What Is Tax Form 8995

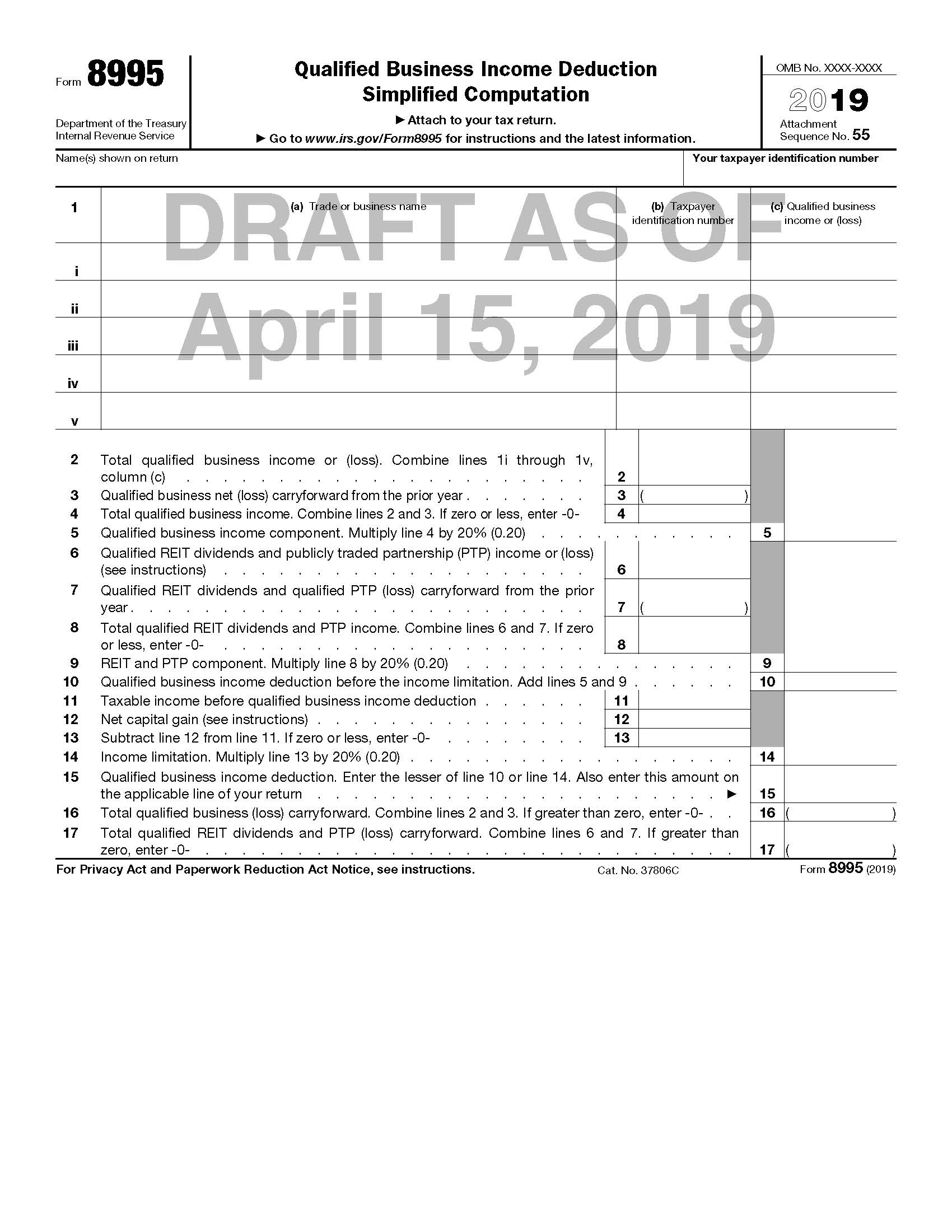

What Is Tax Form 8995 - The draft forms are form. What is form 8995 solved: In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Form 8995 is a simplified. Who can use irs form 8995? Web what is form 8995? Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). And your 2019 taxable income. Web what is form 8995?

