What Is Tax Form 8814

What Is Tax Form 8814 - Web click the taxes dropdown, then click tax on child's unearned income. For the parents' return (form 8814), click. Web what is form 8814, parent's election to report child's interest/dividend earnings? Web for the child's return (form 8615), click tax on child's unearned income. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Complete irs tax forms online or print government tax documents. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Complete line 7b if applicable. Complete, edit or print tax forms instantly. Web click taxes in the middle of the screen to expand the category.

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Complete irs tax forms online or print government tax documents. For the parents' return (form 8814), click. Web what is form 8814? We last updated the parents' election to report child's interest and dividends in january 2023, so this is the. Web for the child's return (form 8615), click tax on child's unearned income. For the parents' return (form 8814), click child's interest and dividend income on your return. Web federal — parents' election to report child's interest and dividends download this form print this form it appears you don't have a pdf plugin for this browser. When a child has investment income above a certain threshold, they. The choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return.

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. We last updated the parents' election to report child's interest and dividends in january 2023, so this is the. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. When a child has investment income above a certain threshold, they. Web what is form 8814? Web for the child's return (form 8615), click tax on child's unearned income. Per irs publication 929 tax rules for. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return.

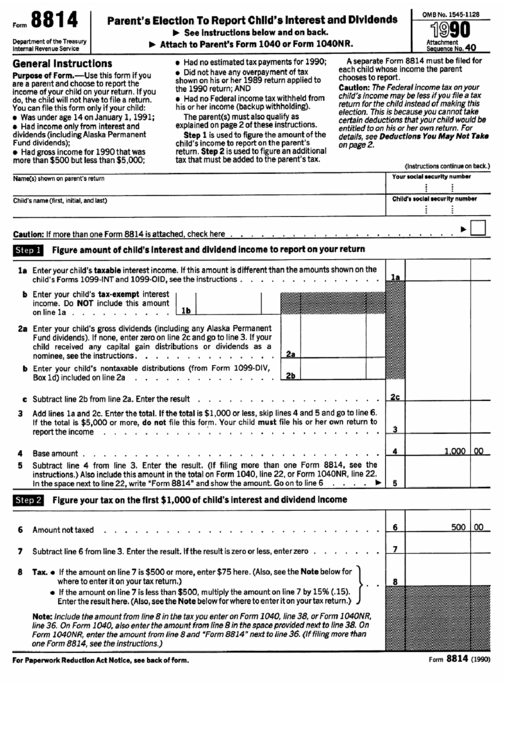

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. When a child has investment income above a certain threshold, they. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web what is.

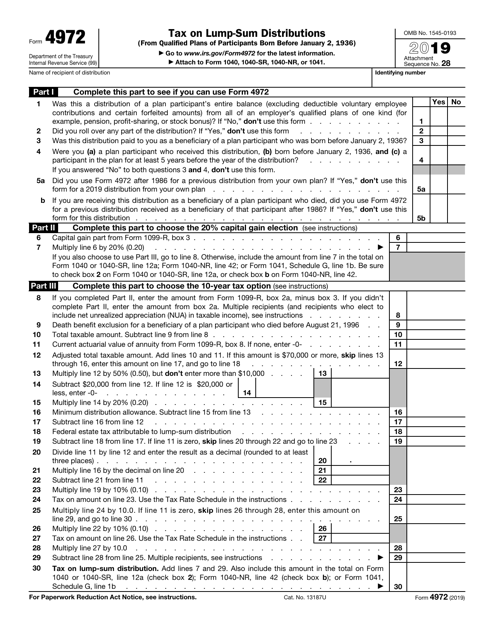

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

A separate form 8814 must be filed for. Web click the taxes dropdown, then click tax on child's unearned income. Web more about the federal form 8814 corporate income tax ty 2022. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Use this form if you elect to report your child’s income.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

The choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return. Per irs publication 929 tax rules for. Web what is form 8814, parent's election to report child's interest/dividend earnings? Web click taxes in the middle of the screen to expand the category. Web for children under age 18 and certain older children.

How to Claim the Solar Investment Tax Credit YSG Solar YSG Solar

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Use this form if you elect to report your child’s income on your return. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web for the child's return.

