What Is Tax Form 5405

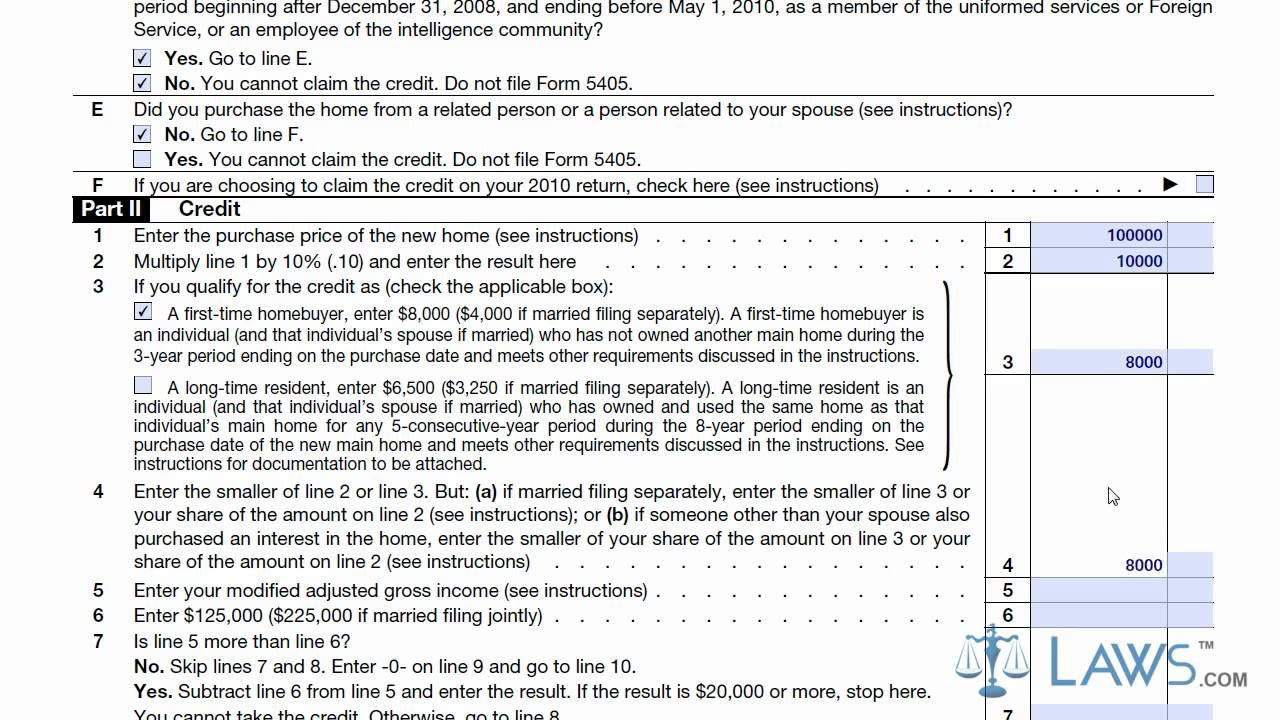

What Is Tax Form 5405 - In the case of a sale, including through foreclosure, this is the year in which. Attach to your 2010 or 2011. You disposed of it in 2022. December 2014) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. The exceptions to repayment of. December 2011) department of the treasury internal revenue service. November 2020) department of the treasury internal revenue service. The form is used for the credit received if you bought a.

The form is used for the credit received if you bought a. Web get irs tax forms and publications at bankrate.com. Web the right amount of tax. You disposed of it in 2022. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. Web easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the home screen. The exceptions to repayment of. Complete, edit or print tax forms instantly. You are not required to provide the information requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb. November 2020) department of the treasury internal revenue service.

Attach to form 1040, form 1040nr,. Repay the credit on form 5405 and attach it to your form 1040. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web the irs requires you to prepare irs form 5405 before you can claim the credit. In the case of a sale, including through foreclosure, this is the year in which. The exceptions to repayment of. The form is used for the credit received if you bought a. Web the right amount of tax. Get ready for tax season deadlines by completing any required tax forms today. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid.