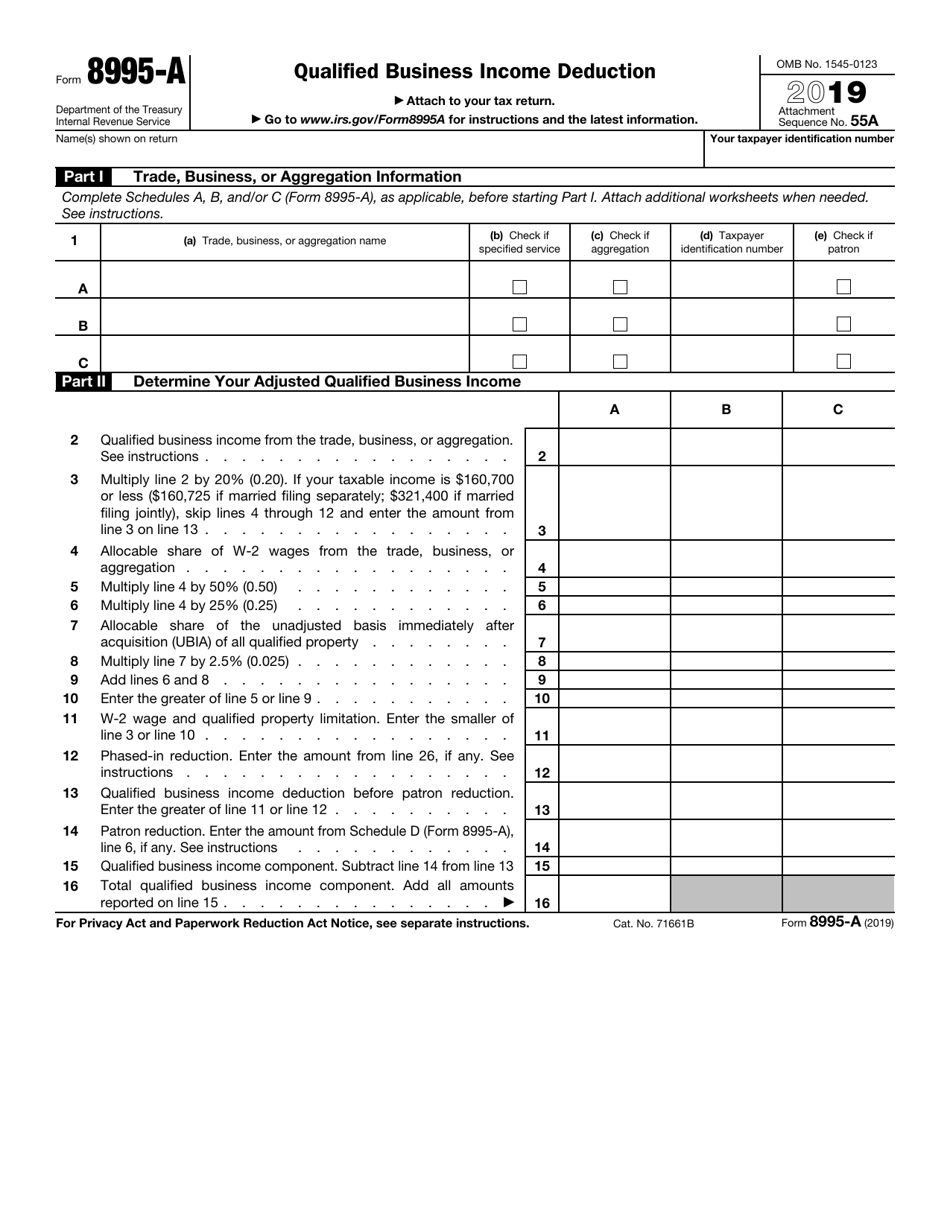

Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. You have qbi, qualified reit dividends, or qualified ptp income or loss; In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. And your 2019 taxable income. Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Web what is irs form 8995? The excess repayment of $1,500 can be carried. Qbi terminology how do i determine what is qbi and what is not qbi? Web in 2021, you made a repayment of $4,500. Web what is an tax form 8995?

Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Who can use irs form 8995? Web in 2021, you made a repayment of $4,500. If your taxable income is more than $220,050 ($440,100 if married filing jointly), your specified. Web what is irs form 8995? You have qbi, qualified reit dividends, or qualified ptp income or loss; Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Business owners can reduce their tax bill by taking advantage of form 8995 and the qbi program (qualified business income deduction). The excess repayment of $1,500 can be carried. Qbi terminology how do i determine what is qbi and what is not qbi?

Mason + Rich Blog NH’s CPA Blog

Web what is irs form 8995? Web what is form 8995? Form 8995 (qualified business income deduction simplified computation) is the irs federal tax form that is used for calculating the qualified. Video walkthrough irs form 8995. Our website is dedicated to providing.

IRS Draft Form 8995 Instructions Include Helpful QBI Flowchart Center

Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Video walkthrough irs form 8995. It is also known as. Form 8995 is a simplified. Qbi terminology how do i determine what is qbi and what is not qbi?

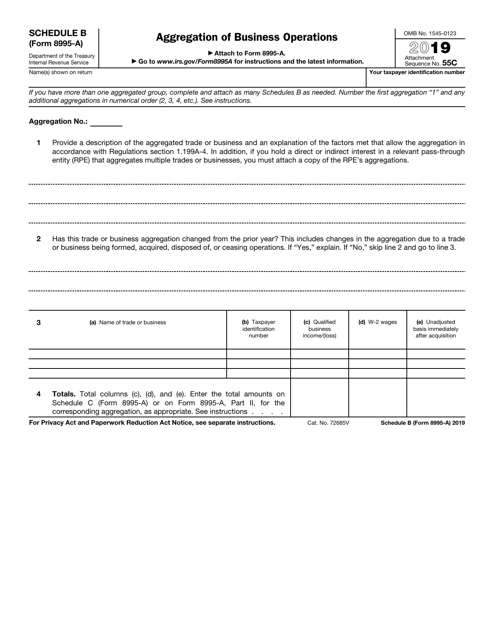

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web in 2021, you made a repayment of $4,500. You have qbi, qualified reit dividends, or qualified ptp income or loss; The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web what is form 8995?

8995 Fill out & sign online DocHub

Web 1 best answer dmarkm1 expert alumni the form 8995 is used to figure your qualified business income (qbi) deduction. Qbi terminology how do i determine what is qbi and what is not qbi? Video walkthrough irs form 8995. It is also known as. Web what is an tax form 8995?

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

If you have a business (1099 income), or an. In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Qbi terminology how do i determine what is qbi and what is not qbi? The draft forms are form. Web the federal form 8995, also known as the qualified business income deduction simplified.

Breanna Form 2 Instructions 2019

Web in 2021, you made a repayment of $4,500. Web what is an tax form 8995? Where is that form out in turbo tax us en united states (english)united states (spanish)canada (english)canada (french). Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. Form 8995 (qualified business income.

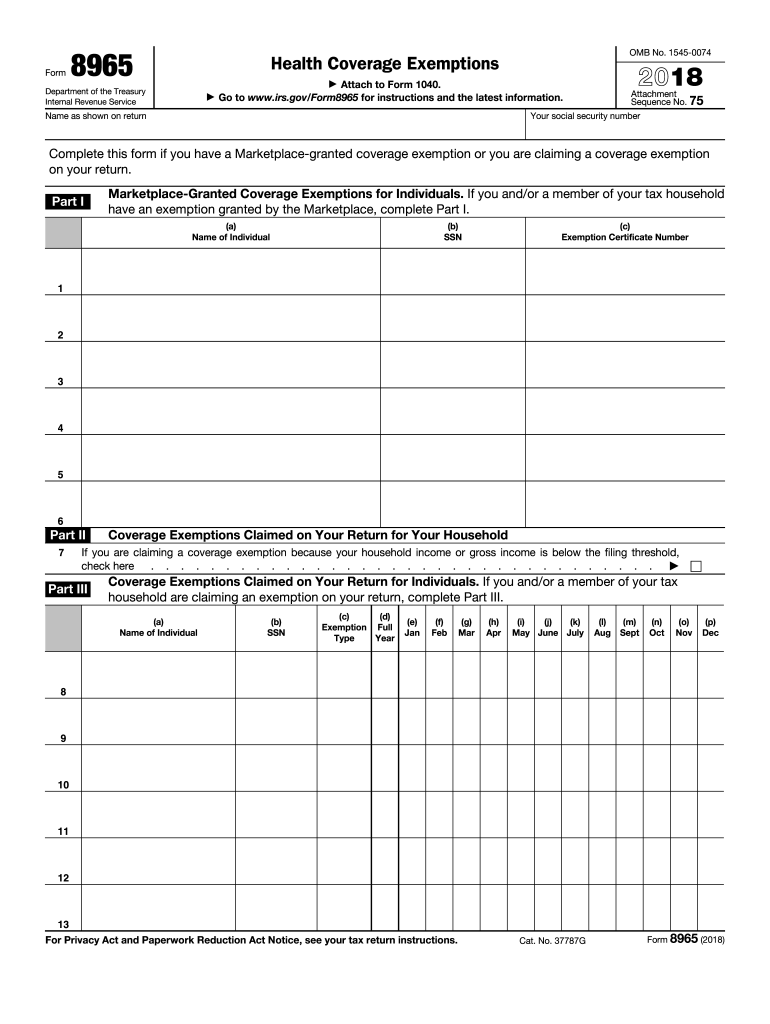

20182023 Form IRS 8965 Fill Online, Printable, Fillable, Blank pdfFiller

Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. And your 2019 taxable income. If your taxable income is more than $220,050 ($440,100 if married filing jointly), your specified. Web what is an tax form 8995? What is form 8995 solved:

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

You have qbi, qualified reit dividends, or qualified ptp income or loss; In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web what is form 8995? Business owners can reduce their tax bill by taking advantage of form 8995 and the qbi program (qualified business income deduction). Web the 8995 form.

Download Instructions for IRS Form 8995 Qualified Business

Web what is an tax form 8995? In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. The excess repayment of $1,500 can be carried. Web in 2021, you made a repayment of $4,500. Web what is form 8995?

Instructions for Form 8995 (2019) Internal Revenue Service Small

Qbi terminology how do i determine what is qbi and what is not qbi? The excess repayment of $1,500 can be carried. If your taxable income is more than $220,050 ($440,100 if married filing jointly), your specified. Web what is form 8995? Web in 2021, you made a repayment of $4,500.

Where Is That Form Out In Turbo Tax Us En United States (English)United States (Spanish)Canada (English)Canada (French).

Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. What is form 8995 solved: Web what is form 8995? Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid.

Form 8995 (Qualified Business Income Deduction Simplified Computation) Is The Irs Federal Tax Form That Is Used For Calculating The Qualified.

Web what is irs form 8995? Web what is form 8995? Web form 8995 is the simplified form and is used if all of the following are true: Our website is dedicated to providing.

It Is Also Known As.

Who can use irs form 8995? You have qbi, qualified reit dividends, or qualified ptp income or loss; The draft forms are form. Business owners can reduce their tax bill by taking advantage of form 8995 and the qbi program (qualified business income deduction).

If Your Taxable Income Is More Than $220,050 ($440,100 If Married Filing Jointly), Your Specified.

If you have a business (1099 income), or an. Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. The excess repayment of $1,500 can be carried.