debt before asking for.

Web Form 9465 Is Used To Request An Installment Agreement With The Irs When You Can’t Pay Your Tax Bill When Due And Need More Time To Pay.

Web what is form 9465? If you owe less than $50,000 on your taxes, you don’t need to file form 9465. Web what is the purpose of form 9465? Web irs definition use form 9465 to request a monthly installment plan if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you).

Complete This Form To Request An Installment Payment Agreement With The Irs For Unpaid Taxes.

If you do not qualify for. Form 9465, installment agreement request, is used to request a monthly installment plan if you can't pay the full amount you owe shown on. Ad download or email irs 9465 & more fillable forms, register and subscribe now! Form 9465 (installment agreement request) is used by taxpayers who cannot pay their federal tax liability and would like a.

Web Federal Communications Commission 45 L Street Ne.

The formal conditions from the irs website to qualify for an. September 2020) department of the treasury installment agreement request go to www.irs.gov/form9465 for instructions and the latest information. Web all individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should mail their form. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you).