What Is Form Pf

What Is Form Pf - Welcome to the form pf and pfrd (private fund reporting depository) homepage with current information about form pf, pfrd, electronic filing and related information for sec registered investment advisers. Web form pf provides the commissions and fsoc with important information about the basic operations and strategies of private funds and has helped establish a baseline picture of the private fund industry for use in assessing systemic risk. Pfrd is a subsystem of the. The form pf amendments will significantly change how and what large hedge fund advisers and private equity fund advisers must report on. Web form pf filings are not available to the general public. The amendments are designed to enhance the ability of the financial stability oversight council (fsoc) to assess systemic risk and. “(i) you advise one or more liquidity funds and (ii) as of the last day of any month. Web division of investment management:electronic filing of form pf for investment advisers on pfrd. Web a provident fund (pf) is also called retirement fund and is used to provide a lump sum or monthly payments to salaried employees when they retire. “large liquidity fund adviser” is defined as any private fund adviser that is required to file section 3 of form pf.

Web form pf is a complicated form that, depending on how large and diverse a private fund adviser's business is, can require a very significant coordinated effort from a firm's financial,. Instruction 3 of form pf states that an adviser is required to file section 3 if: We now have almost a decade of experience analyzing the information collected on form pf. Form pf is a us securities and exchange commission regulatory filing requirement that mandates private fund advisers report regulatory assets under management to the financial stability oversight council, in order to monitor risks to the us financial system. [3] “large liquidity fund adviser” is defined as any private fund adviser that is required to file section 3 of form pf. Pfrd is a subsystem of the. Web form pf (e.g., because it is an exempt reporting adviser) and one or more otheradvisers to the fund isrequired to file formpf, another adviser must complete and file form pf forthat private fund. Web form pf filings are not available to the general public. Web washington d.c., may 3, 2023 —. It is a fixed amount of money that's.

Instruction 3 of form pf states that an adviser is required to file section 3 if: Web form pf filings are not available to the general public. We now have almost a decade of experience analyzing the information collected on form pf. Web a provident fund (pf) is also called retirement fund and is used to provide a lump sum or monthly payments to salaried employees when they retire. Web form pf (e.g., because it is an exempt reporting adviser) and one or more otheradvisers to the fund isrequired to file formpf, another adviser must complete and file form pf forthat private fund. Web form pf is a complicated form that, depending on how large and diverse a private fund adviser's business is, can require a very significant coordinated effort from a firm's financial,. The form pf amendments will significantly change how and what large hedge fund advisers and private equity fund advisers must report on. Web division of investment management:electronic filing of form pf for investment advisers on pfrd. “(i) you advise one or more liquidity funds and (ii) as of the last day of any month. Pfrd is a subsystem of the.