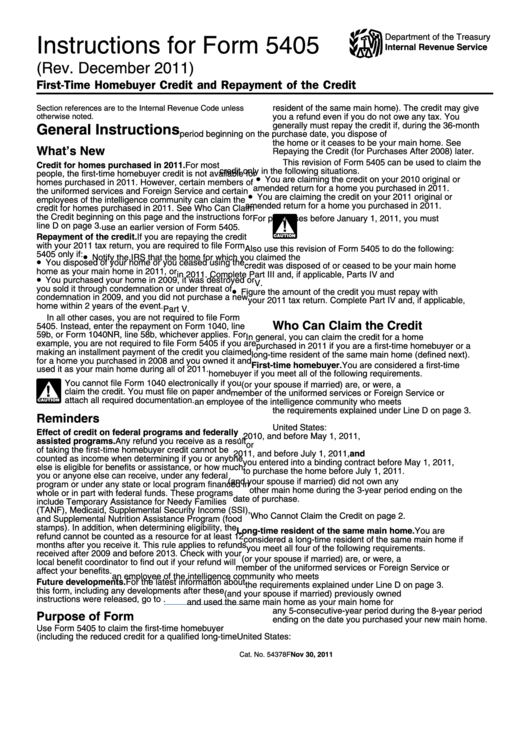

Instructions For Form 5405 Draft (Rev. December 2011) printable pdf

December 2014) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Web get irs tax forms and publications at bankrate.com. Attach to form 1040, form 1040nr,.

