When Is Form 945 Due

When Is Form 945 Due - Employers must let the irs know about backup withholding if they. Irs efile > january 31. Web form 945 department of the treasury internal revenue service annual return of withheld federal income tax. Connecticut, delaware, district of columbia, georgia, illinois,. If you haven’t received your ein by the due date of form 945,. Web july 31, 2023. Forms must be transmitted to the irs before the deadline. Web form 945 deadlines for 2020 the following are the due dates for each filing type. If line 3 is less than $2,500, don’t complete line 7 or. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later.

The form 945 must be filed by jan. The maximum duration to file and. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. Web form 945 deadlines for 2020 the following are the due dates for each filing type. Forms must be transmitted to the irs before the deadline. Employers must let the irs know about backup withholding if they. If line 4 is more than line 3, enter the difference. Web june 20, 2022 5 minute read table of contents hide what is form 945? If line 3 is less than $2,500, don’t complete line 7 or. 3 reasons why your business might need to fill out.

If line 3 is less than $2,500, don’t complete line 7 or. Web july 31, 2023. The irs requires your business to file form 945 if you withhold or are required to. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web form 945 deadlines for 2020 the following are the due dates for each filing type. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. Web when is the irs form 945 due? The form 945 must be filed by jan. 3 reasons why your business might need to fill out. Web when is form 945 due?

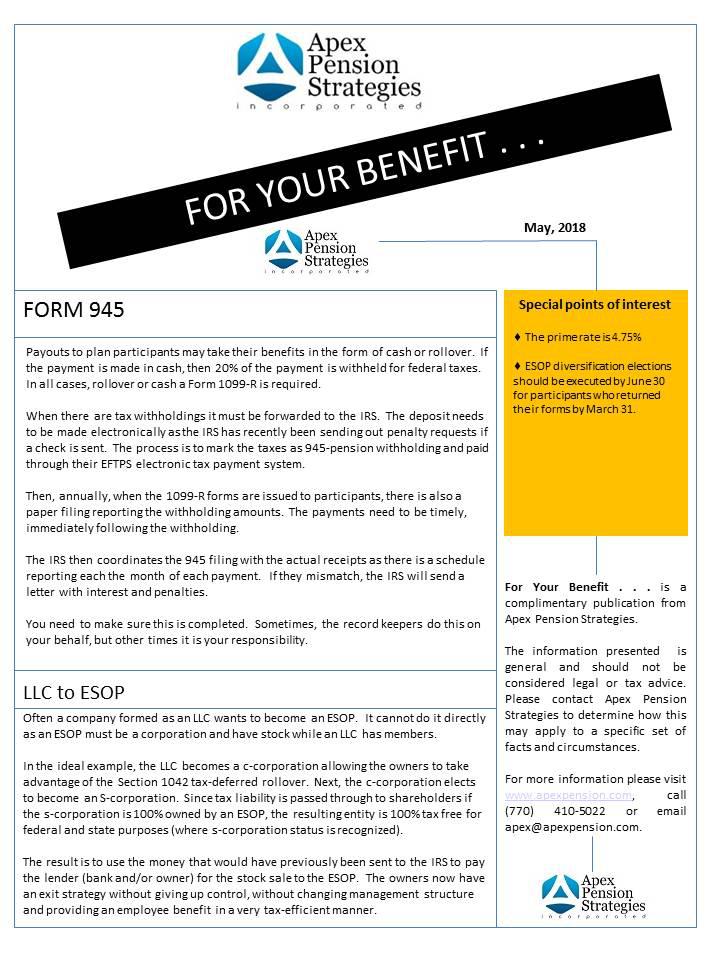

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Web mailing addresses for forms 945. Web when is the deadline to file 945? Web tax planning home » tax planning » tax forms irs form 945 instructions by forrest baumhover july 18, 2023july 18, 2023reading time: Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some.

2019 Form IRS 945 Fill Online, Printable, Fillable, Blank PDFfiller

When would you need to file a 945? Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Purpose of the irs form 945 the irs requires that businesses. In 2021, the due date is february 1 because january 31 is a..

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

The form 945 must be filed by jan. If line 3 is less than $2,500, don’t complete line 7 or. 3 reasons why your business might need to fill out. Web form 945 deadlines for 2020 the following are the due dates for each filing type. Web june 20, 2022 5 minute read table of contents hide what is form.

Form 945 Edit, Fill, Sign Online Handypdf

Web the finalized version of form 945 was released by the irs. The maximum duration to file and. Web when is the irs form 945 due? Web form 945 department of the treasury internal revenue service annual return of withheld federal income tax. When would you need to file a 945?

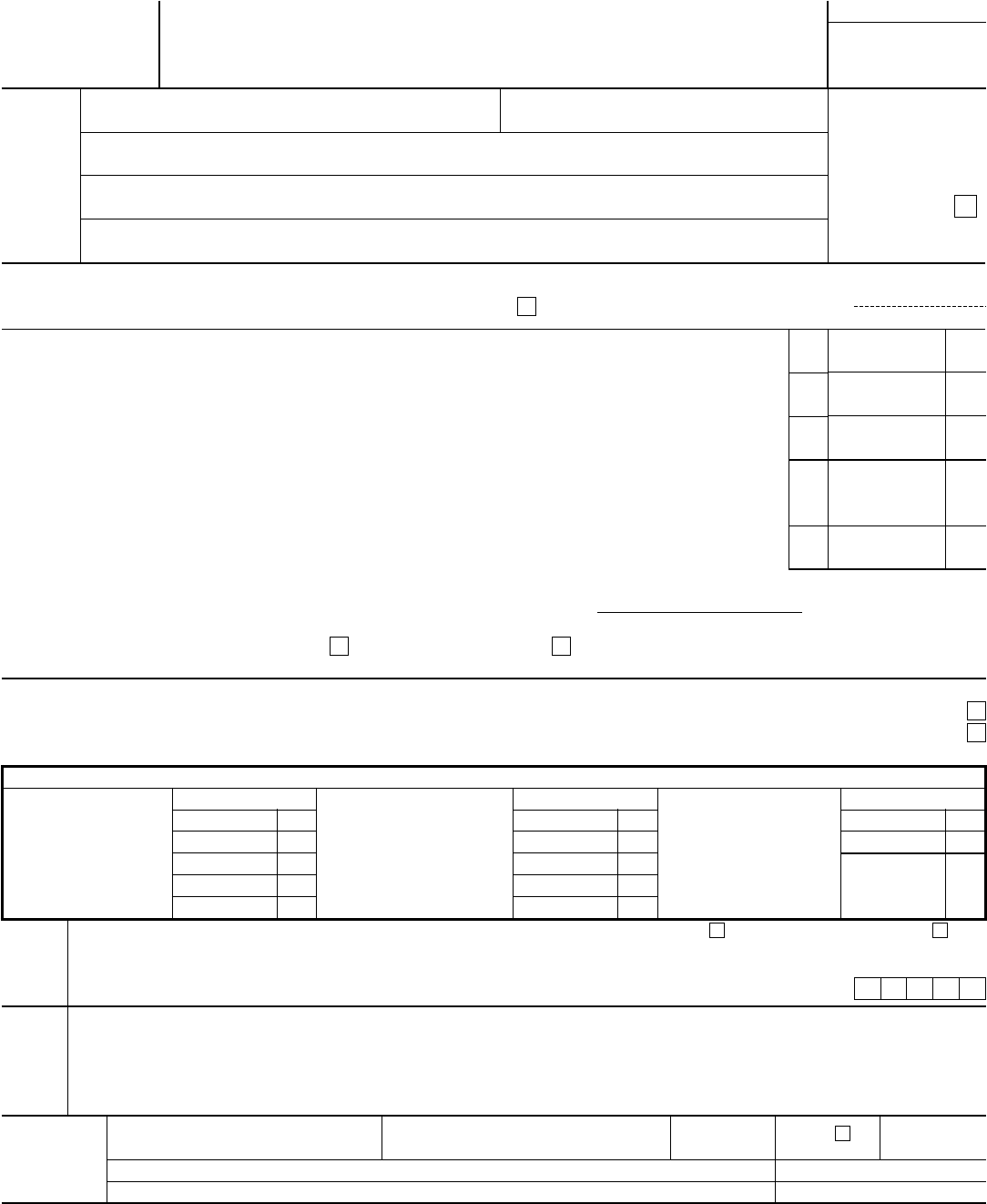

Instructions For Form 945 Annual Return Of Withheld Federal

Forms must be transmitted to the irs before the deadline. Web form 945 deadlines for 2020 the following are the due dates for each filing type. Are there any penalties for form 945? If line 3 is less than $2,500, don’t complete line 7 or. Web the finalized version of form 945 was released by the irs.

