When To File Form 56

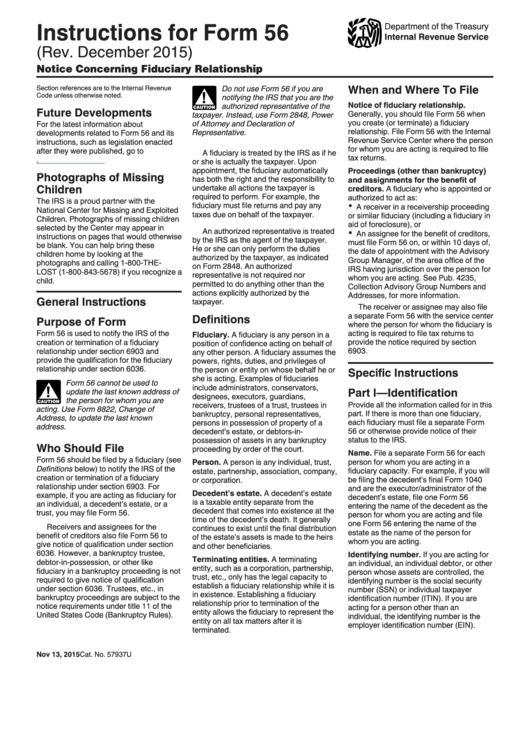

When To File Form 56 - Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies. Form 56 differs from a form 2848,. In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Individuals who are establishing a fiduciary relationship with a. His income was less than $600 for 2016. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship.

In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. I'm the successor trustee for my deceased father's trust. Web 6) the file size per document for esubmit is limited to 50 mb. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. His income was less than $600 for 2016. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. Web when and where to file. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web a fiduciary files form 56 to notify the irs about any changes in a fiduciary relationship.

Web when and where to file. Web 6) the file size per document for esubmit is limited to 50 mb. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Form 56 differs from a form 2848,. Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Individuals who are establishing a fiduciary relationship with a. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies.