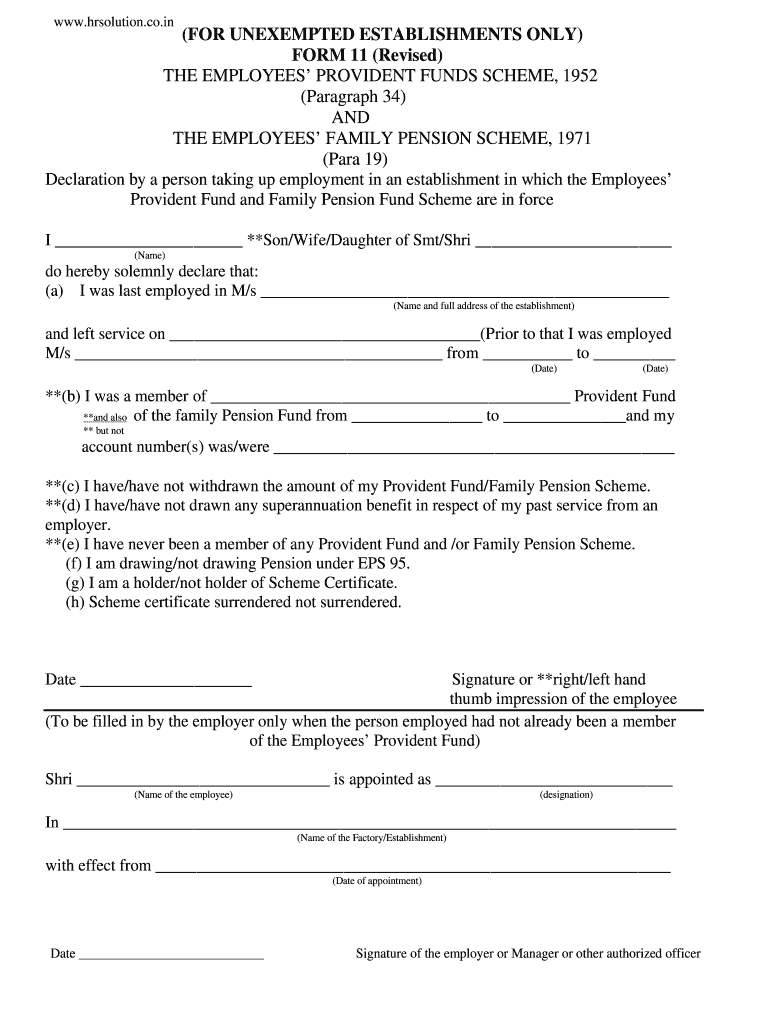

Pf Form 11 Old Download 20202021 Fill and Sign Printable Template

We now have almost a decade of experience analyzing the information collected on form pf. Welcome to the form pf and pfrd (private fund reporting depository) homepage with current information about form pf, pfrd, electronic filing and related information for sec registered investment advisers. “(i) you advise one or more liquidity funds and (ii) as of the last day of.

PF Form10 Lenvica HRMS

[3] “large liquidity fund adviser” is defined as any private fund adviser that is required to file section 3 of form pf. “(i) you advise one or more liquidity funds and (ii) as of the last day of any month. Web division of investment management:electronic filing of form pf for investment advisers on pfrd. Instruction 3 of form pf states.

PF FORM 2 Government Information Politics

Pfrd is a subsystem of the. [3] “large liquidity fund adviser” is defined as any private fund adviser that is required to file section 3 of form pf. Web form pf filings are not available to the general public. Web a provident fund (pf) is also called retirement fund and is used to provide a lump sum or monthly payments.

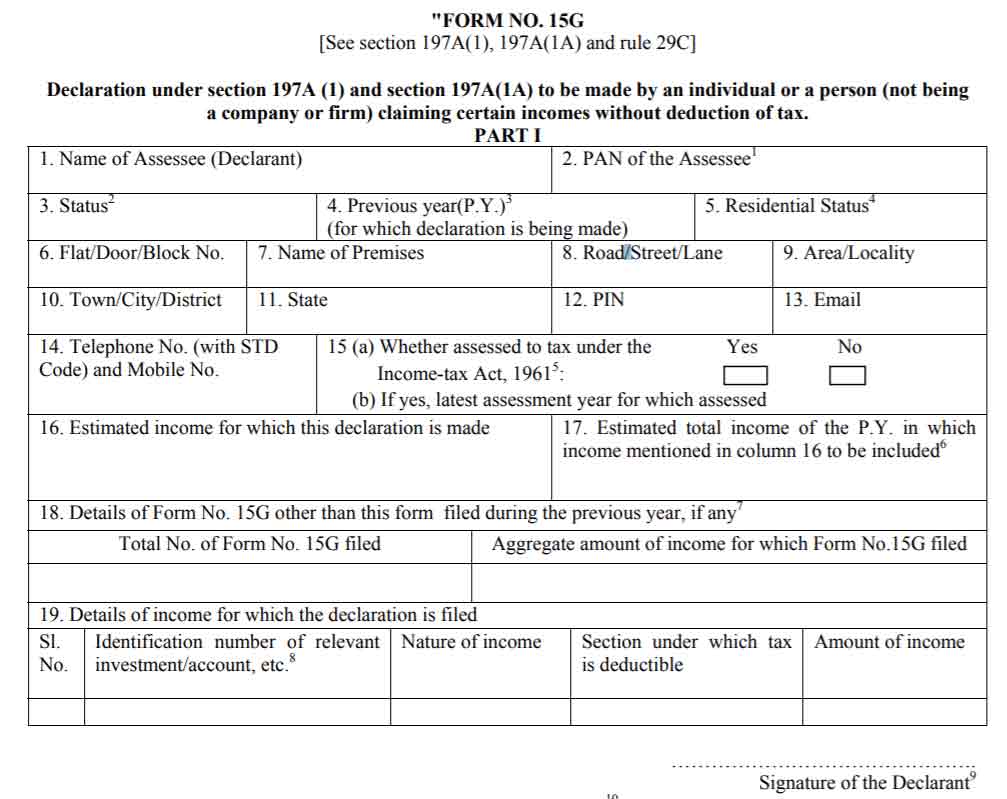

Form 15G How to Fill Form 15G for PF Withdrawal MoneyPiP

Web form pf provides the commissions and fsoc with important information about the basic operations and strategies of private funds and has helped establish a baseline picture of the private fund industry for use in assessing systemic risk. Web washington d.c., may 3, 2023 —. The amendments are designed to enhance the ability of the financial stability oversight council (fsoc).

PF Form6A Lenvica HRMS

Welcome to the form pf and pfrd (private fund reporting depository) homepage with current information about form pf, pfrd, electronic filing and related information for sec registered investment advisers. Web form pf provides the commissions and fsoc with important information about the basic operations and strategies of private funds and has helped establish a baseline picture of the private fund.