FORM 945 Instructions On How To File Form 945

The form 945 must be filed by jan. The finalized 2021 form 945, annual return of withheld. Web form 945 department of the treasury internal revenue service annual return of withheld federal income tax. Web june 20, 2022 5 minute read table of contents hide what is form 945? 3 reasons why your business might need to fill out.

Download Instructions for IRS Form 945 Annual Return of Withheld

Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. It is due till 31st january each year to report the withholding done for the previous year. When would you need to file a 945? Connecticut, delaware, district of.

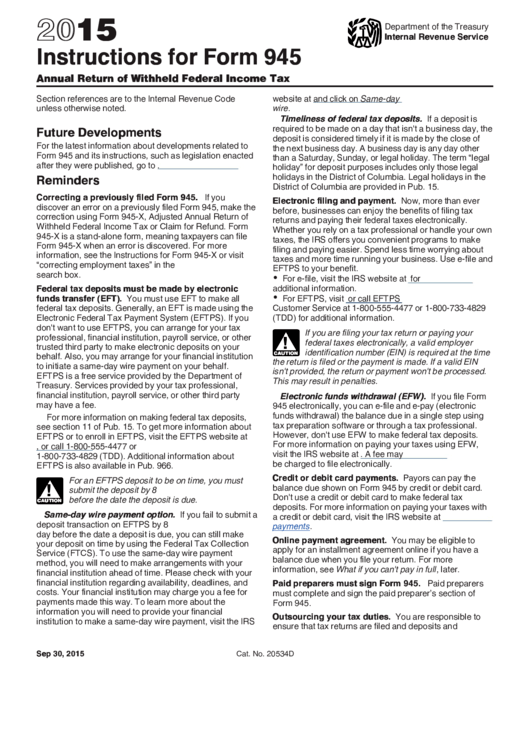

Your Retirement Specialist Form 945

When would you need to file a 945? Web july 31, 2023. 3 reasons why your business might need to fill out. Forms must be transmitted to the irs before the deadline. If line 4 is more than line 3, enter the difference.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

If line 4 is more than line 3, enter the difference. Purpose of the irs form 945 the irs requires that businesses. The finalized 2021 form 945, annual return of withheld. Web june 20, 2022 5 minute read table of contents hide what is form 945? Web any business filing form 945 for 2020 has until february 1, 2021, to.

Irs Form 945 Fill Out and Sign Printable PDF Template signNow

Web when is form 945 due? Web when is the deadline to file 945? Web when is the irs form 945 due? Employers must let the irs know about backup withholding if they. Web form 945 department of the treasury internal revenue service annual return of withheld federal income tax.

Web The Internal Revenue Service Usually Releases Income Tax Forms For The Current Tax Year Between October And January, Although Changes To Some Forms Can Come Even Later.

Web the finalized version of form 945 was released by the irs. Are there any penalties for form 945? In 2021, the due date is february 1 because january 31 is a. The maximum duration to file and.

Purpose Of The Irs Form 945 The Irs Requires That Businesses.

The finalized 2021 form 945, annual return of withheld. Web tax planning home » tax planning » tax forms irs form 945 instructions by forrest baumhover july 18, 2023july 18, 2023reading time: Web form 945 deadlines for 2020 the following are the due dates for each filing type. Web june 20, 2022 5 minute read table of contents hide what is form 945?

Web Form 945 Department Of The Treasury Internal Revenue Service Annual Return Of Withheld Federal Income Tax.

Forms must be transmitted to the irs before the deadline. Web july 31, 2023. Web when is form 945 due? It is due till 31st january each year to report the withholding done for the previous year.

When Would You Need To File A 945?

Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. 3 reasons why your business might need to fill out. Web mailing addresses for forms 945. The irs requires your business to file form 945 if you withhold or are required to.