Form 8814 Parents' Election To Report Child'S Interest And Dividends

When a child has investment income above a certain threshold, they. Web what is form 8814, parent's election to report child's interest/dividend earnings? Web how to make the election. Web click the taxes dropdown, then click tax on child's unearned income. Web for children under age 18 and certain older children described below in who must file, unearned income over.

INTERESTING STUFF 21 February 2020 TIME GOES BY

Web click the taxes dropdown, then click tax on child's unearned income. For the parents' return (form 8814), click child's interest and dividend income on your return. Complete irs tax forms online or print government tax documents. Ad access irs tax forms. For the child's return (form 8615), click tax on child's unearned income.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Form 8814 will be used if you elect to report your child's interest/dividend income on. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. When a child has investment income above a certain threshold, they..

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web for the child's return (form 8615), click tax on child's unearned income. Web how to make the election. For the parents' return (form 8814), click child's interest and dividend income on your return. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. To enter information for the parents' return.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

If you file form 8814 with your income tax return to report your. You can make this election if your child. For the parents' return (form 8814), click. For the parents' return (form 8814), click child's interest and dividend income on your return. Per irs publication 929 tax rules for.

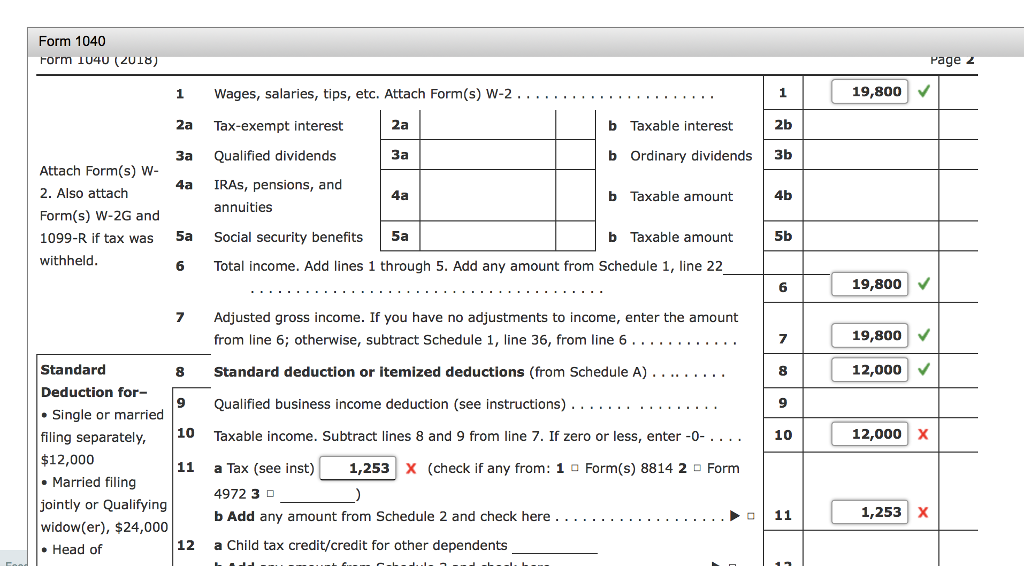

Solved Form 1040 Complete Patty's Form 1040 Form Department

If you file form 8814 with your income tax return to report your. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Complete irs tax forms online or print government tax documents. Web what is form 8814, parent's election to report child's interest/dividend earnings? If.

For The Parents' Return (Form 8814), Click Child's Interest And Dividend Income On Your Return.

You can make this election if your child. For the parents' return (form 8814), click. For the child's return (form 8615), click tax on child's unearned income. To enter information for the parents' return.

We Last Updated The Parents' Election To Report Child's Interest And Dividends In January 2023, So This Is The.

Web what is form 8814, parent's election to report child's interest/dividend earnings? To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Web what is form 8814? If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate.

Use This Form If You Elect To Report Your Child’s Income On Your Return.

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. The choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return. Form 8814 will be used if you elect to report your child's interest/dividend income on. Web how to make the election.

Web To Make The Election, Complete And Attach Form(S) 8814 To Your Tax Return And File Your Return By The Due Date (Including Extensions).

Web federal — parents' election to report child's interest and dividends download this form print this form it appears you don't have a pdf plugin for this browser. Web click taxes in the middle of the screen to expand the category. A separate form 8814 must be filed for. Complete irs tax forms online or print government tax documents.