Use PF for Home Loan? Loanyantra Blog

Web washington d.c., may 3, 2023 —. Pfrd is a subsystem of the. Form pf is a us securities and exchange commission regulatory filing requirement that mandates private fund advisers report regulatory assets under management to the financial stability oversight council, in order to monitor risks to the us financial system. “large liquidity fund adviser” is defined as any private.

PF Transfer in Form_Form No. 13 SAMPLE Employee Government

Web form pf is a complicated form that, depending on how large and diverse a private fund adviser's business is, can require a very significant coordinated effort from a firm's financial,. The amendments are designed to enhance the ability of the financial stability oversight council (fsoc) to assess systemic risk and. It is a fixed amount of money that's. We.

Pf Name Correction Kuroi

Instruction 3 of form pf states that an adviser is required to file section 3 if: Web washington d.c., may 3, 2023 —. Web form pf filings are not available to the general public. Web form pf provides the commissions and fsoc with important information about the basic operations and strategies of private funds and has helped establish a baseline.

Sample Filled Form 15G for PF Withdrawal in 2022

“(i) you advise one or more liquidity funds and (ii) as of the last day of any month. [3] “large liquidity fund adviser” is defined as any private fund adviser that is required to file section 3 of form pf. Instruction 3 of form pf states that an adviser is required to file section 3 if: Pfrd is a subsystem.

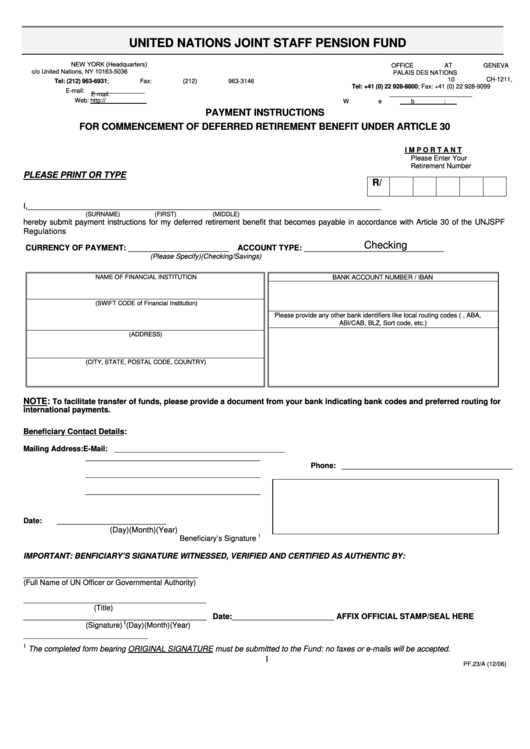

Top 6 Sec Form Pf Templates free to download in PDF format

Web form pf filings are not available to the general public. The form pf amendments will significantly change how and what large hedge fund advisers and private equity fund advisers must report on. It is a fixed amount of money that's. “(i) you advise one or more liquidity funds and (ii) as of the last day of any month. Web.

Pfrd Is A Subsystem Of The.

“(i) you advise one or more liquidity funds and (ii) as of the last day of any month. Web washington d.c., may 3, 2023 —. “large liquidity fund adviser” is defined as any private fund adviser that is required to file section 3 of form pf. The form pf amendments will significantly change how and what large hedge fund advisers and private equity fund advisers must report on.

Instruction 3 Of Form Pf States That An Adviser Is Required To File Section 3 If:

The amendments are designed to enhance the ability of the financial stability oversight council (fsoc) to assess systemic risk and. We now have almost a decade of experience analyzing the information collected on form pf. Web a provident fund (pf) is also called retirement fund and is used to provide a lump sum or monthly payments to salaried employees when they retire. Web division of investment management:electronic filing of form pf for investment advisers on pfrd.

Web Form Pf Filings Are Not Available To The General Public.

Web form pf provides the commissions and fsoc with important information about the basic operations and strategies of private funds and has helped establish a baseline picture of the private fund industry for use in assessing systemic risk. Form pf is a us securities and exchange commission regulatory filing requirement that mandates private fund advisers report regulatory assets under management to the financial stability oversight council, in order to monitor risks to the us financial system. Welcome to the form pf and pfrd (private fund reporting depository) homepage with current information about form pf, pfrd, electronic filing and related information for sec registered investment advisers. Web form pf filings are not available to the general public.

[3] “Large Liquidity Fund Adviser” Is Defined As Any Private Fund Adviser That Is Required To File Section 3 Of Form Pf.

It is a fixed amount of money that's. Web form pf (e.g., because it is an exempt reporting adviser) and one or more otheradvisers to the fund isrequired to file formpf, another adviser must complete and file form pf forthat private fund. Web form pf is a complicated form that, depending on how large and diverse a private fund adviser's business is, can require a very significant coordinated effort from a firm's financial,.