Instructions For Form 56 Notice Concerning Fiduciary Relationship

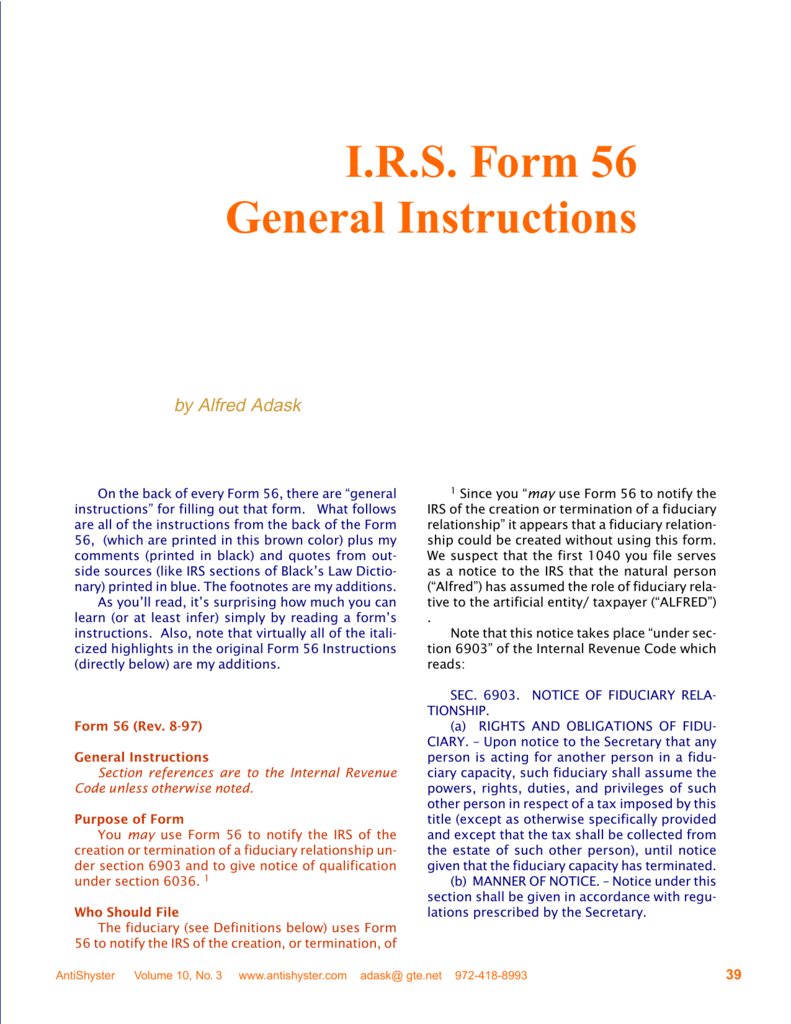

This form changes the estate's notification address to the fiduciary's address. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Web do i need to complete the form 56? Do i need to send form 56 if i. Web use this form to notify the irs of a fiduciary relationship only if that relationship.

I.R.S. Form 56 General Instructions

This form changes the estate's notification address to the fiduciary's address. Web do i need to complete the form 56? Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. For example, if you are. Individuals who are establishing a fiduciary relationship.

Fill Free fillable Notice Concerning Fiduciary Relationship of

Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. Web do i need to complete the form 56? His income was less than $600 for 2016. Form 56 differs from a form 2848,. Web form 56 should be filed by a fiduciary (see definitions below) to.

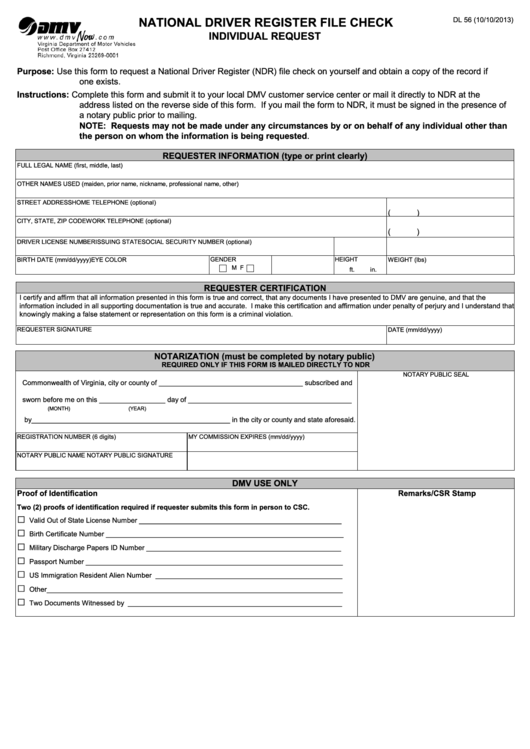

Fillable Form Dl 56 National Driver Register File Check Individual

In order to keep file sizes under this limit, yet still provide for quality documents, the court recommends the. 2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. Web trustees can file form 56 when they gain or lose responsibility over a decedent or a decedent’s.

Patrick Devine Documents Fill Online, Printable, Fillable, Blank

Form 56 differs from a form 2848,. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web trustees can file form 56 when they gain or lose responsibility over a decedent or a decedent’s estate. In order to keep file sizes.

Form 56 About IRS Tax Form 56 & Filing Instructions Community Tax

Web 6 rows file form 56 at internal revenue service center where the person for whom you are acting is required. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). For example, if you are. Web do i need.

All About IRS Form 56 Tax Resolution Services

2 part ii revocation or termination of notice section a—total revocation or termination 6 check this box if you are revoking or terminating. Do i need to send form 56 if i. Individuals who are establishing a fiduciary relationship with a. His income was less than $600 for 2016. This form changes the estate's notification address to the fiduciary's address.

Form 56 Notice Concerning Fiduciary Relationship (2012) Free Download

Web 6) the file size per document for esubmit is limited to 50 mb. For example, if you are. His income was less than $600 for 2016. Web when and where to file. Do i need to send form 56 if i.

Form 56 IRS Template PDF

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Web when and where to file. Web 6 rows file form 56 at internal revenue service.