Form 5405 Repayment of the FirstTime Homebuyer Credit (2014) Free

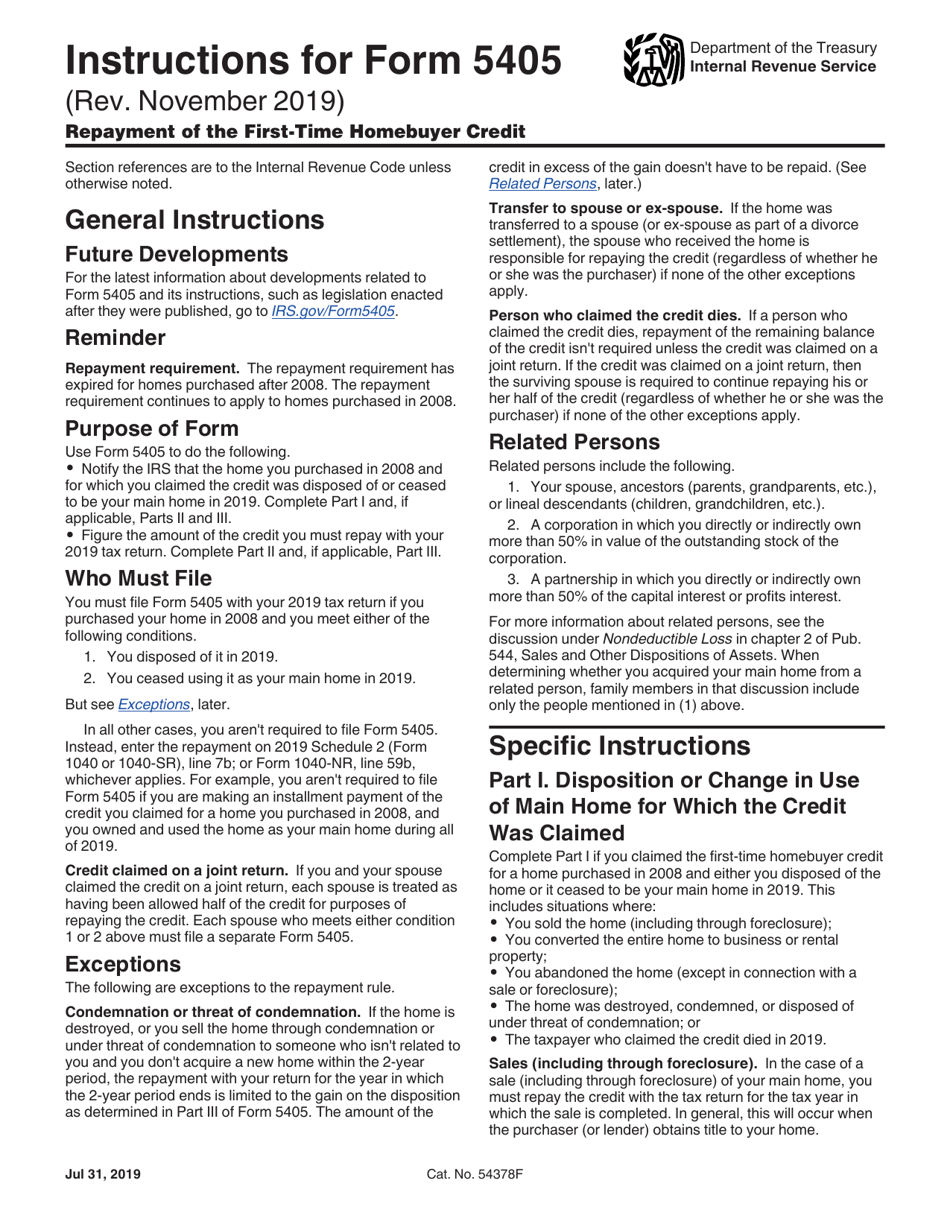

November 2020) department of the treasury internal revenue service. Attach to your 2010 or 2011. Complete, edit or print tax forms instantly. Web the right amount of tax. Attach to form 1040, form 1040nr,.

FirstTime Homebuyer Credit and Repayment of the Credit

Form 5405 is a tax form used by the internal revenue service (irs) in the united states. The form is used for the credit received if you bought a. You are responsible for repayment of homebuyer credit. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Home Buyer Tax Credit Can I Sell the Homestead to My Children

November 2020) department of the treasury internal revenue service. The form is used for the credit received if you bought a. Get ready for tax season deadlines by completing any required tax forms today. The exceptions to repayment of. Web easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the home screen.

IRS Form 5405 Repayment Of First Time Homebuyer Credit Stock video

November 2020) department of the treasury internal revenue service. Other videos from the same category Get ready for tax season deadlines by completing any required tax forms today. December 2011) department of the treasury internal revenue service. Form 5405 is a tax form used by the internal revenue service (irs) in the united states.

Instructions For Form 5405 FirstTime Homebuyer Credit And Repayment

The form is used for the credit received if you bought a. The exceptions to repayment of. December 2014) department of the treasury internal revenue service. December 2011) department of the treasury internal revenue service. Attach to form 1040, form 1040nr,.

4up W2 Condensed Employer Copies v1 5405 Mines Press

Use form 8905 to treat an. Attach to form 1040, form 1040nr,. December 2014) department of the treasury internal revenue service. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. The exceptions to repayment of.

Fill Free fillable Repayment of the FirstTime Homebuyer Credit Form

Web the irs requires you to prepare irs form 5405 before you can claim the credit. You are responsible for repayment of homebuyer credit. Web the right amount of tax. December 2011) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today.

Learn How to Fill the Form 5405 FirstTime Homebuyer Credit and

You disposed of it in 2022. Web the irs requires you to prepare irs form 5405 before you can claim the credit. The exceptions to repayment of. December 2014) department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today.

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Attach to form 1040, form 1040nr,. Get ready for tax season deadlines by completing any required tax forms today. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. Other videos from the same category Form.

Other Videos From The Same Category

In the case of a sale, including through foreclosure, this is the year in which. You are not required to provide the information requested on a form that is subject to the paperwork reduction act unless the form displays a valid omb. Web get irs tax forms and publications at bankrate.com. Complete, edit or print tax forms instantly.

Web Easily Track Repayment Of The Home Buyer’s Tax Credit By Entering Data Into Form 5405 On The Home Screen.

November 2020) department of the treasury internal revenue service. Web form 5405 is used to report the sale or disposal of a home if you purchased the home in 2008 and received the first time home buyers tax credit that must be repaid. Repay the credit on form 5405 and attach it to your form 1040. You are responsible for repayment of homebuyer credit.

The Exceptions To Repayment Of.

The form is used for the credit received if you bought a. Web the irs requires you to prepare irs form 5405 before you can claim the credit. Get ready for tax season deadlines by completing any required tax forms today. Use form 8905 to treat an.

Attach To Your 2010 Or 2011.

Form 5405 is a tax form used by the internal revenue service (irs) in the united states. Web the right amount of tax. December 2011) department of the treasury internal revenue service. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home.

/GettyImages-185121670-be12b2817ff9419497195a93e62632cc.jpg)