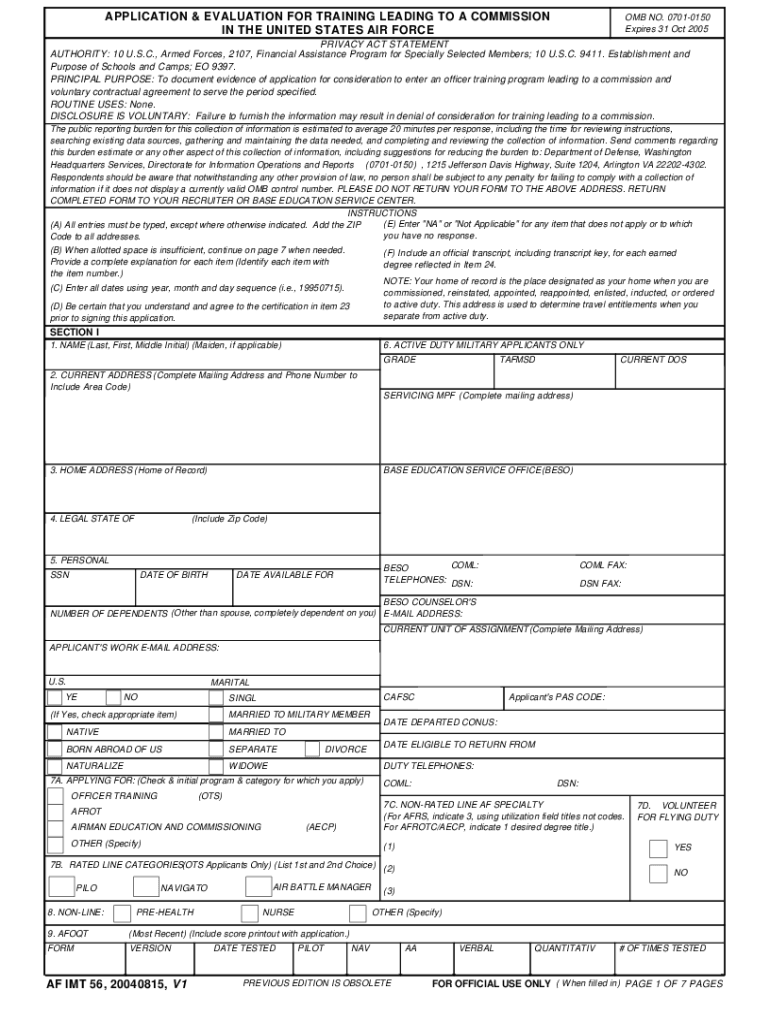

Af Form 56 Fill Out and Sign Printable PDF Template signNow

Individuals who are establishing a fiduciary relationship with a. Web do i need to complete the form 56? Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. His income was less than $600 for 2016. Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence.

For Example, If You Are.

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Do i need to send form 56 if i. Knott 9.86k subscribers join subscribe 208 share save 10k views 1 year ago #irs #estatetax. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

In Order To Keep File Sizes Under This Limit, Yet Still Provide For Quality Documents, The Court Recommends The.

This form changes the estate's notification address to the fiduciary's address. His income was less than $600 for 2016. Individuals who are establishing a fiduciary relationship with a. Web trustees can file form 56 when they gain or lose responsibility over a decedent or a decedent’s estate.

Web 6 Rows File Form 56 At Internal Revenue Service Center Where The Person For Whom You Are Acting Is Required.

Web when and where to file. Web you may need to file form 56, notice concerning fiduciary relationship to notify the irs of the existence of a fiduciary relationship. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Form 56 differs from a form 2848,.

Web A Fiduciary Files Form 56 To Notify The Irs About Any Changes In A Fiduciary Relationship.

Web this form is typically filed when an individual becomes incapacitated, decides to delegate his or her tax responsibilities, or the individual dies. Web do i need to complete the form 56? I'm the successor trustee for my deceased father's trust. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship.